Gold Expert Advisor: The power in 2020!

Gold Expert Advisor is the thing every trader looks for in 2020. In this article, I will show you the process of creating Expert Advisors and strategies. No programming or trading experience is needed.

And I will create actually hundreds of strategies and I will show you how I filter them with the Expert Advisor Studio. This is the software that is integrated on our website.

With the EA Studio, you can create not only Gold Expert Advisor but any type of robot, for any trading asset.

You can find it already on many websites. The good thing is there is 15 days free trial which you can use just to test creating a Gold Expert Advisor.

And during this time, you can export as many Expert Advisors as you wish.

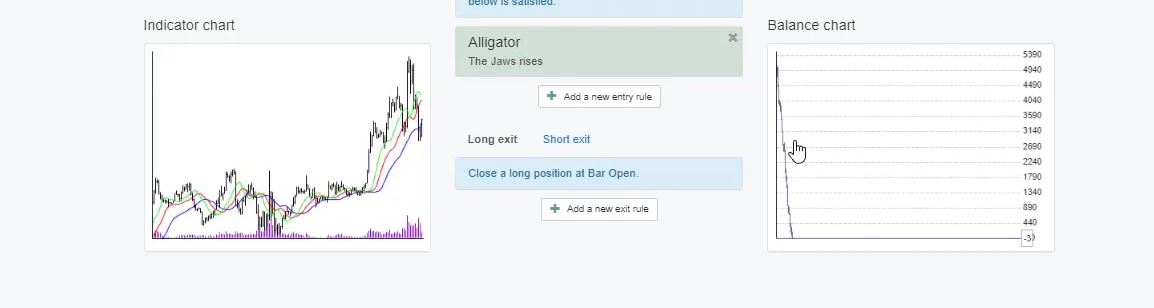

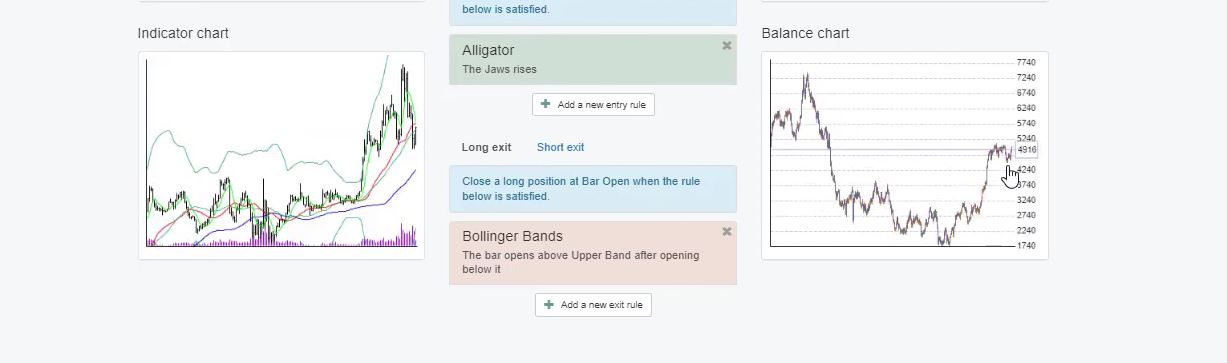

The key point here is that we can export strategies with one click as Expert Advisors without any programming skills. So even if you have some manual strategies, you can put here your entry rule. For example, let’s take the alligator indicator.

I will not do it in details but, for example, if the teeth rises and here is the standard inputs, you can see this is a dramatic loss for this strategy.

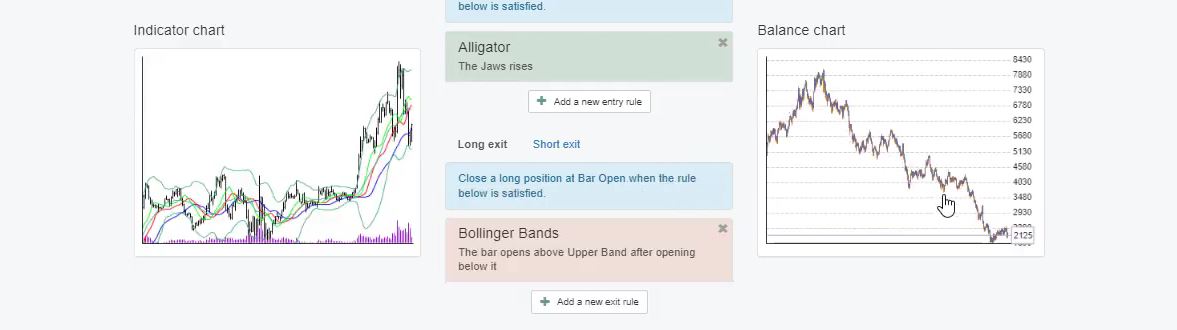

And if I have the Bollinger bands, the rule the bar opens above upper band after opening below it which was the example strategy, you can see we have already a balance chart. But it’s still losing.

The Stop Loss and Take Profit in the Gold Expert Advisor.

And we can add here the Stop Loss, the Take Profit, entry lot with how much you’d like to trade. For example, here if I add Stop Loss of $99, I will click on accept. And if I add a Take Profit, let’s say of $93 and here is in pips, so with the gold, this is $99 and $93.

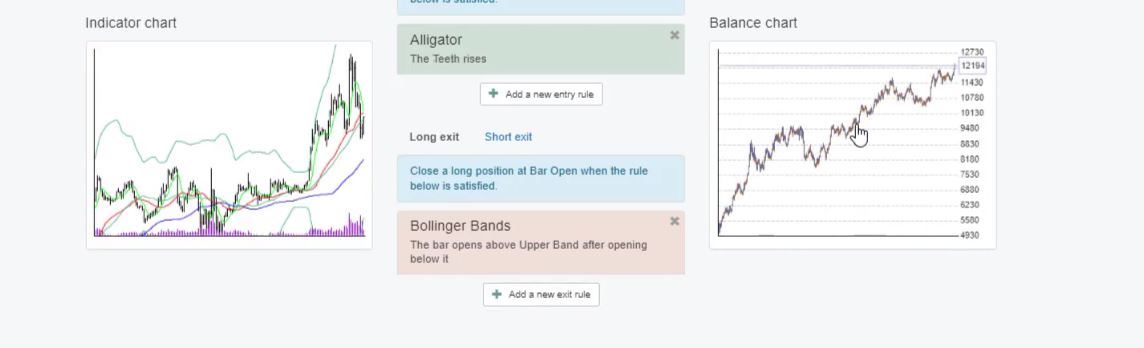

And if I change not used to fixed and as well for the Take Profit and I click on accept you will see there is a difference in the balance chart. Let’s change the parameters of the alligator.

For example, I will change the jaws period to 31, the jaws shift I will change it to 15, teeth period as well I will change it to 15, teeth shift I will change it to 3 and then the lips period I will change it to 3, lips shift 1.

And if I click on accept you will see again the strategy changes.

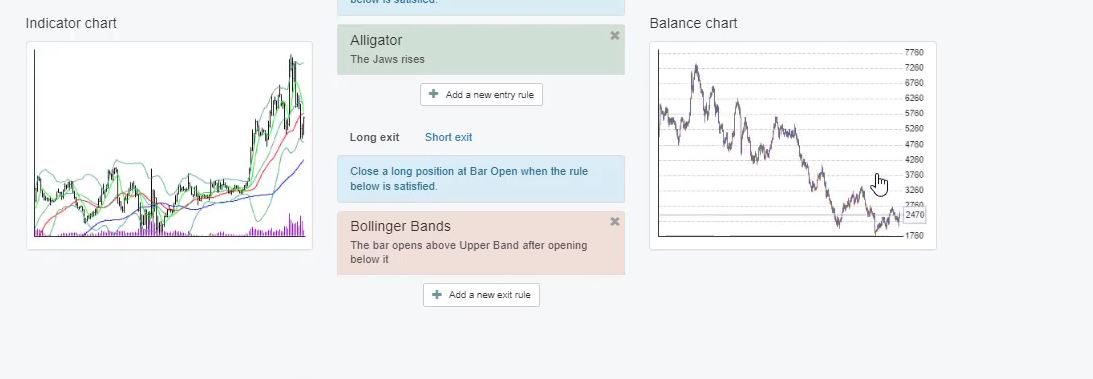

Now, if I change the Bollinger bands as well, you will see again the change in the balance chart. So the period of 20 I will change it to 37 and deviation I will change it to 3.62 and I will click on accept. You can see the strategy is different.

It goes down, then it goes up on a profit. And actually, here I had the teeth rises not the jaws. Sorry guys. I had the teeth rises. And I click on accept and you will see the balance chart.

So this is the strategy that I showed you in the course Top 5 Gold Expert Advisors + 10 EAs.

We can export the strategy as Gold Expert Advisor for Meta Trader 4 and Meta Trader 5.

You can see the balance chart is very nice, it is stable, it actually matches the backtest of the Meta Trader that we did. Just that here it’s in a very small window and more detailed. And here we have actually count of trades – 893.

So we had this strategy executing trades 983 times, not just 30 or 50 which makes the backtest much more reliable. And the thing here is with one click, we can export this strategy as Expert Advisor for Meta Trader 4 and for Meta Trader 5.

So this is why I am using this Strategy Builder and we have implemented it in our website because it helps me and it helps my traders and students to trade automatically with Expert Advisors without programming skills.

So I don’t need to have a developer in the team to develop the strategies. And I can do it, but I have done that. It is very hard to give strategies to someone to automate.

And actually, even if you automate the strategies you don’t know what are the best parameters, you don’t have all the statistics that are here in the Strategy Builder EA Studio which helps a lot the trading and it helps me to improve the strategies. However, I am not going to talk in details about the EA Studio.

Strategy properties in the Gold Expert Advisor.

There are many free videos about it and I have created already many free videos that you can have a look at and learn more about how it works. So now I will generate the strategies. I will delete the strategy that I have created from the collection.

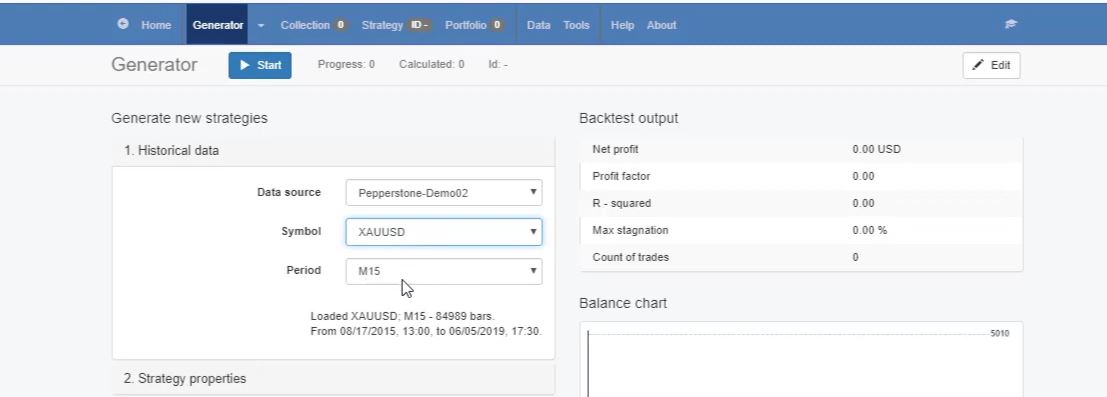

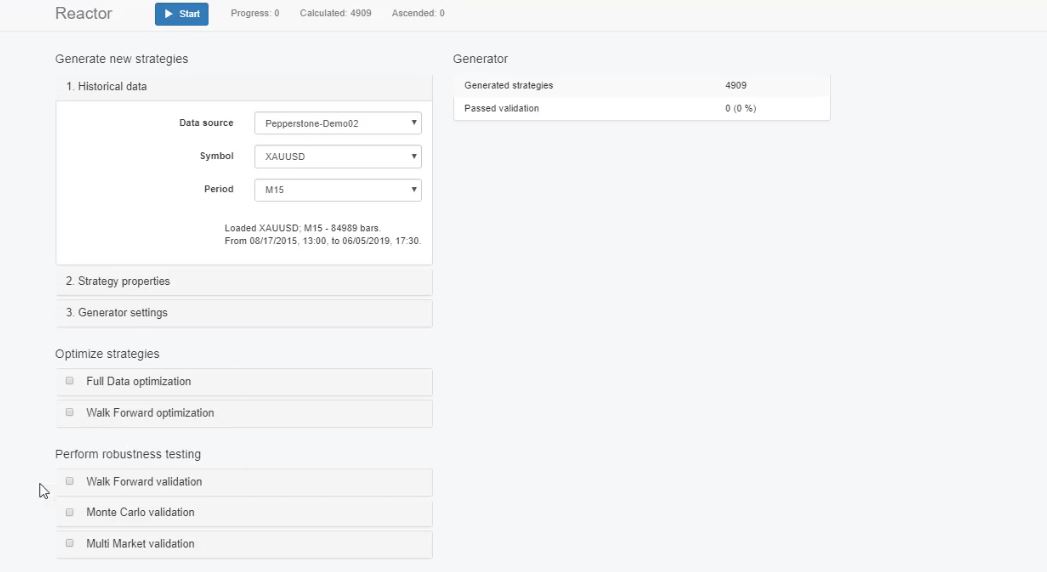

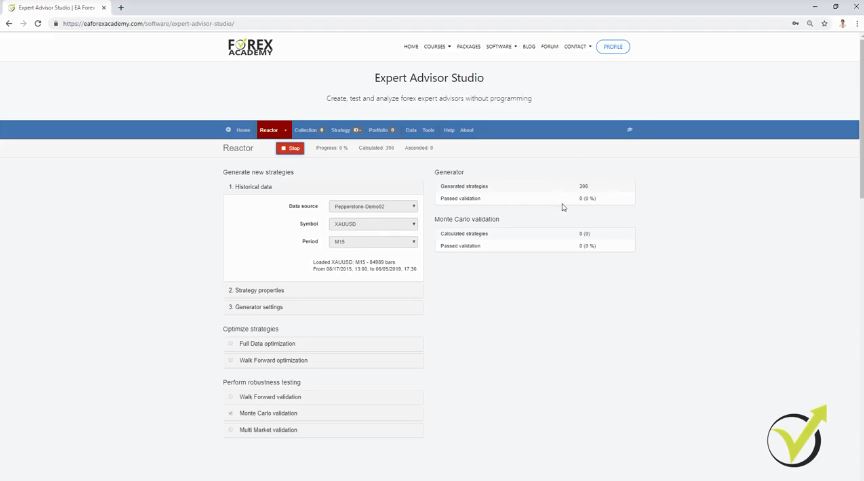

So in the collection, we collect all the strategies that we have created. And I will go to the generator. Simply the generator creates strategies over the historical data that I have selected. In this case, I will use the gold on M15 chart.

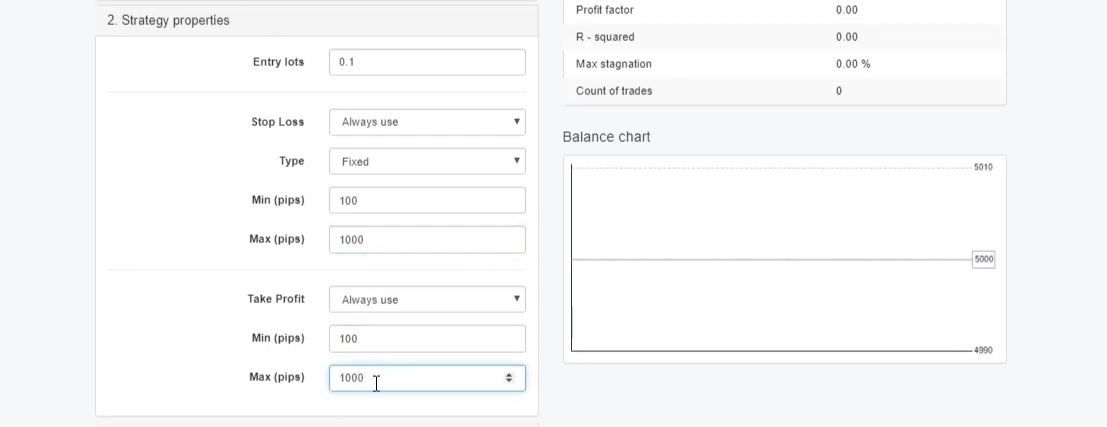

Then from strategy properties, I can select what entry lot I want to have, what type of Stop Loss to use; trailing, fixed or trailing, I will stick with fixed. And then we have the range for the Stop Loss and the Take Profit, so I’ll go between $10 and $100 for the gold Expert Advisor and the same with the Take Profit.

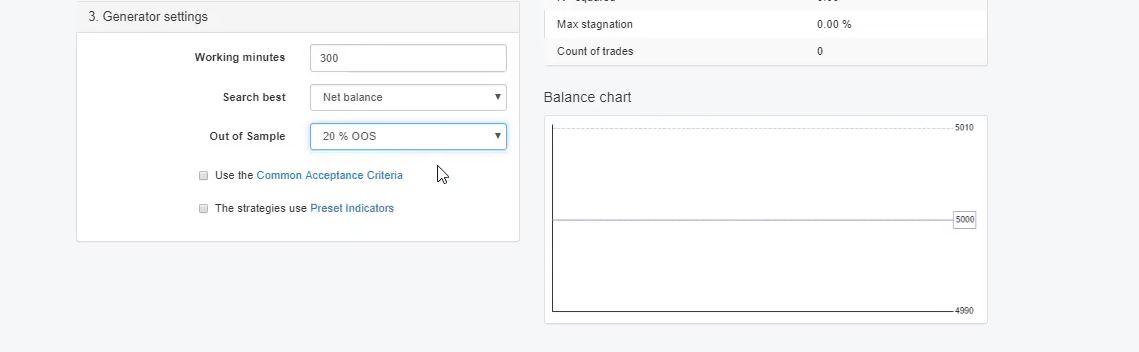

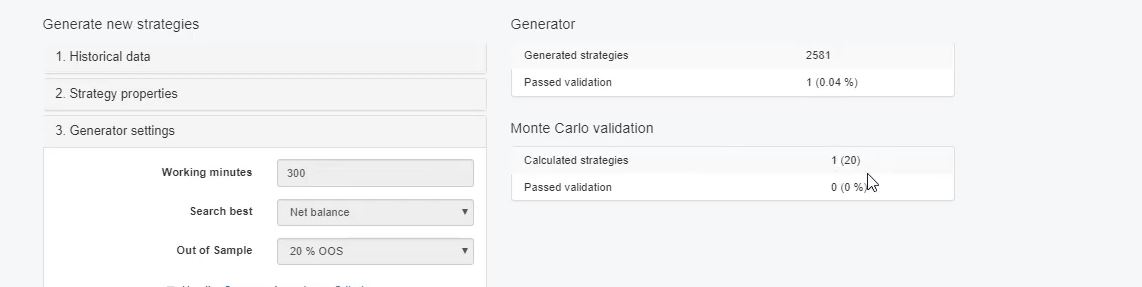

And then we have the generator settings where we set how much time we want the generator to work. I will set it to 300 minutes. And then we have Out of Sample, In Sample. Here, I will choose 20% Out of Sample.

The Acceptance criteria.

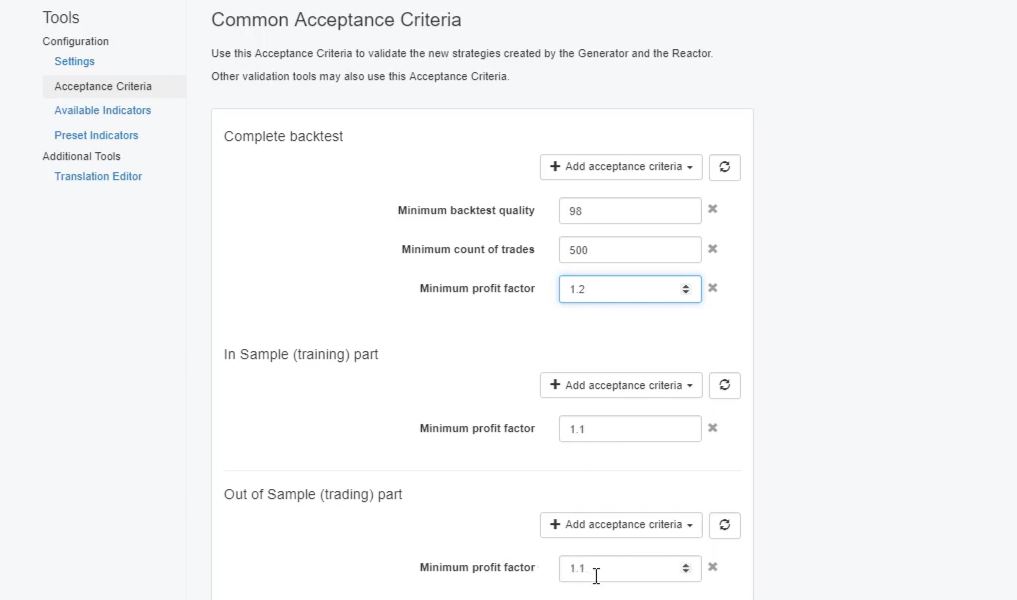

What that means guys, if I click this generator right now without adding the Acceptance criteria, it will generate me many strategies. They will go into the collection. Actually, hundreds are already calculated but only some of those will go to the collection, normally the profitable ones.

And later, I will filter them more with the common Acceptance criteria. Now, what is the idea of using the Out of Sample for those who didn’t watch some of my other courses? We have the whole period where the generator works.

Now, when we use Out of Sample 20%, it means that the generator will generate the strategies only using 80% of the historical data, the white zone. And with the rest 20%, this is the most recent historical data, it will simulate trading and it will perform a backtest for it. So we will see if this strategy performed well during the last few months.

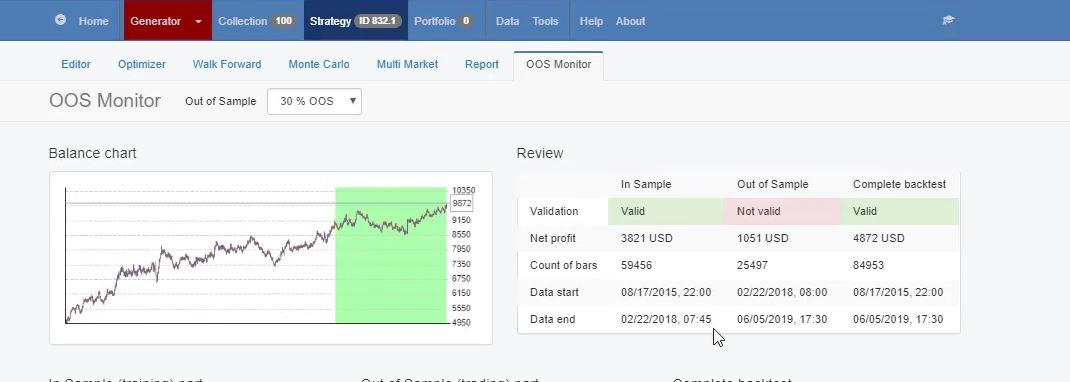

And if I go to more details into that, I will tell you how much time is that. I will go to any of the strategies and I will click on Out of Sample monitor. So here you can see that the white zone, In Sample part, is actually from 17th of August, 2015 to 22nd of February, 2018.

The reactor.

And then Out of Sample part is from this date of 22nd of February 2018 till the current moment. So this is more than 1 year. The strategy was tested for the last 1 year and few months until the moment. It is like what would have happened if we had placed the strategy back on the 22nd of February, 2018.

This is really nice because simply we test the strategy with unknown data and not only on the known data that we have exported from the reactor. And now I will stop this generator. I will delete all of these strategies because you can see some of those are very nice strategies with very nice backtest output.

But I want to filter them. I don’t want to have so many strategies because I want to see only the top strategies into my collection. Now, I will go back to generator and I will switch to reactor. So the reactor is generator plus some optimizing tools and robustness tools.

Now I will leave it here same, with the same Stop Loss range and Take Profit range, same entry lot of 0.1. And generator settings, I will use the common Acceptance criteria, as well I will stick with Out of Sample 20%. So the common Acceptance criteria allows me to predefine some rules for the generator.

The Profit factor.

For example, I would like to have minimum backtest quality of 98%, minimum count of trades here I can go to 500. Normally, with the Forex, I stick with a minimum of 300. This is like the very bare minimum that I want to have.

But with the gold and because I have a nice historical data, I want to see minimum 500 count of trades for every strategy. And then I will have the minimum Profit factor of 1.1. And actually, I will increase it to 1.2 for the complete backtest, but pay attention here.

In Sample, I will have 1.1 Profit factor and for the Out of Sample, I will have 1.1.

So I want to have 1.1 Profit factor in the white zone, in the green zone and for the whole period, I want to have 1.2. This means that in the collection, I will see only the strategies that are profitable during this tested period since 2018 February.

Because I don’t want to see the strategies that failed during this time. There will be such strategies but I really don’t care about them because I don’t want to trade them. I want to trade only the strategies that perform well in the testing period.

In the trading period actually. It is called trading period because it simulates trading. Now, for the people who don’t know what is the Profit factor, this is the ratio of the Net profit vs. the Net loss. Or it shows how much the profit exceeded the loss.

The Monte Carlo.

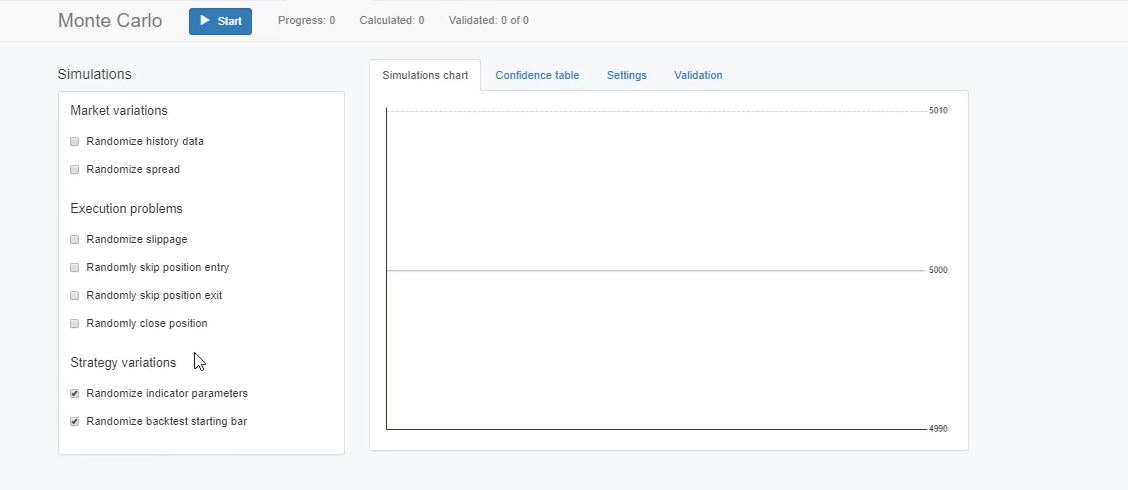

So now going back to the reactor, I will add as well the Monte Carlo validation. This is one of the robustness tools. I’m not going to talk in details about each one of those but the Monte Carlo, simply said, it tries to break the strategy before we actually test it even on a Demo account. So it performs a variety of tests.

In this case, I will stay with 20 count of tests and I want 80% of those tests to be validated. And if I click on Monte Carlo, you can see the different simulations it runs. It can run simulations for the market variations, for execution problems, strategy variations.

And normally, I test it with randomized indicator parameters and randomized backtest starting bar. Which means that for each strategy, it will run different backtests with different parameters.

If they fail, it means that the strategy was over-optimized with the parameters. And it will run different backtests with different starting bar. And this way we will make sure that whenever we start trading with the strategy, it will still be a robust strategy.

EA Studio has a unique speed.

Now going back to the reactor, I think I am ready to start it. I will click on start and the speed of EA Studio is really unique. And these are actually generated strategies. And those of the strategies that passed the validation for the Acceptance criteria right over here, they will go to the Monte Carlo.

Those of the strategies that pass the Monte Carlo, I will see them into the collection. I don’t see so many strategies actually till the moment I don’t have any.

But this way, I want to filter the better strategies and I want to have at the end good strategies into my collection that have Profit factor of 1.2. For the complete backtest, minimum 500 trades. And for the In Sample and for the Out of Sample, I want to have 1.1 Profit factor.

So I have set the generator to work for 300 minutes which is 5 hours. And normally, I run it even for more, like 8 hours to 10 hours I run it. You can see what strategy passed the validation but failed to pass the Monte Carlo.

Feel free to ask if you have any question about EA Studio.

So what I wanted to say is that normally I run it overnight. I leave it working during the night and in the morning I can see the strategies into my collection. So now it will run for 5 hours and after that, I will see the results into my collection and I will continue the video showing you the results.

So if you have any questions about EA Studio, write in our trading Forum. I will make sure to answer you as soon as possible to any questions that you have along the course.