FSB Pro – the professional strategy builder for algorithmic trading

FSB Pro is a software used by many professional traders in the last ten years. It allows the trader to automate strategies into Expert Advisors without any programming skills. This saves a lot of time and resources to the trader.

This lecture is part of the Forex strategy course – Portfolio trading with 12 Expert Advisors, and you will learn more about the strategy builder FSB Pro. Enjoy!

Hello dear traders, my name is Petko Aleksandrov, and I continue with the results from M1 trading plus MACD and moving average filtering on M30. And I also selected the H1 MACD to be another filter. The unique thing with the FSB Pro strategy builder is that it allows higher time frames as filters. This is not permitted with other strategy builders, but that is an essential difference.

When we trade on the small time frames as M1 and M5, the market is very chaotic. That is why we need to have an idea where the longer-term trend goes. One of the best ways is to use higher time frames as filters. So if on H1 the market shows it is going up, but on the small time frame it shows that it is going down, the trade will not be opened by the Expert Advisor. So stay with me about the details around the FSB Pro strategies!

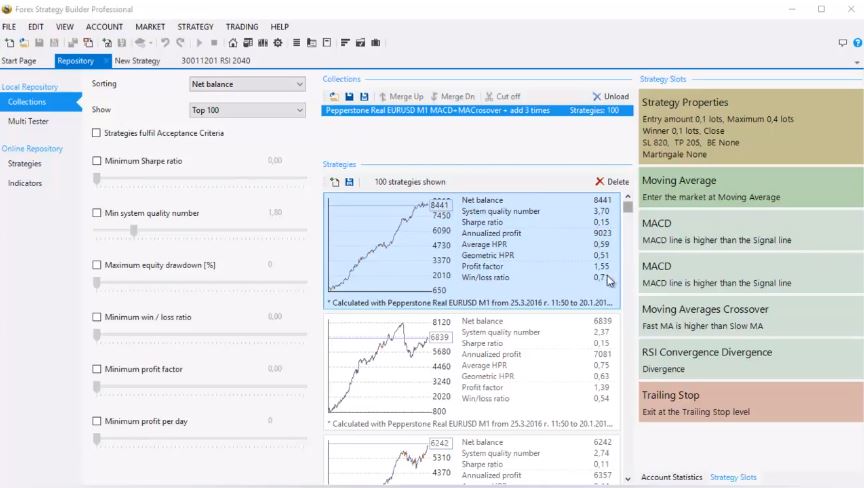

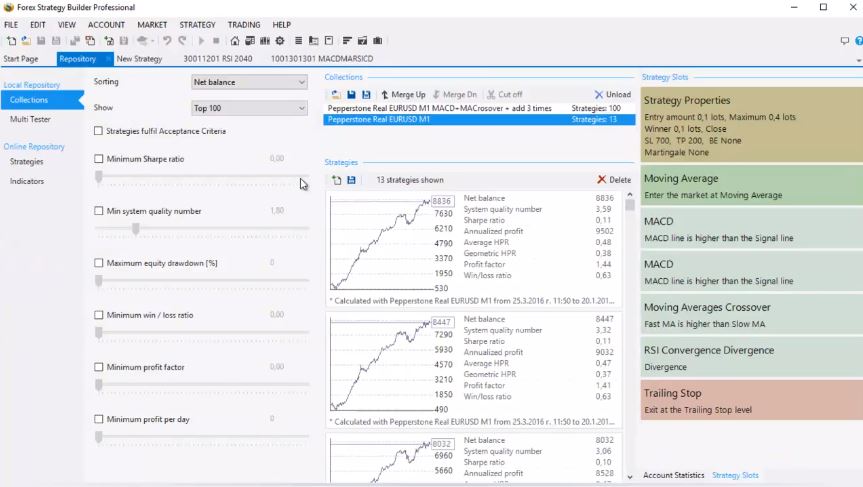

As you can see in collections that are repository up in the bar, I have more than 100 strategies.

It says 100 because this is the maximum we can have in a repository of FSB Pro. But if you delete one of these, another one will pop up on the bottom. And there will still be a hundred. I can now see precisely the number of strategies created. But you can see that a hundred strategy is shown.

And there, by results, the first one is with a fantastic effect. Actually, with 8441 as a profit. I will click a second time on it. Before I click, you can see that if I select a strategy, all the strategy slots are displayed on the right. And actually, the important thing when you’re selecting strategies that I like to look at is the profit line. I don’t want to see significant drawdowns like this one. I don’t want to see colossal stagnation sideways as well.

The first strategy generated by FSB Pro so far looks the best.

You can see that the equity line is very stable, going upwards — no huge drawdowns and stagnations. The FSB Forex software does not have a purpose of showing you a perfect equity line, but an excellent curve-fitted range. This way, the strategies are not over-optimized, and by running some robustness test, we can decide if this strategy is reliable for trading or not.

And I will start with it. But these significant drawdowns, of course, you can change after if you replace some of the indicators. Or if you add some new signs or if you do some change in the input. If there is a significant drawdown, it doesn’t mean the strategy will be not good. You can still try to change it. But let’s start with the first one.

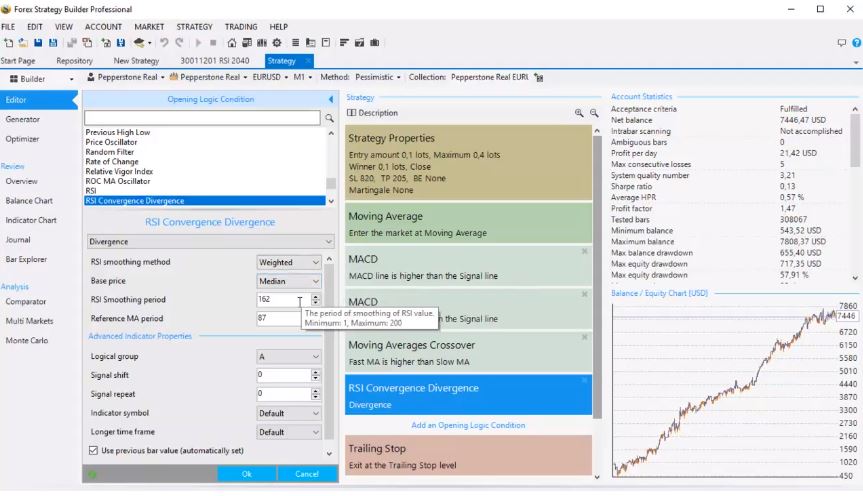

As you can see, the first strategy contains the filters that we choose the MACD, the moving average crossover. And we have RSI convergence divergence. Which uses weighted as RSI smoothing method and base price is median(methods in FSB Pro as in Meta Trader). Also, the RSI smoothing period is 162. And reference MA period 86. I’m a little bit worried here if this indicator over optimizes the strategy.

So, the first thing I will do, I will change it to a round number.

Let’s see if I will have any change. Here I will go to 90 because it’s a more roundish number. Let’s wait a little bit for the program to calculate the new result. If there is a considerable change, it will give me a sign that this strategy is over-optimized. And if there is no chance, it’s all right for me. And you can see that the change was not big. The profit line is the same. Just the result is a little bit smaller.

So, what can I do next? I want to go to the trailing stop.

There is a trailing stop of 236 pips. But I can see that Stop Loss of 82 and Take Profit of 20 pips is there. This trailing stop doesn’t mean anything at the moment. I will go to the settings to the strategy properties, and then I will round this Stop Loss to 80 pips. In FSB Pro, the values of SL and TP are in points. And also the Take Profit I will round 20 pips. Let’s see the result now. This way is even a little bit better.

What will I do now?

This RSI converges divergence. What I don’t like is the weighted smoothing method. I want to use simple, but I’m pretty sure now there will be a massive change in the profit line rest. And the base price also likes to use always close. So, what we do? We stay simple and close. You see, there is a margin call with this one. I can give it a try.

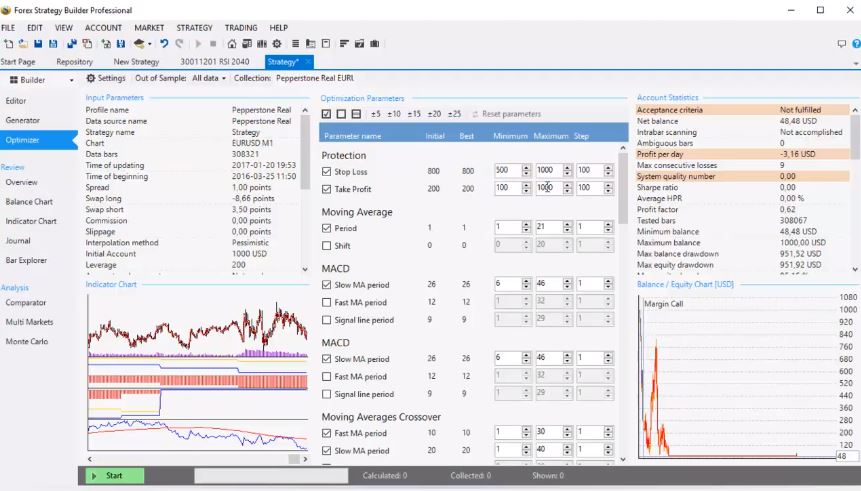

What do I mean? I will go to the optimizer of FSB Pro, and I will do one optimization for this strategy.

I will keep all of the indicators the same. But I want to see with this simple and close method if I will have a good strategy using those. If not, I will go back. What will I do to stay round? I will choose a step of 10 over here. The trailing stop as we said it doesn’t matter so much. But let’s make it round as well. Maybe when I’m optimizing, it will find some good trailing stop there. So, I will go to 200.

And then, if I go to the optimizer, I will choose a step of 10 pips. Here I need a step of 10 to stay around. Fast-moving average shift and slow-moving average shift. We always try to stay away from shifting the indicators. And then for the moving average crossover, we have 10 and 20 as default. Here we can have a look for a better moving average crossover.

For those who did not try the FSB Forex software before with simple words, we can say that this tool improves the strategy by changing the parameters of the indicators. However, that might be risky because the strategy might fit the past Historical data, and it will show better results. But this does not guarantee future success. This is why in FSB Pro, we have the Monte Carlo and the Multi-Market, which are tools to check if the strategy is over-optimized or not.

I will give it a try with the optimizer. The MACD, when I’m using MACD on a higher time frame, what I like to do is to optimize only the slow moving average. This way, I’m staying away from the over-optimization. Because if I over-optimize the slow, the fast, and the signal line period, the program will find the best input for 3 of those. And the strategy will be over-optimized.

This is what you need to be careful of when using the FSB Pro optimizer.

I optimize only the slow-moving average period. Then for the moving average, I can see also if there will be a better entry on the moving average. And the Stop Loss I will stay with ten as a step. And then, if I click plus-minus 20, I need to arrange the minimum and the maximum. Here I would like to stay at 10. The ceiling will be 100 pips. Now, we wanted to Stop Loss from 50 to 100. And Take Profit from 10 to 50 pips:

And then moving average 1 to 21 is ok for me. The MACD in FSB Pro is just the same as in all platforms, no matter the look is different. It is the same formula. I need to have a slower moving average more significant than the fast and will put as a minimum 13.

I will do the same with add the MACD. The moving average crossover to keep the fast-moving average smaller than the slow I need to put kind of border between them. Here I will place 15 as maximum, and I will place 15 as a minimum for the slow-moving average.

This means that the fast-moving average will be between 1 and 15. And the slow will be between 15 and 40. Then for the RSI convergence divergence, I need to place here 10 and 10. Here I will stay at 100.

So, now, actually here I need to place 200.

Because the RSI smoothing period could be more significant than 100, actually, both of them could be bigger. Let’s say what will happen if I stay with the 200 as the maximum because this is the maximum of the inputs that come with Forex Strategy Builder or FSB Pro. And then the trailing Stop Loss I will go from 10 to 200, which is the maximum for the trailing stop. But I don’t think this will have any impact on the strategy.

But let’s see what will happen if a good strategy will come up with this optimization. And if it doesn’t, I will go to the properties of RSI convergence divergence. It will take a couple of minutes to do this optimization because we are using a lot of indicators here. I will continue with this video once the optimizer is ready.

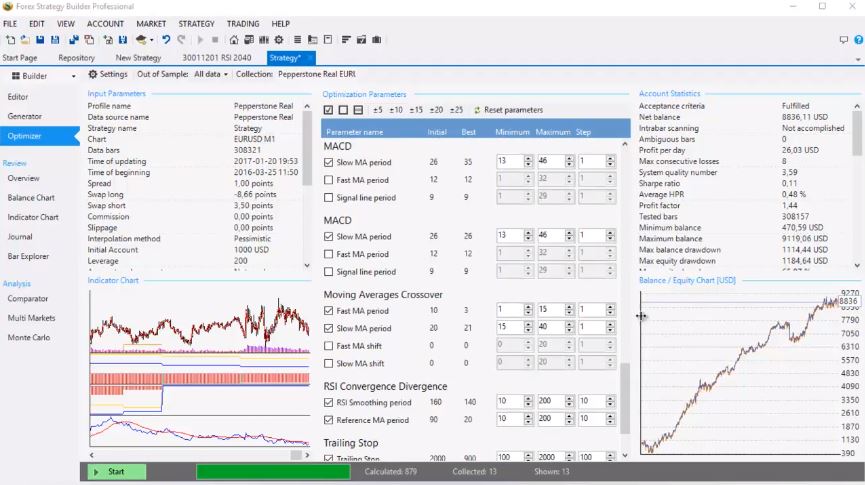

After the optimizer in FSB Pro is ready, I can see that I have a much better profit line with a lovely result.

And let’s see the differences.

I can see a little bit bigger Stop Loss of 90 pips, which is all right. Here we see the initial input, and here is the best data, which is after the optimizer. The moving average didn’t change, which is all right. MACD went to 35, and the other MACD stay it 26. The moving average crossover the fast change to 3 and slow went to 21, which is all right as well.

The RSI convergence divergence 140 and 20. But there we have the simple and the close, which is better for me. We have a trailing stop of 90, which is the same as the Stop Loss here. I think we have a better strategy:

Let’s go to the editor and over here what I think now is the right thing that the trailing stop is having an impact. And then the RSI converges divergence is with the simple as a smoothing method, and the base price is close.

I think this FSB Pro strategy is good.

I see here one significant drawdown. Let’s have a look at how much is that. The maximum balance drawdown is above $1000, which is not nice. And in the beginning, as you can see here, there is drawdown also, which is almost leading the strategy to the margin call. The thing here is that this strategy starts from 1000, and I’m adding three times 0.1 lot size.

Normally, I wouldn’t do that if I’m trading 1000 account. I trade 0.1 of my strategies when I’m trading 10 000 of account. Here I would usually trade it this way. If I have $1000 of account, I will trade it with 0.02. And then the maximum position would be 0.08. Which is four times, and here on the winner, I will add 0.2? And then the amount to close on the reduction will be 0.2.

Now you will see a vast difference there. With 1000 account, there is a maximum equity drawdown of 236, which is all right. And as you can see here, the result is $2567. As you know, our money management is according to the account. And we don’t use percentage when using the FSB Pro strategies.

We trade with 0.01 lot if we are trading account below $1000.

Between $1000 and $2000 of account, we trade with 0.02. So, let’s say our account now is 1000, we reached above 1000. Or we start with above 1000 account between 1000 and 2000 of account. What do we do? We trade with 0.02. And when the account reaches 2000 let’s say it reaches at this point 2000.

OK, let’s say we’re trading one strategy only. Which we never do. We always trade portfolio strategies. But I want to be clear with my explanation. The example I would give you, let’s say, we started with a $500 account. What do we do? We will trade with 0.01, which is the minimum amount allowed? And then I’m trading, for example, a couple of days and weeks, and the account reaches 1000, above $1000.

Then I will change to 0.02, and then when the account reaches 2000, I will change to 0.03. This is very important to be understood that the amount of a lot size traded should be according to the amount of the account. And when you are using a portfolio, you are diversifying the risk. Everything is all right. In this case, I would stay with this example. So, here, the maximum drawdown is all right, which is above 14%.

And if your account is between 1000 and 2000, you should be trading with 0.02 as a lot to enter. This is a money management system, and it has nothing to with the FSB pro.

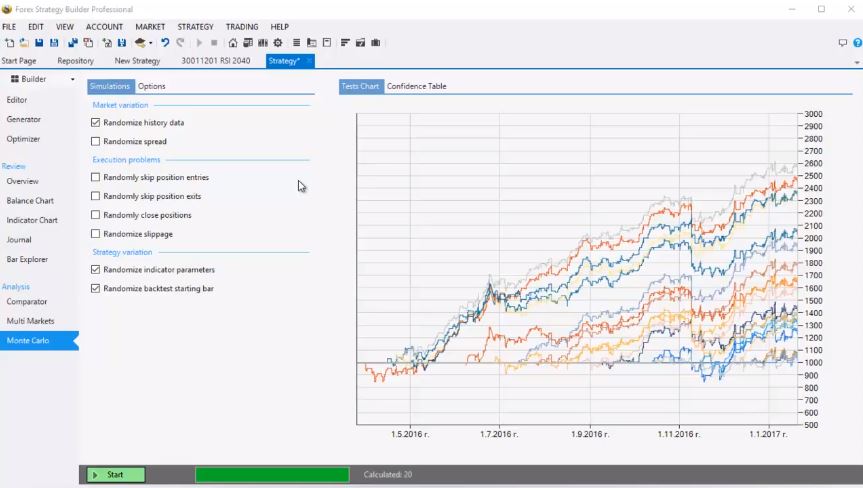

Let’s go now to the Monte Carlo of FSB Pro.

I want to see one more time if this strategy is over-optimized or not. Here I am always checking the randomized history data, randomized spread. I don’t think I need this because EURUSD is a really small spread in Pepperstone.

The strategy variation – this is the most essential randomize indicator parameters.

It means the program will do simulations with different indicator parameters. And if there is a losing strategy, it means that the strategies over-optimized with the current inputs. And the randomize backtest starting bar is important as well. We want to check what the strategy started on a different backtesting date. And then I will click on start, and let’s see what will happen.

It will take a couple of seconds and minutes. And I will continue the video after that. Once the FSB Pro Monte Carlo test is ready, I can see excellent results there:

As you can see, the profit line is pretty much the same everywhere except its different results. Which is reasonable because the strategy starts on a different backdate. And then I will go back to the editor.

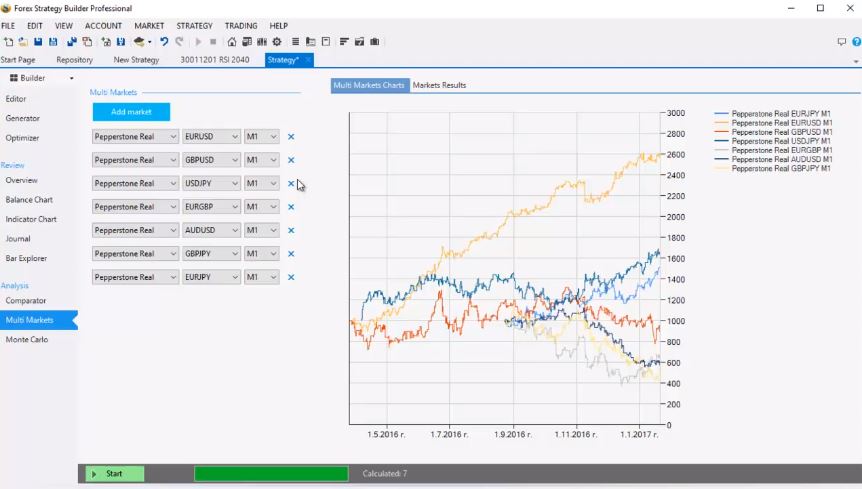

Multi-Market is one of the other tests you can do. This is the type of analysis that I’m not always doing. And I will tell you why. It’s an excellent option for the Forex Strategy Builder professional, of course. But the idea behind it is different for me.

What I mean is, we do the Multi-Market test in FSB Pro, I will run it now.

And I will explain while the Multi-Market is doing the test. The thing here is that EURUSD is a different market from all the others. The cable is different from all the others and the JPY and so on, and so on. What I mean is there are various markets. There are currencies of different countries, and this doesn’t mean that if this strategy fails here as you can see, it fails on 4 of the market, and its profitable a lot of 2.

This doesn’t mean that this strategy will not work on EURUSD. Because it’s created based on the backtesting data of the EURUSD. I’m expecting it to continue working on the EURUSD. What I mean is that I use this Multi-Market to see in which other markets I can use this strategy.

That is why the FSB Pro comes very useful. It shows the results in seconds and saves so much time for testing on Demo account

And there will be video in the Forex Strategy Course – Portfolio Trading with 12 Expert Advisors actually how we change the strategy from one market to another mostly using the optimizer.

You can do this Multi-Market test. I recommend you do this all the time in the beginning. And with the time you will decide for yourself, is it all right or not to right to use it. Of course, if this Multi-Market analyzes test shows that all the other strategies are losing, this will link me to the thought that probably there is something wrong with the strategy is over-optimized by the FSB Pro optimizer.

But with the result like this, this is very normal.

There are two markets more that are profitable. There is four losing, but they’re not really like losing dropping down, which is all right. And if I play with the inputs a little bit more there, I use the optimizer with a roundish number. I’m sure this strategy will work on the other markets as well:

So, pretty much, I’m ready with this strategy. What will I do now?

I will go to the strategy properties in FSB Pro. I will go back to 0.01 because I need to test this strategy first with 0.01 lot size before I place it on a more significant account. And that’s why I’m here using 0.01 as always, and this is actually suitable for using on accounts smaller than $1000. Then what I will do? I will save this strategy. I will save it in the folder that I’ve created.

It says to add three times M1 means we are adding three times with the strategy. M1 is the trading period we are using. We have MACD and moving average filters on M30 and H1 MACD. All these strategies from the collection that I will select, I will put them in this folder.

I will have a pack of Expert Advisors, a package of strategies that I know are in this folder because of these filters. The name of the strategy, I will have an exclusive video about how I name the strategy. I always start first with the market I’m using, with the pair.

So, this is EURUSD. It starts with ten; this is the magic number.

Then I have the filters. I have 30 and H1 as a filter. But first of all, it is the trading period. It will be 1001 because we are trading on the 1-minute time frame. Then I have a 30-minute filter. And I also have a 60-minute filter. But then here I will place just one, or you can place 60, which is 30 and 60 minutes. Or you can place 30 and 1, which is 1 hour. It’s up to you which one makes you more sense in which one is easier for you to use.

I will stay with 10 for EURUSD, 01 for the main trading period, 30 and 1, which I will know that this is 30 minute and 1-hour filters. This is what makes FSB Pro unique software because it allows the Longer Time Frames.

And then I need to have a clue that here and this strategy I’m adding three times. I will add three, and then I will go for 01. Three is because I’m adding three times and 01 because this is the first variation of the strategy. I will have another 98 possibilities to change this strategy.

Once again, 10 for EURUSD, 01 because this is the main trading period. 30 because this is one of the longer time filters, and 1 is another long time filter that I’m using for the MACD. And then three because this is how many times we are adding to the position. And 01 this is the first variation of the strategy.

Then I put some of the indicators that I’m using, and I have the MACD and the moving average crossover. And then, I have the RSI convergence divergence.

And this is pretty much all about it. I will save this strategy over here in this folder. And it will come here with the name.

What do I do after that? I will go to the repository, and I will select some of the other strategies:

But I will continue with this on the Forex Strategy Course – Portfolio Trading with 12 Expert Advisors.

In this course, I show the FSB Pro and the EA Studio, which is the web-based strategy builder.

Of course, I’m not going to do hundreds of videos about these strategies. Probably, I will do 1 or 2 more.

What is the most important with FSB Pro?

- build a strategy

- optimizing

- testing

- analyzing

- robustness testing

- export with one click for MT4 and MT5

And actually, here are the strategies. But here you can see there is Pepperstone EURUSD M1, which came after the optimization. The older strategies that I’ve tried and selected and tested. Here all the variations of these strategies. You can delete this from unload, and here is the collection where I selected the first strategy.

If you have any questions about FSB Pro or the course, let me know in our SUPPORT FORUM. I’m always there to answer.

Trade safe!

What is FSB Pro?

FSB Pro is a software that allows the traders to automate their trading strategies as Expert Advisors with one click.

How can I test FSB Pro?

There is a 15-days free trial for everyone who wants to test the program. During this time, an unlimited number of Expert Advisors could be exported.

Is FSB Pro useful for beginner traders?

The program comes with a complete user guide and free educational videos. It is suitable for beginner traders.

Can I use FSB Pro if I am not a developer?

The traders export the strategies as Expert Advisors with one click for MetaTrader4 and MetaTrader 5. No IT skills are required.