Forex buy and sell explained

In this lecture, we will explain what is the difference between buying and selling in Forex, when to buy, and when to sell.

At Trading Academy, we share everything we know about the Forex market, the crypto & the stocks. And we want to make simply useful content for all beginners. And you should know how the market works, even before you risk a single dollar. So take your time to watch some of our YouTube videos, online courses, and anything that is useful, which will protect you from losing money.

I want to explain what exactly Forex means, when to buy it and when to sell it, and how actually you’re selling the Forex market. And then I will make a second lecture from my trading screen.

The Forex market

And I will give you a few strategies, not just one which you can use for the Forex and you will know when to buy and when to sell it. So first of all, the Forex market is the biggest one out there.

These are all the transactions that happen from banks to institutions, hedge funds, managers on huge corporations who exchange one currency for another, a British company working in the United States taking its profits at the end of the month and transferring or exchanging pounds or dollars to pounds or vice versa.

This moves the market. That’s the Forex market, everything that involves currencies. And by the time I’m recording this lecture, the Forex market has over $5 billion daily transactions. That’s a lot, guys, it’s a huge market. That’s why we as small traders or small players need to be very careful, we need to understand how it works, anyway, we can be just wiped up.

Courses on Forex market

We can blow our accounts easily and that’s not something you want to experience. I can tell you from my personal experience as a beginner, I didn’t spend enough time learning, I didn’t spend a lot of time understanding how it works. I was very passionate, I knew that I will conquer it.

It didn’t happen this way, it took me a lot of time to learn. And back in those days, it was a little bit harder than now, there were no YouTube videos and there were no free courses or paid courses online, I had to travel to London to learn to trade. It took me a lot of time and money but I never regret I did that.

What I do now, I create a lot of videos and online courses to be useful for everyone who starts. So how to buy and sell the Forex market is something which turns out not to be very difficult if you understand how it works. So let’s take EURUSD as a currency pair because that’s the most traded currency pair.

The spread

It has the lowest spread which makes it suitable for beginner traders. The spread is the difference between the Bid and the Ask price. Just like on the exchange bureau when you go for a vacation or you go to the bank to exchange your currency for a currency that you need.

And there are always 2 rates. The Bid and the Ask or the buy and the sell. One is more expensive than the other one. There is a difference between the two and this is because they have to profit. The bank, the exchange bureau, they’re not doing exchanges just for you to feel comfortable on your excursion.

They do it for profits, that’s why a very small difference is there with the EURUSD. So if you buy EURUSD, what you’re buying actually is the EUR and you are selling the USD. And if you sell EURUSD, you are selling the EUR and you are buying the USD.

Start with a Demo account

So you predict or expect that the USD will rise. That’s why you are selling EURUSD for the purpose to buy it at a cheaper price or closing the position at a cheaper price and your profit out of that. So how does that all work?

First, you need a broker, which is a company that will allow you to trade, open an account with it. And then you need to fund an account. Now, keep in mind that most of the brokers have Demo trading accounts. This means you will be able to trade with virtual money and you won’t be risking anything while you’re learning.

And that’s the best thing out there. Start with a Demo account. When you decide that you want to trade with real money, you fund your account, let’s say with $1,000 or $10,000. And your money is with the broker. Now, you will be using this money to buy EURUSD but at the same time, you can sell EURUSD before buying it previously.

Short trade

That’s something that most beginners don’t understand. So selling the market is when you expect the asset to fall and you open a short trade. This is how it’s called, when you’re selling, it’s called short trade. So understanding how Forex works and when to buy and when to sell it, is according to the strategy that you will be using.

But at any moment, you can buy the market, you can sell the market. And when you are selling it, simply, this is called CFD trading. I don’t want to go into details but CFD trading means Contract for Difference. So I’m not actually purchasing the asset or I’m not actually selling the asset.

When I say I’m selling EURUSD or when I’m selling EUR buying USD, it doesn’t mean that in my trading account with the broker, the broker will exchange my initial EUR, for example, for USD, and in my account, I will have USD, no. You have the amount, your currency. The one that you funded the account with, and you’re just using that amount of money to buy and sell.

CFD trading

And every time you buy and sell, this is called CFD trading, Contract for Difference. So every time you’re doing a contract with the broker that if you sell and the price drops and I close the position there, the broker will pay me this difference as a profit.

At the same time, if I buy and the price drops and I close the trade, I will lose this difference. That’s why it’s called Contract for Difference and this is how the trading works. I’m not exchanging actual EUR for USD, you are participating in the Forex market but you are not interrupting the price.

Doesn’t matter if you are selling it or buying it, this will not affect the EURUSD rate. No matter how much your trading rate, simply because you’re not exchanging real EUR for real USD. This is how the brokers offer Bitcoins, this is how they offer stocks, this is how they offer indexes, futures, it’s all CFDs

Good money management

I know there are some brokers now starting to offer real shares, real Cryptos. But maybe by the time you’re reading this lecture in a few years time, they will be offering real assets. But even if it’s not real, that’s how the trading works for decades now. So the thing is when Forex buy and when to sell it comes to the question to use a strict strategy.

So you will know exactly at which moment it is suitable to buy EURUSD and it is suitable to sell EURUSD. That’s very basic guys, this is the first thing you need to understand before you start trading. Anyway, you will just blow your account easily because you won’t understand Forex money management, something important.

You need to have good money management in your account, you need to have a strict strategy that you will follow, and you need to have patience. Forex trading is not for the people who want to become rich in 2 days, probably you’re more of a casino guy or you want to. You have a bigger chance at the lottery. Not on the Forex market.

Don’t trust anyone else

So trading is a difficult thing but it could be easy if you go the right way. The right way to go is to watch as many videos as you can. Diversify the promotional videos and the educational videos. Because the promotional videos always aim to bring you to a website where they will ask you to open an account for you, to trade for you on your behalf. Don’t ever do that, guys.

The only person you should trust is yourself when it comes to Forex trading. You should be taking the decision when to buy and when to sell and don’t depend on anyone else to manage your funds. Because these are all scammers and one sad day you will realize that you’ve lost everything.

So never give your money to other people to trade with. Whatever they say, whatever they promise, whatever certificates they show you. It’s all scammed, Stay away from that. And from there, when you gain enough knowledge and you want to test it out, go for a Demo account.

Practice patience

Practice as much as you want, you can always restart it. And later in this lecture, I’ll be showing you a few strategies that you can use and you will see that it’s not really hard if you do it the right way. But don’t fall into the emotions to just start trading and get some money quickly.

That is not what you want to do. Because that’s not the reality. But don’t try to make quick money from Forex trading. That’s not the idea. If you want to make some quick cash and get out, it’s not for you. That’s not the Forex market, it’s not the reality. You need patience, time, and you need to be very careful where you put your money.

When to buy and sell in Forex

Now, I’m going to demonstrate a super simple strategy, when to buy and when to sell the Forex market.

I will show you how actually it works when we do Forex, when to buy and when to sell it. And you will see that it is not hard just funding the money and trading with them. But it is hard to be consistent and that’s why you need a strategy.

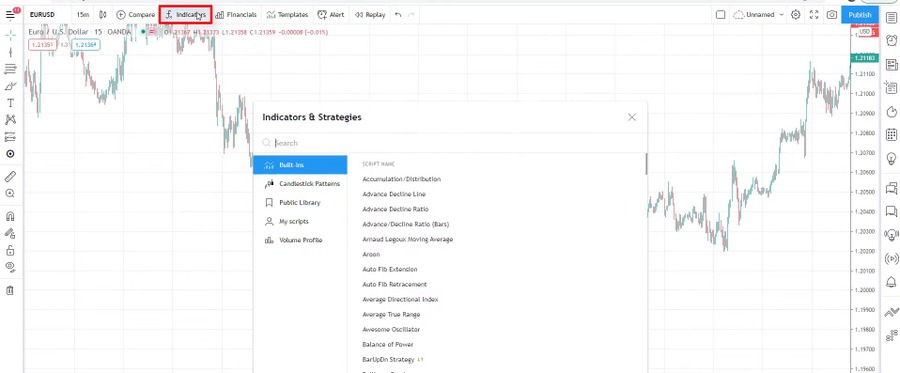

So for the people that do not know me, my name is Petko Aleksandrov from Trading Academy. I share a lot of trading strategies on YouTube and today I will demonstrate a super simple system that you can use for the EURUSD. So right now I am on tradingview.com which is kind of an independent platform that I’ve been using for technical analysis and price action.

And it works really nice because we have many drawing tools on the side and we have indicators, templates, and a lot of options with that platform. So no matter which broker you have selected to use, you can still use tradingview.com to make your analysis and execute the trade on external platform.

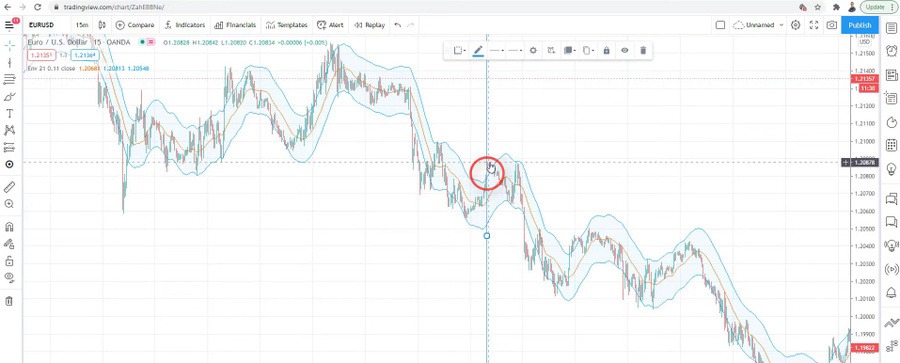

M15 timeframe

And of course, there is an option that I never did to connect the platform straight with your broker so you can execute the trades. And if you have hard times finding a broker, I will put in the description below a link with the trusted brokers that we use in the Trading Academy. Now for that simple strategy, I will use just one indicator and you will see that

it works really easy.

And this strategy is on the M15 timeframe. Now many of the students and the followers ask me why I prefer the M15 timeframe, this is because, especially with the Forex market and the currency pairs, it is very hard to recognize the trend. Because, when you look at the big picture, you can notice the price is going up. And then the price goes down.

Now it is going up again, it forms higher highs and higher lows, which is the definition of uptrend.

And in this period it forms lower lows and lower highs, which is the definition of the downtrend.

We have higher highs and higher lows. So are we in an uptrend now or we are still in the major downtrend?

Envelope indicator

And I’m a huge fan of the Dow Theory of higher highs and higher lows for the uptrend and lower highs and lower lows for the downtrend, but not on the Forex market. I use it for the Cryptos and I use it as well for Stocks and indexes. So when it comes to EURUSD and the Forex market, I definitely prefer the M15 timeframe.

Very simple strategies do not require you to follow the huge trend, which as I’ve said already it is very hard to recognize. So for the very beginners, when we start trading, we need to have a strict system to follow. A strict strategy that will ignore the emotions.

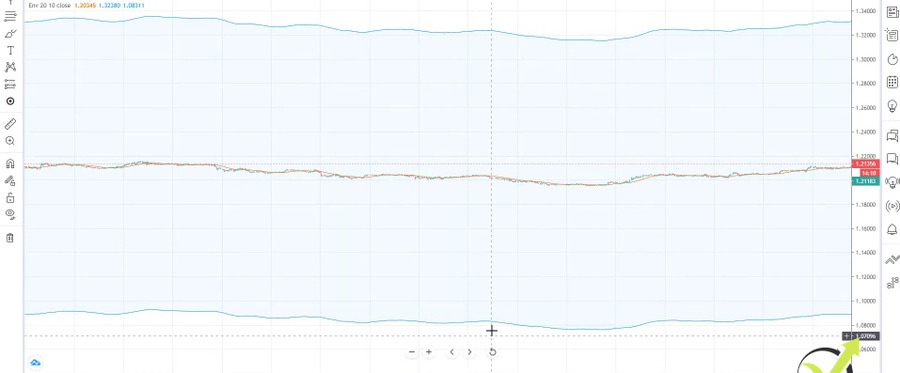

So it really doesn’t matter what you feel at that moment, do you feel that EURUSD goes up? Do you feel that at that moment it goes down? You don’t know what will happen in the future. So the purpose of this video is to show you a simple Forex, when to buy and when to sell a strategy. So the first thing I will do is, I will add an indicator called envelope.

Default parameters

And I have the option to search it, which will find it faster, I will click on it and it’s over the chart. Now the default envelope parameters are huge. If I scroll out, you can see how far the envelopes are.

So these are parallel lines that go around the price, and we have one in the middle.

Now, obviously, I’m not going to use these default parameters because remember something, the default parameters were created from the brokers because they want you to lose money. So I never use the default parameters. Instead, I will be using length of 21 and deviation or percent of 0.11.

And if I click on OK, there’s a difference. The envelopes are very tight to the price, they follow the price nice and smoothly and it gives us great entry points.

But one more time, this strategy works only for EURUSD and for M15. And in the end of the video, I will show you how I have backtested this strategy.

The downtrend

This means that I will show you some entries over the chart but I will show you that these are realistic entries. And this strategy has a fantastic backtest. So after I have the envelopes, all I will do now, I will use the drawing tools to show you some examples.

Now I will pick anything randomly over the chart, for example, I will put the line anywhere on the chart and I will explain to you how that works. The idea of this strategy is that we are buying or we are selling whenever we have a retracement. For example, already we have a kind of down movement.

EURUSD goes down which means that the USD is stronger compared to the EUR for some reason. And, for example, right over here, we see that the price went outside the envelope.

That’s something interesting that I want you to notice. We already have a downtrend. The price goes down and when we are in a downtrend, usually the price gets outside of the envelope on the downside below.

Candle stick

It barely gets outside above the upper band. This is exactly our entry. I am selling it, or I’m shorting it, or I am opening a sell trade whenever we have a Candle stick opening above the upper bend after opening below it. So right over here, I will just zoom in a little bit more, you will see that we have this Candle stick opening below the upper band.

And after that we have it opening above the upper band, which means that this is the moment I want to sell. I will make it red, so it will be more visual. And this is our entry, I will take one circle to point out exactly where I’m selling. And at that moment it could be strange if you see the price just going up and you sell but that’s the strategy, guys.

This is what I’ve noticed with the years that work the best. This is how I’ve done awesome profits with Bitcoin in 2020 and 2021. Because I was buying the dips or I was buying every time when the price drops. The entry price is 120.80. The good thing with TradingView, you can just copy the line and paste it, which will bring you another one.

Stop Loss and Take Profit

And this one, I will be using for a Stop Loss level. Now the Stop Loss for that strategy is 70 pips higher. My entry is 120.80 plus 70 pips, 121.50. A little bit higher and it is, 121.50. I’m not going to put it exactly right now, I just want to show you the strategy. And I will just copy-paste one more, ctrl+C plus ctrl+V on my keyboard, and that one I will make it green because it will be our Take Profit of 90 pips.

So we have an entry of 120.80 and then I will have a Take Profit of 90 pips lower, which will make it 119.90, right, 119.90. And here we go.

So the Stop Loss is a little bit smaller than the Take Profit but you should not go for the common 2 to 1 or 3 to 1 risk to reward Stop Loss and Take Profit.

If you guys put your Stop Loss very close to the entry point, for example, if I have a Take Profit of 90 pips and I have a Stop Loss of 30 pips, the smaller the Stop Loss is, the higher the risk that the price will hit it. The smaller your Stop Loss is, the more often you will hit the Stop Loss. And that’s something you don’t want to do.

Forex when to buy and when to sell system

Now let’s see what happens after that, price went lower, a little bit sideways, retraced. So here is another entry.

The price went outside of the envelope above the upper band. And on the opening, you can have another entry or that’s another sell trade. After that, the price goes sideways, and boom! We have 90 pips into our account. So let’s now delete that and see what we will have.

We have the opposite signal. At that moment I should be buying. Because I have the very opposite thing. The Take Profit was hit and I’m waiting for the next entry, which comes a little bit later when I have the price going below the lower band.

So that strategy as a Forex when to buy and when to sell system and it will give you a buy sell, sell buy or a few consecutive buys.

But in this case, I had a selling opportunity and I’m having now a buying opportunity. So my entry is at 119.69. I have a buy which means that my Stop Loss will be below the entry price 70 pips lower would be 118.99.

Expert Advisor Studio

And my Take Profit would be 70 pips higher which in this case I will make green because it is a Take Profit and I will have 119.69 plus 70, that would be 120.59 approximately.

So at that moment I should be buying and I put a Stop Loss and I put a Take Profit. What happened with the price? It went sideways and it went very close to the Take Profit.

It went really close to the Take Profit but it didn’t close and after that, the Take Profit was hit.

So keep in mind that there will be always the case where the price goes very close to your Take Profit but it doesn’t reach it and then it can fall down and hit your Stop Loss. So I would suggest, if you are in front of the computer, you can always take your profit if it reaches very close to the Take Profit level.

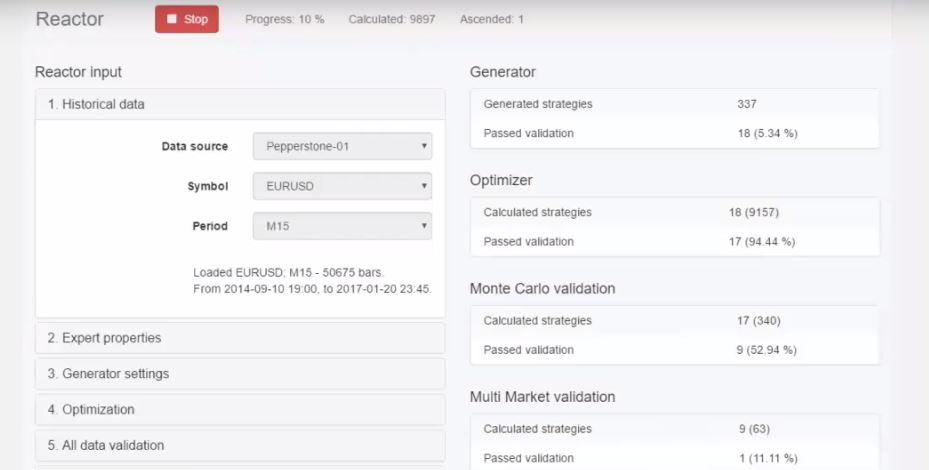

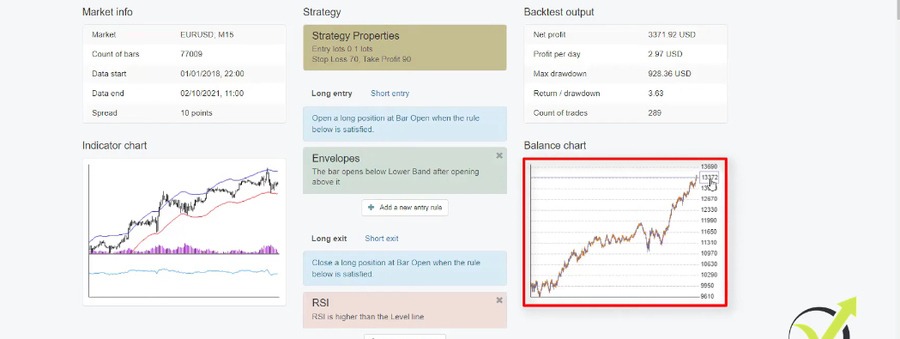

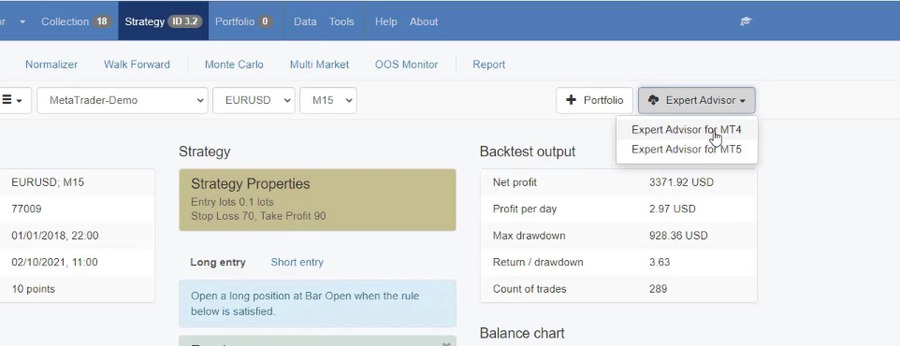

It’s not worth waiting another 3, 4, 5 pips and to lose the trade. So this strategy works really nice and as I’ve said, I will show you how I know the backtest and how I know that actually, the performance of the strategy is good. I’ll just bring the Expert Advisor Studio which is the software I’ve been using for backtesting.

Exit indicator

We have the very same strategy, envelopes as an entry indicator, we have the Stop Loss, the Take Profit, and we have our balance chart. You can see a very smooth balance chart, of course, with a few drawdowns but that’s normal.

We have the indicator chart where I can see precisely all of the entries. I can see exactly where the trades were opened, where they were closed, for what reason?

Was the Stop Loss hit? The Take Profit? And actually, that strategy has an exit indicator as well if you want to use it. It is the RSI, so you can add it on the chart and whenever the RSI is higher than the level line, you can take your profit. But I personally prefer to use just Take Profit of 90 because it works just great.

And if you want to use the RSI for that strategy, we’ve been using period of 41 and level of 95. Again not the default parameters. And the good thing with this backtesting software is that I have a huge report with a lot of information for that strategy. I can see a lot of statistics and a lot of graphs and things that I usually don’t look at a lot. All I care about is a stable balance chart and of course, a strategy that will persist in time.

Your opinions and suggestions

And that strategy has been working great until the moment. I’ve been testing it with an Expert Advisor. So with EA Studio we have the opportunity to export strategies easily and you can do that if you want to trade that strategy with a Robot automatically.

So that’s a super simple Forex strategy that will give you the idea when to buy and when to sell.

And you will feel comfortable using it because it has a good risk reward. Return to drawdown is 363 and we had 289 trades executed with that strategy since the beginning of 2018. It’s a lot of trades that prove that the strategy is actually robust. So let me know how you feel about that strategy. If you tested, drop your opinions and suggestions as well in the comments below.

It would be great to discuss the strategy and if anyone has any idea how we can improve it, I can test it out in EA Studio and actually see if it will give me a better result. Because any time I make a change, for example, if I change the profit to 100, immediately I will see a change in the balance chart. With this Take Profit recently, actually, the strategy starts to lose.

So 90 works really nice for the moment and gives a better equity line.

Thank you very much for reading this lecture, guys. If you want to get more free trading strategies, ideas when to buy and when to sell in the Forex market, subscribe to our YouTube channel. I will see you in the next lecture.