The foreign exchange (forex) market remains one of the largest and most liquid markets globally. Success often depends on choosing the right currency pairs. But with so many options, which pairs should you focus on? Traders and investors continuously seek out the most traded currency pairs for their liquidity, tight spreads, and the ability to execute trades efficiently.

As we move through the final quarter of 2024, certain pairs dominate the global forex market, offering traders consistent opportunities. These pairs are traded by institutional and retail traders alike, thanks to their liquidity and price movements driven by macroeconomic trends. Below, we’ll explore likely the top 5 most traded forex currency pairs in 2024, why they continue to dominate the market, and show you how to trade them using algorithmic trading strategies.

Table of Contents:

Top 5 Most Traded Forex Currency Pairs: Quick List

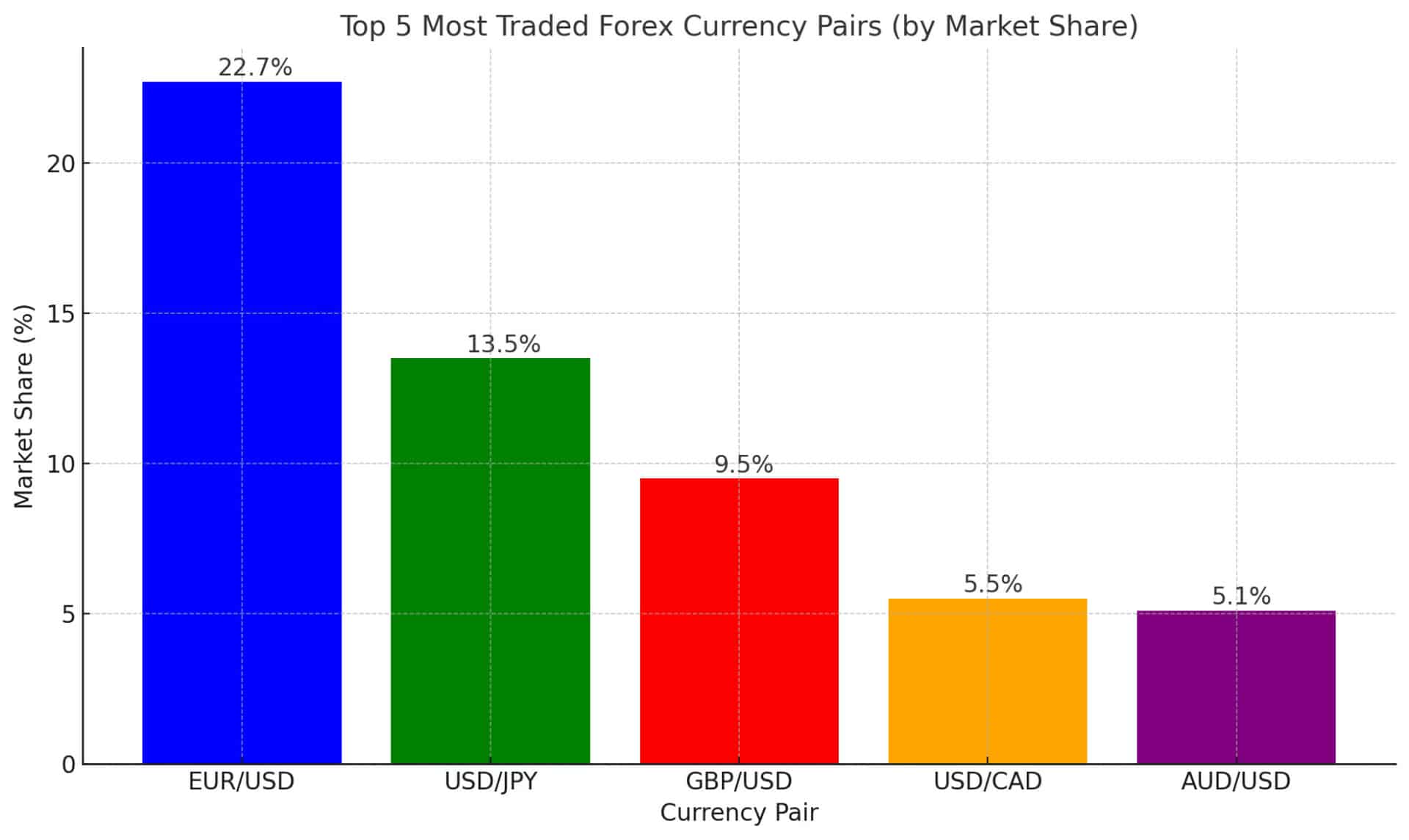

- EUR/USD (22.7%) – The most liquid and widely traded currency pair globally.

- USD/JPY (13.5%) – Heavily influenced by interest rates and the Japanese economy.

- GBP/USD (9.5%) – A popular choice driven by UK and US economic dynamics.

- USD/CAD (5.5%) – A key pair tied to oil prices and US-Canada trade relations.

- AUD/USD (5.1%) – Linked to global commodity prices and China’s economy.

These pairs account for the majority of forex trading volume in 2024, driven by their liquidity, tight spreads, and frequent price movements.

Most Traded Forex Pairs by Volume

According to the Bank for International Settlements (BIS)’s 2022 Triennial Survey, daily forex trading volume reached $7.5 trillion in 2022, with a significant portion concentrated in a few key currency pairs. The EUR/USD remains the dominant pair, responsible for nearly 23% of daily trading volume, followed by the USD/JPY at 13.5% and the GBP/USD at 9.5%. These three pairs alone account for nearly half of the entire forex market, making them the preferred choices for both institutional and retail traders.

The popularity of these pairs is attributed to their liquidity, tight spreads, and constant volatility, which creates frequent trading opportunities. For traders looking to maximize their returns in 2024, these currency pairs offer the most potential.

While more recent data for 2024 is yet to be published, the market structure has remained largely consistent, and there is little reason to believe these figures have changed significantly in 2024.

Detailed Overview of the Top 5 Most Traded Currency Pairs

Let’s now take a closer look at each of the top 5 currency pairs, exploring what makes them so widely traded, and how you can take advantage of their unique characteristics in your trading strategy.

EUR/USD – The Global Leader

The EUR/USD is surely going to be the most traded forex currency pair in 2024 as well. It maintains its position as a favorite among traders worldwide. There are several reasons for its dominance:

- Liquidity: The EUR/USD offers unparalleled liquidity, allowing traders to enter and exit positions with ease. This is particularly attractive for high-frequency traders and those using algorithmic trading.

- Tight Spreads: Because of the pair’s popularity, spreads are extremely tight, minimizing the cost of trading.

- Economic Drivers: The EUR/USD is highly sensitive to events such as European Central Bank (ECB) monetary policy decisions, US Federal Reserve interest rate changes, and geopolitical events within the Eurozone.

Trading the EUR/USD with Algorithms:

For algorithmic traders, the EUR/USD is ideal due to its high liquidity and responsiveness to technical analysis. Traders can use Expert Advisors (EAs) to automate strategies based on key indicators like moving averages, Bollinger Bands, and the Relative Strength Index (RSI). As the pair is less prone to erratic moves compared to some emerging market currencies, algorithms can achieve consistent returns with relatively low risk.

USD/JPY – The Interest Rate Play

The USD/JPY remains a top-traded currency pair in 2024, heavily influenced by the monetary policies of the Bank of Japan (BoJ) and the Federal Reserve. There are several reasons that draw traders interest to this pair:

- Interest Rate Differentials: One of the main drivers of USD/JPY is the difference in interest rates between the US and Japan. The carry trade strategy, where traders borrow in low-interest currencies like the JPY and invest in higher-yielding currencies like the USD, continues to be a popular strategy.

- Safe-Haven Appeal: The Japanese yen is often seen as a safe-haven currency, particularly in times of global economic uncertainty. As a result, the USD/JPY can experience sharp movements during market volatility.

Trading the USD/JPY with Algorithms:

Algorithmic traders can capitalize on the predictable interest rate-driven trends of the USD/JPY. Expert Advisors can be programmed to enter trades based on the spread between US and Japanese government bonds or in reaction to key economic data releases, such as US non-farm payroll reports or BoJ meetings. A common algorithmic strategy is the mean reversion, where traders exploit short-term price deviations before they revert to their average.

GBP/USD – The “Cable” Pair

The GBP/USD, commonly known as “Cable,” is another highly traded pair, offering plenty of opportunities for traders in 2024. Here’s why:

- Volatility: The GBP/USD is known for its volatility, driven by economic data from both the Bank of England (BoE) and the Federal Reserve, as well as political factors like Brexit. This volatility makes it an attractive pair for traders seeking short-term opportunities.

- Economic Indicators: Key data points like UK inflation, employment figures, and interest rate decisions heavily influence the GBP/USD.

Trading the GBP/USD with Algorithms:

Algorithmic traders often use breakout strategies on the GBP/USD due to its volatile nature. By setting triggers around key support and resistance levels, Expert Advisors can automatically enter and exit trades during periods of sharp price movements. Timeframes such as H1 (one-hour charts) work well for algorithmic strategies on the GBP/USD, as the pair frequently sees price swings within a single trading session.

USD/CAD – The Oil Connection

The USD/CAD is another major currency pair, with its movements closely tied to the price of oil, one of Canada’s largest exports. Key factors influencing this pair include:

- Oil Prices: Since oil is a major driver of Canada’s economy, fluctuations in oil prices significantly impact the USD/CAD. For example, a rise in oil prices often strengthens the Canadian dollar, while a decline weakens it.

- Economic Relations: The strong trade ties between the US and Canada, including agreements like USMCA, also affect this pair.

Trading the USD/CAD with Algorithms:

Algorithmic trading strategies for USD/CAD often involve tracking oil price movements or economic data releases, such as US crude oil inventories. Commodity-linked strategies can be implemented through Expert Advisors. This will allow traders to take positions when oil prices move in correlation with the Canadian dollar.

AUD/USD – The Commodity Currency

The AUD/USD is a top 5 currency pair due to Australia’s strong ties to global commodity markets, especially those in China. Key drivers include:

- Commodity Prices: Australia is a leading exporter of commodities like iron ore and coal. As such, movements in global commodity prices, especially driven by demand from China, have a direct impact on the AUD/USD.

- Economic Indicators: Australia’s economic health, particularly its trade balance, inflation, and interest rates, plays a major role in this pair’s price action.

Trading the AUD/USD with Algorithms:

Algorithmic traders can benefit from the cyclical nature of commodities and China’s economic performance. Strategies that track commodity price indices or China’s GDP growth can provide valuable signals for trading the AUD/USD. Trend-following algorithms are particularly effective on this pair, as the AUD/USD often follows long, sustained trends tied to macroeconomic developments.

How to Trade Forex Most Popular Pairs with Algorithmic Trading

The forex market can be overwhelming, especially when trading these top currency pairs. However, algorithmic trading simplifies the process, allowing traders to automate strategies, reduce emotional bias, and capitalize on market opportunities around the clock.

Using Expert Advisors:

Algorithmic trading involves using Expert Advisors (EAs) to automate your trades. These software programs are designed to follow specific rules based on technical analysis indicators like moving averages, RSI, or Bollinger Bands. The beauty of algorithmic trading is that it removes the need for manual intervention, letting traders manage multiple pairs simultaneously.

For example, using the EUR/USD, you can set an EA to trade based on key support and resistance levels, executing buy or sell orders automatically. Similarly, for pairs like the USD/JPY or GBP/USD, algorithms can trigger trades based on interest rate announcements or geopolitical events.

Now that you know the top 5 most traded currency pairs in forex and how to approach them with algorithmic strategies, it’s time to take the next step. Why not automate your trading using the Top 10 Robots App? This app provides access to the best-performing Expert Advisors, allowing you to trade the majority of the most traded currency pairs in forex effortlessly.

Conclusion: Trading Success with the Right Currency Pairs

The key to forex trading success lies in choosing the right currency pairs and trading them effectively. In 2024, the EUR/USD, USD/JPY, GBP/USD, AUD/USD, and USD/CAD likely will remain the top 5 pairs, offering liquidity, volatility, and trading opportunities. By combining your knowledge of these pairs with algorithmic trading strategies, you can maximize your potential profits.

If you would like to read about Top 10 Most Volatile Forex Pairs + The Reasons Why, follow this link.