Many traders want to use a Moving Average Crossover Robot to save time. In EA Trading Academy’s recent videos, we exposed a few YouTubers who are teaching moving average strategies that can lead to a high number of losses.

We’ve created dozens of strategies with Moving Average Indicators. In all, we’ve actually created 97 MA Crossover robots that use the moving average crossover indicator.

We’ve also made our best moving average crossover robot available to you, so you can download it at the end of the page. In this post, we’ll share why that moving average crossover robot performs very well

Benefits of a Moving Average Crossover Robot

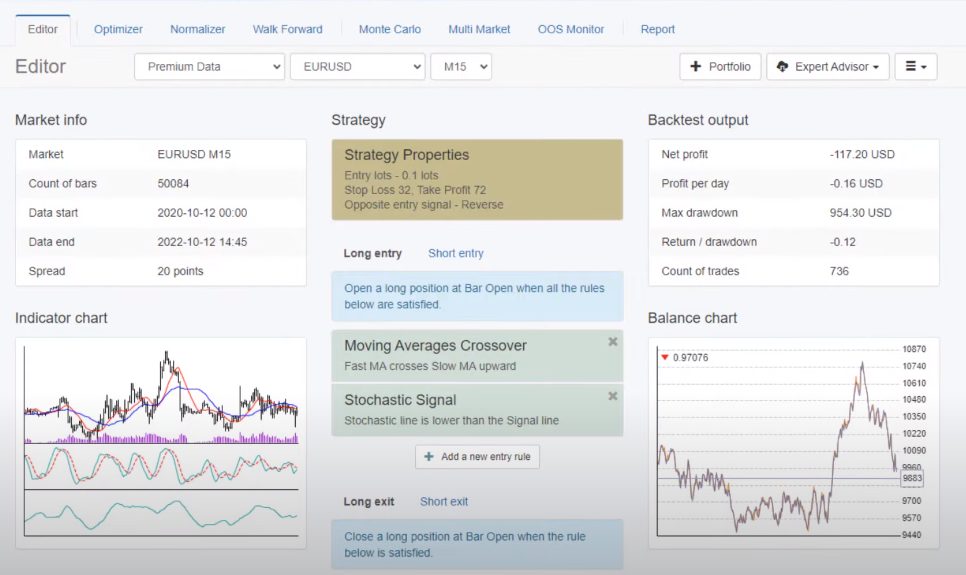

A moving average crossover robot will automatically open Buy positions when the Fast moving average crosses the Slow moving average. The robot can also open sell positions automatically.

A moving average crossover robot is very useful for traders who like to use MetaTrader 4. Like every strategy, this Moving Average Crossover strategy has Pros and Cons.

There are drawdowns. You can also lose or profit from some trades especially when the market moves sideways. However, at the end of the day, you’ll get more profits than losses with your trades. To be precise, this strategy has a bigger profit factor than one.

Remember, profit factor is determined by all the profits divided by all the losses. When we check our statistics for the moving average crossover, we’ll see that our profit factor is 1.45.

We also use the following with this moving average crossover robot:

- Stochastic signal

- DeMarker

- Stop Loss

- Take Profit

These all help to protect your capital when you’re using the strategy.

How This Moving Average Crossover Robot Works

This strategy uses two moving averages. So, traders will look for the points where the moving averages cross over each other.

The two moving averages (MAs) have different speeds. So, traders can think of them as the fast MA and the slow MA.

So, the strategy works with fast MA 12 and slow MA 26. We’ll look for points where the fast MA crosses the slow MA upwards.

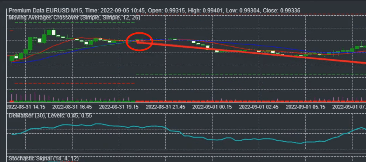

The fast MA reacts more quickly to price changes. On the chart, the fast MA is the red one. The slow MA is the blue one. So, the blue one reacts more slowly to price changes.

Whenever the fast, red MA crosses the blue, slow one upwards, we should buy. When we have the opposite, we should sell.

However, this strategy uses two more indicators. We’ll use those indicators to confirm our entries.

Confirm Entry Points With the Moving Average Crossover Robot

The first indicator that we use along with our MAs is the DeMarker (DeM). It must be lower than the level line of 30 level of 45.

For example, in the image below, we look for the DeM to be lower than the level line. It’s lower. In fact, it’s just in the middle.

The other confirmation that we look for comes from the Stochastic signal. So, the Stochastic line must be higher than the signal line k. 14 d. So, if we want to buy, we must look for:

- The fast moving average crossing the slow moving average upwards

- The DeMarker below the level line

- The Stochastic is higher than the signal line

When we see all of these signals, we can open the trade with our moving average crossover robot, taking a long position. We also have to use a Stop Loss and Take Profit to protect our capital.

As a reminder for beginners, we’ll place our Stop Loss below our entry price for our long trades. When we’re going long, we expect the price to rise. So, our Take Profit will be higher than our entry price.

If the Stop Loss and Take Profit are not met, we should close the trade whenever the momentum is higher than the level line, momentum period of 49 and level 100.69.

So, always remember, to exit a long trade look for the momentum going above the line of 100.69. We only need to use this exit rule if the Take Profit isn’t reached.

Example of a Profitable Trade

In the example below, we did a short trade with our moving average crossover robot. This was a profitable trade. We reached the Take Profit. You can see that the fast MA went below the slow MA. The DeMarker was above the line. That’s the opposite of what we look for with long trades. The stochastic was below the signal line. Momentum also showed that we should exit.

Moving Average Crossover Robot – Example of a Losing Trade

Every strategy has losing trades. So let’s look at our losing trade with this strategy. This was a short trade. We had all of the confirmations. However, we had to reverse.

That’s because we got the opposite signals. Always remember, if you see a signal that you’re wrong when you’re entering a trade, exit immediately. It just means that the market turned.

If you’re wrong and you don’t accept it, you’ll lose money. So, if you open a long trade and realize that you’re wrong, close it. You can open a short trade instead. You can do this with Bitcoin trading, cryptocurrencies, and other assets.

Many people lost money in the crypto market because even when they saw the market crashing, they didn’t sell any of their coins. The crypto market might rise again but not in 2022. That’s because we’re in a stage of increasing interest rates.

Try This Strategy for Yourself

You can get this moving average crossover robot from us and try it yourself on a Trusted Broker.

Put it on the chart on MetaTrader and see how it goes. You can put the indicators on it and test it. The strategy has many indicators to follow. However, if you only follow the moving average indicator you lose money.

That’s because moving averages follow the market. The market doesn’t follow moving averages. So, you have to combine moving averages with other indicators, your Stop Loss, and Take Profit.

You’ll also need to backtest the strategy. However, we’ve already done all of these things at EA Trading Academy. You can save time with this strategy but do your own due diligence with it.

We hope that you liked this post. Please visit us on our YouTube channel and subscribe to learn more about our other trading robots.

If you have any ideas or thoughts that you’d like to share on this post, please do so in the comments below. Have a wonderful day!