In this Forex for beginners guide, if you have been struggling to find the best, clearest, ultimate guide to Forex for beginners then you just found it!

If you are new to the money market, you have probably heard of the term Forex trading, and you are probably wondering what it means.

Forex, also popular as foreign exchange or currency trading, is a global decentralized market where all the currencies of the world trade. The Forex market has an average volume that exceeds $5 trillion per day. This makes it the largest, most liquid market in the world.

A vast amount of foreign exchange is done for purposes that are practical. However, the highest number of currency conversion is done by Forex traders whose aim is to earn a profit. The amount of conversion of currencies taking part each day can cause extreme volatility in some currencies due to the movements in prices. This volatility attracts people to do Forex trading since the risk is high, but the profits are even higher.

First Steps in Forex for Beginners

Now, before we begin, let’s make it clear. Forex can be “easy money” or what some call “instant riches” ONLY if you have the right temperament for it.

The game of Forex is not just price action trading but is an emotional game of control and balance. If your mindset and your emotions are not right, you will lose.

As a newbie in Forex trading, all this information can be a bit overwhelming. However, in this ultimate Forex for beginners guide, we will teach you everything you need to know to start with Forex trading for beginners, along with tips and mindsets to implement.

However, we are here to guide you through the stages of Forex for beginners, what to do and what to avoid, and the pros and cons of Forex trading. You want to be equipped with the necessary knowledge of currency to avoid losing money.

Risks to avoid, essentially a Forex for dummies guide; with all the skills, patience, application, and education that you will ever need to guarantee success.

The History of Forex

After World War II, the allied nations along with the rest of the whole world were either in economic collapse or just chaos, scrambling to make a living. Out of this despair, in 1944, a new monetary system, or “Bretton Woods System” came into existence. Its purpose was to stimulate trade and with efforts to stabilize the global economy.

The history of when the Forex system that we know today became official is a long, debatable topic for many. Multiple experts agree that it was in 1996 when retail Forex brokers were established or embraced by the public, 4 years after the signing of the Maastricht Treaty due to “Bretton Woods System” failing its purpose.

The Bretton Woods System

Bretton Woods System had failed in its monetary purpose or policies. Gold was the main reason why it had failed. Many nations took advantage of the system even one of the co-founding members. For more information about this, please follow this link.

In short, Forex is the modern barter system operating on limitless possibilities, when compared to old barter systems that take hours for a single large transaction to happen.

In Forex, multitudes of large trade transactions are done within an hour. Literally, millions of dollars are being traded on an hourly basis.

The total volume of money being traded in the Forex global market is roughly $4-$5 trillion dollars per day compared to a stock market where they trade around $200 billion dollars per day. The reason why the volume of money being traded in Forex is trillions of dollars per day is it operates 24 hours compared to 8 hours.

Traders just like you

Ordinary people looking for financial freedom, are achieving their dreams on a daily and weekly basis. When you read the section on risks, you will come to understand why trading Forex is both extremely rewarding and can be extremely devastating if not handled properly.

Major Forex for Beginners Terminologies

Aside from the basic terminologies such as currency pairs (two currencies paired together), you analyzing that your trade will go long (also called bull, going up in value) or short (also called bear, going down in value). Here are the major Forex for beginners terminologies that you must familiarize yourself with:

Trading Hours

While the Forex market operates in the interbank market meaning 24 hours, as a trader, you must understand how timezones work as there are currency markets that all Forex traders watch out for. The Euro, the U.S. Dollar, the Japanese Yen, the British Pound, the Canadian Dollar, and the Swiss Franc currency markets.

When you “watch out” for a currency market, it means, your Forex trading sessions must be done within your targeted currency market’s timezone. When two currency markets are reaching that prime hour when both markets are in full swing.

For example, if you live in France, you are in the Central European Timezone. Let’s say your target market is the United States whose timezone is Eastern Standard Time. You are ahead by 6 hours. This means:

- France, 10:00 am is equal to New York, 04:00 am.

- … the US financial market does not open until 08:00 am which means your trade starts at 02:00 pm.

Volume

Volume is basically is the complete tally or amount of money being traded on a daily basis. As of 2020, the Forex global market trades roughly around $4-$5 trillion dollars per day.

Volatility

In simple words, volatility means liquidity or fluctuation. And depending on your appetite meaning you are either an aggressive trader or a more conservative trader, you may trade currencies with massive spikes of volatility where, for example, you can make well over $1,000 in 30 minutes or loss $1,000 in 30 minutes.

PiP

To keep it simple, Points in Percentage is basically the number of winnings or losses that you gain. For example, if you open a trade on EUR/USD at 1.0000 and you close at 1.0100 – this means, you have won 100 PiPs and now, depending on your leverage, will determine what the worth of those “100 PiPs” are.

Leverage

Leverage is a bit confusing to simplify but in essence, it is the value of your money. Pip is sometimes displayed in a ratio of 2:1. This means that for every pip or point that you win, you get half your money’s worth. Remember that leverage or ratio, determines the value of your money. The ratio essentially cuts the value of your money.

In the example below, we are using the dollar as our example:

Your Leverage is 2:1

You Pip Winnings is 100

You Earn $50

… or another way to see it is, you take the total PiP winnings and divide that by 2. The first number is essentially the divisor and the last number is the dividend.

Don’t worry if you can’t understand this. When you start trading Forex, this will become very clear. It’s important to take this in now so that when you start trading, you will better understand how to maximize your FX trades.

Lot

Lots are used for trade currencies. Lots are batches of currencies whose job is to standardize Forex trades. The movement of Forex is usually in small amounts, but lots tend to be big.

One hundred thousand units of the base currency form a standard lot.

Therefore, since most traders cannot place 100,000 units of the currency they are trading on each trade, they opt to trade through leveraged products.

Forex Brokers

When learning about Forex trading for beginners, you must know what a Forex broker is.

A Forex broker is a firm whose job is to buy and sell currencies through currency trading platforms.

Currency brokers trade on behalf of retail traders. Like stockbrokers, currency brokers charge a fee to trade on behalf of clients. The fee is usually presented as a spread and not a commission. There is, however, a difference between stockbrokers and currency brokers. For Forex brokers, they place trades over-the-counter and not an exchange like stockbrokers.

Forex brokers have been the go-to firms when it comes to Forex transactions. However, with the rise of online trading, you can avoid brokers. Instead, you can take advantage of the movement of Forex prices through CFD trading and spread betting derivatives.

What Are Derivative Products

The ways in which you can trade Forex are two: using derivative products and through a Forex broker.

Derivative products are utilized by traders to trace an underlying market so that they can speculate how the price will behave, will it rise or will it fall. CFDs and spread bets are the two most popular Forex derivatives.

Spread betting

A Forex spread bet is a derivative that allows you to predict the direction the price of a currency pair will take. Two things determined whether you make a profit or loss. The first determinant is the movement of the market in your favor before closing your position. The second determinant is the amount of money you have invested per point of movement.

The advantage of spread betting is that this derivative is tax-free.

CFD trading

CFD trading is a consensus established from when you open your position to when you close it. Under this consensus, you agree to exchange in price of a Forex pair during the agreed period. You profit when the market moves in your preferred direction, and you go at a loss when its movement is against you.

How Does the Currency Market Operate?

Whether you choose to trade Forex through a broker or using derivative products, you must understand how the underlying currency market works. Remember, knowledge is power, and knowing the Forex market’s basics could determine whether you make money or lose it.

Forex trading is quite different compared to shares or commodities. Currency trading takes place directly between two parties, that is why it’s referred to as an over-the-counter (OTC) market. Shares, on the other hand, are traded through exchanges, the trading is not OTC.

A global network of banks runs the currency market. These banks are located in four major Forex trading centers, each in a different time zone. These trading centers are in Sydney, Tokyo, London, and New York. Trading Forex takes place 24 hours a day since there is no central location.

What are the different types of the Forex market?

Forex markets are grouped into three:

Spot currency market

This is the exchange of a pair of currency that takes place physically at the point where the trade is settled. The transfer of the currencies occurs on the spot or within or in a short period.

Forward Forex market

In forward Forex trading, a contract is established with a consensus to buy, at a specific price, a given amount of currency. The buying of the currency is set to take place at a given date in the future or between several dates in the future.

Future Forex market

In future-forward trading, a contract is established where the buying or selling of a given currency is agreed. The transaction has a specific set price, and the amount of money that will be bought or sold is also specified. The date of this transaction is set in the future. However, unlike forwarding marketing, the contract created in the future currency market is binding legally.

What is a base currency?

You might have come across the term base currency, and you might not know what it means. Base currency is the first currency that appears on the list of Forex pairs. The quote currency is the second currency. Currencies are paid since Forex trading involves the sale of one currency in order to buy another one. The worth of one unit of the base currency in relation to the quote currency gives the price of a Forex pair.

Three-letter codes are used to represent each currency in the pair. Often, the code is comprised of two letters that represent the region of the currency, and one letter stands for the currency itself. For example, USD/GBP is a pair currency between the US dollar and the Great British Pound. In this transaction, the US dollar is being bought while the Great British Pound being sold.

Therefore, the base currency is the currency you are buying when trading in Forex pairs, while the quote currency is the currency you are selling in Forex trading.

To make it easier to understand the currencies, most providers divide pairs into the following categories:

Major pairs

The major pairs are a composition of the currencies that contribute to 80% of the global currency trading. These include EUR/USD, USD/JPY, GBP/USD, and USD/CHF.

Minor pairs

These are the currencies that are traded less frequently. Minor pairs involve major currencies trading against each other instead of trading with the US dollar. Examples of minor pairs is EUR/CHF, EUR/GBP, and GBP/JPY.

Exotics

Exotics is a trade between a major currency and a small or emerging economy. Examples include EUR/CZK, USD/PLN, and GBP/MXN.

Regional pairs

These are pairs grouped according to regions. They include AUD/NZD, EUR/NOK, and AUD/SGD.

How does Forex trading work?

Forex trading for beginners should not skip out on this vital question, how does currency trading work? Forex trading works just like any other exchange where you use a currency to buy an asset.

In Forex trading, the market price is the indicator of the amount of one currency needed to buy another. For example, the currency exchange rate GBP/JPY indicates how many Japanese Yen buy one pound.

You trade on leverage when you use CFDs and spread bets to speculate the movement of Forex prices. Trading on leverage allows you to create a position using a fraction of the trade’s full value. You do not take ownership of the assets when trading on leverage. The position you take is on depending on how the market behaves, do you think the market will rise or fall?

The advantage of leveraged products is they can magnify your profits. The flipside of these products, however, is that if the market moves against you, the products will magnify your losses.

How to Trade Forex for Beginners

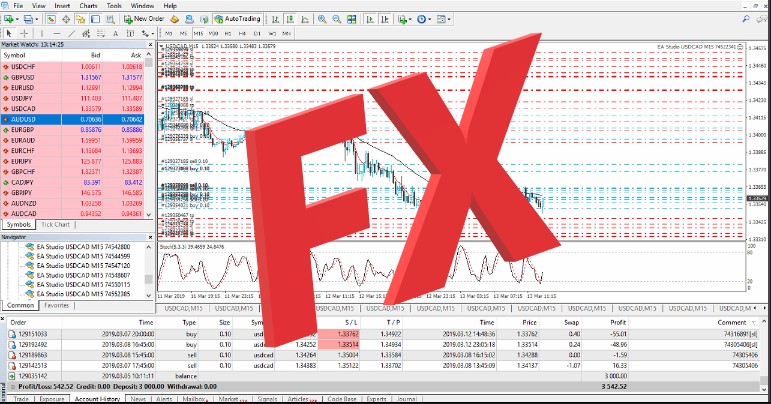

First, you will need a trading platform. You can either go with a Forex brokerage, in order to gain access to a trading platform, such as MetaTrader or you can also do it yourself by joining other electronic trading platforms. Then, you simply open a position, and now, you are trading Forex.

When you open a trade this essentially means you are taking or standing with one currency against another currency.

For example, when you open a trade on the EUR/USD pair, this means you believe that the EUR currency will either go up or down in value against the USD currency.

The most important aspect that you must understand when trading Forex is the opening and closing of major financial markets. Especially when two prime financial currency markets meet that is when the USD and EUR markets are both waking up and their timezones are intermingling, some traders call this “prime time trading”.

This is the time when volatility often spikes up and down very quickly, not just in those two financial markets but other major markets. Even minor markets are all being impacted, all at the same time. During “prime time trading” is where most traders make their money.

Main Forex for Beginners Trading Styles and Strategies

A trading style is a term they use to determine the appetite of a trader. Most beginner Forex traders are very aggressive, this kind of appetite is called a scalper. Here are common trader styles and the strategies one uses:

Scalper Trader

Scalper Trader is a trader who opens positions very aggressively during spikes or volatile trading times such as when a major economic event is being announced and the volume is going up or going down very, very fast. A scalper is looking to make money during the whole period of volatility.

Day Trader

Day Trader is a trader that likes to open positions during the opening of a financial market and would often close their trades at the closing of that financial market. The appetite of a day trader is often neutral meaning they want to make money as safely as possible.

Trend Trader

Trend Trader is a trader that follows the trend of a financial market meaning they study the country, its economics, the status of jobs, policies, impact, influence, and even its citizens’ quality of life. The appetite of a trend trader is often semi-aggressive. They are looking for signals, confirmations to go forward with their trades.

Swing Trader

Swing Trader is the most patient of them all. A swing trader will open a trading position, and leave that going for months sometimes even years. They are the epitome of long term trading. Their appetites are generally very calm, slow, looking to make gains over time, and very, very analytical in their approach.

What are Currency Pairs, and which are the major (most used) types

A currency pair is when you take two currencies and you pit them against one another meaning one acts as the base and the other the quote.

To simplify, think of it as you picking fighter A, and choosing that he will lose or will win, against fighter B.

For example, EUR/USD – EUR is fighter A and based on your analysis, EUR will go long or bull against fighter B or USD who is going short or bear in value. In simple words, EUR is going UP and USD is going down.

When you first open a trading platform and you see a currency pair for the first time, you will see two sides to a pair. The one on the left is called “bid” while on the right is called “ask”. The bid tells you how much you will need to buy a currency while the ask tells you how much you will make.

Here are the major currency pairs:

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

- USD/CAD

- AUD/USD

- NZD/USD

The reason why most traders open positions on major currency pairs is because of the spread and can be very liquid (volatile) in the Forex global market. This means it’s affordable and relatively speaking, safer to trade large positions when compared to other pairs or minor currency pairs.

What moves Forex trading?

The Forex market is influenced primarily by the rule of supply and demand. Supply and demand are determined by the fluctuation of prices, making it essential for you to understand the forces behind price fluctuations.

News reports

Economies portrayed as having a stable outlook tend to draw banks and investors. Therefore, when the market receives positive news about a given region, investors are drawn to that region and the demand for that region’s currency increases. The price of a currency will increase because of the disparity between supply and demand.

Like how good news positively affects a region’s currency, negative news also has an impact on the currency. Negative news leads to a decrease in investments, and with low investments comes a low price for a currency. Therefore, currencies are a reflection of how well an economy is doing in the region they represent.

Central banks

Central banks control supply since they announce measures that affect the price of their currency significantly. To protect the price of an economy’s currency from dropping, central banks can practice quantitative easing. Quantitative easing involves inputting more into an economy to boost its currency.

Market sentiment

Market sentiment is the reaction to news regarding a particular economy. Sentiments are influential movers of currency prices. If traders predict that a currency is moving in a particular direction, they will direct their trades in that direction. The trading may convince other people to follow suit, therefore, causing an increase or decrease in demand.

Forex Trading Risks & Tips for Beginners

When it comes to Forex for beginners, knowing the risk factors and the tips to maximize your trades can literally save you thousands of dollars as well as your own sanity.

Here are three of the most common Forex trading risks:

Interest Rate Risk

Remember that in Forex, economic announcements, especially in major financial markets such as the United States, the United Kingdom or Japan, can drive the volatility of those currency markets up or down, very fast.

This is why among the many tools a Forex trader has is his/her fundamental skills which involve a lot of research and staying up-to-date in a financial market’s geopolitical conditions.

A prime example of this is, when a central bank such as the Federal Reserve in the United States and its Governor speak, the majority of traders are listening as a policy announcement can severely impact their trades.

Transaction Risk

Transaction Risk is a risk that involves timezones. Remember that the Forex market operates in an interbank environment meaning when one financial market opens another one closes and sometimes even two major financial markets collide at a certain time called “prime time trading.”

Unless you are a swing trader, most traders (trend, day, scalper) prefer to close their positions before the close of the market. If you do not close your trade by the end of the market, your trade could be stuck and you lose control.

Imagine, having a pair like EUR/USD and you’ve won over 250 PiPs, and during the night or when you have no control, the currency moves and you slowly start losing PiPs. Not only did you lose 250 PiPs but you actually lose an additional 250 PiPs over circumstances that you could not control.

Leverage Risk

Leverage Risk is a double-edged sword. It can either bless you with wealth or curse you with poverty. Leverage essentially captures the appetite of a trader in full detail.

A trader with leverage or ratio of 1:1 is often considered a very aggressive trader. And ratios above that are considered semi-aggressive.

Imagine this, your account has a leverage value or ratio of 1:1. This means for every PiP that you will or lose, it is equal to your actual money. It is literally 1 is to 1, it’s not a percentage, it’s the complete package.

If you open a trade on EUR/USD at 1.0000 and you close at 1.0500, then you win $500 but if your trade closes at 0.9500, you just lose $500 – again, the leverage is your appetite. Are you comfortable at gambling $500? Are you willing to push your luck? Can you live without the $500? What if it’s $100,000?

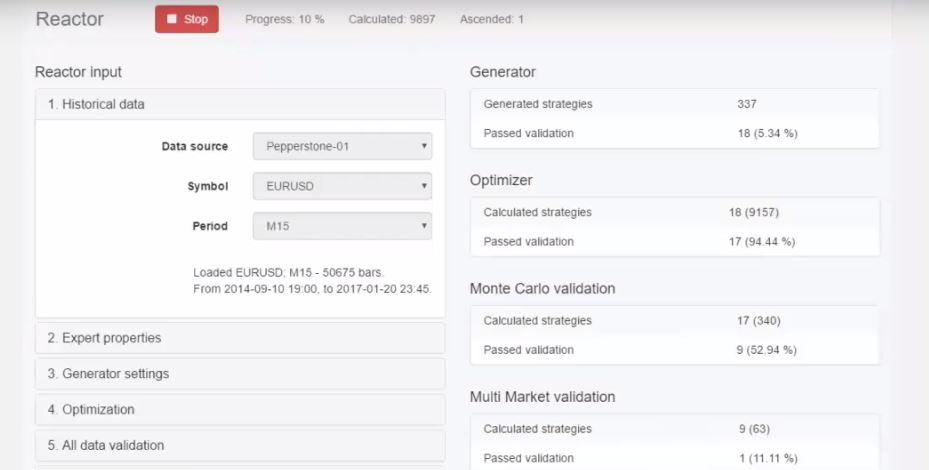

What are Forex Robots (Expert Advisors)

A Forex Robot is a software that acts as an Expert Advisor. Its purpose is to remove the detrimental emotions involved in trading Forex. Think of Forex Robots as more of a user profile of an expert trader or more of a simulation, a copy of that expert trader.

For example, you like Jordan the Expert Trader because Jordan knows and understands signals and has been using those signals for years. The Forex Robot will simulate Jordan’s actions.

Now understand, it will never 100% legitimately mimic Jordan’s intuition but a Forex Robt can copy Jordan’s trading prowess and decide making skills (signals).

Your trades will be automated, and yes, you can adjust certain parameters. You can even make your very own Forex Robot, based on multiple trader profiles and appetites.

A good and safe place to start and practice using Forex Robots is with a demo account. This way you get to see how the Forex Robot acts and behaves during different times and economic announcements.

And as you gain more and more experience, you can start developing your very own Forex Robot, full of all the signals, indicators that you are comfortable with.

There are hundreds if not thousands of experienced traders that use Forex Robots to reduce the stress they experience and the emotions that hinder their success in Forex trading – all to enable them to monitor their trades more relaxed or more passive.

Education Sources

When it comes to educational sources for Forex for beginners, there are multiple books available for you to study. There are countless hundreds if not thousands of YouTube videos available for free, there are Ebooks and of course, there are educational websites for learning Forex for beginners.

You can learn more about currency trading online through a webinar. When using a webinar, you will receive high-level personal training through the webinar’s one-on-one training format. If you cannot access a personal Forex professional, attending a webinar is your next great option.

Webinars offer different types of training, each geared towards your trading needs. They may also have a library containing past training sessions and recordings that you can access and listen to, to learn more about Forex trading in your free time.

But here’s the biggest drawback to all of those, they’re mostly outdated and not as detailed when compared to a fully-pledged program, where the instructor actually guides you, step by step, on the principles of success behind Forex trading.

Now, when it comes to actual websites that traders use to analyze their trades, here are the websites that you can take a look at:

- https://www.forexfactory.com/

- https://www.fxstreet.com/

- https://www.bloomberg.com/

- https://www.forexlive.com/

- https://www.dailyfx.com/

But learning Forex on a professional level will require some investment. And you can not really depend on the websites that provide free staff. Usually, they offer something on the side.

Forex Training Courses for Beginners

We have given you a manual of the basics of Forex for beginners. However, before starting trading in the currency market, it is crucial you take lessons to understand fully the ins and outs of Forex trading.

Our trading courses aim to bring beginners to a professional level. And you will find different ready trading strategies and ready Expert Advisors in each course.

Conclusion

With everything that you have read about Forex for beginners, we are sure by now that you have a fuller understanding of what the Forex global market is and how rewarding it can be. And if not handled well, can quite literally destroy your life. Education is an absolute must when it comes to trading Forex.

At Forex Academy, we have taken the time, to educate you and provide fellow students, all that you need to know to start trading Forex safely, as well as the many mistakes, signals, warnings, and signs to avoid. And tips on how to leverage your trade position, when to open a trade, when to close, make money, and many more.

As you join and enroll with Forex Academy, we will not only teach you the basics of trading Forex. We will show you how to start trading with a demo account. That way we can safely guide you and educate you, as we give you the experience that you will need when you start trading Forex for real.

We all have to start somewhere when beginning a new venture. Do not let Forex trading scare you. Enroll now and join the thousands of satisfied students who are living the dream lifestyle you want!

How to trade Forex for beginners?

To trade Forex, you need a trading platform. You can gain access to a trading platform either using a Forex brokerage like MetaTrader, or you can do it yourself by joining other trading platforms. Then, you simply open a position, and now, you are trading Forex.

What is Leverage in Forex?

Leverage is the process used to gain exposure to currency in large amounts without you paying the upfront the full value of the trade. What you do instead is put down a minimal deposit, known as margin. The full size of the trade will determine your profit or loss when you close a leveraged position.

What is Spread in Forex?

The difference between quoted prices for buying and selling a Forex pair is a spread. You are presented with two prices when you open a Forex position. You trade at the buy price when you opt to open a long position. The buying price is usually slightly higher than the market price when trading at the buying price. You trade at the selling price when you opt to trade at the sell price. The sale price is usually slightly lower than the market price.