Portfolio of trading strategies – the smarter approach to algorithmic trading.

Portfolio of trading strategies is what most algo traders are concentrated during 2019. Hello, dear traders, this is Petko Aleksandrov, and I will show you what is the difference when you are trading with one strategy and when you’re trading with many strategies. And I will use the EA Studio strategy builder to demonstrate to you how the balance line changes when we have many strategies in one Expert Advisor, also called portfolio Expert Advisor or Portfolio of trading strategies.

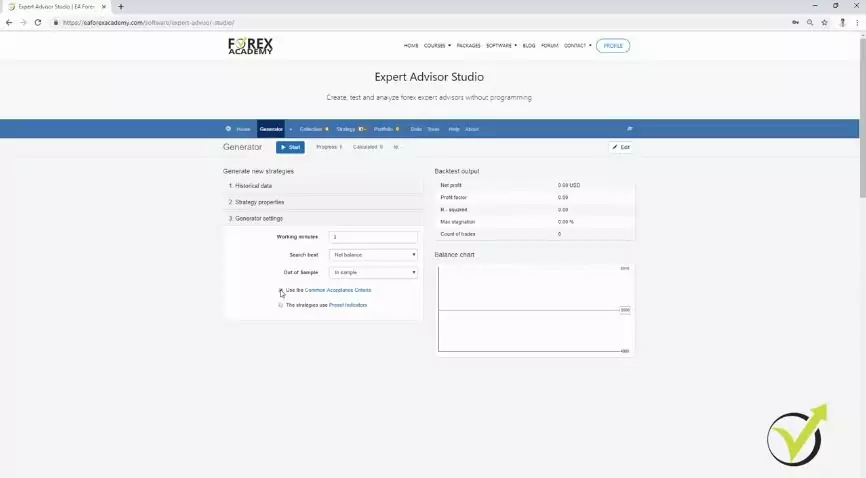

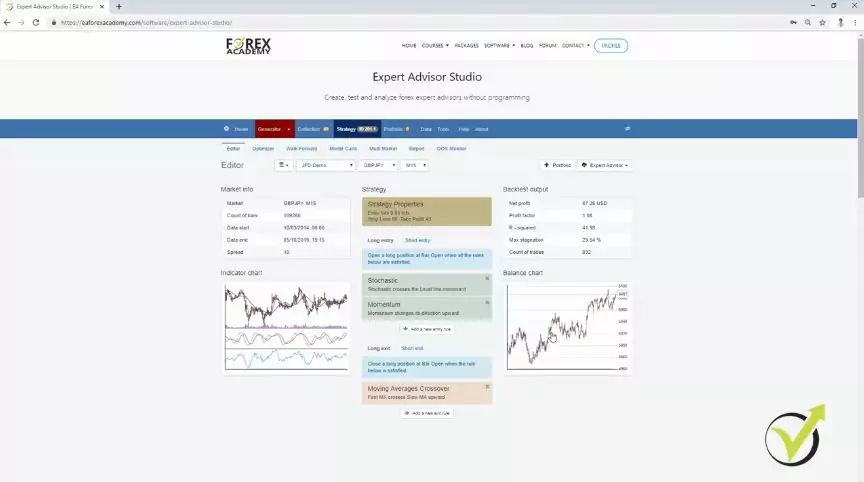

For the beginner traders, the EA Studio is a professional trading software for algorithmic trading. There is a generator that we use to create EAs and many analytic tools. Also, with EA Studio, we can export the strategies as Expert Advisors with one click. No need to program anything.

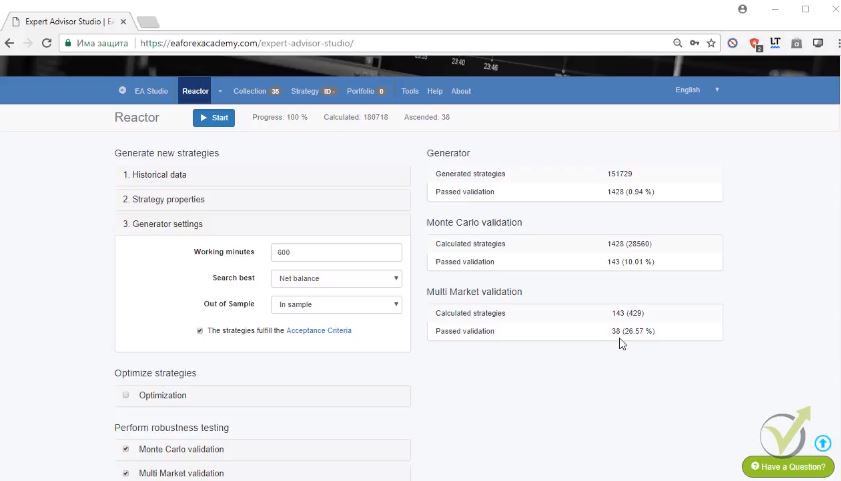

So I have the generator in front of me here, and I will run it very quickly to get some strategies. As a symbol, I will stay with GBPJPY. And periods M15, as strategy properties, I have the range between 10 and 100 pips for the Stop Loss and the Take Profit.

Entry lot, a minimum of 0.01. And as generator settings, I will leave it just to 3 minutes and I will not use the common Acceptance criteria. So I will not filter the strategies in any way. I would want to generate some strategies, and for Out of Sample, I will stay with In Sample.

So I’ll just run now the generator, and if you have tested it, you would know that it works fast. For seconds hundreds of strategies are calculated. And in the collection, I see already strategies, 18 and 19 and they’re increasing.

If you haven’t tested EA Studio, there is 15-days free trial that you can take advantage of.

Stagnation period is what we need to avoid.

But these strategies that I just generated, they are not filtered. I didn’t put any Acceptance criteria. I just wanted to demonstrate the difference when we have one strategy and when we have many strategies.

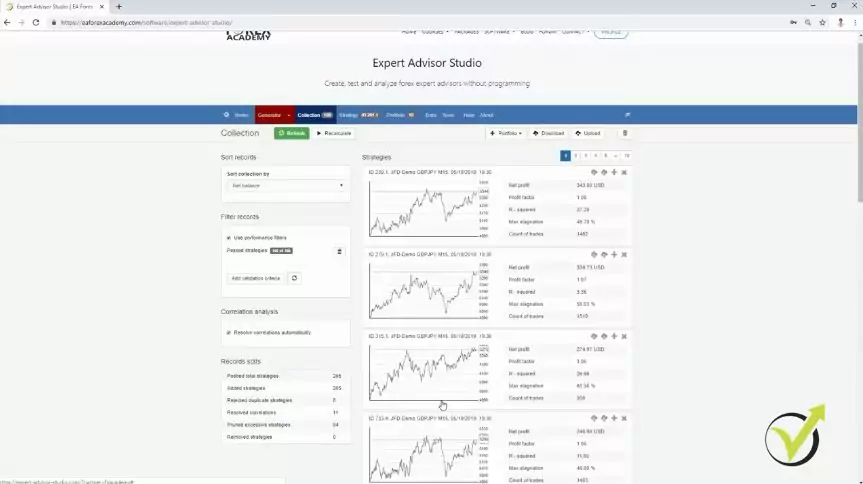

If I click on refresh, the new strategies will show. I will pick any of the strategies randomly, so let’s take the first one.

You can see there are these vast drawdowns or stagnation periods in the strategy. Stagnation period is when in the balance chart, the profit reaches to one point and then for a long time, it does not make a better profit. You can see in the picture below that there are many stagnation periods in the Balance chart.

And we don’t want to have such huge stagnations. You can see that this strategy has some drawdowns, going down for quite a long time, not making a new profit. In the end, it’s a profitable strategy, but there are these huge drawdowns.

The balance chart says a lot about the strategy. Let me go to the collection one more time, and I will choose some other strategies.

What we have in EA Studio is a portfolio of trading strategies. And I can add to portfolio many strategies.

For example, I will add the first ten strategies. 1, 2, 3. I use this + button, and it says add to the portfolio, and I have already three strategies in the portfolio. And I will go to the 4th, the 5th, the 6th, the 7th, the 8th, then 9th, and the last strategy.

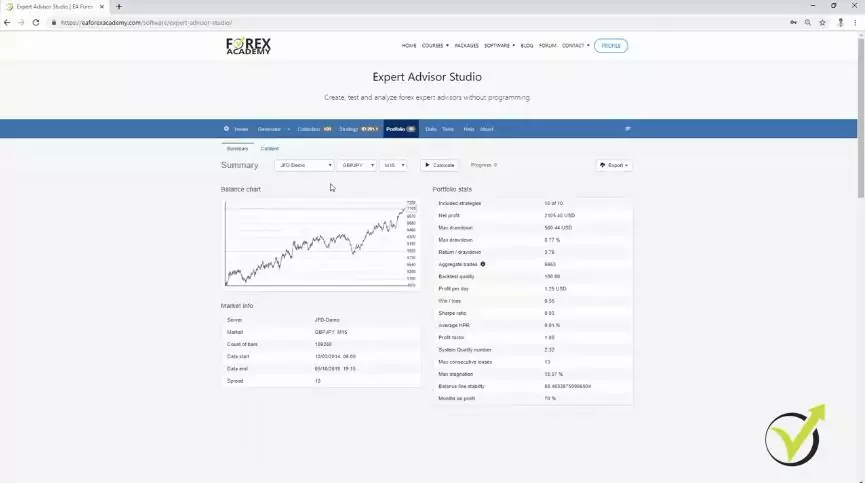

So the first ten strategies that I have for the current moment, just generated in less than 1 minute are now in the portfolio. If I click on it, you will see the balance chart. There is a massive difference between this balance chart and each balance chart into the collection.

You can see each strategy has these huge drawdowns, losing sometimes, has stagnations, and when we are trading with the portfolio, we avoid these periods. In the portfolio strategy, I can see how stable the strategy goes. There is one stagnation over here, but it is much smaller than what we have in the other strategies:

Risk diversification is what we are looking for when trading with Portfolio of trading strategies.

And this is because when one strategy loses at a current moment, the others will compensate for the loss. When the strategies have a stagnation period, the others will be in a profit at this moment. And this is visual in the collection picture above.

When 1, 2, strategies are losing, the others will be profiting at this moment, and there will be less stagnation. Still, there will be some stagnation and drawdowns but not that huge as when we are trading with one strategy. This is why we say when we are trading with many strategies or with many Expert Advisors, we diversify the risk.

We don’t rely on a single strategy because every strategy has its losing phase, and it’s not only one. Many losing phases could appear, and this is very normal with every strategy. As I always say, don’t look for the strategy that will bring you constantly profits because there is no such strategy simply because the market changes.

Keep in mind that trading with many strategies simultaneously is hedging.

So the difference, once again, is that when we combine many strategies in one portfolio Expert Advisor, and this is possible with the EA studio, you can see below that we have a much better, balanced chart. And actually, all of the statistics are much better. For example, you can see the maximum stagnation is 15% over here and with each strategy we have here 29%.

Let’s have a look at the others, 58%, 60%, 46.8% and so on. So when we combine the strategies in 1 portfolio Expert Advisor, we have much better statistics and a much better balance chart. But keep in mind that this chart is a combination of all the strategies.

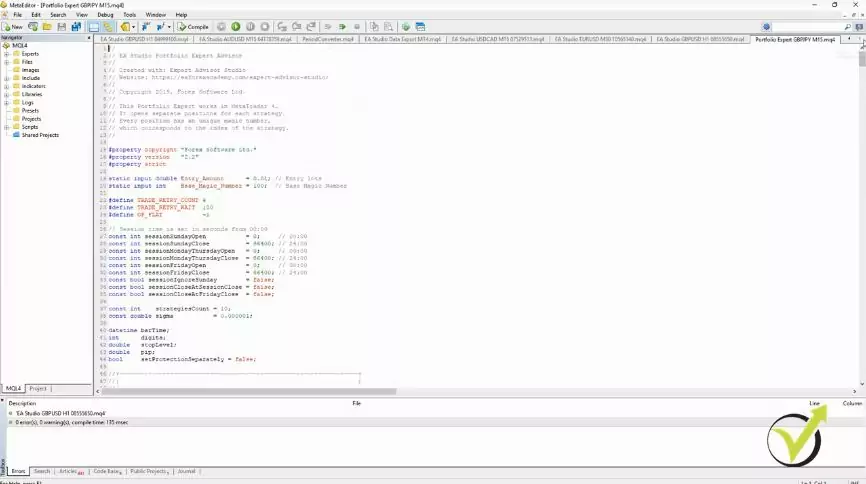

It’s not a single strategy. It combines all the strategies that I have selected from the collection. And with EA Studio, we can export it as a portfolio Expert Hedging Meta Trader 4 Expert Advisor. So here we don’t have the Meta Trader 5 because most of the brokers on Meta Trader 5, they don’t allow hedging.

That’s why it’s not available here. Probably if one day the brokers start to offer to hedge with Meta Trader 5, the option will be available as well in the software. And if I click on it, the portfolio Expert Advisor is exported, and I can put it on Meta Trader for trading.

The code of the Portfolio Experts is similar to the single EA.

So I will be trading these ten strategies on one chart in Meta Trader as a single Expert Advisor. Of course, I will not do that because I didn’t filter these strategies. I just wanted to show you the difference of the balance line of the statistical information when you are trading with one strategy and when we’re trading with a portfolio of strategies.

I will remove now this collection and the portfolio Expert. Also, I will delete the strategies, and I will continue now working with the Generator but using the Acceptance criteria. You can learn more about it in the free video:

Generating strategies with EA Studio Expert Advisor builder

Thank you for reading. If you have any question, drop it in our forum, and I will get back to you.

Cheers.