Introduction

If you’re researching brokers and want a detailed, up-to-date IC Markets review, you’re in the right place. Known for raw spreads, fast execution, and powerful platforms, IC Markets has become a top choice for both beginner and advanced traders. In this review, we’ll break down everything you need to know — from trading conditions and account types to regulation, tools, and support — so you can decide if this broker fits your trading goals.

What Is IC Markets?

IC Markets is a global Forex and CFD broker known for speed, transparency and low cost. Founded in 2007 by traders, it was designed to give retail clients institutional grade conditions – tight spreads, deep liquidity and fast execution without unnecessary fees or dealing desk intervention.

The broker is operated by Raw Trading Ltd and regulated by the Seychelles Financial Services Authority (FSA) under license SD018. It also has regulatory entities in Australia (ASIC) and Cyprus (CySEC) but this review is for the globally available FSA regulated entity.

Today IC Markets handles over $1.6 trillion in trading volume per month and has over 200,000 clients worldwide. Its infrastructure is designed for active traders with servers hosted in the Equinix NY4 data center for ultra low latency and high speed execution.

IC Markets operates a true ECN model and connects to over 25 liquidity providers so spreads can go as low as 0.0 pips during peak trading hours. It’s a great fit for scalpers, algo traders and anyone who values precision and performance.

Who Can Trade with IC Markets?

IC Markets accepts traders from most global jurisdictions, including India, South Africa, Malaysia, and Thailand. Registration is done online and verification processes within 24 hours typically.

Clients operate with multiple base currencies including USD, EUR, AUD, GBP, JPY, and SGD, eliminating currency conversion fees during account funding.

IC Markets restricts access from the United States, Canada, Brazil, Israel, New Zealand, and specific jurisdictions due to regulatory compliance requirements.

Traders can access unlimited demo platforms, multilingual assistance, and 24/7 support channels for immediate trading.

Is IC Markets Regulated and Safe?

As mentioned above, IC Markets operates under Seychelles FSA regulation through Raw Trading Ltd. The broker maintains adequate safety standards and runs on an ECN model.

Client funds stay in segregated bank accounts, separate from company money. Data protection uses SSL encryption and two-factor authentication, with transactions processed through secure systems.

They don’t run a dealing desk, so there’s no conflict of interest — they earn from spreads and commissions, not client losses.

IC Markets Review: Trading Platforms

IC Markets provides three trading platforms — MetaTrader 4, MetaTrader 5, and cTrader — giving traders standard tools and execution speed.

MT4 remains the most common platform in the industry. It works reliably and supports third-party indicators and Expert Advisors (EAs). IC Markets provides raw pricing without a dealing desk, suitable for manual and automated trading.

MT5 expands on MT4 with additional timeframes, indicators, economic tools, and multi-asset access. It handles more complex requirements, including stock and futures CFDs.

cTrader serves traders who need fast execution and detailed order management. It includes Level II pricing, detachable charts, and built-in algorithmic trading through cTrader Automate. The platform runs efficiently in ECN environments.

All platforms work with IC Markets account types, providing raw spreads, fast infrastructure, and VPS support for continuous trading.

Platform Performance and Infrastructure

IC Markets platforms connect to Equinix NY4, an advanced financial data center. Execution speeds average under 40 milliseconds. Fast-moving markets and automated systems benefit from this setup.

Order routing goes direct, no dealing desk involved. Platforms maintain stability for high-frequency strategies and institutional order sizes.

IC Markets built its platform for automated and algorithmic trading. These systems handle over 60% of trades placed daily. The broker processes more than 500,000 trades each day through Expert Advisors, or trading bots as they are more commonly referred to, and high-frequency systems.

IC Markets Review: Account Types

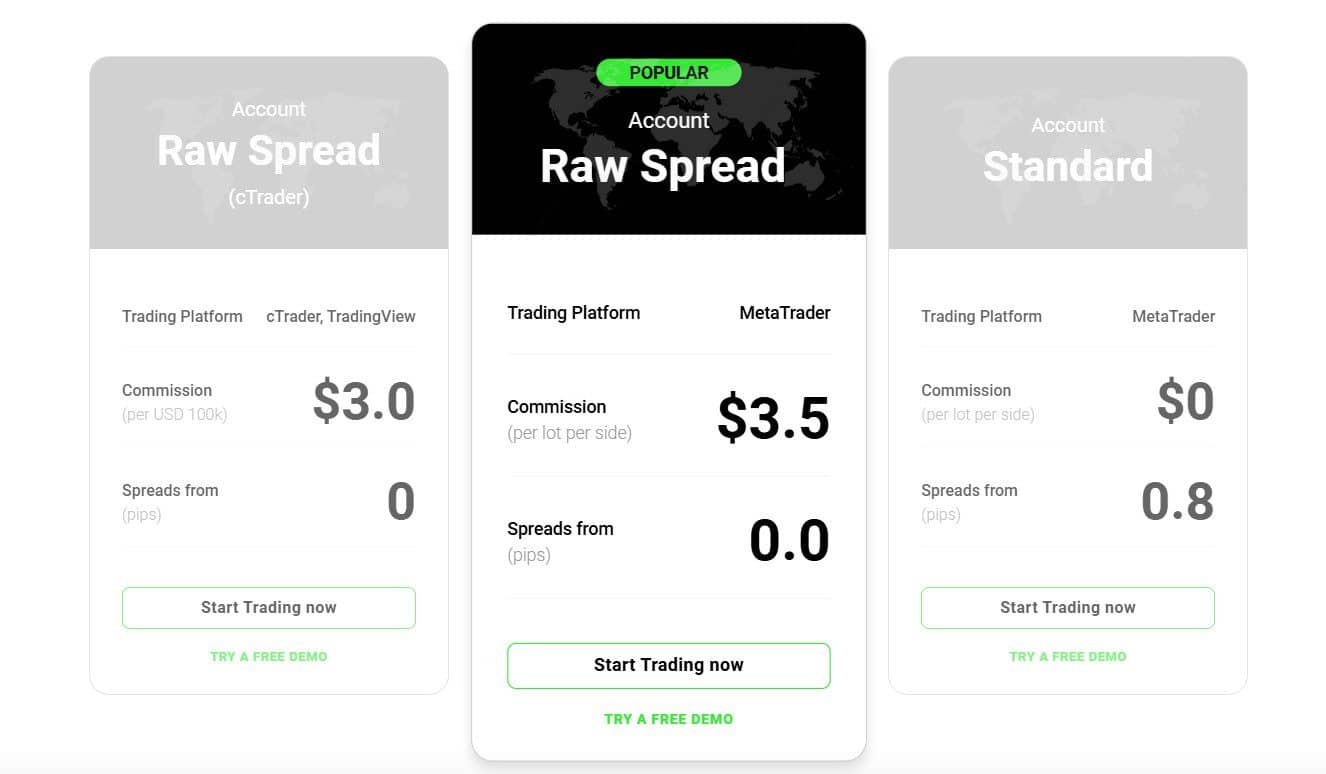

IC Markets offers three main live trading accounts: Standard, Raw Spread (MetaTrader), and Raw Spread (cTrader). Each account delivers tight spreads, low costs, and fast execution for different trading needs.

The Standard Account charges no commissions. Trading costs are built into spreads starting from 0.6 pips on major pairs. This makes cost calculation simple and suits beginners and swing traders who prefer transparent pricing. The account uses IC Markets’ no-dealing-desk execution.

The Raw Spread Account for MetaTrader 4 and MetaTrader 5 starts spreads at 0.0 pips during peak hours. IC Markets charges $3.50 commission per standard lot per side, totaling $7 per round-turn. Scalpers, high-frequency traders, and algorithmic strategies use this account. It connects to 25+ liquidity providers.

The Raw Spread Account on cTrader matches MetaTrader execution quality with $3.00 per lot per side commission. Traders who prefer cTrader’s interface, Level II pricing, and chart tools choose this option.

IC Markets provides a free demo account that doesn’t expire with regular use. The demo replicates real market conditions across all platforms and account types. New traders use it for learning basics while experienced traders test strategies.

Consider your platform preference, cost model, and trading approach when choosing accounts. All IC Markets accounts provide fast execution, no dealing desk, and transparent pricing for scaling strategies.

What Can You Trade?

IC Markets provides access to over 2,250 tradeable instruments. These cover Forex, commodities, indices, stocks, crypto, bonds, and futures through a single account.

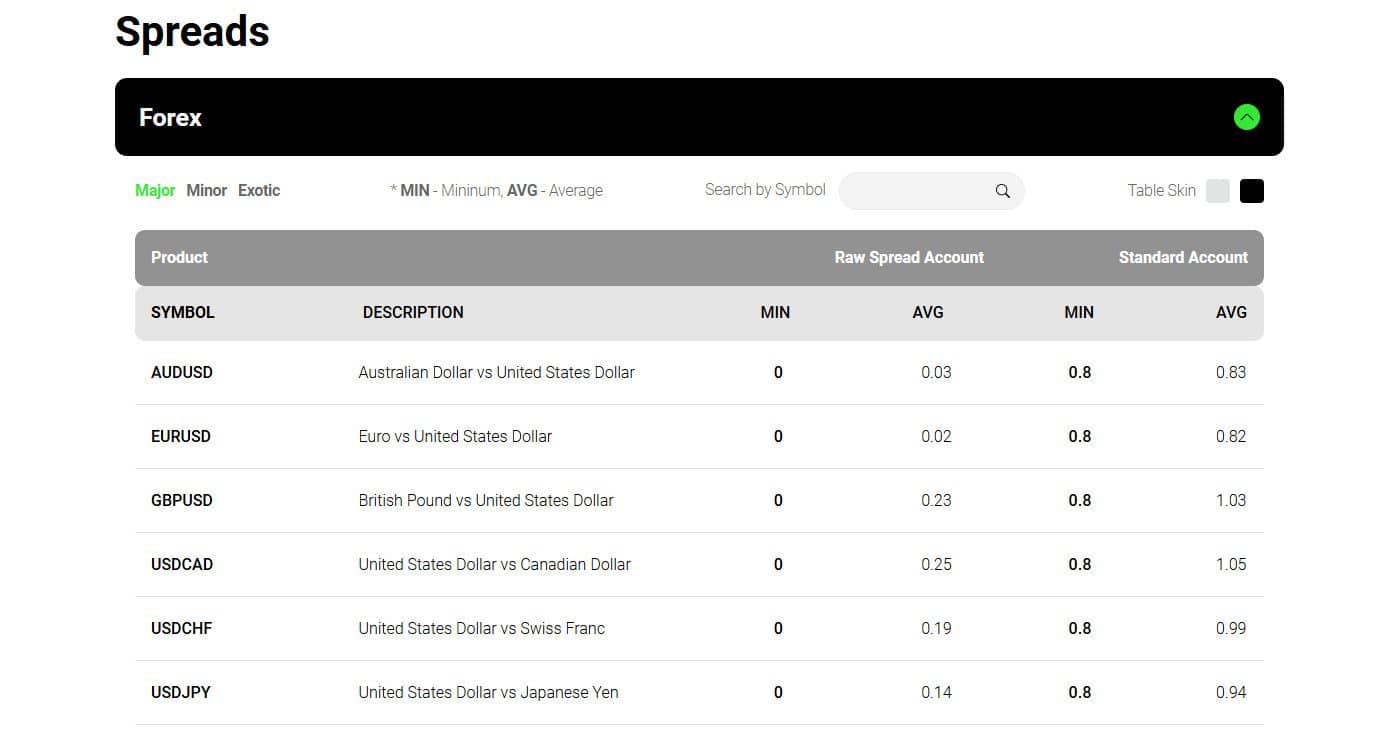

Forex represents the primary market offering, with over 60 currency pairs available. These include majors, minors, and exotics. Spreads start at 0.0 pips, and trading operates 24/5 with standard liquidity and execution.

Commodity CFDs cover gold, silver, oil, and agricultural products. Gold (XAU/USD) maintains activity levels with competitive spreads during standard market hours.

Indices such as the S&P 500, NASDAQ 100, DAX 40, and Nikkei 225 operate nearly 24/5. These instruments allow traders to access broad market movements.

Stock CFDs include 2,100+ global companies from US, European, and Asian markets. MetaTrader 5 handles these exclusively, supporting both long and short positions with leverage options.

Crypto CFDs feature Bitcoin, Ethereum, Ripple, and others with 24/7 availability. No wallets or exchange fees apply, though regional restrictions may exist.

Bond and futures CFDs provide exposure to interest-rate assets and global futures contracts. No separate futures account is required for access.

This instrument range supports diversified strategies and global market access through one platform.

IC Markets Mobile App

IC Markets provides a mobile trading app for iOS and Android devices. The app lets traders monitor markets, execute trades, and manage accounts from their phones — you can’t lose the core functionality when you’re away from your desktop.

The app includes real-time price feeds, interactive charts, and access to order history and open positions. It handles all standard order types and supports one-click trading for quick market moves. You can check account details, handle deposits or withdrawals, and reach support directly through the app.

Traders who need constant market access or prefer using smartphones and tablets get a secure interface that doesn’t compromise on essential trading functions.

IC Markets Review: Trading Conditions: Spreads, Speed, and Execution Quality

IIC Markets is renowned for its low spreads, fast execution and transparent pricing — essential for scalpers, day traders and algo systems.

Raw Spread accounts have institutional grade pricing from over 25 liquidity providers, with 0.0 pips on major pairs like EUR/USD. Standard accounts start from 0.6 pips and have no commissions, a simpler cost structure.

If you choose Raw Spread, you’ll pay $3.50 per side on MetaTrader platforms or $3.00 per side on cTrader. IC Markets charges no extra fees for platforms, inactivity or withdrawals.

All trades are executed from the Equinix NY4 data center, under 40 milliseconds. This low latency reduces slippage and ensures fast and accurate fills — perfect for high frequency trading and automation.

IC Markets is a no dealing desk (NDD) execution model, so trades aren’t routed or manipulated. There are no re-quotes, slippage is minimal or even in your favour. Scalping, hedging and using Expert Advisors are fully supported, so you have full control over your strategy.

IC Markets Review: VPS Hosting and Automated Trading

For algorithmic traders, system uptime and execution speed is everything. IC Markets gets it and offers Virtual Private Servers (VPS) so you can stay connected to the market 24/7 — even when your own computer is off.

This is a big win for algorithmic traders, especially those using Expert Advisors (EAs) or high-frequency systems.

Why use a VPS?

A VPS hosts your trading platform in a secure, always-on environment — so your strategies run even if your local internet or power fails. Located near IC Markets’ NY4 data center, a VPS minimizes latency and improves execution precision, which is key for scalpers and algorithmic traders.

IC Markets partners with top-tier VPS providers like NYC Servers, Beeks FX and ForexVPS. Active traders may qualify for free VPS, typically by trading around 15 lots/month on a Raw Spread account. Contact support with proof of trading volume to apply.

EA and Automation-Friendly Environment

IC Markets is one of the few brokers that fully supports Expert Advisors, copy trading platforms, and other forms of automation. There are no restrictions on EAs, no limitations on high-frequency trading, and no trade rejections tied to automation.

This makes IC Markets especially appealing for tech-savvy traders who rely on scripts, bots, or signal-based systems. Whether you’re using a commercially available EA or coding your own strategies, the broker’s infrastructure is ready to support it.

Combined with the raw spreads and low-latency data center access, IC Markets offers one of the most automation-friendly environments in retail trading.

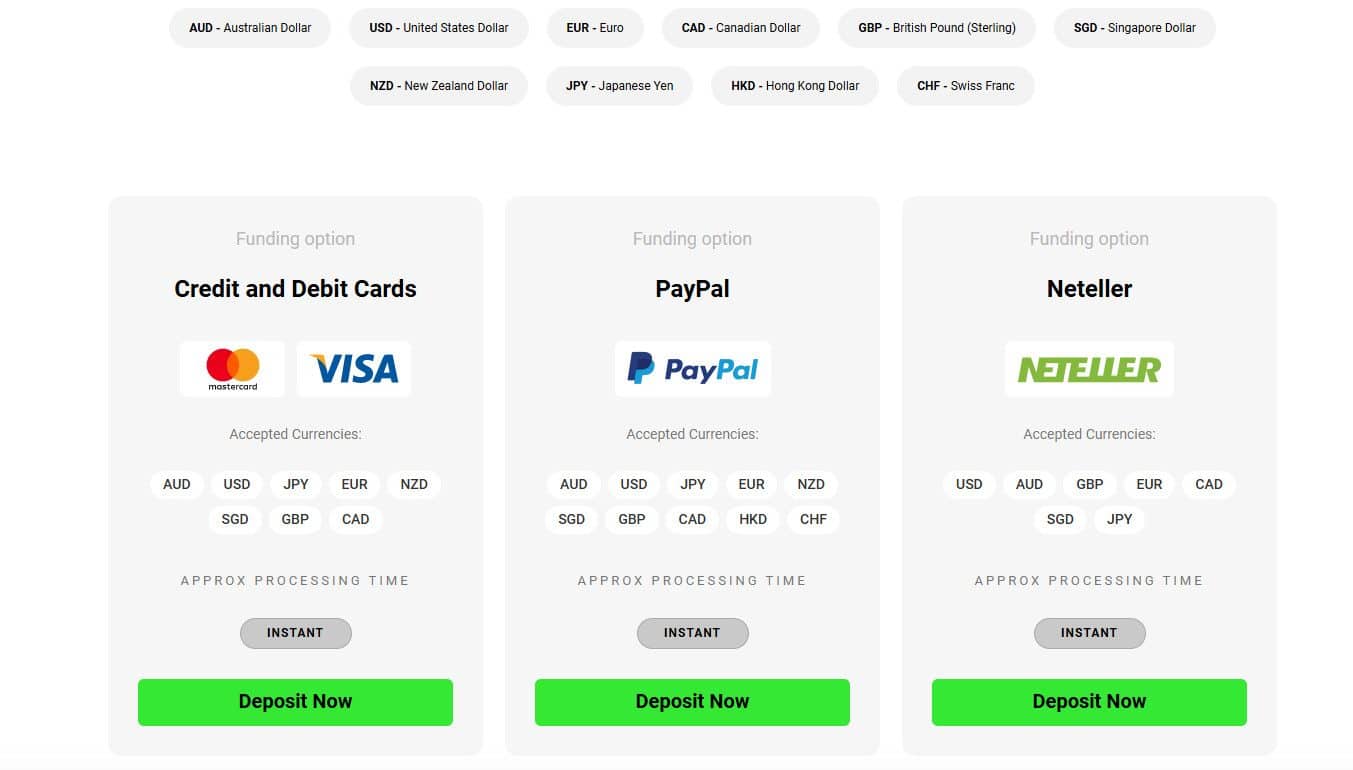

IC Markets Review: Deposits and Withdrawals

IC Markets offers a quick, easy and flexible funding experience for traders worldwide. Whether you’re depositing to start trading or withdrawing profits, the broker prioritises speed, security and zero fees on their end.

Fast Deposits

You can fund your trading account using a wide range of payment methods. These include:

- Credit and debit cards (Visa, MasterCard)

- Bank wire transfers

- eWallets such as Skrill, Neteller, PayPal

- Cryptocurrencies such as BTC, ETH, USDC, USDT

- Regional options based on your location (e.g., FasaPay, UnionPay, POLi, and more)

IC Markets processes most deposits instantly for card and wallet based payments. Bank wire transfers may take 2–5 business days depending on your bank and location.

The broker doesn’t charge fees on deposits, but your payment provider may charge fees or conversion costs. You can deposit in multiple base currencies including USD, EUR, GBP, AUD, SGD, NZD, JPY and more which helps reduce exchange costs when funding with a matched currency.

Fast Withdrawals with No IC Markets Fee

Withdrawals are also quick. Most withdrawals are processed within 24 hours, especially during business days. Card and eWallet withdrawals tend to be faster, while bank transfers may take several days depending on the receiving bank and country.

IC Markets doesn’t charge any withdrawal fees, regardless of the method. However, your bank or third-party processor may deduct a transaction or intermediary fee for international wire transfers.

You can manage both deposits and withdrawals through the secure client portal which uses encryption and other security measures to protect your payment details.

IC Markets Review: Security and Transparency

All funding operations are secured through encrypted payment gateways and protected by SSL protocols. IC Markets holds client funds in segregated accounts, so your trading capital is separate from the broker’s operational funds – so you’re protected in the event of any financial issues at the company level.

There’s full transparency across all stages of the funding process. The broker provides real-time updates via the client portal and if you need help 24/7 support is available to assist with any issues.

No Inactivity Fees or Hidden Costs

IC Markets operates without inactivity fees, platform fees, or hidden charges. The broker maintains this policy regardless of trading frequency.

Accounts remain unaffected during periods of market absence. Funds stay intact unless you execute trades or request services like withdrawals, which IC Markets processes without charge.

This approach suits both frequent and occasional traders. The policy reflects standard operational practices without additional account maintenance costs.

IC Markets Review: Education and Tools

IC Markets goes beyond pricing and execution by offering useful resources and tools for traders of all levels.

Its Education Hub has clear, beginner-friendly content on order types, risk management, leverage and technical analysis. Platform tutorials and video guides are also available to help you navigate MetaTrader and cTrader.

For more in-depth information, IC Markets hosts webinars led by market professionals. These sessions cover trading techniques and market trends in real time. The broker also publishes daily market analysis highlighting key events, chart setups and price action insights to help you stay informed and plan better.

Tools for Advanced Traders

Beyond education, IC Markets has several useful tools for advanced traders.

First, there’s Autochartist, an automated market scanning tool that integrates into MetaTrader. It finds chart patterns, key levels and potential breakout zones in real time. You can use it to validate setups or generate new trade ideas.

IC Markets also integrates with DupliTrade, a copy trading platform where you can mirror strategies from professional traders. Perfect if you want to be in the market but don’t have time to trade manually.

Finally, for coders and strategy developers, MetaTrader 4, MetaTrader 5 and cTrader have custom indicators, scripts and algorithmic bots. Whether you write your own code or use third-party tools, the platforms give you full control over how your system works

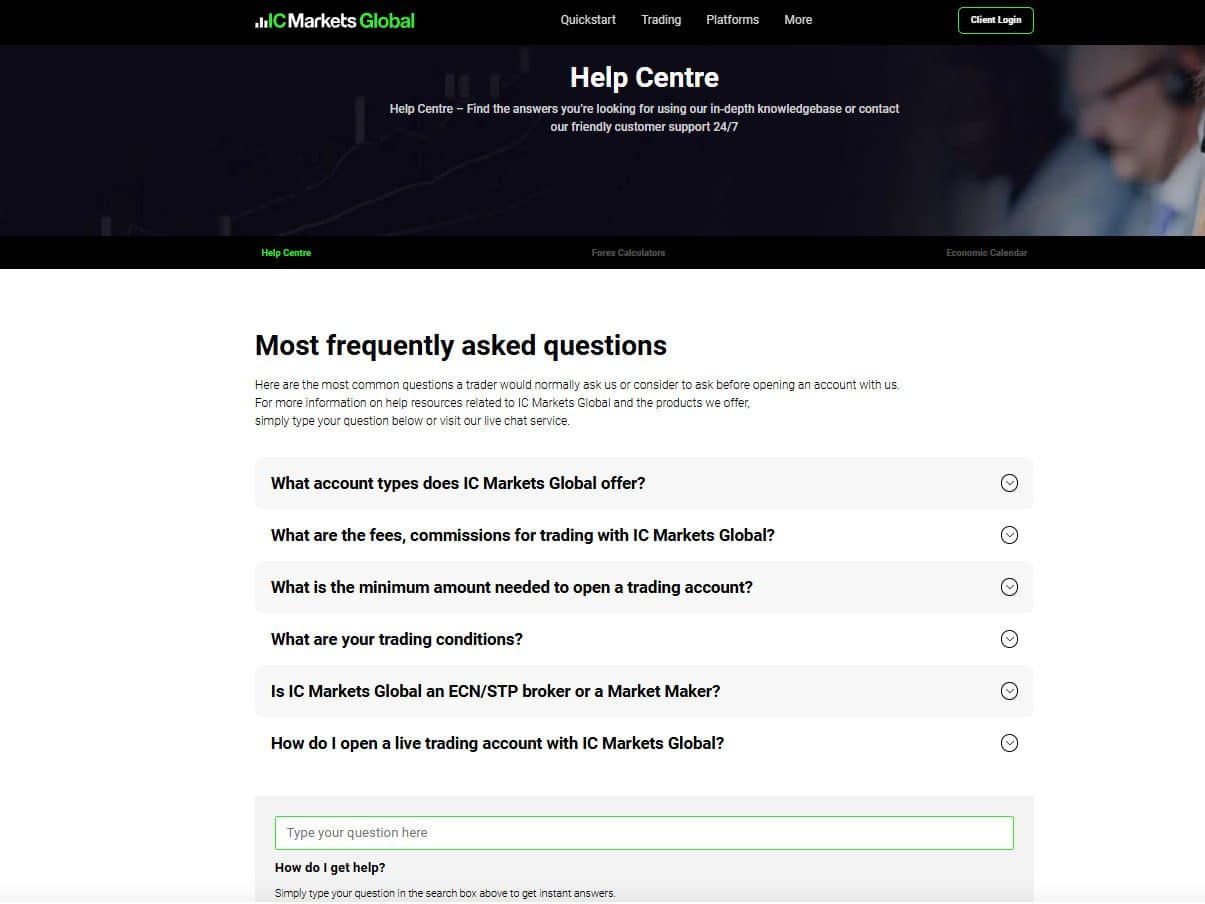

IC Markets Review: Customer Support

IC Markets has 24/7 customer support through live chat, email and phone. This is very useful for traders around the world who might be in a timezone other than the broker’s or traders who trade particular sessions that might fall in the middle of the night elsewhere.

Live chat is the fastest option. Most users get connected to a real person within a few minutes. The support team handle everything from technical questions and platform issues to funding and account setup.

If your issue requires more in-depth help you can also email. Support teams respond within 24 hours and escalate as needed. Trained agents handle urgent matters by phone not outsourced call centers.

Knowledgeable and Friendly Agents

IC Markets has multilingual support in English, Spanish, Chinese, Vietnamese and Portuguese. This makes it easier for traders worldwide to get help in their own language.

The Help Center is well organized with step by step articles and FAQs for verification, funding and platform setup. Ideal for self service users.

And all traders get equal support whether you have a $200 account or trading 6 figures. The broker’s client first approach means prompt and helpful assistance for everyone.

Final Verdict: Should You Choose IC Markets?

IC Markets has raw spreads, fast execution and advanced trading platforms, making it one of the best for active retail traders.

The broker delivers 0.0 pip spreads, sub-40ms execution, and MT4, MT5 and cTrader. With over 2,200 instruments across Forex, crypto, indices, shares and more it’s built for serious traders who want flexibility and depth.

Customer support is fast and reliable, and the platform infrastructure is for discretionary and algorithmic strategies.

But IC Markets isn’t available in U.S., Canada, Brazil, Israel and New Zealand. Also, stock CFDs are only available on MT5, which may be a problem for some users. While the Seychelles FSA regulation is good it’s not tier one.

Still, for traders who want low costs, speed and a smooth trading experience, IC Markets stands out. Whether you’re starting out or scaling up it has pro tools and infrastructure for traders who take performance seriously.