Crypto Trading course for ETH: 10 FAQ

Crypto trading course for ETH is one of our best courses for price action trading with the direction of the trend

Welcome to the 10 most frequently asked questions for the Crypto trading course: Learn to TAKE the Profit. These are questions that I receive daily and I decided to make such articles for all of my trading courses.

So I will give more details about each topic and, of course, if you have more questions you are always welcome to drop them in the Forum.

I will answer you very quickly. There are other traders who will share their experience with you so don’t hesitate to ask questions. It’s very important in trading if you have any questions, to have the answer for them.

1. “This strategy in the Crypto trading course is suitable for other assets?”

Absolutely. This strategy could be used for any other cryptocurrencies, stocks, indexes, currency pairs, whatever trading assets you are interested in. The strategy is based on the trend and every asset has its trend at the moment.

This is why you can implement this strategy to any trading asset, just the same way that I have shown in the course.

2. “Do we define the trend on all time frames in the same way?”

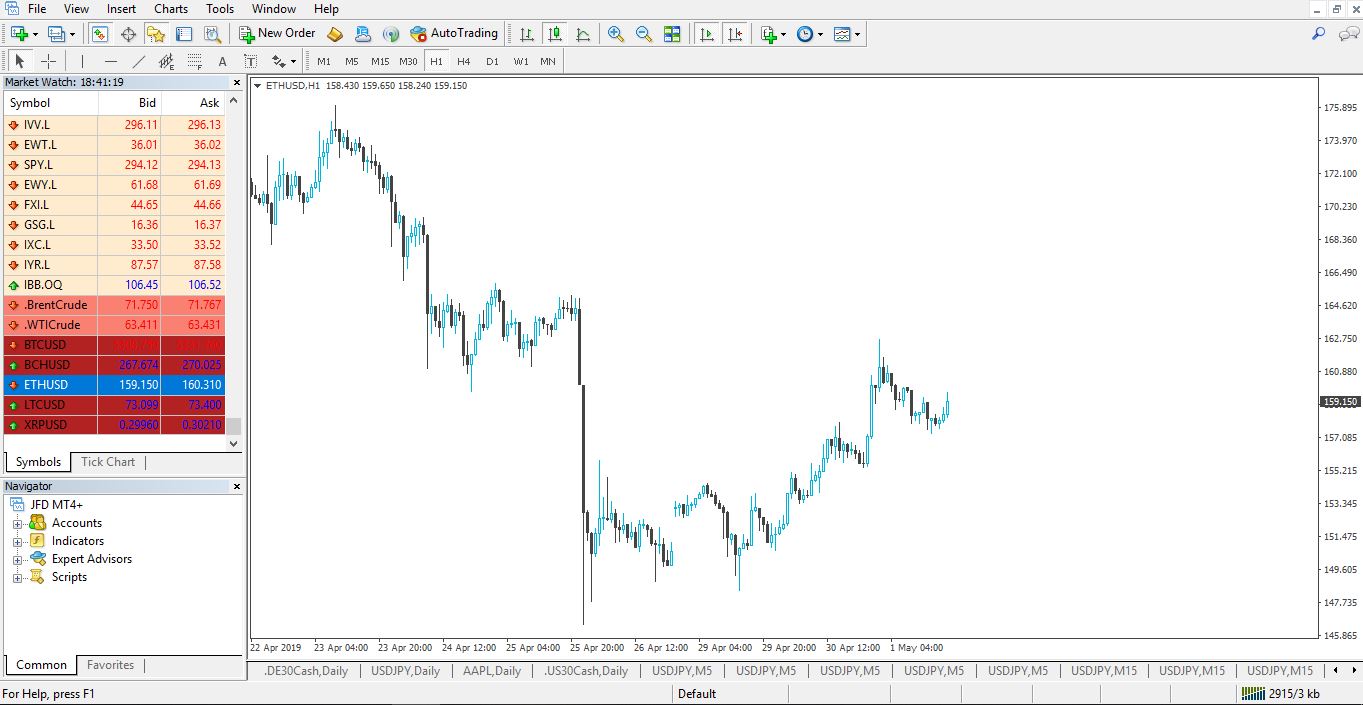

Yes, the trend is defined as a series of higher highs and higher lows for an uptrend and series of lower lows and lower highs for the downtrend. Now if you look, for example, at the hourly trend you can see that it’s in an uptrend, for example.

And if at some moment you look at a lower time frame as M15, M5 or M1, you might notice that actually, it’s the opposite direction.

And this is quite normal because obviously, it is a different time frame. That’s why when you are looking for the system when you’re looking for the entry conditions to enter into the trade according to the trend, you need to look at one and the same time frame.

So just don’t mix it because obviously, in one time frame you can be in an uptrend, in the other one you can be in a downtrend for the very same asset.

3. “What exactly is CFD trading in the Crypto trading course?”

Now CFD trading is one and the same thing with all assets, with all cryptocurrencies or currencies or stocks, indexes, anything that you have with your broker. CFD trading stands for Contract For Difference. This means that we are not really buying Ethereum, Bitcoin or oil, gold…but what we are doing, we do a contract for difference with the broker.

This means that we fund an account and we have this money with the broker and we can use this money to buy or to sell an asset. So even without having the Ethereum previously, we can still sell it. If the price goes down and we close the position, we will take the profit. So this is CFD trading.

We made a contract with the broker and if the price goes in our direction, the broker will pay us the difference. If the price goes in the opposite direction, trade is closed and we will pay this loss to the broker.

4. “Can we use Meta Trader with the exchanges?”

As far as I know, there is no exchange that offers Meta Trader. Meta Trader is a platform that is provided by the brokers. So how is it working? MetaQuotes Company developed The Meta Trader platform and they provided to the brokers.

So the brokers pay to the MetaQuotes Company and the brokers provide the platform to us the traders for free. So we don’t need to pay for the platform to anyone.

But one more time, as far as I know, the exchanges do not offer Meta Trader. That is why in the Crypto trading course I selected to use the CFD brokers and not the exchanges.

There were some reviews from my students who shared, they succeeded to connect it via API but I really don’t know how they did it. I’m not really interested in exchanges. So there are some tricks that I’m not really familiar with.

So you can look for it but I would stick to Meta Trader with the brokers if I’m using Meta Trader. But if you’re using exchanges just stick with the platforms that the exchanges offer.

5. “Why is it better to use Stop Loss and Take Profit?”

- less time in front of the screen

- lowers the risk for the trading account

- locks the profits from the strategy we use

- eliminates emotions while trading

This is very simple. When we use Stop Loss and Take Profit, we limit the time that we are staying in front of the computer. We don’t want to wait for the price to reach a certain level.

So, for example, if now Ethereum is, let’s say, at $200 as an example, and we put our Take Profit at $220. And what we need to do, we will need to stay in front of the computer and wait for the price to reach there in order to close the trade manually. But we don’t want to do that.

We want to place our Take Profit at this level so when the price reaches, it will close the trade automatically, and even during this time, we could be sleeping. Same with the Stop Loss, we might limit our loss if this is your strategy. And you should do this by using the Stop Loss and not by waiting in front of the monitor to do it manually. I will demonstrate that in this Crypto trading course.

6. “What risk to have when trading with the system from the Crypto trading course?”

Now at the end of the Crypto trading course, I have attached one sheet with an example, “Risk Management” and what I’m following is 2%. No bigger risk. No matter whether it is this trading system or it is another trading system, I don’t risk more than 2% from my account.

So, for example, if I’m trading $1,000 then 2% is $20. But this doesn’t mean that I will open a trade using $20, I will have my Stop Loss maximum at $20. Because I can open a trade using $15 from my account but if it goes to a big loss, it will be more than 2%.

So it’s not important with how much you’re trading, it’s important how much you’re risking. This is very important.

7. “Can I open a Demo account with every broker?”

Normally yes, you can open a Demo account with every broker and I’m talking about the legit and the regulated brokers. As far as I know, there were some scam brokers that do not offer Demo trading. They will tell you that it’s not reality, that you are not learning when you’re trading with Demo account, you should put real money and so on.

This is absolute scam guys. The regulated brokers offer Demo accounts and you can open as many as you want. And you can practice as long as you wish.

You can practice on a Demo account for years and the regulated broker should not say a word about it. It’s your choice if you will be trading on them or you will be risking your real money. So yes, look for those regulated brokers that will give you a Demo account without any problems.

8. “I do not see the Ethereum with my broker?”

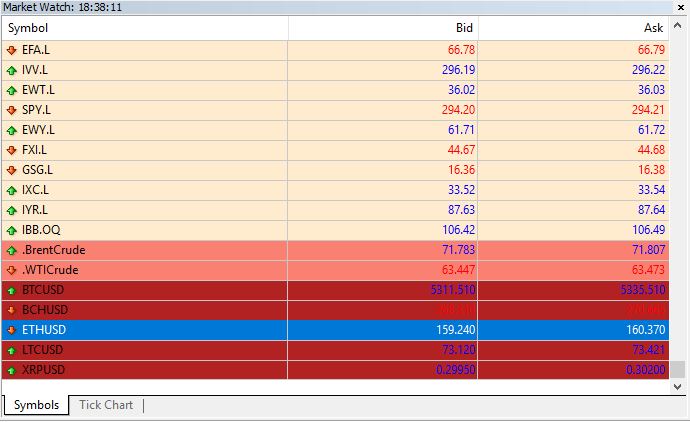

Now if you don’t see the Ethereum with your broker, what you might try is just right click over the Market Watch and select “Show All.“

This will show you all the trading assets provided by your broker. If you still don’t see the Ethereum, then probably this means that your broker does not offer the Ethereum.

But if you see it and you want to open the chart and you cannot open a trade with Ethereum, this might mean that your broker keeps the Ethereum on the market watch but they have disabled the trading with Ethereum. In 2018, the beginning of 2018 and the end of 2017, many brokers disabled the trading with cryptocurrencies because the market was crazy. They couldn’t afford it.

So some of the brokers really removed the cryptocurrencies which were, I can say, not really proper from their site according to the connection between the broker and the trader. Because when we have opportunities on the market, we want to use them. They should give us the chance to the traders to trade these volatile moments.

But obviously, many brokers lost money. Some nearly closed doors because they lost a lot. And one of the protections they did, it was just to remove the cryptocurrencies.

Anyway, now the market is calm and the spreads are back to normal. All the brokers that normally had the cryptocurrencies put them back in. This makes the Crypto tracing course suitable for everyone who wants to trade!

9. “Can I use the system from the Crypto trading course on exchanges?”

Yes, you can use the system on exchanges. You can use it on any trading platform, web-based platform…it’s not meant to be on Meta Trader. I like Meta Trader because I use algorithmic trading and Expert Advisors on Meta Trader.

But you can use the system from this Crypto trading course for any assets on any different platforms or exchanges. I don’t see a reason why you cannot do it.

10. “I cannot download Meta Trader 4, it always installs Meta Trader 5.”

This is probably if you install or download the Meta Trader platform from the MQL5 website. This is the official website of MetaQuotes Company. There, they have removed the Meta Trader 4 because they want to push the traders to Meta Trader 5. However, most of the traders prefer still to use Meta Trader 4.

I still prefer to use Meta Trader 4 and I think it will stay for a longer time. So these are the 10 frequently asked questions that I receive. And one more thing about the last question, if you want to use the Meta Trader 4 you need to download it from your broker.

From their website or when you register for a Demo account, they will send you the link via email. Click on it and you will download it from there. But not from the official website.

Thanks for reading, these are the 10 frequently asked questions that I receive for the Crypto trading course: Learn to TAKE the Profit. If you have any other questions drop them in the Forum.

See you inside the class!