How to become a successful Forex trader – quick tips and guides for algorithmic trading

How to become a successful Forex trader is the thing every beginner trader looks for. Hello, dear traders, this is Petko Aleksandrov, and I will give some tips about the way I became successful in Forex trading with Expert Advisors. These are the trading Robots that become more and more popular nowadays.

Because I am not a developer but a trader, I can not code Experts, and I never wanted to learn it because it takes a lot of time, and there is no need to do it. Today we have strategy builders which are professional software for automating and testing strategies.

The favorite one that I use is called EA Studio, and it comes with a 15-days trial period.

In this article, I will talk about one of the features in this program that changed my trading. Not only I became profitable, but now I work less than I used to before.

The Reactor – the answer to How to become a successful Forex trader.

This is the tool you can find. If you click the arrow next to the generator, there is the reactor, there is the validator. So the validator is where you can drop old strategies, collections, or complete folders with strategies.

And you can validate them with new historical data or with data from a different broker. And it’s very helpful because when we generate strategies, we save them in collections and after that, we can validate them. So we don’t lose time again to generate new strategies.

But we can filter them through the validator with the recent historical data. So the reactor is the tool where we do everything automatically. And we don’t need to perform robustness testing manually or Walk Forward optimisation and validation.

Not only automated trading but an automated process to create EAs.

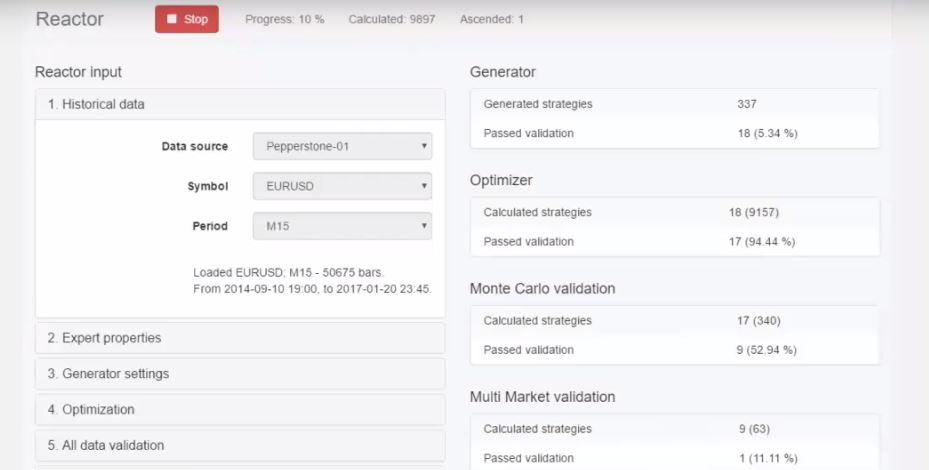

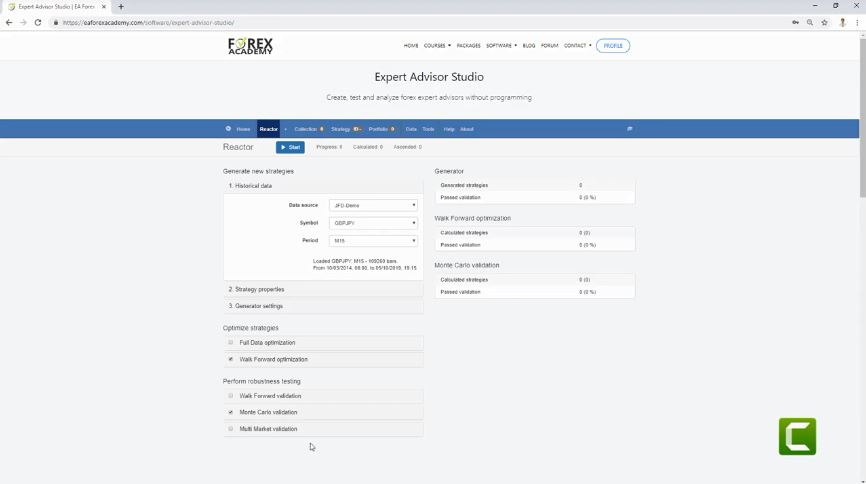

Everything is done automatically by the software and by the reactor. So first, we have the generator settings. I will demonstrate it to you how it works, and I will select here the GBPJPY on the M15 chart.

As strategy properties, I will keep 0.01 as the minimum lot. Then I will use range from 10 to 100 pips for the Stop Loss and same for the Take Profit. And as well in generator settings, I will keep it search best as a Net balance so I will see the strategies with the most balance on the top.

I have the chance to choose Out of Sample and In Sample. But here I will stay with In Sample. So I will be using the Out of Sample in the Walk Forward optimisation.

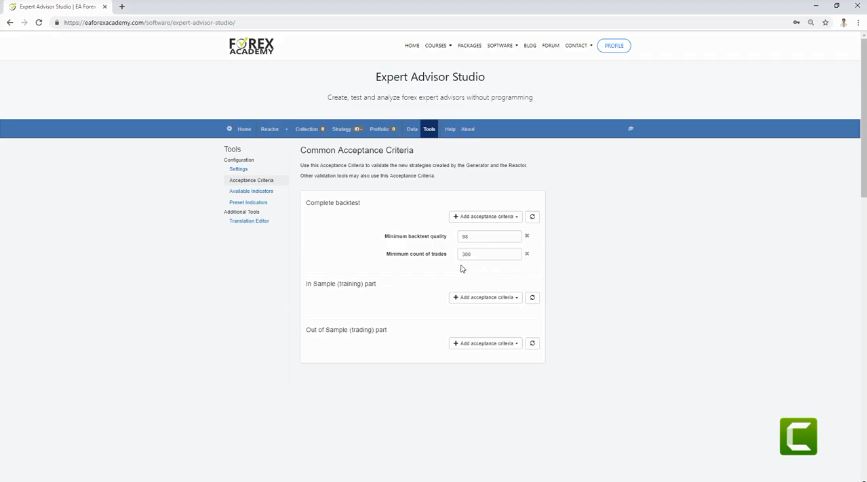

And below is the common Acceptance criteria. If I click on it, I have minimum backtest quality of 98 at the moment, Minimum count of trades 300, which is just fine. And I will add minimum Profit factor of 1.1.

The acceptance criteria are essential

As well I will add minimum Profit factor for the In Sample part and for the Out of Sample part which I will use in the Walk Forward optimisation. Profit factor 1.1 and here as well I will choose Profit factor of 1.1.

So I want to have a Profit factor of 1.1 for the complete backtest for the In Sample part and for the Out of Sample part. Now, going back to the reactor, I will go to the Walk Forward optimisation. I have the choice of whether to use it or not.

All the tools below I can select if I want to use them or not. At the current moment, I have chosen the Walk Forward optimisation and the Monte Carlo validation, and this is what I will use now. So what is the idea of the reactor?

Strategies that pass the Acceptance criteria go into the collection.

When the strategies are being generated, they automatically go to the Walk Forward optimisation or the tool you have selected here to use. And if they pass this optimisation, or the validation, or whatever you choose to use, they will go to the next one. So from the Walk Forward optimisation, in this case, they will go to the Monte Carlo validation.

And it will perform the variety of tests that I have shown in the previous lectures. And if the strategies pass, then I will see them in the collection. So here, the reactor does all the job automatically, and before we were doing it manually.

For each strategy, we were performing optimisation, robustness testing, and now when the reactor is available (since 2018), it is effortless to do it because we need to set up the reactor and it filters the strategies automatically. And at the end, in the collection, we have the strategies that are within our Acceptance criteria.

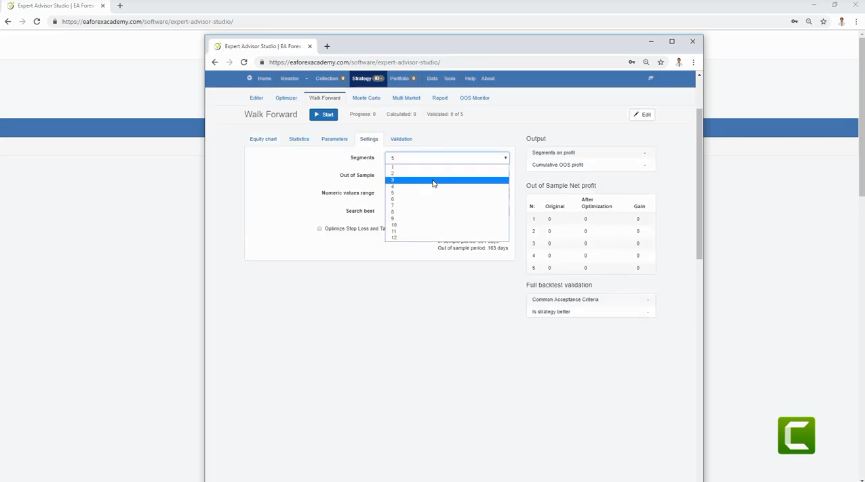

For Walk-Forward optimisation, what I will be using is a lower number of segments. So I will go down to 3. So it will be the very same thing that I have already showed but with three segments.

While generating your strategies, you can work with as many as you please.

How to become a successful Forex trader if you trade with many EAs?

- place them all on a Demo account and test

- select which ones to place for real trading

- follow the results and keep the top EAs from the Demo in the Live account

My recent tests showed that it works a little bit faster to generate strategies, and personally I like it at the moment to work with three segments and not with 5. Of course, if you want to generate your strategies, you can test with 3, with 4, with 5, with any other number. For Out of Sample, I will stay with 30%, search best; net balance, and let me have a look at the settings that I have in the Walk Forward.

In settings I will choose three segments. Out of Sample below is just fine, as validation I will stay with a minimum of $10, and here are the parameters, the statistics. Going back to the reactor, I have the Out of Sample percentage, Net balance, the Walk Forward settings are fine, validated segments if I choose to use three then I want to have 3 out of the three segments validated.

You can select if you want to use the common Acceptance criteria or not. Yes, I want the final backtest with the last parameters to be validated with the Acceptance Criteria.

EA Studio is a web-based platform, and it is a crucial solution to how to become a successful Forex trader

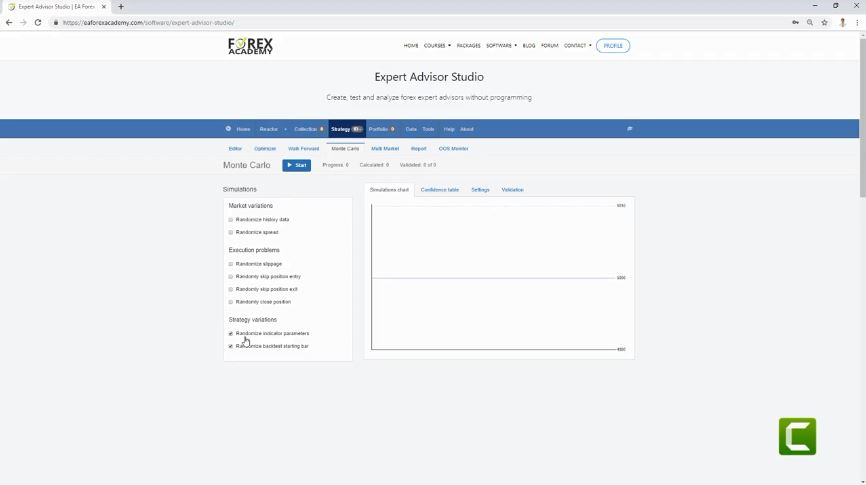

So I would like my strategies to have 1.1 Profit factor for the complete backtest for the training part and the trading part. And then we go to the Monte Carlo. I will stick with the default settings. And as I have shown, I usually use the strategy variations, the randomised indicator parameters, and the randomise backtest starting bar.

So this is how I set up the reactor, and this, of course, is an example. One more time, if you want to do it in a different way, you are very welcome to experiment. This is how traders learn to trade.

I will click on start, and I will see the strategies are being calculated. So one more time, those of the strategies that pass the generator, they will go through the Walk Forward optimisation, and then if they pass the Walk Forward optimisation they will go to the Monte Carlo validation. So in the generator, the strategies need to pass the Acceptance criteria.

The very same Acceptance criteria that are after that with the Walk Forward optimisation. Now, what is the great thing with EA Studio? It is web-based, and I can set the very same thing on another browser.

Expert Advisor Studio is integrated into our website.

We want to help our students with the question How to become a successful Forex trader. That is why we are always looking for the best programs on the market.

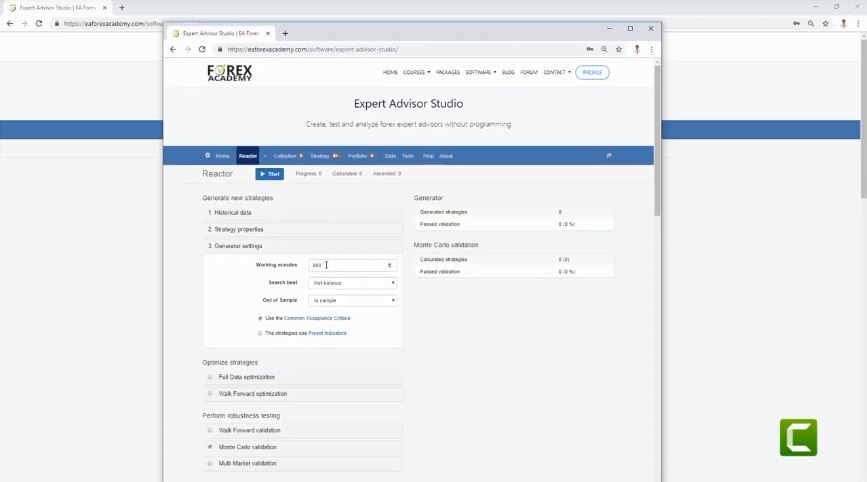

So if I open one more time our website, Trading Academy, and I go to the Expert Advisor Studio which is integrated, and I log in to my account, I have some old work here with EURUSD strategy that loads automatically. And I will run now a reactor, but I will separate the tab. It works faster if I separate the tabs.

So I have already done it for the GBPJPY, now what I will do, I will set it up for the EURGBP. I will stick on M15, and then the same settings should be saved, but I always check them one more time. And here, I will use working minutes 600.

And I usually run the reactor at the end of the working day so the morning I have new strategies into the collection. So 600 minutes is precisely 10 hours, and it works fine for me to leave three reactors working overnight. So I will do the same thing here, 600 minutes for the EURGBP.

The reactors work simultaneously.

The Acceptance criteria it did not save. In this case, I will need to do it one more time, so 300 counts of trades and a minimum Profit factor of 1.1. And I will do the same for the Acceptance criteria in the In Sample part, minimum Profit factor of 1.1.

And then I will have a minimum Profit factor of 1.1 as well in the Out of Sample part. Here it is. And then for the reactor, I will choose to use Walk-Forward optimisation, which is right over here.

And of course, I need to select three as well as validated segments. Let me have a look at the Walk Forward settings, here it should be 3.

And the Monte Carlo is saved to 20 and 80%, same for the strategy variations. So I think I am ready now and I will click on start. And now both reactors work simultaneously.

How to become successful Forex trading automatically? You need the ability to run several reactors because it saves time.

This saves a lot of time because we can run a couple of reactors. I usually run 3 to 4. Just don’t make it too complicated. Make sure you organise your work if you decide to generate your strategies.

So one more time, I will open the Expert Advisor Studio, separate tab, and I will have it for EURJPY, right?

Let me check one more time, I have it for EURGBP, and I have it for GBPJPY, and I will have it for the EURJPY. On the H1 chart, strategy properties, it is the same. Minimum lot of 0.01, Stop Loss range from 10 to 100, Take Profit range from 10 to 100, and generator settings 600 minutes.

Standard Acceptance criteria, let me do it, so it’s 1.1 Profit factor, 300 counts of trades, as well Profit factor of 1.1 for the In Sample part and 1.1 for the Out of Sample part. Here it is. Going back to the reactor, I will select the Walk Forward optimisation, where I said three segments out of the three should be validated.

The more reactors you run, the slower your computer becomes.

And as well in settings, I will change to 3 segments. And now I am already with the last reactor. I will click on start and now that 3 of them are working simultaneously.

I have selected the three currency pairs EURGBP on M15, GBPJPY on M15 and EURJPY because this way I have two times the EUR, two times the GBP, and two times the JPY.

And if you run more, they might get a little bit slower.

So ho to become a successful Forex trader with IT SKills? You already know the answer. It is easy. Just use strategy builders like EA Studio.

Visit our Forum for any questions.

But usually, I keep it 3 to 4 to make the best of it. And just a couple of seconds after I ran the reactor for the EURGBP, already one strategy passed the Acceptance criteria in the generator, or this is the standard Acceptance criteria. Then it went to the Walk Forward optimisation. It passed the Walk Forward optimisation.

But then it couldn’t pass the Monte Carlo. So this is how it is working; it is straightforward to set it up. I will leave it now, and I will show you what the results that we generate are.

Thank you for reading. If you have any question, feel free to drop it in our forum.