Forum Replies Created

-

AuthorPosts

-

Marin StoyanovKeymaster

Marin StoyanovKeymasterHello James,

We don’t set limitations on the usage of our EAs – you can use them on any kind of account and on as many accounts as you like.

This sounds like some protections being hit but to help you better I would need some screenshots from the MetaTrader platform and some more details about your account size and the actual EAs you trade.

I requested them via email, please reply in the thread so I can look into this and tell you what’s happening.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi John, the problem with your access is solved now. Your profile was missing first and last name, that was an issue back in 2024 but was fixed in bulk for all of our users. Seems that your profile didn’t went through that update last year. Now all is fixed and you should be able to access the app as usual.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi, during the program you will receive around 12-13 tasks, across 21 days. There aren’t tasks every day because the courses need time to watch and practice with the EAs.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi,

1. To enroll in the program, please complete the form on this page and you will receive email with the following steps: https://eatradingacademy.com/algo-program If you’ve done that in the past, please drop an email to support @ eatradingacademy com once you’re ready to start the 21 day program again and we will restart your enrollment. Bear in mind that if you already went through the Top 10 app trial period and the EA Studio trial period, you won’t be able to use new trials for them.

2. The program that we use to create the robots in the Top 10 Robots app is Express Generator (https://eatradingacademy.com/software/express-generator/) which is kind of offline version of EA Studio. It does most of the stuff that you can do in EA Studio, but it requires some technical knowledge. We have a playlist with videos dedicated to Express Generator from where you can see what you can achieve with the software: https://www.youtube.com/playlist?list=PLmiKIf9uqZqrm8eJd813MWfi0s7whM7te

To create your own robots, you will need at least EA Studio, because Express Generator creates the JSON collections of strategies which then should be imported into EA Studio and downloaded as MQL expert advisors.

3. I would start with the 21 day algo program which is free and gives access to few of our courses which already include trading robots, that are updated every month. This is a great learning path and also very practical with these robots. Once you get the the routine you might explore additional options like our apps, or 3rd party EAs.

4. We’re education provider and don’t offer financial or investment advise or services and the the prop firm app on our website isn’t limited to any country. You can use it from Israel for sure. The prop firms which you see on our website allow trading with expert advisors under certain conditions (like randomizing trades, etc.) and the prop firm robots app is absolutely suitable for them. We trade those prop firms because they are less restricted when it comes to algo trading but still you should read all their rules carefully to be sure that you’re not going to breach any.

If you’re interested in purchasing both the Top 10 Robots app and the Prop Firm Robots app together, we can offer you 50% discount for one of the apps of your choice, no matter the access plan. So for example if you go with the lifetime for the Top 10 App, and 1-year access to the Prop Firm Robots App, we will give you a discount code to get 50% Off from the Top 10 lifetime which is the more expensive out of the two. Just email as at the above support email and we will sent you an exclusive discount code.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi, the account is raw spread. We trade the Happy Gold (scalper version) on XAUUSD M30. By the time of writing, ping is 250ms and we trade it on our own VPS machines. Although our severs are good and we use fast-speed internet, most likely the difference comes from the account type – if you’re using a standard account the conditions would be different and you might get higher spreads which might limit the profits or even turn your account into losing one.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi, I completely understand your frustration. We’re working on a new system that will make customer support much faster and easier. Also we might offer priority support for users who actually purchased products from our website. In the meantime you will receive a reply to your emails as soon as our support team reach the queue.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi,

The error is due to recent changes in the MetaTrader API.

Please refresh the app and re-download the robots to resolve the issue if you’re on MT5 (our team is still working on a solution for MT4).

Kind regards,

Marin

Marin StoyanovKeymaster

Marin StoyanovKeymasterHello, in every of our courses there are many videos showing how to setup the EAs. Please refer to them and in case you need any additional support you can drop a message to our support email address.

Marin StoyanovKeymaster

Marin StoyanovKeymasterYes, it is. If you comply with the rules, just follow the steps and contact us at the provided email.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi Chris, I’m sorry to hear about your experience. I replied to your email. If you need any additional information or support, please reply directly to the email so we can keep communication organized and in a single place. Take care!

Marin StoyanovKeymaster

Marin StoyanovKeymasterPlease share a video from the steps that you follow so we can understand what’s wrong and help you (you can reply to the email I sent you).

Also be sure that the robots are placed in the MQL > Experts > Advisors folder and after you compile them, restart the MetaTrader platform.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey @hugco, I am not a lawyer for anyone, and I do not defend or accuse anyone (vendor or robot). I’m simply sharing another opinion and my experience with this EA.

I understand where you’re coming from and I agree to some extent. For newbies, just starting with algo trading, or with this robot, or with prop firms, I wouldn’t suggest trading with the Forex Gold Investor at the moment but this doesn’t mean that this is a bad EA. When people were “printing” money with this EA and passing almost every challenge, no one said a single word how good the EA is. Also when people were making money from stocks no one was complaining but then when the US president announced new tariffs and stocks wend down, people got scared. But now a few weeks later we can see how the stocks go up again.

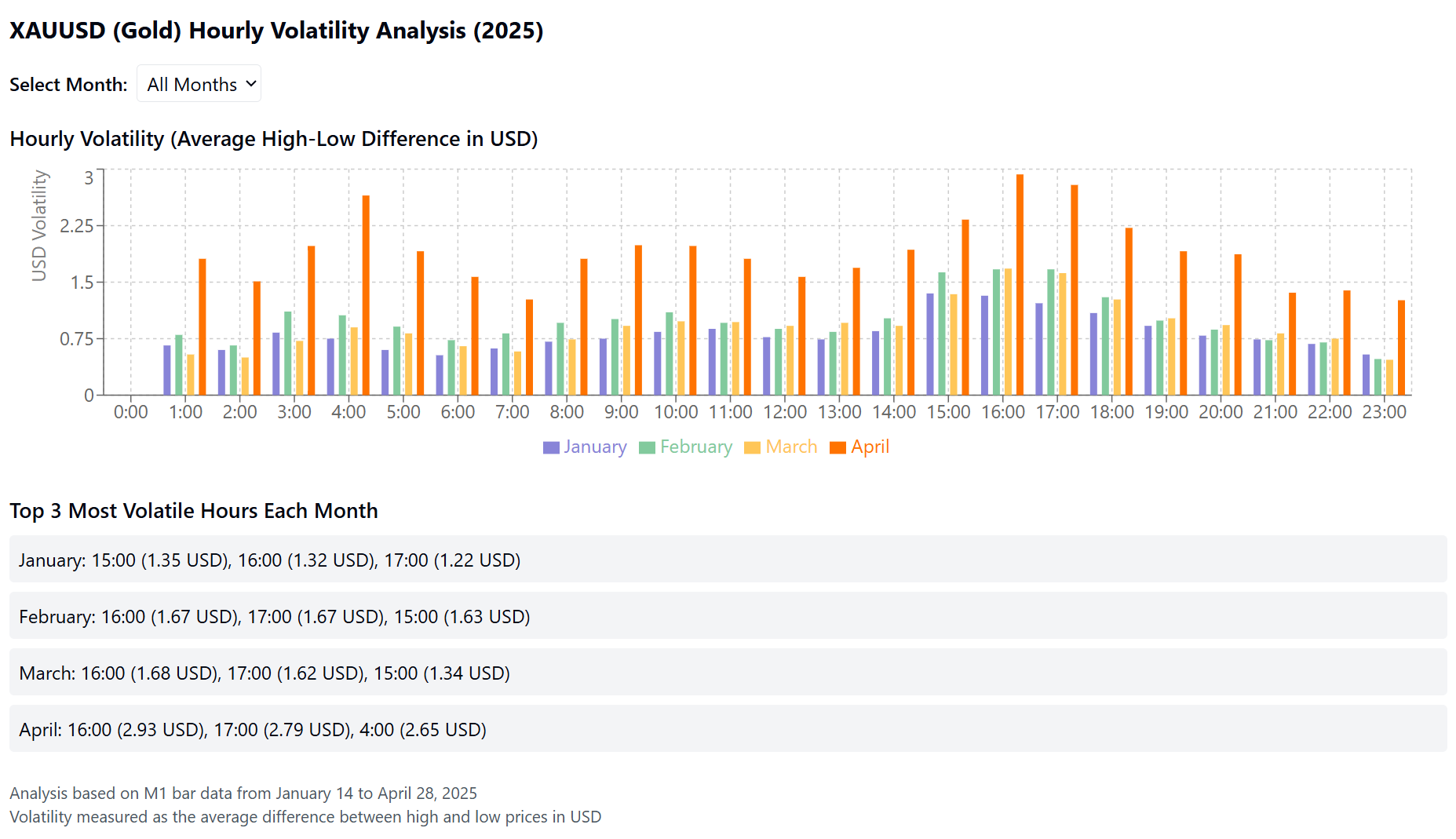

Personally I don’t plan to stop using the robot completely. I still paused trading it for a few days to observe how the market would react after last Tuesday’s price gap. My personal goal is to adapt under these conditions (without taking huge risks), by doing a lot of backtesting with different settings and lowering my overall risk (and also limiting the times when the EA trades based on the volatility analysis I made).

From what I’ve observed, Forex Gold Investor is a time-based, volatility-sensitive EA. It buys gold during “deep” drops or strong momentum moves, and also trades trend pullbacks, using momentum indicators and Bollinger Bands for confirmation. And it’s very sensitive to high spreads, and especially to volatility.

I did some analysis and sharing some of the numbers I’ve been looking at recently (data source is The5ers M1 bar data, I pulled it from one of my current challenge accounts). If you examine gold price volatility in 2025, you’ll see that we’re currently in the most volatile period since the beginning of the year. Gold even reached an all-time high in April before starting to decline again. So, the market is more volatile than usual, and personally, I believe that’s the main reason for FGI’s poor performance at the moment.

In the below graph, you can see that the gold market at The5ers closes every night at midnight. Typically, in most of my accounts FGI enters trades between 21:00 and 23:00 my local time (GMT+3), but after the midnight gap, the price often opens lower, making it nearly impossible for the EA to recover. Interestingly, the 15:00–17:00 window consistently shows the highest volatility across all months, which aligns with the overlap of the European and U.S. trading sessions. However, based on my observations, FGI rarely trades during this high-volatility afternoon period because of the built-in spread filter. So the main issue remains: the midnight gaps combined with the significant volatility that follows (as the robot already entered trade and in many cases it ends up hitting the SL).

This isn’t the first time FGI has had drawdowns – and it certainly won’t be the last. If you look at the vendor’s track record starting from August 2019, you’ll notice a significant drawdown in April last year, and several more later that same year. But since the beginning of 2025, the EA has been performing very well—until now. So I believe better times will come. The more I dig into the data and view it from different angles, the sooner I believe I’ll catch the next uptrend wave. At least, that’s what I believe in and what numbers show me.

I traded for a few days this week, for example yesterday I traded only around afternoon and then stopped, and skipped the losing period at midnight. Now I stopped because of the upcoming holidays and the limited trading hours and closed gold markets at some prop firms.

As I wrote above, my plan is to observe the market and try to adopt and learn something new for myself.

To answer the question of @boyanlow , Petko passed a few challenges with FGI earlier this year – with FundedNext and with The5ers but this was before Trump’s tariffs announcements on the 9th of April which ignited the fire of volatility. Currently the robot doesn’t perform well but I’m a believer that this time will pass and it will be a good choice again. Also for that price, Forex Gold Investor is a must-have in my opinion.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi, the app shows the best strategies from our automated strategy generation process.

In January 2025 we made significant improvements to the strategy validation process and now the strategies in the app are cross-validated with historical data from multiple brokers which ensures that more robust strategies are available for download. Only the best strategies which pass the criteria are shown in the app. The strategies shown in the app are the best which passed all the criteria, including they performed well enough in the last 1 month. If there are less strategies for some pairs this means that the other strategies didn’t pass all validations. There may be some times when strategies will be fewer but until now they were way more than 10 per asset. We can easily lower the criteria and fill the app with strategies but we don’t won’t sacrifice quality for quantity.

Should you have any additional questions, please let me know or drop an email at our support inbox.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Mike, I see that Аlan has given you detailed information so I’ll elaborate on your latest question.

You’re on the right track – it could definitely be due to spreads, but there are also a few other common reasons why the MT4 and MT5 versions of the same expert advisor (EA) behave differently:

– MT5 might use RAW or ECN pricing with lower spreads but commissions, while MT4 might have wider spreads with no commission.

– Differences in execution speed, slippage, or margin requirements could affect trade conditions.

– MT5 uses different order execution (position-based vs MT4’s ticket system)

Also, if the MT5 and MT4 platforms are at different brokers, then the results will be different for sure as brokers have slightly different pricing or candle data, which affects indicators or signals.

For context, I’m sharing a link to the video where we showed and shared these EAs for free.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi Zachary,

Marin here from the customer support team. I’m sorry to hear about your experience. Since I can’t find email coming from your registered order email, neither any held comments under the YouTube video, I sent you an email with instructions what to do to trigger the refund process.

For transparency I want to point out that we don’t delete user comments on YouTube or anywhere else. If you read some online reviews about our company you will see that we don’t have any complains about holding users money or etc. For us user satisfaction is one of the most important things and we will keep it this way going forward.

Please check your email and sent me the requested information to proceed with the refund request.

Thank you and have a nice week ahead!

-

AuthorPosts