In the world of financial trading, automation has taken center stage, revolutionizing how traders engage with the market. Forex algorithmic trading represents a cutting-edge approach, where sophisticated software executes trades based on pre-defined strategies, offering precision, speed, and efficiency. As the financial markets become increasingly competitive, traders turn to algorithmic systems to manage complexity and capitalize on opportunities that would be nearly impossible to identify manually. By eliminating human emotions, such as fear and greed, these systems provide an objective framework for consistent decision-making.

This guide uncovers the details of Forex algorithmic trading, exploring its mechanics, detailing strategies, and examining the challenges and emerging trends that are shaping the future of this transformative trading method.

Table of Contents:

- What Is Forex Algorithmic Trading

- How Does Forex Algorithmic Trading Work

- Benefits of Forex Algorithmic Trading

- Common Algorithmic Trading Strategies

- Challenges and Risks in Forex Algorithmic Trading

- Emerging Trends in Forex Algorithmic Trading

- How to Start Forex Algorithmic Trading: Practical Guide in 4 Basic Steps

- Top 5 FAQs on Forex Algorithmic Trading

What Is Forex Algorithmic Trading

Overview of Forex Algorithmic Trading

Forex algorithmic trading, often called algo trading, involves using pre-programmed instructions to analyze market conditions and execute trades. These algorithms are designed to process vast amounts of data, identify trading opportunities, and make precise decisions based on parameters such as price, volume, and timing. Unlike manual trading, which can be influenced by emotions like fear or greed, algorithmic systems provide an objective and consistent framework for executing trades efficiently.

The Objective of Forex Algorithmic Trading

At its core, Forex algorithmic trading aims to maximize profit while minimizing risk. For example, an algorithm might execute a buy order when the price of a currency pair crosses above a specific moving average, while simultaneously setting a stop-loss order to protect against unexpected market downturns. Such strategies allow traders to take advantage of rapid market movements that would be difficult to exploit manually.

Continuous Market Analysis

Moreover, these algorithms operate continuously, scanning markets in real-time to identify opportunities. This ensures that traders do not miss out on potential profits, even during non-traditional trading hours. By automating these critical tasks, algorithmic trading has become an essential tool for both individual traders and institutional investors seeking to optimize their trading processes.

How Does Forex Algorithmic Trading Work

The Role of Strategy Development

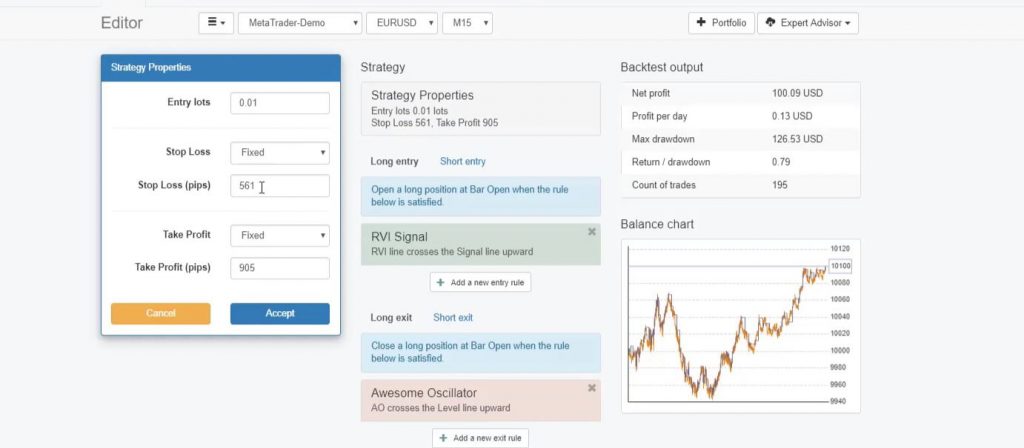

The process begins with defining a trading strategy. This strategy is then coded into an algorithm that can analyze real-time data, evaluate market conditions, and execute trades accordingly. Advanced algorithms often incorporate technical indicators like Moving Averages, Relative Strength Index (RSI), and MACD to filter and validate trading signals.

Tools for Implementing Algorithms

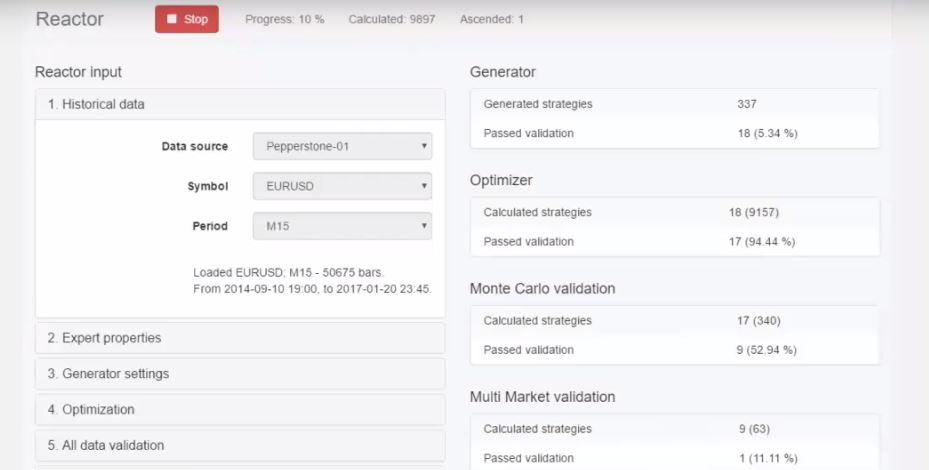

Tools like Forex Strategy Builder Professional (FSB Pro) and Expert Advisor Studio (EA Studio) simplify this process. FSB Pro, for example, allows traders to customize entry and exit rules while supporting multi-timeframe analysis. On the other hand, EA Studio’s web-based interface is beginner-friendly and offers automated strategy generation. These tools make it easier to bridge the gap between strategy design and practical implementation.

Automation in Action

Once deployed, these algorithms operate autonomously, continuously analyzing market conditions and executing trades based on predefined criteria. This automation ensures consistency and efficiency, enabling traders to capitalize on market opportunities with precision. For example, an algorithm might automatically adjust position sizes based on volatility, ensuring optimal risk management.

If you are eager to explore the transformative power of algorithmic trading, why not kickstart your learning with the 21-Day Free Algo Trading Course? This hands-on program equips you with the knowledge to design, test, and implement your own trading strategies. Whether you’re a beginner or an experienced trader looking to refine your skills, this course is tailored for all levels. Enroll for free now and take control of your trading future!

Or take a look at our collection of Forex Algorithmic Trading Courses that will teach you how to create Expert Advisors by yourself to find the one that suites you best. No programming skills or trading experience is required. Additionally, you will be able to download ready-to-use EAs from most of our algorithmic trading courses from the Academy.

Benefits of Forex Algorithmic Trading

Speed and Efficiency

Algorithms can analyze vast datasets and execute trades in milliseconds, outperforming human reaction times. This speed is particularly advantageous in high-frequency trading scenarios, where fractions of a second can make a significant difference.

Emotion-Free Trading

By adhering strictly to predefined rules, algorithms eliminate emotional decision-making. Fear and greed, which often lead to poor trading decisions, are completely removed from the equation.

Backtesting Capabilities

Traders can test strategies on historical data to evaluate performance and refine parameters. Backtesting allows traders to identify weaknesses in their strategies and optimize them before deploying them in live markets.

Scalability

Automated systems can manage multiple trading accounts and strategies simultaneously. This scalability enables traders to diversify their portfolios and reduce reliance on a single strategy or market condition.

Practical Example

For instance, a trader using MACD-based strategies might test different timeframes and parameter combinations to optimize results, a task that would be arduous and error-prone manually. By leveraging automation, they can streamline the process and achieve more consistent outcomes.

Common Algorithmic Trading Strategies

Trend-Following Strategies

These strategies aim to capitalize on sustained price movements. Algorithms identify trends using indicators like Moving Averages or Bollinger Bands and execute trades in the trend’s direction. For example, a trend-following algorithm might enter a long position when a currency pair’s price breaks above a key resistance level.

Arbitrage Opportunities

Arbitrage strategies exploit price discrepancies across markets or instruments. For instance, an algorithm might buy a currency pair on one exchange and sell it on another where the price is slightly higher, generating risk-free profits. These opportunities are typically short-lived, requiring high-speed execution.

High-Frequency Trading (HFT)

HFT involves executing thousands of trades within seconds to capitalize on minor price changes. This strategy requires advanced infrastructure and low-latency systems to ensure rapid order execution.

News-Based Strategies

Algorithms monitor news feeds and execute trades based on economic announcements or geopolitical events, often responding faster than manual traders. For instance, an algorithm might initiate a sell order following a negative GDP report.

Range Trading

Range trading, or mean reversion, involves identifying price ranges and executing buy orders at support levels and sell orders at resistance levels. These strategies are particularly effective in markets with low volatility.

Challenges and Risks in Forex Algorithmic Trading

Over-Reliance on Technology

System failures or connectivity issues can disrupt trading, potentially leading to losses. For example, a sudden internet outage might prevent an algorithm from executing critical stop-loss orders.

Over-Optimization

Excessive tweaking of parameters during backtesting can result in strategies that perform well on historical data but fail in live markets. This phenomenon, known as overfitting, is a common pitfall for novice traders.

Market Volatility

Sudden market movements can lead to unexpected losses, especially if stop-loss mechanisms are not robust. Algorithms must be designed to adapt to changing market conditions to mitigate this risk.

Risk Management

To address these challenges, traders should implement comprehensive risk management strategies. This includes setting realistic stop-loss levels, diversifying strategies, and regularly monitoring algorithm performance.

Emerging Trends in Forex Algorithmic Trading

Artificial Intelligence and Machine Learning

AI-driven algorithms are becoming increasingly popular for their ability to learn and adapt to changing market conditions. These systems analyze patterns in historical and real-time data to improve decision-making and enhance strategy performance.

Cryptocurrency Integration

The rise of cryptocurrencies has opened new avenues for algorithmic trading. Tools like FSB Pro now support crypto trading strategies, enabling traders to diversify their portfolios and tap into the growing digital asset market.

Social and Collaborative Trading

Platforms are incorporating social features, allowing traders to share strategies and collaborate on algorithm development. This trend fosters a sense of community and accelerates the learning curve for novice traders.

How to Start Forex Algorithmic Trading: Practical Guide in 4 Basic Steps

Step 1: Define Your Goals

Determine your trading objectives, risk tolerance, and preferred trading style (e.g., scalping, swing trading). Clear goals will guide your strategy development and tool selection.

Step 2: Choose the Right Tools

Select a platform that aligns with your skill level. Beginners may prefer EA Studio for its simplicity, while advanced traders can leverage FSB Pro’s customization options.

Step 3: Develop and Test Strategies

Use backtesting to evaluate your strategy’s performance on historical data. Adjust parameters to optimize results without overfitting. Robust testing ensures your strategy’s reliability in live markets.

Step 4: Deploy and Monitor

Implement your algorithm on a demo account before transitioning to live trading. Continuously monitor performance and update strategies as needed. Regular evaluations help identify and rectify any issues promptly.

We also recommend checking this video about How to Create Forex Trading Robot for FREE without any programming skills required.

Top 5 FAQs on Forex Algorithmic Trading

1. “Should we avoid trading with the Expert Advisors from the Forex Algorithmic trading strategies course at the end of the month, at the end of the year, or any other time?”

We recommend to avoid trading during ending the year. The last two weeks of December and the first week of January. During this time there are huge transactions that happen on the market and they impact the Forex market.

These are huge transactions between corporations, companies, and banks. Huge companies taking their profits, exchanging into their currency. We are talking about millions and billions here so any of these transactions, they impact the market.

And it’s an expected move that comes which normally will cause you some losses. It could profit with the Expert Advisors but, we would say, there’s some uncertainty during this time. Also, many traders avoid trading during the last day of the month, so every last day of the month but we wouldn’t advocate for this. We would advise on keep it trading during last day of the month apart from December of course.

So it’s up to you. With some Expert Advisors, we have concluded it is better to pause during the news, with some we see it’s great to trade all the time. But at fully algorithmic trading we aim at trading all the time, no pausing.

2. “Can I trade in one $1000 account, 10 Experts Advisors with 0.01 lot?”

We always suggest the students and the traders open live accounts after they have tested the same amount on a Demo account.

So first, open the Demo account. If you are planning a $1000, open a Demo account with $1000. Test it with 0.01 for some time, see how much margin will be left in your account. Because it depends a lot on the leverage you are using.

But in this case, no matter the leverage you’re using with 0.01 it should be fine to trade the 10 Experts Advisors (from the Top 10 GBPUSD Expert Advisors Forex Algorithmic Trading course)with $1000 of an account. But always what you’re planning for the live account, do the very same thing on the Demo, see how it’s going and you will decide for yourself. Is it enough, is it too risky, should you increase the lot or reduce it.

3. ” For how much time should I trade the Expert Advisors from the Forex Algorithmic trading strategies course?”

Now there is no precise answer to this question. We never know how much time the Expert Advisors will last on the market.

Because it depends actually from the market. And this is why we update the Expert Advisors from time to time, like every 2 months or every 3 months. Simply at the end of the month, we check if the Experts Advisors are doing good during this month, if it was needed to make some change with any of the Expert Advisors, so they will be working better according to the recent 1 month and I simply add the historical data from the last month.

And we improve the Expert Advisor. So we never know how much time one Expert Advisor will last. So we never know how much time one Expert Advisor will fit the market conditions. Sometimes it could be even for 6 months, but it doesn’t happen all the time.

4. “Do you update the Forex Algorithmic trading course with new parameters for the Expert Advisors or with new Expert Advisors?”

Particularly these top 10 GBPUSD in the Forex Algorithmic trading strategies course, we update with new parameters of the Expert Advisors. At the end of the month we check if it is needed or it’s not needed, and we do an update. But we don’t create new Expert Advisors in this course every month.

Because these Expert Advisors are already trading quite a long time. We are just updating them, they work fine. We really don’t get any negative feedback for the Expert Advisors so far which is great.

Because it’s not only us testing them, there are already hundreds and thousands of students testing them, which actually gives us a better idea of the Expert Advisors and so far we don’t see a reason to change them. Of course if one day we see such a reason, we will do our best to create new and even better Expert Advisors if possible.

5. “What is the good money management with the Expert Advisors for these Forex algorithmic trading strategies?”

Generally, we avoid suggesting trading capital, starting amount and the money management. Overall, we advise that you should not risk more than 2 to 5% from your account. And when we say 2 to 5%, this means that if you are trading these 10 Expert Advisors and you have, for example, some 200 or let’s say 300 pips as a Stop Loss. So you should look at the Stop Loss of all Expert Advisors, calculate it, sum it and see what is the maximum.

In the worst-case scenario, you have the 10 Expert Advisors hitting the Stop Loss at the same time, or let’s say the same day, you should know how much is that risk at one moment.

And this risk should be no more than 2 to 3% or maximum to 5%. So the sum of all Stop Losses in your trading account and this is not only with this course, but with any course, with any strategy with any system. You should always know what is the maximum Stop Loss that might happen to you.

And especially if you are trading with a couple of Expert Advisors, you need to summarize it. And you will need to calculate with how much you should be trading in order to avoid losses bigger than 2 to 5 % from your account.

Conclusion

Forex algorithmic trading offers unparalleled opportunities for traders to automate and optimize their strategies. By leveraging advanced tools and techniques, traders can achieve greater consistency, scalability, and efficiency. Whether you are a novice or an experienced trader, understanding the fundamentals and staying updated on emerging trends will ensure you remain competitive in this fast-evolving field.