Forex trading software – algorithmic trading is much easier nowadays!

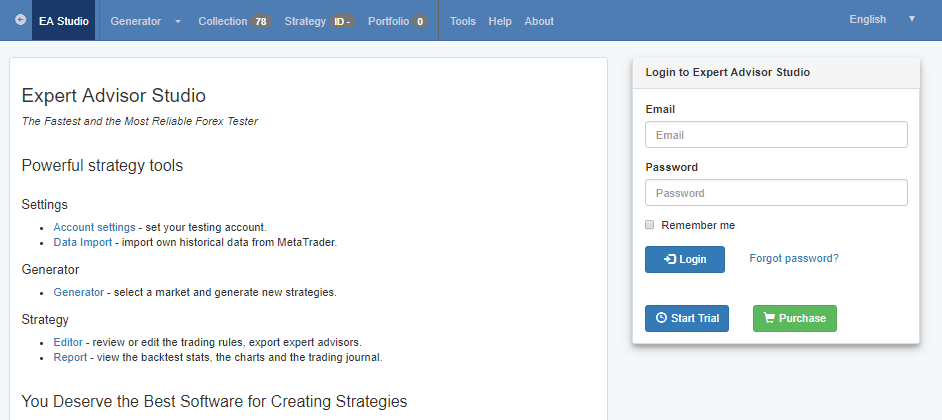

Forex trading software and its features are the topics of this article. I am Petko Aleksandrov from EA Forex Academy, and I would like to give you a little bit more information about the Expert Advisor Studio.

This is the Forex trading software that we use in the Academy. The other one is the FSB PRO – where you also have 14 days free trial.

Basically, the difference between the two is that Forex Strategy Builder Professional works with custom indicators as well. It has higher time frames as filters. For example, if you trade on M5, you can have M15, H1, H4 as filters to enter into the position, and as well Forex Strategy Builder needs to be installed on your computer to use it.

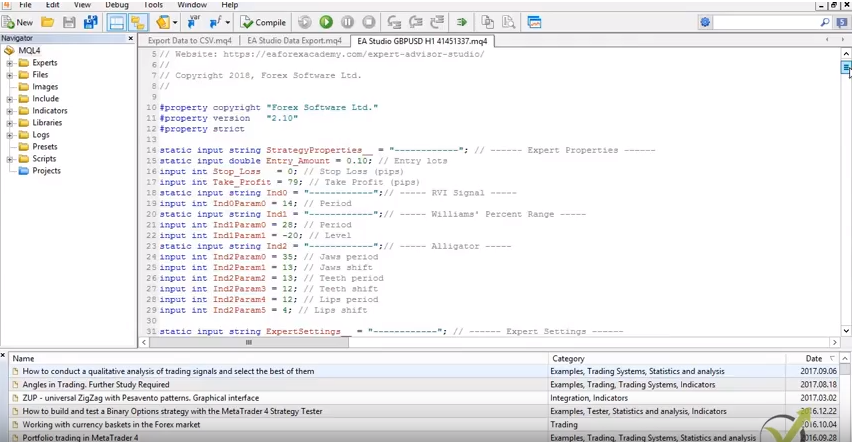

EA Studio is web-based. It means that you can use it from any browser, work so well with Chrome, and also you can use it on a couple of windows, so you can run 3, 4, 5 generators or reactors at the same time. And an Expert Advisor Studio as well works with the indicators from Meta Trader 4 only with those, that why it’s quite faster. Said the strategies, the code for the strategies it’s much more simple.

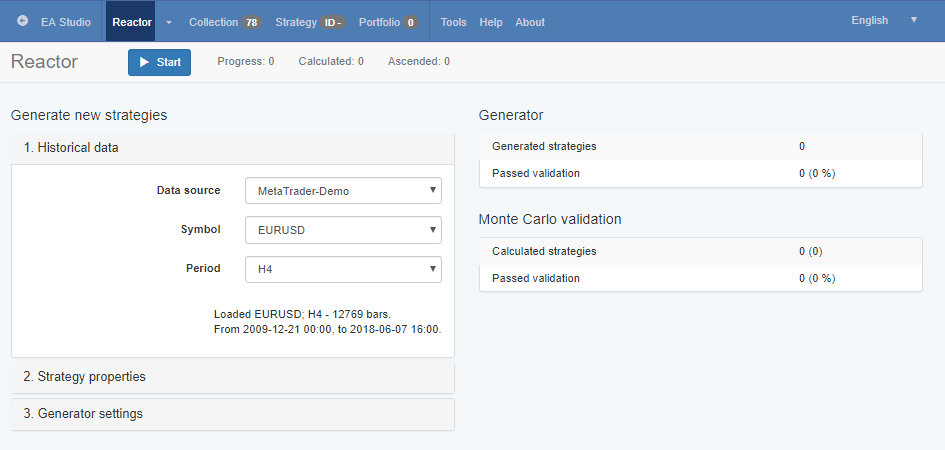

The other thing is that we have this powerful tool here, the reactor, which makes all of the processes automatically, but I will explain in detail a little bit later. The thing here is you have another 15 days free trial for EA Studio. You can register as I have explained in the previous lecture.

What is Forex Trading Software?

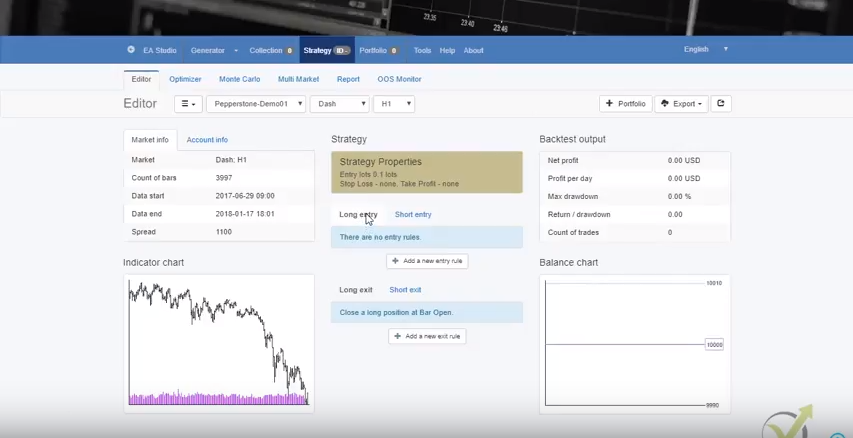

Let’s make it from the beginning, so we used Forex trading software to create strategies that are automated, which have rules to enter like long entry, long exit. What are the rules to enter in an extended position, what are the rules to exist in an extended position, and you can see the result immediately. And we can export these strategies as Expert Advisors with this Forex trading software. So, we don’t need to pay for developers.

If you pay to any IT company or any developer like a freelancer, it takes a lot of time, guys, it cost a lot of money as well!

I have done that already. It was a very horrible process for me. I was working for this risk company as an institutional trader. And one of my jobs as well as to communicate with the developers to automate the strategies that we were using. Basically, we were sending these strategies to them manual explanations, so they were trying to do it automatically.

It was taking so long time nearly 2, 3, 4 weeks and the cost of this is quite expensive as well. A usual Expert Advisor with 2, 3, 4 entry conditions are somewhere between $200 to $500, and it’s full of mistakes. At the end of the day, when we were trying to use this software for trading, obviously, there were a lot of errors.

We avoid now the whole process with this developers’ thing, which I had a bad experience with. And what this Forex trading software does is to export the ready strategies with one click, which is fantastic, really quick.

How does this Forex trading software work?

Let’s say you choose a strategy somewhere from the internet. You like the strategy, nice name, nice Profit shown over there. And there are some entry conditions, some exit conditions. They show you what the Stop Loss is, what is the Take Profit when you should enter and so on, and so on.

And what do you do?

You learn this system, and you start testing it. On a demo account usually. After sometimes you see that the system is not so stable something is missing, you should try another thing. You should add some indicators and so on and so on. If you use this system over here, the one that you choose from the internet you can add your entry conditions over here.

Let’s say we are having this system where the moving averages are crossing, which is very, very famous. And we have two moving averages with a period of 12 and 26. You click on accept, and this is the fantastic thing here with the Forex trading software.

You see the result immediately.

Let’s say your system is having Stop Loss of 30 pips and Take Profit of 90 pips, so it’s 3 to 1. And you see the result immediately. So, this is what I’m talking about.

When you test the strategy manually, first of all, you don’t know what is the result. Because they show huge profits, but you don’t see the exact results with the time. Right here, with every change you do for the entry or the exit condition. You see it immediately on the balance chart and as well every change you do to any of the indicators. Let’s change, for example fast moving average to 20, you click on accept, you can see another horrible result.

Just now, I took an imaginary system, I put an entry condition, I put Stop Loss and Take Profit, and I saw the results. I didn’t spend weeks to test this strategy to realize that it’s losing strategy. And this result it’s very real as you saw at the beginning of the course. Where I’m explaining how to import the Historical data for the Forex trading software, you should understand that if you backtest it on Meta Trader, you will receive the same result over there.

This is the thing if you want to make your strategy automatically. If you have an existing strategy simply you can put the rules over here:

- the entry rules

- the exit rules

- the Stop Loss

- the Take Profit

You can add few entries, and you will see the result immediately. On the indicated chart, you can see where the trades were executed, where they were closed. You can see here we have this short trade after two moving average cross.

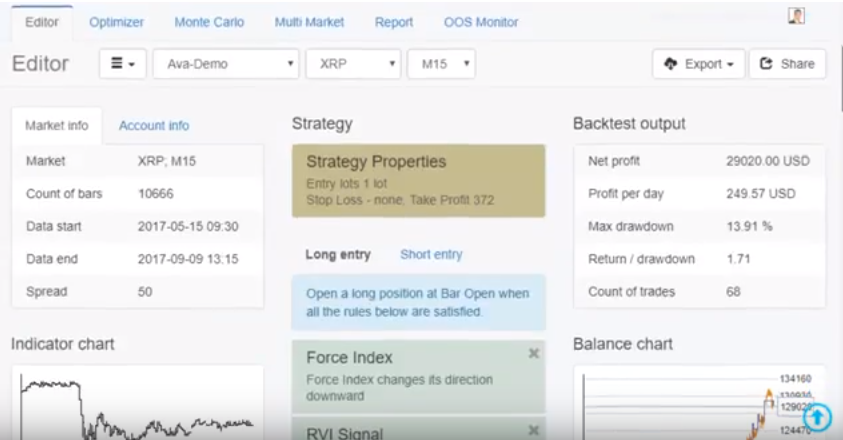

This is up the indicated chart you can see as well the Journal. Here are the orders that were executed, the positions, and you can see exactly the prices and the Profit. And you can compare it as well with Meta Trader. But if you have imported your history data correctly, it should match 100%.

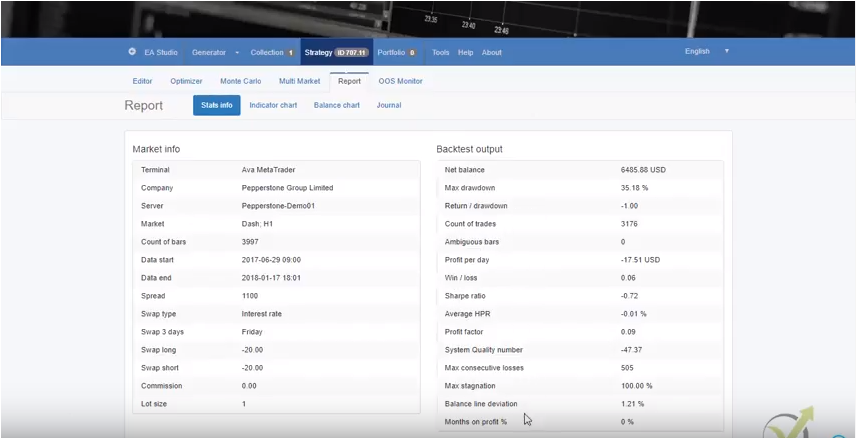

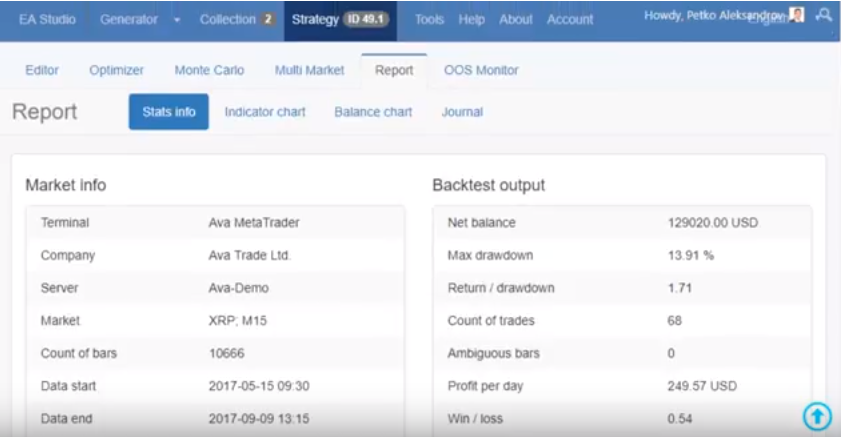

And the other one is the Stats info provided by the Forex Trading Software.

You can see precisely in detail how many counts of trades you had, how much was drawn down, how much the average Profit per day, and so on, and so on. And this is very, very important as well. Because if you test the strategy, manually you’re not testing 24 hours every day. You will check it a few times during the day. You will open a couple of trades, and you will make a conclusion that is not 100% correct.

Simply because you’re not in front of the computer all the time. I’m talking here, of course, about the strategies that are not connected with any trading hours. What I mean is that by this software simply we save a lot of time about testing the strategies. And about exporting them as Expert Advisor, so you don’t need to pay to any IT developer.

The next thing in the Forex trading software is the generator. A generator is a powerful tool from EA Studio, which generates strategies for you. Let me log in, and I will show you what I mean. It has two different options. One is the generator, and the other thing is the reactor, the validator is quite different.

The generator uses the predefined data source that you uploaded.

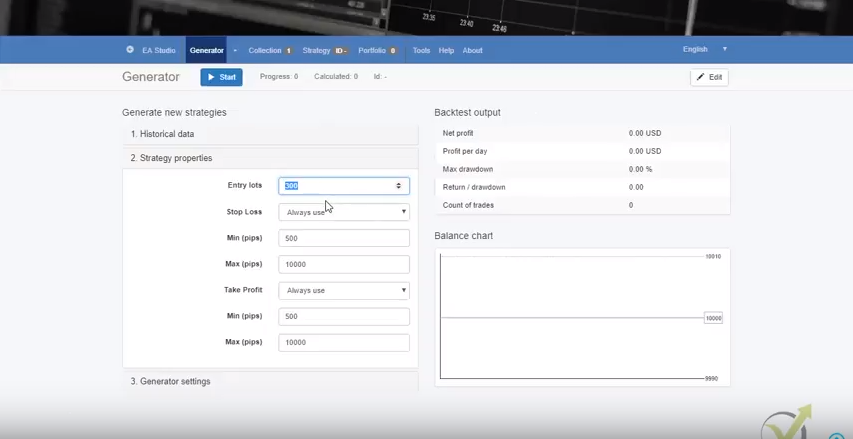

You select a symbol that you wish to trade. Let’s use, for example the cryptocurrencies because this is what we are doing over here and you choose:

- the selected period

- the period you want to trade

- the time frame that you wish to trade.

Here you define:

- what strategies you want to have

- how much should be the Stop Loss

- how much should be the Take Profit

- do you want to use Stop Loss at all or not, or you want to use only Take Profit for example

- what settings you would like to have, so working minutes you can set it even as long as you wish.

I usually set it for nearly 8 hours, so I do it over the night. Let’s say I do it for 500 minutes, how you want to select your strategies.

Obviously, the net balance is the thing that we want to have more and out of sample, or in of example you can use this tool as well.

Here you can choose:

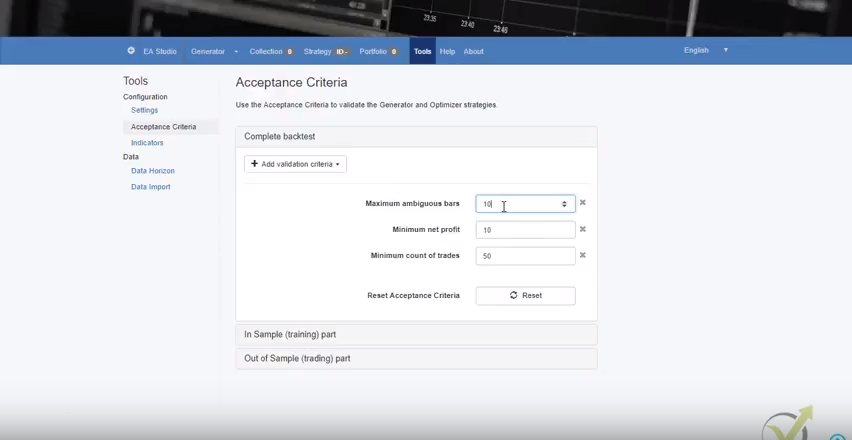

- acceptance criteria, so basically this is how would you like to have your strategies selected

- how many counts of trades you want to have

- the maximum ambiguous bar

- the minimum net Profit and the generator will create plans for you that only fit this acceptance criterion.

And when I click start, you can see how quickly this generator is working. These are the calculated strategies. This is like really, really unbelievable in the beginning when you see it. But with the time you can get used to it. And it will generate these strategies only the ones that fulfill the rules that I had set over here. Let’s stop it now. I will not wait until the end. And I have chosen the collections that I have chosen over here from by course.

Let’s choose this strategy, the Ripple strategy on M15. Once you have generated a strategy, guys, what you do?

You go through the Monte Carlo. You go through the optimizer. So the optimizer is the tool where you can optimize your strategy. Be very careful with that because if you don’t have enough historical data, you should not optimize your strategy. And also, if you have these EAs if you wish to trade with these EAs or any EAs, it’s very recommendable for you to optimize the strategy for your broker over the history data of your broker.

This is essentially important when you buy an Expert Advisor to optimize it. You can do this as well with Meta Trader 4 or 5. But the optimizer and the back tester there is not really reliable. I’m not going to talk about that right now. You can find a lot on the internet for it.

Said if you want to optimize your strategy, you can do it with the Forex trading software. It’s terrific to do it when you have a lot of historical data. And as well it’s good to use steps higher or rounded numbers for the indicators when you’re optimizing. You will avoid over-optimization.

Does that mean over-optimization, guys?

If I optimize this strategy, I will see a better profit line over here. But this is because the Forex trading software will find an input for the indicators that fit the best this period. As I said in this course, I’m not using massive historical data. Because I wanted to do it from your point of view when you don’t have a lot of historical data. To optimize it you need to collect more historical data. Leave your Meta Trader running 24/7. And it will generate for you more historical data with the time going.

After that, you can optimize it, or once again, I say if you buy an Expert Advisor if you receive a ready Expert Advisor, which was created for the different broker, you need to optimize it for your broker. Make sure it works with your broker. Because really, every broker shows so many different prices every day, you cannot imagine that.

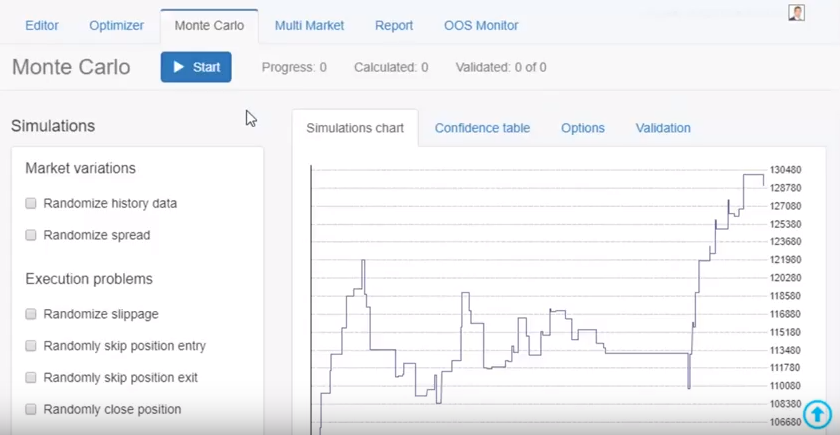

The next thing with the Forex trading software is the Monte Carlo. This is a very important thing as well.

Here you can do simulations about market variations, about randomize history data, a randomize spread. If you have a vast spread, it’s very good to test this one. If you have execution problems as well with your broker or strategy variations again to avoid the over-optimization. And you need to see whether this strategy fulfills the Monte Carlo, how many tests you want. From over here you can choose how many tests.

You can have the validation how the minimum count of trades as well for the Monte Carlo. This is the confidence table, the simulation chart is the one over here. With a lot of tools, with the Monte Carlo, the idea is that if you use the Monte Carlo, it will only try to break your strategy before you run it on the Meta Trader. This is the robustness test we have in the Forex trading software.

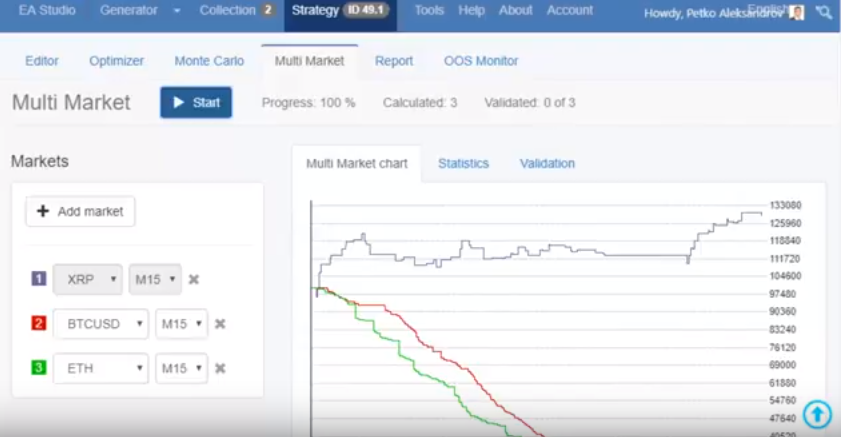

The Multi-Market, guys, is very interesting. Something that causes a lot of arguments between traders of algorithmic trading. I’m not a massive fan of it, and I will explain to you why. Because when you use it, Multi-Market, this is like a test if this strategy that you were having will be trading as well on the other markets. But at the end of the day, this strategy was not created for the different market.

So, why should it work over there?

This is a huge question we have. But it’s perfect when you have, for example the currencies and you have created a strategy for EURUSD. And you have like 5, 6, 7 other currencies, it’s good to see if this strategy will perform well on some of the others. But if it loses on all of the others, there is probably something wrong with this strategy. But I again say probably maybe there is no. So, we need to find out, and it’s a lot of tools over here you can use to find that out.

I will show you now. For example, if I click start, you see this strategy works with the Ripple, with the Bitcoin, and the Ethereum is losing. But again, I say this doesn’t bother me because this strategy was not created for these two.

Simply, you can ignore that when you are testing different markets because, for me, the cryptocurrencies each one is a totally different market. It’s a totally different market, it’s like you compare gold and soybeans. Or Gold and Cable, so nothing in common. Each cryptocurrency is different, the creation is different, prices are totally different nowadays, so it’s a totally different market. Keep that in mind.

Anyway, Multi Market is a very nice tool in the Forex trading software, so if you have a strategy that performs well on the other market, go and use it on the other market as well. I hope that’s clear.

So, the next thing we have, guys, the report. You can see the report of each strategy as I showed you here this is:

- the Stats info

- the Indicator chart

- the Balance chart

- the Journal.

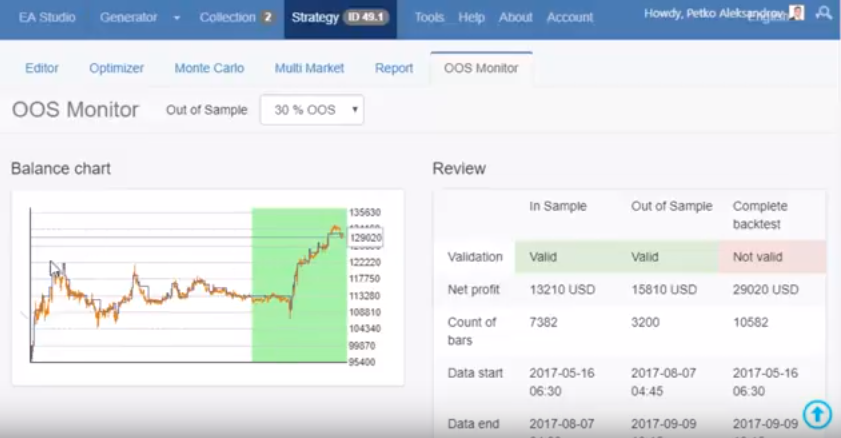

And what is the OOS Monitor?

This is something really interesting and nice, something that caused a lot of arguments as well. The idea here is that you can select this green period, and you can test your strategy only over this period over here. I am explaining it very simply. You can see what the result will be after that.

So for example, if you use this Forex trading software you can divide your period of historical data on three pieces, you can test it on 66% and leave 33% not going like the 30% which is the case over here, and you would see how your strategy performs after that. There are a lot of ways to use that, I’m not going into details now. After our generator creates strategies they go-to collection you can see here all of the collections, you can see the most important information we need, and you can download the whole collection.

After that, when you import more history data, you upload your collection again, and you can recalculate it with the newest historical data, and you don’t need to run a generator again.

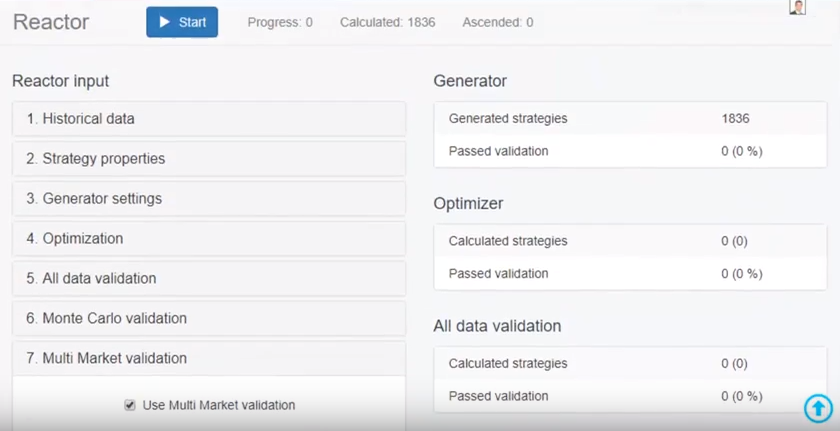

The next thing, guys, is the reactor-this is the thing from 2017, and that changed the Forex trading software EA Studio quite a lot, and I can say a good job to the developers of Forex software company!

Said guys, the reactor does the whole thing that I explained to you automatically.

What you see here is the history data, or you define it again as with a generator, you put your strategy properties, your acceptance criteria with the generator settings. And then, you select whether you want to use optimization. Let’s say we have a vast historical data and you want to use the optimization. After that, you can use as well all data validation, the OOS that I showed you.

You want to use the Monte Carlo as well, and you want to use the Multi Market as well as I said works well when you have normal currency. You can see all the selected tools that you want to use are right over here. When you click start, guys, what happens is that the generators start calculating strategies. The ones that will pass the validation they will go to the optimizer.

The ones that will pass the optimization validation they will go to all data validation, they will go through Monte Carlo, to Multi Market and at the end of the day in your collection, you will have only the robust strategies, the ones that passed all these tests and this happens fully automatically, which is nice, guys. This thing, this reactor saves the so much time because it does all automatically, and this is the thing that most of the traders now prefer the Forex trading software EA Studio from FSB because only it saves a lot of time, but at the end of the day the two software are quite different, it depends really what kind of strategies you are trading and what kind of strategy you want to export as Expert Advisors.

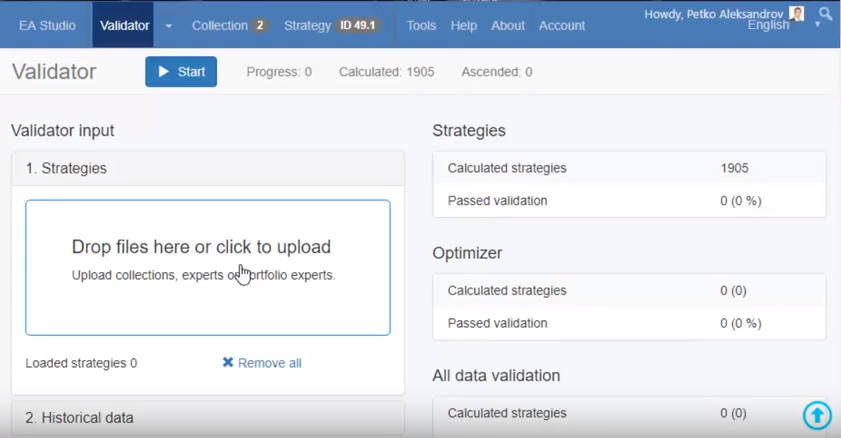

The third thing here is the Validator. What does this thing do?

The validator you can see here what does it say, drop files here or click to upload, upload collections, experts, or portfolio experts. If you have collection, let’s say from two months ago you can simply drop it over here you can drop Expert Advisors you’ve created with the Forex trading software a year ago or a whole folders even and when you click to start the validator will validate for you again with the fresh historical data only the ones that are performing, that are passing the validation.

And you don’t need to do everything over and over again. Once you have your collections, save them in folders, put them in order, put your work in order very important, guys, and after then you need to recalculate those with the validator. This is pretty much about it.

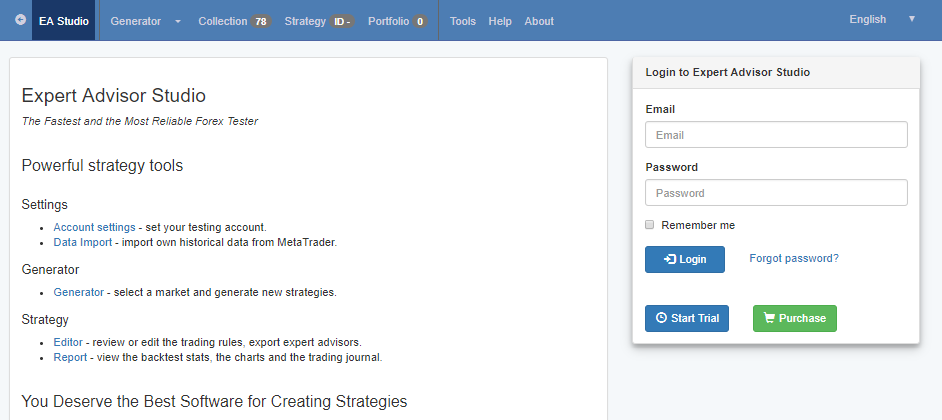

You have the tools over here for the Forex trading software.

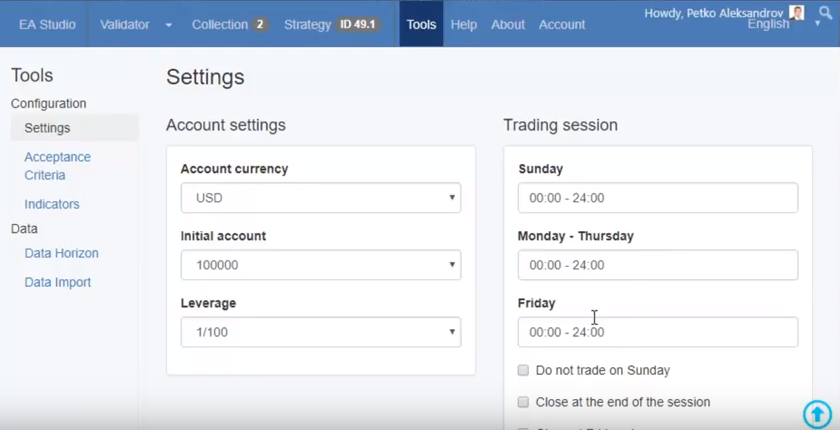

You have the settings, the working hour is a new tool from the middle of 2017, only here you can predefine the trading section if your broker is working only till 11:45 and it opens let’s say at 00:30 minutes after that you should put that thing here. If you want to close your trades on Friday at 11:00 a.m. London time, let’s say you can set it from here. And from here, you choose what Account currency you would like to have, what Initial account you want to trade with, what is a Leverage, so try to make it as similar as possible to your trading account with your broker.

Here are the Acceptance criteria, which I have explained to you. You can use a lot of tools from over here, so you can choose the maximum drawdown you want to have. How many percents, so you should like to have strategies with no more than 10 to 20% of drawdown and so on and so on. Here you can choose what indicators you want to have.

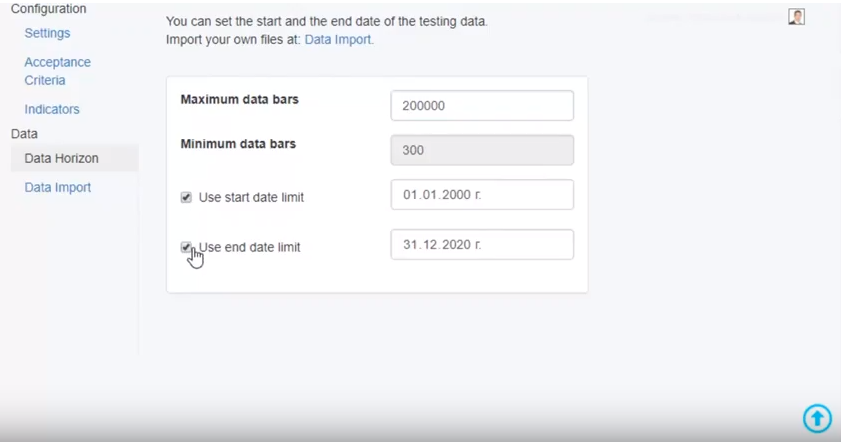

, you can generate strategies with the Forex trading software only with some indicators that you like and you don’t want to use all of the indicators, so from here, you need to unpick them. And about the data- this is the data horizon how many maximum bars you would like to have in your final test, the maximum you can have it’s 200 000 with EA Studio, which is pretty much enough.

Trading hours for the strategies!

And from here you can use as well Use start a date limit and Use end date limit if you wish or the best thing is you use the whole date available, and from data, import is from where you import your historical data and from here you can download the EA Studio Data Export script for Meta Trader 4 or Meta Trader 5 depends which one you are using.

This is pretty much about this Forex trading software, guys, a really professional tool to export Expert Advisors, to create strategies, to generate strategies and as you know the whole idea in the Academy and the whole idea actually is that we create many Expert Advisors, we create hundreds of strategies, we test them, but we test them first over here with all of the tools.

The one that passes all these validations we passed on a demo account.

And after that, we select only the best performers to trade on the live account. If at any moment one of these best performers starts to lose, we replace it with another strategy that is already generated, tested, optimized, and so on. And this way, we are not limited by the strategy we are having. We have hundreds of those, and it’s easy to do it all.

You need to organize your work to follow the strategies, in order not to do it all over again. But to always trade the best strategies that you have.

More detailed explanations for the Forex trading software you can find in the course Forex Strategy Course – with 12 Expert Advisors

Thank you very much for reading, let me know if you have any questions about the Forex trading software at our support Forum