Dollar cost averaging – a precise investing strategy for buying an asset at the right time time

Dollar cost averaging is a popular strategy for investing where you buy assets divided into different amounts. This way you reduce the risk of volatility and you have a final average price.

Most of the cryptocurrency exchanges offer the deal where you can set recurring purchases for any asset. This way if you buy every week a piece of Bitcoin at the end of the year you will have an average price or this is called Dollar cost averaging.

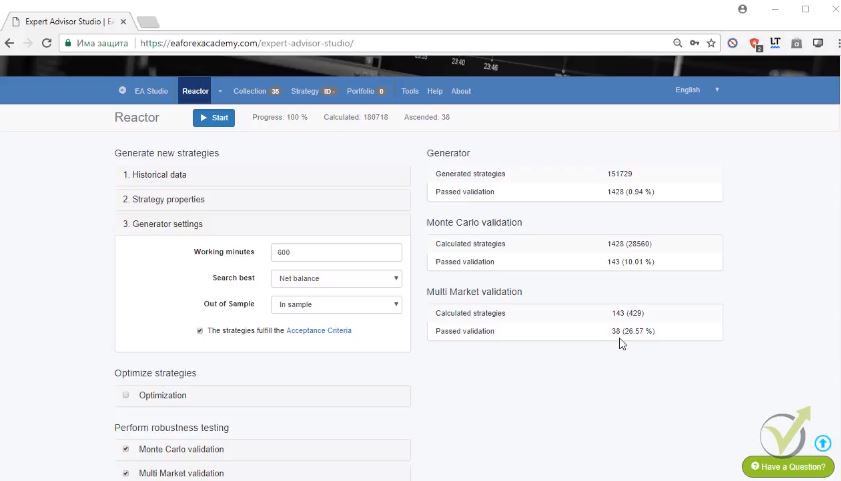

I will show you a strategy that we use at the Academy to buy cryptocurrencies following Bitcoin. You should use a strategy to buy at the right moment, and not using time intervals.

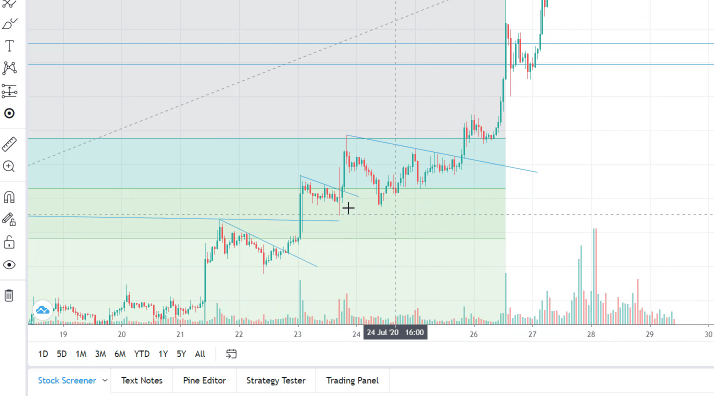

In the picture below we have another great opportunity to buy cryptocurrencies, flag. The counter trend line is our entry moment.

After the last counter trend line, the price reached the Take Profit. I sold some of the cryptos in the previous lectures. And then the Bitcoin continues higher. It reached nearly 11,500 and that’s a huge level for the Bitcoin having in mind that it failed to take the 10,000 many times.

But now it is about 10,000. We’ll see what happens. I’m just strict with the system and I’m taking any new opportunities that are there on the market. The target is very close at 12,169, so it’s just about $1,100 higher. I think it’s very achievable at that moment when Bitcoin is very bullish.

So now I have the counter trend line again, I have the failure, I have an aggressive break, and the price actually just returned to where my entry was. This is a great moment to buy another piece of crypto and to add to my dollar cost averaging strategy.

I saw it just a couple of minutes ago while recording this lecture. Now I will be buying some more cryptocurrencies.

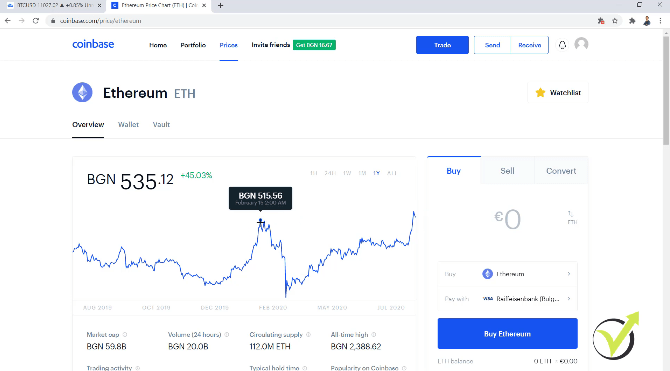

Ethereum performed well

I will go to Prices on Coinbase and I will have a quick look over the cryptocurrencies that I’m having at the moment. The Tezos, not really moving a lot, same with the Stellar and the Chainlink. Ethereum did a great move together with Bitcoin. I have some Ethereum in my Wallet from another strategy that I follow.

But below you can see that it’s above the yearly highs. And simply, it did a new high.

I think there is a lot of potential in Ethereum. However, I’ll be happy to buy it at a cheaper price because I think now it’s a little high. If you look at the yearly chart, it’s great that it covered these highs that we had in February.

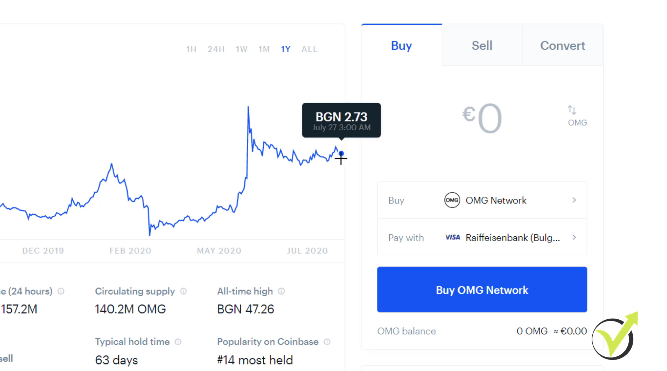

But I will look for opportunities to buy more Ethereum at a lower price. Just cheaper. Now, I will buy some more OmiseGo this time because I want to average the price. Last time I bought it at a more expensive cost.

This way I am not aiming just at dollar cost averaging in this strategy but I want to buy the next piece at a lower price.

We have an uptrend

It is important to buy an asset if the trend is upwards. But just look at the chart, it had a drawdown, now it’s going up again. And if I go to the yearly chart, you will see something very interesting. Here are the highs. And this was the moment when I noticed the OmiseGo thus I bought it.

But I bought it quite expensively. Not on the top. And now we have a small uptrend on the one year chart. We have higher highs and higher lows and now it is on the next low. So I think it might be a good opportunity to buy the OmiseGo.

The next time when Bitcoin reaches the target, I will have bigger chances to have the OmiseGo on profit and not on loss. So I’ll see what happens. If it drops lower, I will look to buy some more so I will have a better average price. But now let’s buy another €500.

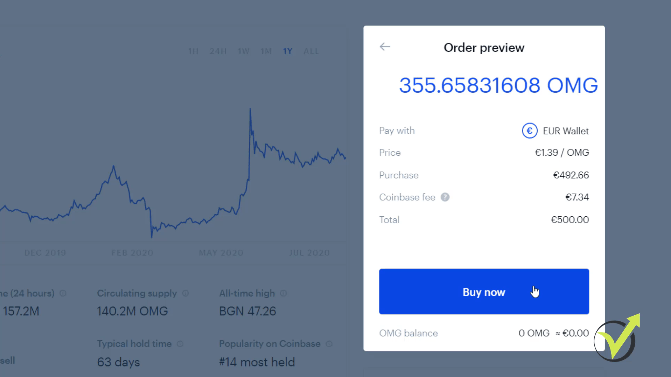

Now, I will not be using my Visa card, but I will be using my EUR Wallet which will make the transaction cheaper for me. I click on Preview Buy and here it is below.

The price in EUR is 1.39 at the moment. You see my Coinbase fee is just €7.34 and I click on Buy now.

Confirm your tax laws before you start trading or investing

So let’s go back to Bitcoin and I will keep you updated with what’s going on next. We’ll see how it goes. Is it going to reach the Take Profit of the Fibonacci at 12,160 and something? Actually, if I go back at the beginning, I will see exactly what the price is. It is 12,168.

This is the next target I am looking at. So I use dollar cost averaging strategy for my entries but at one moment I want to sell it all and take the profits. And we will see at that moment what I will have in my portfolio. And something I missed to cover in the previous lectures, and I guess now would be a good time to do it because I really didn’t want to make a separate lecture about it, are the taxes.

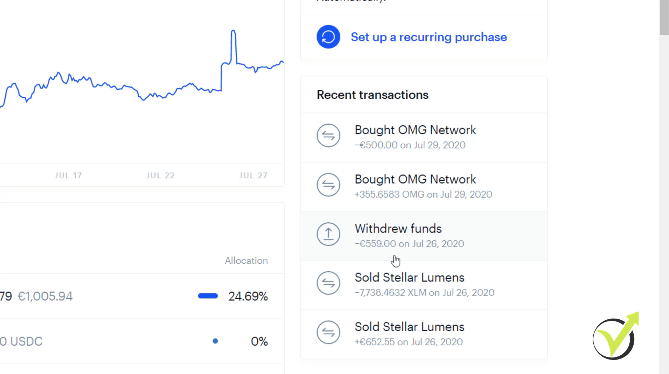

Make sure to check how the taxes work when you are trading cryptocurrencies in your country. For example, in Bulgaria where I live, we have to pay tax on the profit that we do. As you saw last time, I did a withdrawal of €559.

Since this is a profit, I need to pay tax on that, which in Bulgaria is 10%. But if I buy more cryptocurrency until the end of the year with more value, I will not need to pay this tax. Just at the end of the year, if I have a profit and I didn’t buy more cryptocurrency with this profit, I will not pay the tax.

Stay tuned for more examples with this dollar cost averaging strategy

But if I have just a profit in the account and there are no opportunities to buy anything, I will have to pay the tax. This is how it’s working in Bulgaria. Make sure you check that in your country.

Thanks for reading the lecture. I will continue recording some more examples with the cryptocurrencies so you will learn the strategy and the system better so you will not be missing any opportunities on the market. All the examples you can find in the Cryptocurrency investment course as videos.

See you in another blog post