Forex EA Generator

EA Generator is the dream of all algo traders and MQL developers.

Dear traders, before I start with the software Expert Advisor Studio, I will make it very clear what is the Forex EA Generator for the beginners.

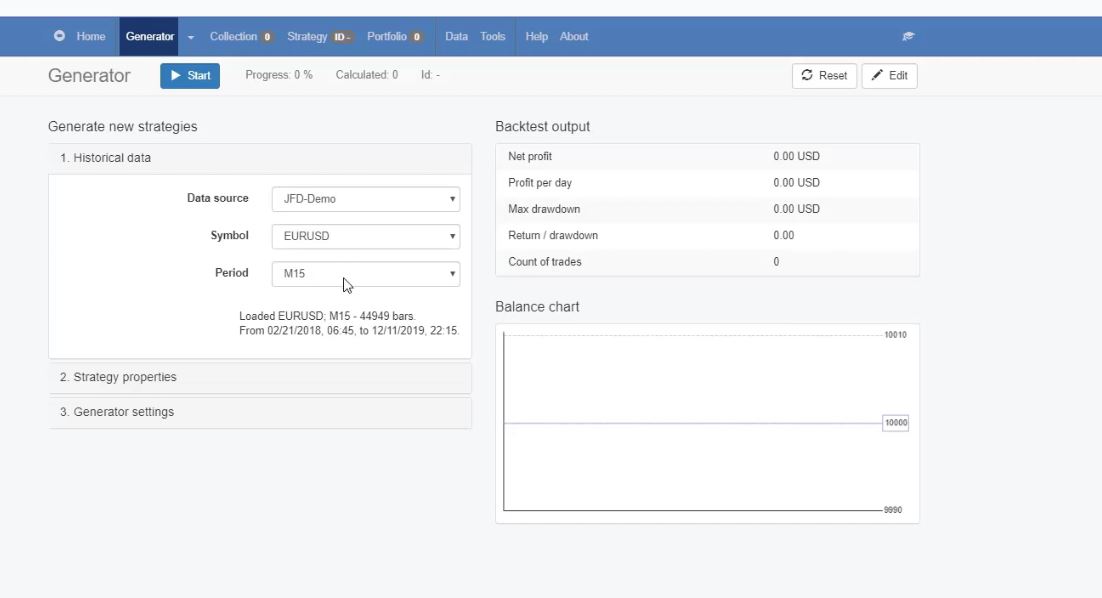

This is a program that creates new strategies for Expert Advisors from scratch. It uses Historical data from the broker you are using and generates the rules for entry, exit, Stop Loss, and Take Profit. Let’s have a look in-depth at EA Studio.

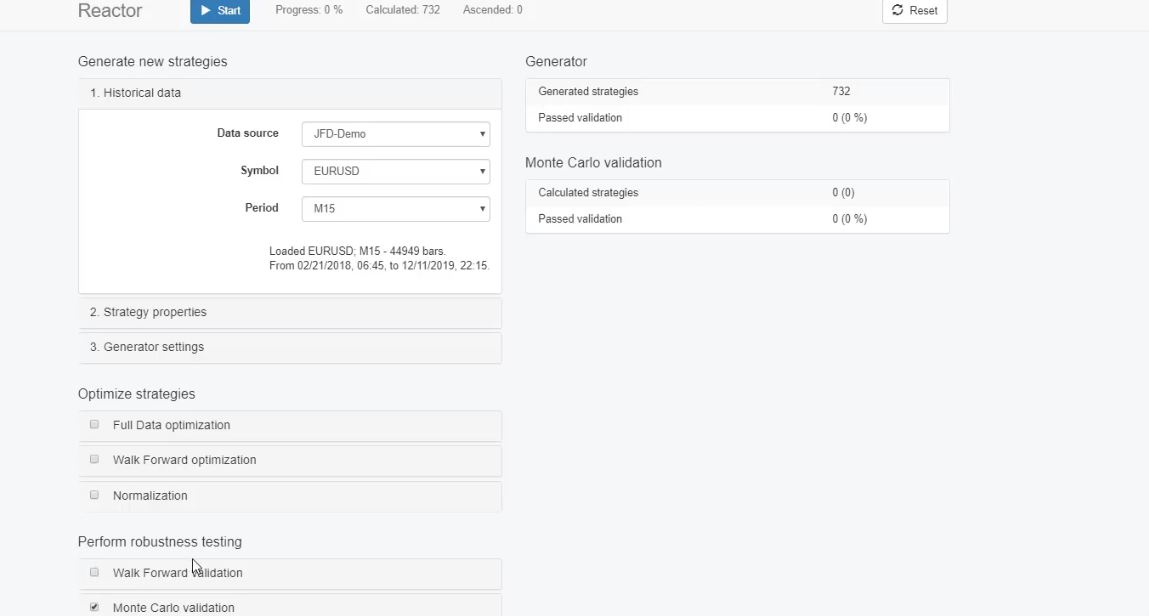

I have imported the data from the broker I have selected to use for this course. And now, I will create strategies for EURUSD on M15 chart,

and also after that, I will create for H1 chart. So I will leave it to EURUSD.

With the Forex EA Generator from EA Studio, you have different symbols that I have exported from JFD.

And if you just want to use MetaTrader-Demo, the data that comes by default, you have some symbols that you can use. So I will stick to EURUSD on M15.

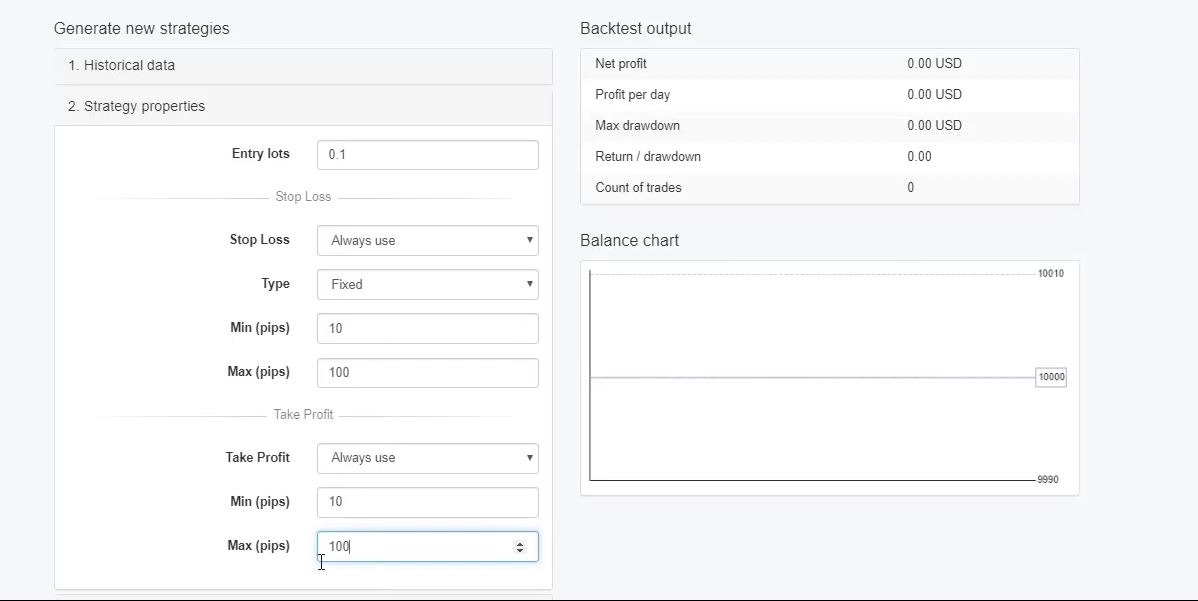

And then for strategy properties, I can set the range I want to have for the Stop Loss and the Take Profit. And, as well, I can set the Entry lots. I will leave it to 0.1. And I prefer always to have a Stop Loss.

If you select May use, it means that some of the strategies that will be generated will have Stop Loss, some of the strategies will be without a Stop Loss. But I stick to Always use Stop Loss.

And as a range, I will leave it from 10 to 100. As a Type, we can use Fixed Stop Loss, or we can use Trailing. We have the option to select Fixed or Trailing, which means, again, the software will decide which type of Stop Loss to place. I will leave it to Fixed.

EA Generator settings

Take Profit; we have Always use, May use, Do not use, again the same logic. You choose if you want to have it or if you will leave it to the software. I will stick to Always use and again range from 10 to 100.

So this means that all of the strategies that I will have in the collection will have Stop Loss and Take Profit within the range between 10 and 100 pips.

As EA Generator settings, I can select how much time I want the Generator to be working. Usually, I leave it for about 10 hours. I leave it overnight.

And then I have a couple of more options that I will not get into in-depth details, but Search best means how I want to organize the strategies, I want to see on the top the ones that have the best Profit so I will leave it to Net balance.

In Sample and Out of Sample is something very interesting that I will be using. If I leave it to In Sample, this means that the Generator will use all the historical data I have imported.

If I use Out of Sample, for example, 20%, this means that the Forex EA Generator will use 80% of the historical data, and it will test the strategies for the last 20%.

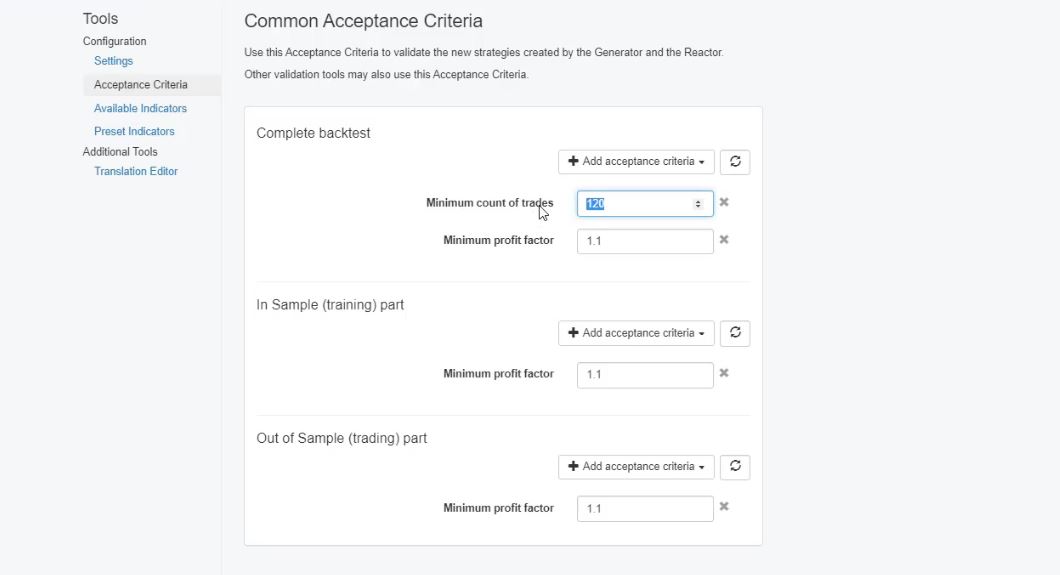

The Acceptance criteria

So let’s say we have ten months of historical data, and I leave it to 20% Out of Sample, this will mean that the Generator will use the first eight months of the historical data, and the last 2 months, it will simulate trading for the strategy. So it is something like we would place this strategy 2 months ago.

But now this is 20% out of the whole historical data and in the next lectures, we will see how much time exactly that is. Below, we have the option to choose if we want to use preset indicators, which I usually don’t.

And then, we have to Use the standard Acceptance Criteria, which is something fundamental. From here, we set the minimum criteria for the strategies.

For example, with Forex trading, I always stay above 300 Count of trades, and I will even increase it now to 500. So the idea here is that we want to depend on strategies that executed many times during the backtest.

We don’t want to rely on a strategy that was executed just a couple of times like 10, 20, 50 times for this period that we have from the beginning of 2018.

Profit factor in the Forex EA Geneartor

We want to have many trades that were executed for this strategy so we will have a stable statistic. If we have a nice Balance chart, it will be more reliable if this strategy was executed more times.

So basically, this way, we will be sure that all the entry rules and exit rules are in the right combination, that this strategy had many trades, and at the same time, it remained profitable.

I will go back to the Acceptance Criteria, Profit Factor. I always use the Profit Factor above 1.2.

And for the beginner traders, the Profit Factor is the gross Profit divided by the total loss or the profits divided by the losses.

Now, below we have In Sample part and Out of Sample part. And this was an update from EA Studio, which changed the Out of Sample tool.

Before that, I was not using it a lot, but now I’m using it because these 2 are separated. So I can select the Minimum Profit Factor of 1.1 for the In Sample part, and 1.1 for the Out of Sample part. And what does this mean?

EA Studio’s speed is unique

This means that the EA Generator will select strategies that had for the complete backtest Minimum Profit factor above 1.2. Still, at the same time, these strategies will have a Profit factor above 1.1 in the In Sample and the Out of Sample part.

Or in other words, in the green zone, the 20% where we are simulating trading, we will see just the profitable strategies, where the profits are more than the losses.

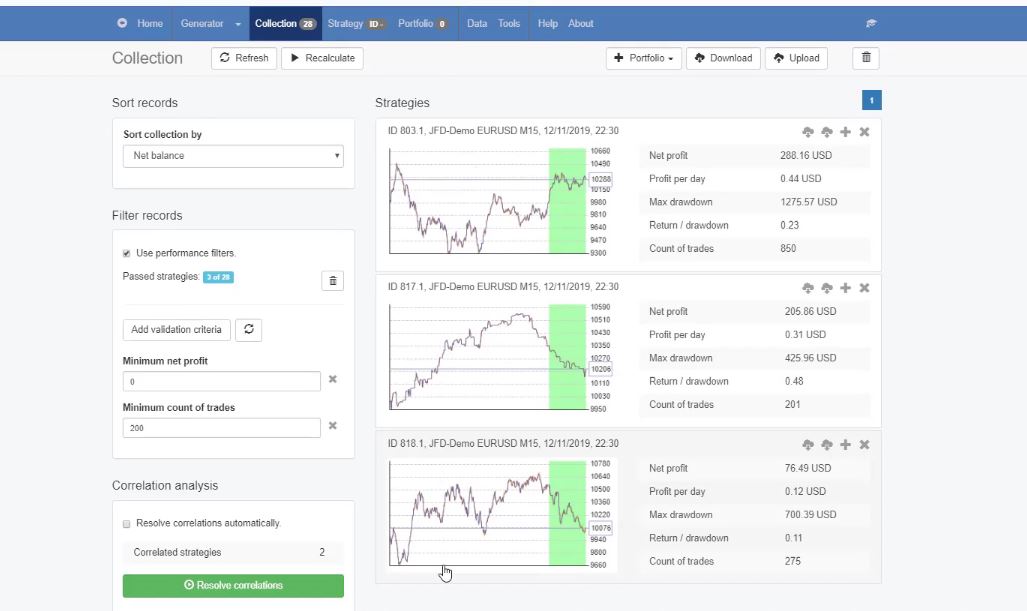

I will just remove the Acceptance Criteria, I will press on Start, and the speed of Expert Advisor Studio is impressive. It calculates strategies extremely fast. Now, let me stop it, and you see that already in the collection, I have 28 strategies.

So what you see is that in the In Sample part, which is the white zone, these strategies are going up and down, as well in the Out of Sample part, going up and down, but let’s focus on the 2nd strategy.

It makes Profit in the In Sample part, this is where the Generator was working, and in the Out of Sample part, it was losing.

When it was backtesting this strategy for the last 20%, it shows losses. Now, I don’t want to see these strategies in my collection. I don’t need them. I don’t want to lose time with them.

The Validator

And by placing Profit factor above 1.1 in the Acceptance Criteria for the Out of Sample zone, I will eliminate the strategies that are losing in the last 20%. I hope it’s clear.

I will remove it now, I will go back to the Generator, and I will click on Use the Acceptance Criteria, which, one more time, has the Profit Factor and the Minimum count of trades.

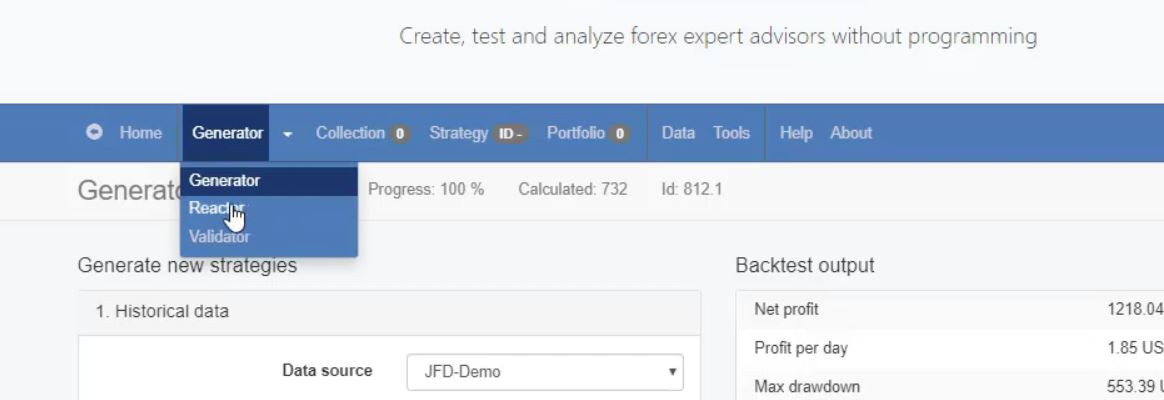

Now, next to the EA Generator, you can see there is a small arrow. Below, you can see the Reactor and then the Validator.

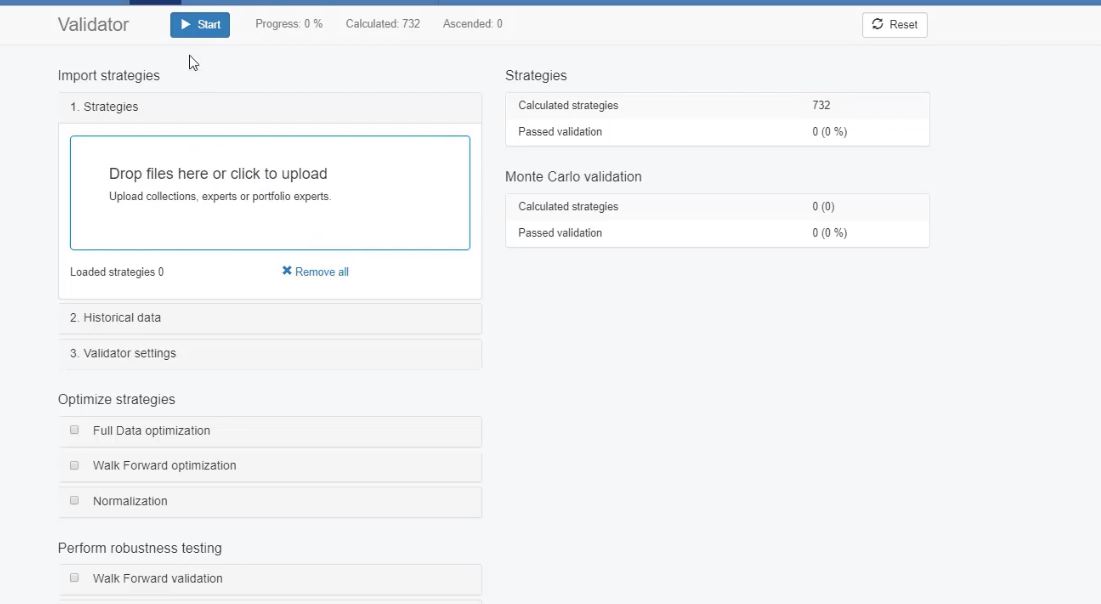

The Validator is used to recalculate all strategies that were once created with the EA Generator.

You can import them, and you can recalculate it with the new historical data, something very useful, but I will now use the Reactor. So the Reactor is a generator, what I was showing so far, plus some optimization tools and robustness tools.

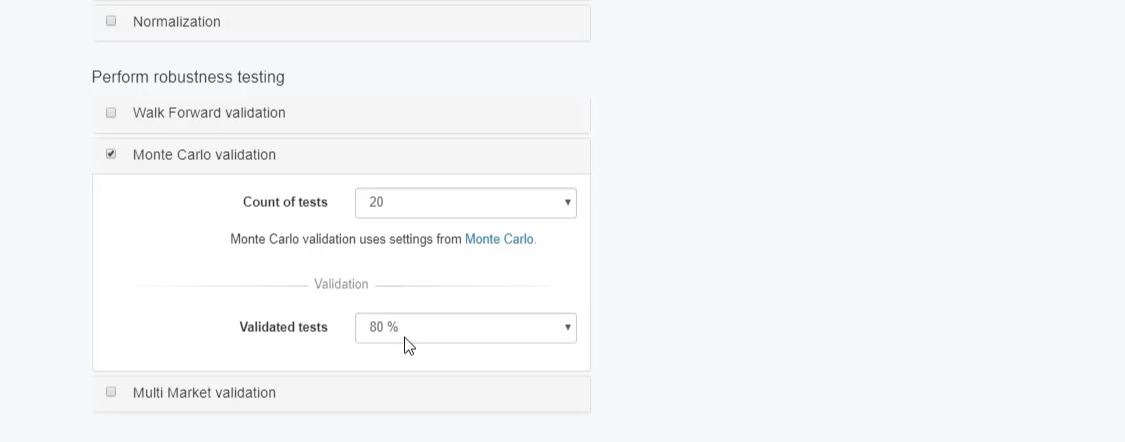

One more time, I’m not getting into details about all of that. I just want to show you how I’m using it. But in this Top 10 EURUSD course, I will only use the Monte Carlo validation, which is very useful. So the Monte Carlo performs different tests for the strategy. In simple words, it tries to break the strategy before we use it.

Monte Carlo

And I will dedicate one lecture to Monte Carlo because it’s an essential tool for checking the robustness of the Expert Advisors. So for the moment, I will just select it, I will stick to the default 20 Count of trades and 80% validation tests.

In very simple words, it executes different tests for the strategies with different parameters, different backtest starting bar, and things I will explain in the next lectures.

But now, I will just include it. And before I click on Start, I will just select to use the common Acceptance criteria which I have prepared.

I have the Monte Carlo, so I click on Start. And now what happens is the Generator starts working. It works so quickly. It was unbelievable for me when I first tested it.

So it’s generating strategies, but in the collection, I will see only the strategies that are within my strategy properties that pass the Generator settings, the Out of Sample, and the Acceptance Criteria.

And the strategies that pass the Acceptance Criteria, which have 500 counts of trades, 1.2 Profit Factor and 1.1 for the In Sample, and for the Out of Sample, they will go to Monte Carlo.

Feel free to try whichever timeframe with the Forex EA Generator

If Monte Carlo allows them to pass, they will come to the collection, and this is where I will see them. I already have above 3,000, almost 4,000 strategies generated and calculated, but none of them passed the Acceptance criteria and the Monte Carlo.

Now, I will leave this EA Generator working for 10 hours, but while it’s working, what I will do, I will start a Reactor for one more timeframe, which is H1.

I will go again to the Expert Advisor Studio, and I will prepare the very same settings that I did for the other Generator. So I have some old collections, I will remove them.

I will log into my account, and I go to Reactor straight away. So what I have, JFD, H1, I will just make the very same settings. Now, why do I use M15 and H1?

Naturally, it’s not like these are my favorite timeframes, but with time I tested so many strategies, hundreds, thousands because I’ve been doing this for so much time.

I have tested so many strategies over the years. What I’ve noticed is that with M15 and H1, I get the best results. That’s personally me. If you want to test it with different timeframes, you are very welcome to give it a try. You will still find some decent profitable strategies.

Don’t hesitate to ask questions in our Trading Forum.

But for me, I figured out that using M15 and H1 works the best. So I will now prepare the H1 Reactor, and I have the Monte Carlo. I will make it to 20 Count of trades, and 80% validated tests, and I will click on Start. Now, the two will be running simultaneously.

This is very nice of Expert Advisor Studio because you can use it on different computers, you can use it on different browsers, and at the same time, you can generate strategies for different assets and timeframes.

So I will leave them both and already in the first one I have one strategy. Let’s have a look. You can see what an equity line.

Profitable in the 80%, in the In Sample, and productive in the last 20%, Out of Sample. I click on it. It’s a simple strategy. This is what we are looking for. One entry rule, Stochastic, one exit rule, Bollinger Bands, and it had 665 count of trades, which is excellent.

Now, I will leave the two reactors working, and I will continue with the results that I have.

Thank you for reading, and always reach out to me with questions if you have about the Forex EA Generator.