Forex account management

Hello, everyone. In this lecture, I will talk about the Forex account management, which is essentially important while you are trading.

It’s a very common question and I receive it daily from the students and the traders – how much they should start with and how much should be the risk in their account. Now, I don’t want to suggest anybody with starting amounts.

This is a personal choice. It depends on how much you can afford and it depends on how much you want to risk. What I like to say is that you should never be risking more than 10% of your saved money. So let’s say you have $10,000 saved money. You should not open a live account with more than $1.000. That would be a smart Forex Account Management.

And I have covered that in my newest course, The Cryptocurrency Investment, where I teach the same. That when you are investing, again, no more than 10%. And if you are trading at the same time, another 10%. So totally you will be risking 20%.

My suggestion is to diversify the risk on many trades – the best solution for Forex Account Management

Don’t ever put in a real account all your savings, things might go wrong. You might lose it all. So you should stay really safe with no more than 10% of the account. And now when I say 10% of your savings, it doesn’t really mean that you will be risking all of that.

This is how much you should open an account with. So, again, if you have $10,000 saved and you open a live account with $1,000, this is just fine. And from this $1,000 account, you should not risk more than 2-5% for manual trading. Which means 20-50 dollars per day for trading.

Not just a single trade, but I’d also suggest you diversify the risk on many trades. So if you’re trading manually and you have a $1,000 live account and you’re risking 5% maximum, this is $50. And if you have 5 different trades, for each one, the maximum risk should be $10. This means total risk is $50 if all 5 trades go wrong, which usually doesn’t happen.

This is the idea of diversification and this is a good Forex account management. When I cover that in my courses, I teach that you should use different strategies in your trading. So if you have 5 trades, they should be based on 5 different strategies. The chance that all of them go wrong is smaller.

Trading with Expert Advisors is not a bad idea

So, one more time, if you have $10,000, you should open a live account with $1,000, 10% of your savings. And from there, if you’re risking 5% per day, this is the very good Forex account management you can keep. This is $50. Diversify that on 5 different trades based on 5 different strategies and you will have a very small risk of $10 per trade or per strategy.

And here is a video which will show you some realistic trading with many Expert Advisors (Trading Robots).

It is very important because the market is different every day, which means that one strategy will be profitable at one moment and tomorrow it might be losing. But when you have 5 different strategies and you are trading at the same time or you’re trading them simultaneously, well, they will compensate each other.

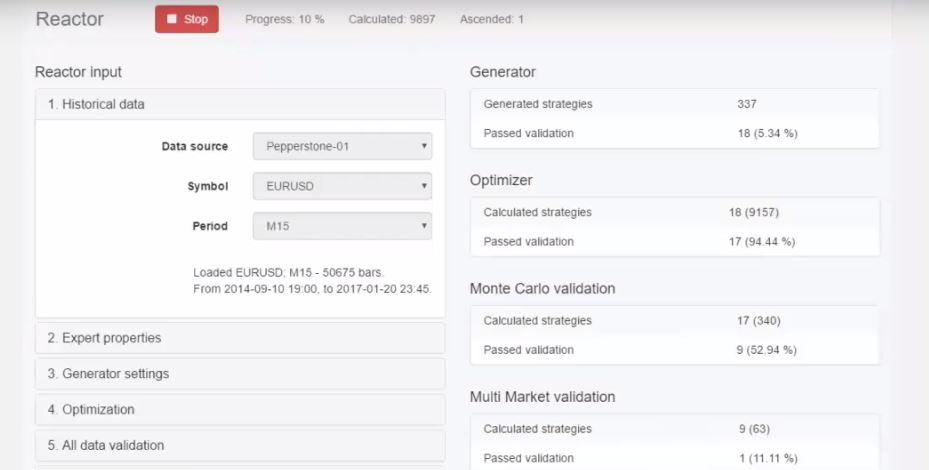

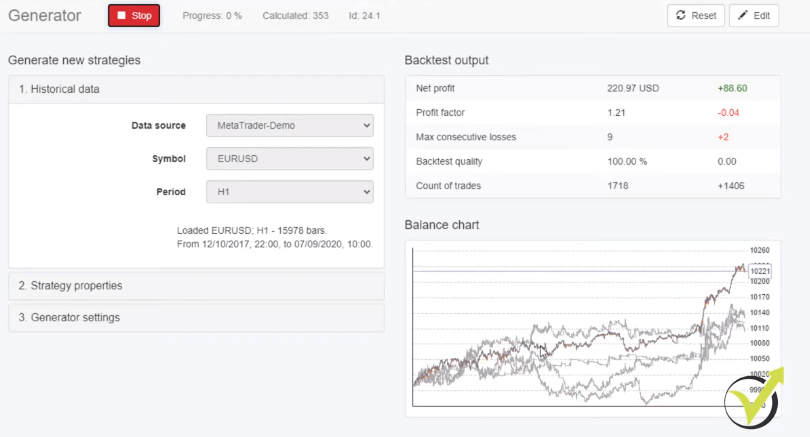

And this is for manual trading. Now, when it comes to algorithmic trading things are different. With EA Studio, especially what I show in my courses, we have a better risk diversification because we can trade with hundreds of Expert Advisors.

If I stick to the same example of $10,000 saved money, you open a live account with $1,000. How much should you be risking with the Expert Advisors? Again, no more than 5%. And it’s up to you if you want to trade 5, 10, or 100 strategies.

The portfolio Expert Advisors gives you the best Forex account management

With EA Studio we have the chance to create so many Expert Advisors that you could be trading 100 strategies in a portfolio Expert Advisor.

For example, if you go with 0.01 lot, you can do that. In a $1,000 account, I would suggest you have no more than 10 Expert Advisors with 0.1 lot.

Or you might have 100 Expert Advisors with 0.01 lot. That would work fine as well. And quite often I receive the question for the Expert Advisors like how many in one account, for how many currencies. I would suggest you stick to no more than 3 currency pairs and that way it will be less difficult for you to manage it.

And if you use the portfolio Expert Advisor it will be easier.

This is why in The Ultimate Forex Trading Package I include 99 Expert Advisors which should be loaded on different charts. But in the portfolio courses, the EURUSD, the 100 EURUSD, the 100 GBPUSD, and the Walk Forward optimization, there I include portfolio Expert Advisors which means that you can add all of them to a single chart and they trade.

I show in the courses how to follow the results.

But what I wanted to say is stick to the same account management. And something very important I would like to say again is when you block $10 from your account, this is the margin, it doesn’t mean you’re risking $10.

Check for the Stop Loss range

The risk is always the Stop Loss. That’s a common mistake by the beginner traders. Usually, what they do is they say, “I will risk today $20.” And they follow the strategy and they don’t calculate the lots, this is what I saw. The proper way is first to see what is the range of the Stop Loss.

For example, in automated trading, I usually use 10 pips to 100 pips. It’s never more than 100 pips so I know where is the risk. But the proper way to do the Forex account management before trading is to calculate how much you will be risking if the price hits your Stop Loss.

When the price hits the Stop Loss, you’re losing. This is the risk. It’s not how much you are blocking from the account. The right way is to calculate the Stop Loss, what is the distance, how much you can afford to trade with, what will be the lot, so you will fit in your account money management. Not the other way around.

Usually people first decide how much they will be risking, and they open the trade, and the Stop Loss turns out to be more than what they expect to lose. So first, calculate the Stop Loss distance, see how much you can trade with, what will be the lot, and fit it in your Forex account management.

Feel free to ask questions

If you have questions, of course, about the Forex account management, the risks, don’t hesitate to drop them in the comments below. I will do my best to answer as soon as possible.

Cheers, guys.