The Forex market is a dynamic and fast-paced environment, with traders constantly seeking tools to gain an edge. Automation has become a vital part of this journey, with Forex robots—automated trading systems—taking center stage. A Forex robot builder allows traders to create personalized trading robots, tailored to their unique strategies and goals. Unlike pre-made Expert Advisors (EAs), these tools give you complete control and transparency.

In this guide, we’ll explore everything you need to know about Forex robot builders. We’ll also highlight two leading platforms, Expert Advisor Studio (EA Studio) and Forex Strategy Builder Professional (FSB Pro), to help you build, test, and optimize your own trading robots.

Table of Contents:

- What is a Forex Robot Builder

- Why Build Your Own Forex Trading Robot

- The Top Forex Robot Builder Tools: EA Studio and FSB Pro

- Quick Guide to Building a Trading Bot with Forex Robot Builder

- Best Practices for Forex Robot Builders

- Advanced Features of Forex Robot Builder

- What to be Aware of When Using Forex Robot Builder

- Combining EA Studio and FSB Pro for Maximum Results

- Why Forex Robot Builders Are a Game-Changer

What is a Forex Robot Builder

A Forex robot builder software is any program that allows the trader to generate, automate and analyze trading strategies. These programs are designed to simplify the trading process, making it accessible to both novice and experienced traders who want to move beyond pre-made Expert Advisors (EAs). Pre-made robots often come with flashy promises but fail to deliver due to their generic nature and lack of adaptability to specific trading conditions.

With a Forex robot builder, you can tailor strategies to align with your unique trading style. For instance, if you prefer trend-following strategies, you can configure the robot to use moving averages or momentum indicators. Alternatively, range traders can employ indicators like Bollinger Bands or support and resistance levels. Additionally, the software allows you to adjust critical parameters such as stop-loss levels, take-profit points, and risk-reward ratios, ensuring that the strategy meets your goals.

Platforms like EA Studio and FSB Pro take this customization to the next level by offering advanced features. These include automated strategy generation, in-depth testing tools like Monte Carlo simulations, and seamless export options for MetaTrader 4/5. The ability to validate and optimize strategies within these platforms ensures that traders have robust systems ready for live markets. Overall, a Forex robot builder empowers traders with the transparency, control, and flexibility needed to succeed in the fast-paced Forex market.

Forex robot builder is an innovative software tool that enables traders to create, customize, and test automated trading strategies without the need for programming knowledge.

Why Build Your Own Forex Trading Robot

Limitations of Pre-Made Robots

Pre-made robots often come with flashy promises but lack transparency. Many are over-optimized for historical data and fail in live markets. Additionally, they don’t offer customization options, leaving traders stuck with generic strategies.

Advantages of Building Your Own Robot

- Customization: Tailor your robot to suit specific market conditions or personal strategies. Whether you’re a trend follower or prefer range trading, your robot can adapt.

- Cost Savings: Avoid the high costs associated with purchasing EAs by creating unlimited strategies for free during trials or at minimal cost.

- Learning Opportunity: Designing a robot deepens your understanding of trading indicators, risk management, and market behavior.

- Transparency: With a Forex robot builder, you know exactly how your strategy works and can adjust it as needed.

Tools like EA Studio and FSB Pro make this process accessible even for beginners, offering intuitive interfaces and powerful features to streamline the experience.

The Top Forex Robot Builder Tools: EA Studio and FSB Pro

EA Studio: Simplicity and Speed

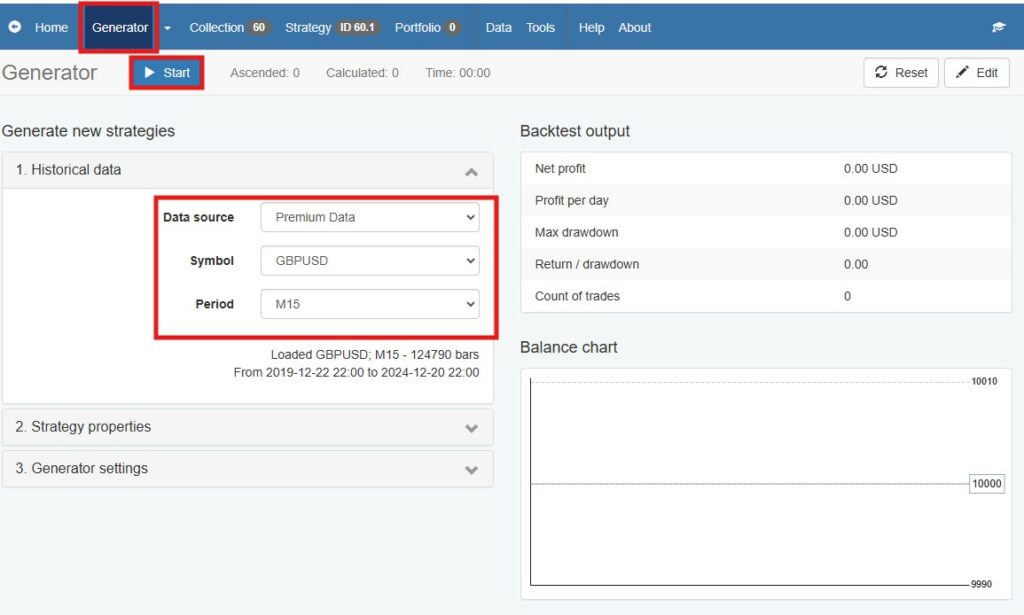

EA Studio is a web-based Forex robot builder ideal for beginners. Its intuitive design and automation features make it perfect for traders who want results quickly without compromising quality.

Key Features:

- The Generator: Automatically creates strategies based on historical data and predefined parameters.

- Acceptance Criteria: Filters out suboptimal strategies, ensuring only high-quality ones are retained.

- The Reactor: Combines strategy generation, testing, and optimization into a single workflow.

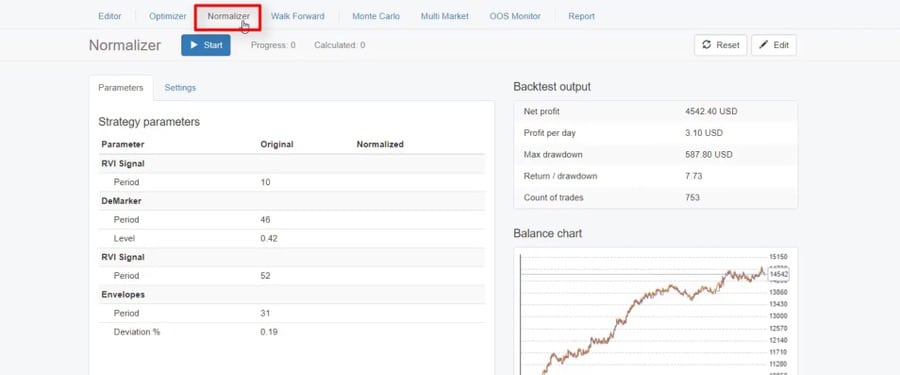

- The Normalizer: Simplifies strategies by removing redundant elements, improving reliability.

- 15-Day Free Trial: Test the platform and export unlimited robots without any financial commitment.

FSB Pro: Advanced Features for Professional Traders

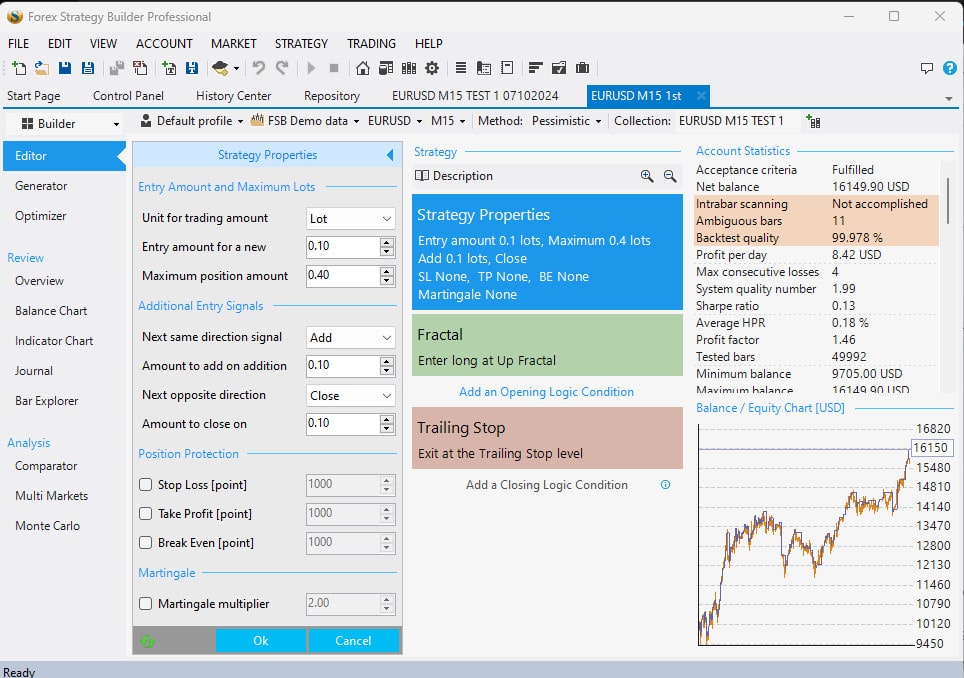

Forex Strategy Builder Professional (FSB Pro) is a desktop application designed for advanced users who require detailed customization and in-depth analysis. It provides flexibility and powerful tools for creating sophisticated strategies.

Key Features:

- Custom Indicators: Import or design unique indicators for tailored strategies.

- Portfolio Management: Combine multiple strategies into a single portfolio to diversify risk.

- Multi-Market Testing: Validate strategies across various assets and timeframes.

- Real-Time Analysis: Instantly evaluate strategy performance with detailed metrics.

EA Studio vs. FSB Pro

- EA Studio: Best for beginners or traders who prioritize speed and simplicity.

- FSB Pro: Ideal for experienced traders seeking advanced tools and customization.

- Combining Both: Many traders use EA Studio for quick strategy generation and FSB Pro for detailed refinement.

Take Action with EA Studio and FSB Pro

If you’re ready to take your trading to the next level, now is the time to explore these powerful tools. EA Studio’s simplicity and speed make it perfect for generating strategies quickly, while FSB Pro’s advanced features offer unmatched depth and flexibility. With their FREE trials, you can experience the benefits firsthand without any risk. Don’t wait—start building your own trading robots today and gain the edge you need in the Forex market!

And if you want to start with EA Studio, don’t miss the free course for this amazing forex robot builder.

Quick Guide to Building a Trading Bot with Forex Robot Builder

1. Getting Started

The first step is to choose your platform (EA Studio or FSB Pro) and import historical data from your broker. This ensures your strategies reflect real market conditions. With the Forex Historical Data App premium data comes automatically.

2. Generating Trading Strategies

With EA Studio:

Use the Generator to produce multiple strategies automatically. Input your criteria, and the tool will create strategies tailored to your requirements. Set parameters such as:

- Currency pairs (e.g., EUR/USD or GBP/JPY).

- Timeframes (e.g., H1, M15).

- Risk levels and lot sizes.

With FSB Pro:

Design strategies manually by linking indicators and setting specific rules. For example:

- Entry Rule: Price crosses above the 50-day moving average.

- Exit Rule: Relative Strength Index (RSI) drops below 30.

3. Testing and Refining Strategies

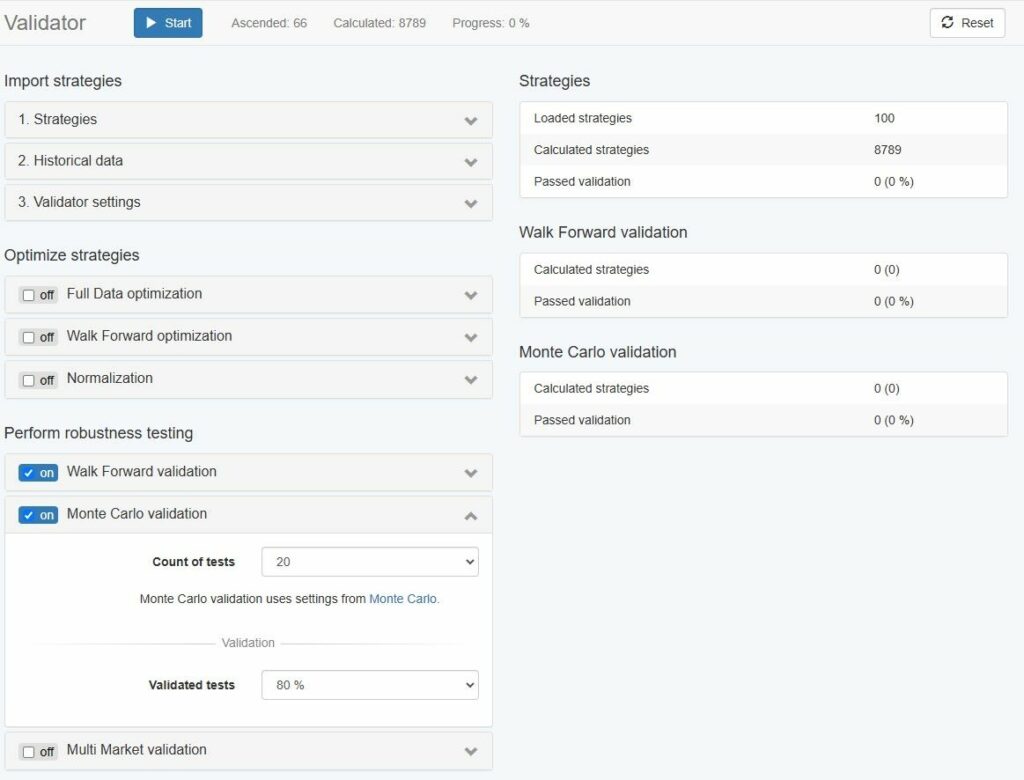

Backtesting is essential to evaluate how your strategy would have performed in the past. Both platforms offer advanced tools:

- Monte Carlo Simulations: Test the strategy’s robustness by introducing variables like slippage or spread changes.

- Walk Forward Optimization: Optimize your strategy in one dataset and test it on another to avoid overfitting.

- Out-of-Sample Testing: Simulate live trading conditions without risking real capital.

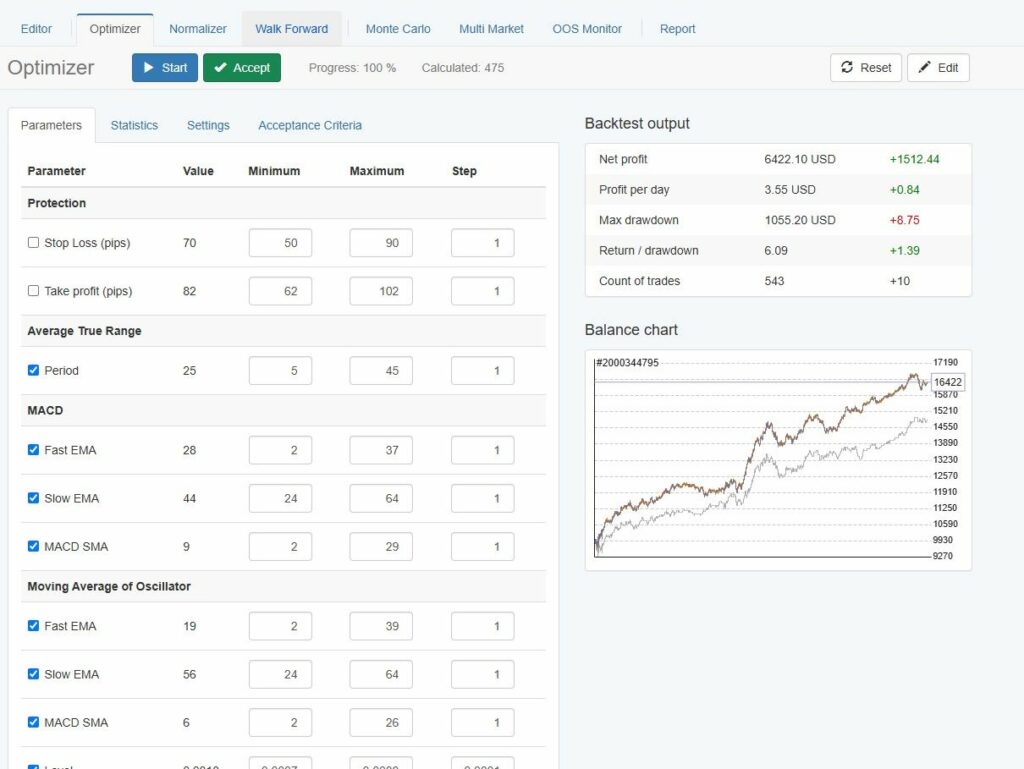

4. Optimizing for Better Results

From Optimizer feature, available in both forex robot builders, adjust parameters such as:

- Stop-loss and take-profit levels.

- Indicator settings (e.g., Bollinger Bands deviation).

- Risk-reward ratios (e.g., 2:1).

Example: If your initial strategy uses Bollinger Bands, you might refine it by reducing the period or increasing the standard deviation to better match market conditions.

5. Exporting and Deploying Your Forex Robot

Once finalized, export your robot as an Expert Advisor compatible with MetaTrader 4 or 5. Deploy it on a demo account first to observe its performance in real-time before going live.

Check out also how to create forex robot without programming skills article for more in-depth information about using forex robot builders for generating own forex robots.

Best Practices for Forex Robot Builders

Forex robot builders are powerful tools, but using them effectively requires adherence to key best practices. These ensure that your strategies remain robust and profitable over time.

1. Avoid Over-Optimization

Over-optimization occurs when a strategy is too finely tuned to historical data, often resulting in excellent backtest performance but poor live trading results. To avoid this, focus on building strategies that are robust and perform consistently across various market conditions. Use tools like Walk Forward Optimization and Monte Carlo simulations, available in platforms such as EA Studio and FSB Pro, to test how your strategy behaves under different scenarios.

2. Incorporate Risk Management

Risk management is crucial for long-term success in trading. Always set stop-loss levels to limit potential losses and ensure proper position sizing to manage overall portfolio risk. Forex robot builders allow you to customize these parameters, ensuring that your strategies align with your risk tolerance. For example, you might set a maximum loss of 2% of your account balance per trade to protect against large drawdowns.

3. Regular Updates

Markets are dynamic, and what works today may not be effective tomorrow. Regularly test and update your strategies to adapt to evolving market conditions. This might include revisiting your choice of indicators, adjusting parameters like moving averages or Bollinger Bands, or even discarding strategies that no longer perform well. Continuous evaluation ensures that your trading robots remain relevant and profitable in changing markets.

By following these best practices, you can maximize the potential of Forex robot builders and create robust, reliable strategies that stand the test of time.

Advanced Features of Forex Robot Builder

EA Studio’s Unique Tools

EA Studio is designed to make the strategy creation process seamless and efficient, offering traders advanced features that enhance usability and effectiveness:

- The Reactor: This is a game-changing tool that automates the entire lifecycle of a trading strategy. It not only generates strategies but also tests and optimizes them in a single workflow. This means traders can focus on evaluating results instead of manually handling multiple steps. The Reactor ensures that your strategies are ready for real-world application with minimal effort.

- The Normalizer: Simplifying strategies is critical for avoiding overfitting, and the Normalizer excels at this by removing unnecessary elements and redundant indicators. This tool helps create clean and robust strategies that are more likely to perform consistently in live trading conditions.

FSB Pro’s Robust Features

FSB Pro offers advanced capabilities for traders who require detailed customization and in-depth analysis:

- Portfolio Management: This feature enables traders to combine multiple strategies into a single, diversified portfolio. By balancing different approaches, such as trend-following and range-bound strategies, traders can mitigate risk and improve overall profitability.

- Multi-Market Testing: FSB Pro allows you to test strategies across various assets and timeframes, ensuring they perform well under diverse market conditions. This feature provides a clear picture of a strategy’s adaptability and reliability, which is crucial for long-term success in Forex trading.

With these advanced features, both EA Studio and FSB Pro empower traders to create, test, and refine strategies that align with their trading goals while ensuring robustness and adaptability.

What to be Aware of When Using Forex Robot Builder

Forex robot builder is a powerful tool, but it comes with potential pitfalls that traders must avoid to ensure long-term success:

- Over-Reliance on Automation: While Forex robot builder simplifies the trading process, it’s essential to understand the logic behind your strategy instead of blindly trusting automation. Relying entirely on a robot without understanding its indicators, entry/exit rules, and risk management parameters can lead to unexpected losses when market conditions shift.

- Skipping Validation Steps: A robust strategy requires rigorous testing. Always perform thorough backtesting and utilize tools like Monte Carlo simulations or Walk Forward optimization to ensure the viability of your strategy across various scenarios. Skipping these steps increases the likelihood of deploying a strategy that fails in live trading conditions.

- Ignoring Market Changes: The Forex market is constantly evolving, and strategies that work today may not perform tomorrow. Regularly revisit your strategies to ensure they remain effective. This includes updating parameters, testing against recent data, and replacing outdated strategies with new ones tailored to current market dynamics.

By being mindful of these pitfalls and actively addressing them, traders can maximize the effectiveness of their Forex robot builder and achieve consistent results in the dynamic world of Forex trading.

Combining EA Studio and FSB Pro for Maximum Results

Using both EA Studio and FSB Pro in tandem can significantly enhance your trading experience by combining the strengths of both platforms. EA Studio excels at generating strategies quickly and efficiently, making it an ideal tool for creating a wide range of potential trading systems. Traders can leverage its Generator and Reactor tools to produce and filter multiple strategies in minutes, focusing on ones that meet specific criteria such as profitability and drawdown limits.

Once you have a selection of promising strategies from EA Studio, FSB Pro steps in as the perfect tool for refinement and validation. With its advanced testing features, including portfolio management and multi-market testing, FSB Pro allows you to stress-test strategies across various currency pairs and timeframes. For instance, a range-bound strategy created in EA Studio can be tested for robustness in trending markets using FSB Pro’s simulation tools.

This workflow ensures that your trading robots are both versatile and reliable, prepared to handle different market conditions. By combining the automation capabilities of EA Studio with the advanced analytical features of FSB Pro, you can create a well-rounded and robust trading portfolio that maximizes your success in the Forex market. This synergy makes these tools an unbeatable combination for any trader looking to excel with a Forex robot builder.

Key takeaways:

- Use EA Studio to quickly generate multiple strategies.

- Refine and validate these strategies with FSB Pro’s advanced tools.

- Example Workflow: Create a range-bound strategy in EA Studio, then test its robustness in FSB Pro across multiple markets.

Why Forex Robot Builders Are a Game-Changer

Forex robot builders are revolutionizing the way traders approach the market by offering unparalleled transparency, control, and customization. These tools enable traders to design, test, and deploy automated trading strategies tailored to their unique goals. Unlike pre-made robots, which often lack adaptability and insight, Forex robot builders put the power directly in the hands of traders.

Platforms like EA Studio and FSB Pro simplify the process, making it accessible for both beginners and experienced traders. EA Studio’s automation tools, such as the Reactor and Generator, allow users to create multiple strategies quickly, while FSB Pro’s advanced testing features ensure robustness and adaptability. This combination of speed and precision transforms trading into a streamlined and effective process.

Whether you are looking to refine an existing strategy or build one from scratch, Forex robot builders eliminate guesswork. They empower traders to optimize every detail, from risk management to indicator settings, ensuring strategies are reliable and profitable. By leveraging these tools, you can enhance your trading performance and achieve consistent results in the ever-evolving Forex market.

Conclusion

Building your own trading robot with a Forex robot builder offers unparalleled benefits. Platforms like EA Studio and FSB Pro simplify the process, making it accessible to traders of all skill levels. Start your journey today with their free trials and take control of your trading success.

By following this guide, you can leverage the power of Forex robot builders to create automated strategies tailored to your goals. The future of trading is in your hands—start building your robot now!