Traders who use an ETH trading bot are watching to see what will happen when the Ethereum merge takes place. It’s now September and a lot of traders have huge expectations about what the merge will mean for their Ethereum investments.

When the merge happens, Ethereum investors could see huge price movements. The market is really positive about the merge. So, Ethereum is recovering faster than Bitcoin.

What is the Ethereum Merge?

The Ethereum merge will involve a change of networks. Ethereum will move from a Proof of Work (PoW) system to a Proof of Stake (PoS) system.

When Ethereum moves, all of its transactions will speed up. Ethereum will also have less of an environmental impact on a Proof of Stake network.

Proof of Stake might result in a reduction of the number of ETH that are issued per block. Proof of stake will also decrease gas fees.

All of these factors could increase the demand for ETH. An increase in demand can drive Ethereum prices up. However, if the Fed increases rates, that could cause the price of Ethereum to drop.

The Ethereum merge is a huge software upgrade. Big software upgrades are susceptible to bugs. Price changes will depend to a large extent on whether the merge is successful.

My Current ETH Trading Strategy

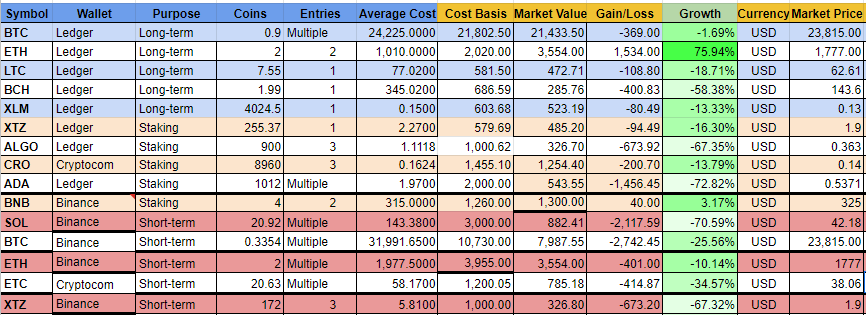

If you check out my trading page, you can see everything that I’m doing. Right now, I’m buying Ethereum in order to hold it.

I’m completely transparent with all of my trades. On my page, you can see which cryptos I bought and which cryptos I sold to take profits in this bear market.

I’ve sold several cryptos in order to take a profit. Still, I’m holding some cryptos. So my current portfolio has a loss of 25% over the past few months.

This is very good when compared to the performance of Bitcoin. Bitcoin has dropped 74% over the same time.

If the merge is successful, the price of the Ethereum that I’m buying now will go up. However, we know that if the merge fails the price will drop.

ETH Trading With Robots

I like to trade with professional strategy builders from EA Studio and FSB Pro. I save time with robots because they help me to analyze the details quickly.

I’ll show you how I use them in this article. You can use my strategy with any broker that offers CFD Trading with MetaTrader.

So, you can use my ETH trading strategy with Binance. You can also use it with Crypto.com and Kraken. As long as you’re trading with candlesticks, you can give my robot trading strategy a try.

I Monitor My ETH Trading Robots

When you’re using robots for ETH trading or other crypto , sometimes you’ll have to manually close your trades. For example, recently I used a Bitcoin robot to trade a $5,000 trading account and I doubled it with just two trades.

The first one hit take profit at $20,538. However, I closed the second trade manually.

I also switched off the Auto Trading feature. I did that because when I checked the daily chart there was a possibility that Bitcoin could form a double bottom and reverse upward.

That would wipe out my profit. I wasn’t taking that chance, so I closed the trade.

How does My ETH Trading Strategy Work?

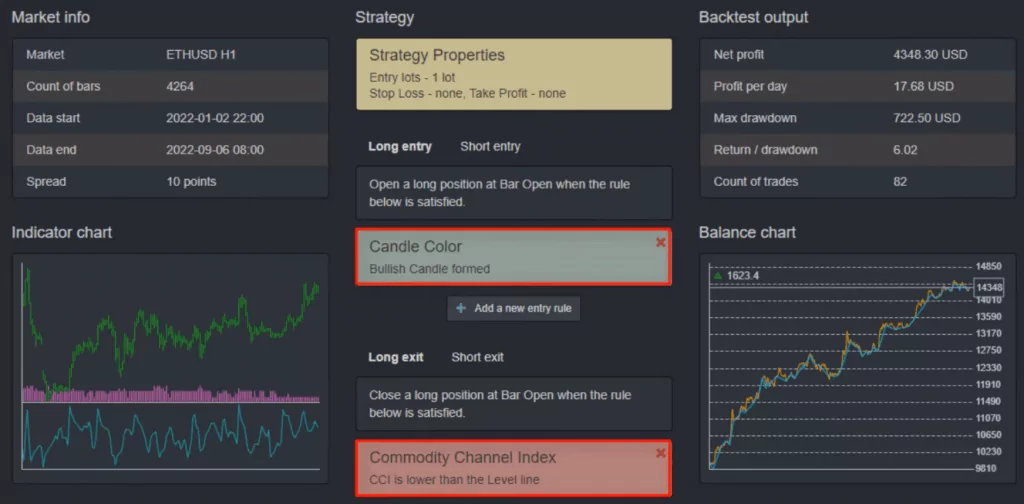

My ETH trading strategy uses one entry indicator and one exit indicator. I watch the color of the candlesticks.

With my ETH bot, I buy ETH whenever I have two consecutive bullish candlesticks. So, on the opening of the third candlestick we’ll buy.

With ETH trading, we sell when we have two bearish candlesticks. So, on the opening of the third bearish candlestick, we’ll sell.

We also check Commodity Channel Index (CCI) levels. So, if the CCI is lower than the level line of negative 190, the robot will close the long trade.

The opposite applies to short trades in ETH trading. So the robot will check for the CCI going above the positive 190 level.

With this strategy and every strategy, you’ll always have profits and losses. What you need to do is look at the big picture.

So with this strategy, I’ve done over 80 trades since the beginning of 2022. I’ve made an average profit of $17.68 per day.

Be Cautious With Margin Trading

I can use my robots to trade on margin at popular brokers. Margin trading has a lot of benefits. If you’re going to use margin trading, always practice good money management.

If I used the same robots for ETH trading but I increased the lots 10 more times I would make 10 times the profit. However, I would put more of my capital at risk.

Similarly, if I decrease the lots by 10 times I would make less profit. I am not going to take any risks with my account. If you are a beginner trader, it’s a good idea to stick to one lot.

You can export your expert advisors to MetaTrader 4 and MetaTrader 5. After you export them you can change the lot size as you wish.

Which Robot Is Right for You?

You might be wondering which robot is right for you. Even if you are a beginner, you can use robots to trade. Robots can help beginners and advanced traders.

If you’re interested in a particular ETH trading robot, try it on a demo account for the platform that you like first. You could try different robots to find the one that fits your trading personality.

Final Thoughts

ETH trading with robots can work for both beginners and advanced traders. It can help you to save time. Robots can help you to take advantage of opportunities in the market as long as you use them wisely and you’re careful with your margins.

Thanks for reading this article. If you have any questions about robot trading with Ethereum please leave them in the comments below.

I love you guys. I look forward to seeing you soon.