Gold trading has become a prominent aspect of the financial markets, attracting traders from various backgrounds. Understanding the intricacies of trading gold can elevate a trader’s ability to enter a trade successfully. With the right indicators and trading strategies, traders can capitalize on the price movement of gold, whether they are day trading or employing longer-term strategies. In this article, we explore the best indicators for gold trading and effective technical analysis tips that can enhance your trading experience.

Understanding Gold Trading

Gold trading encompasses various methods and strategies that traders utilize to capitalize on the fluctuations in the price of gold. The significance of gold in financial markets cannot be overstated, as it often acts as a safe haven during times of volatility. Traders keen on entering the gold market need to familiarize themselves with the best gold trading practices, including the use of technical analysis. By understanding how to read market signals and price action, traders can make informed decisions on when to buy or sell gold.

The Importance of Gold in Financial Markets

Gold serves as a critical asset in financial markets, often viewed as a hedge against inflation and economic uncertainty. Its intrinsic value makes it a preferred choice for traders looking to diversify their portfolios. The price of gold tends to remain stable or even increase when other commodities, like oil, face downturns. This characteristic allows traders to identify trade opportunities that may not be apparent in other markets. Consequently, understanding the dynamics of the gold market and the factors influencing gold prices is vital for any trader aiming to maximize profits.

Overview of Gold Trading Strategies

Successful gold trading relies heavily on effective trading strategies tailored to the trader’s style and goals. Strategies may include trend trading, where traders follow the momentum of price movements, or scalping, which involves making quick trades based on small price changes. Utilizing technical indicators like moving averages and the relative strength indicator (RSI) can provide traders with insights into market conditions, helping them determine if the market is overbought or oversold. By applying these trading tactics, traders can enhance their ability to spot potential trading signals and enter trades with confidence.

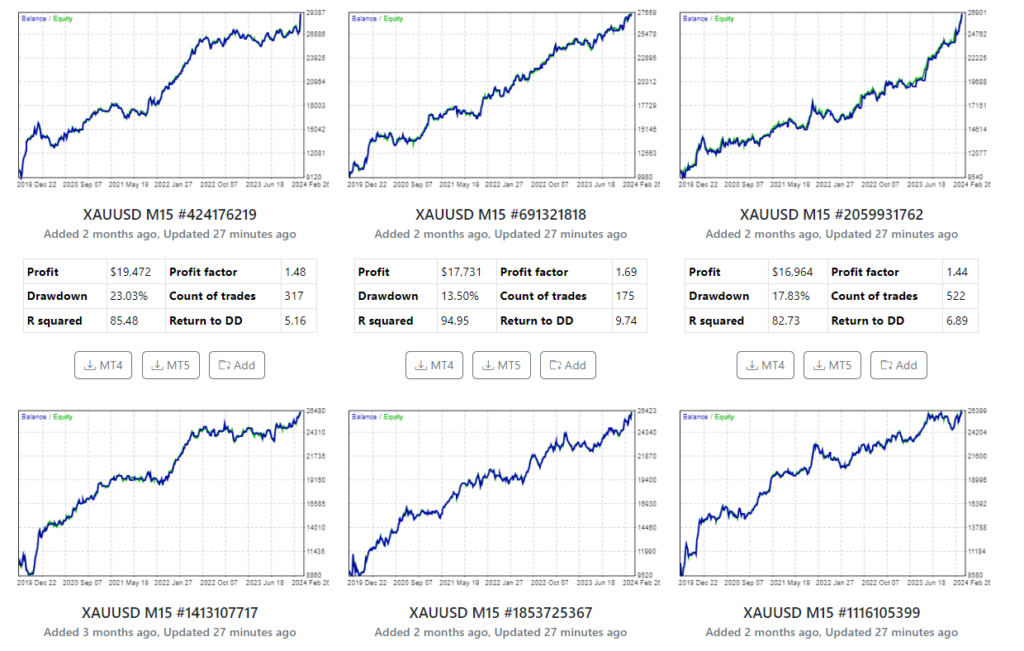

If you want to trade with profitable automated strategies and have lifetime access to them, Get the Top 10 Gold Robots from Top 10 Robots App

Types of Gold Assets: Futures vs. Spot Trading

When considering gold trading, traders often weigh the options of trading gold futures versus spot trading. Gold futures involve contracts that obligate the trader to buy or sell gold at a predetermined price on a future date, allowing for leverage and the potential for larger profits. In contrast, spot trading involves the immediate exchange of gold at the current market price, which appeals to traders looking for instant transactions. Each method has its advantages, and understanding the differences between these types of gold assets is crucial for developing effective gold trading strategies tailored to individual trading styles.

Key Indicators for Gold Trading

Moving Averages: A Fundamental Indicator for Gold

Moving averages are among the best indicators for gold trading, providing traders with a clear view of price trends over specific periods. By smoothing out price fluctuations, moving averages help traders identify potential trade opportunities and determine whether to buy or sell gold. For instance, a simple moving average (SMA) can highlight the average price of gold over the last few days, while exponential moving averages (EMA) give more weight to recent prices, making them responsive to price movement. Utilizing moving averages in conjunction with other technical indicators can enhance a trader’s ability to identify momentum shifts and potential reversal points in the gold market.

Relative Strength Indicator (RSI) in Gold Trading

The Relative Strength Indicator (RSI) is a crucial momentum indicator that helps traders assess whether the price of gold is overbought or oversold, thereby guiding them in making informed trading decisions. Typically, an RSI above 70 indicates that gold may be overbought, while an RSI below 30 suggests oversold conditions. This analysis in gold trading can signal potential reversal points, providing traders with strategic opportunities to enter or exit trades. By integrating RSI into their technical analysis framework, traders can enhance their understanding of market dynamics and improve their chances of executing profitable trades throughout various trading sessions.

Best Gold Indicators for Technical Analysis

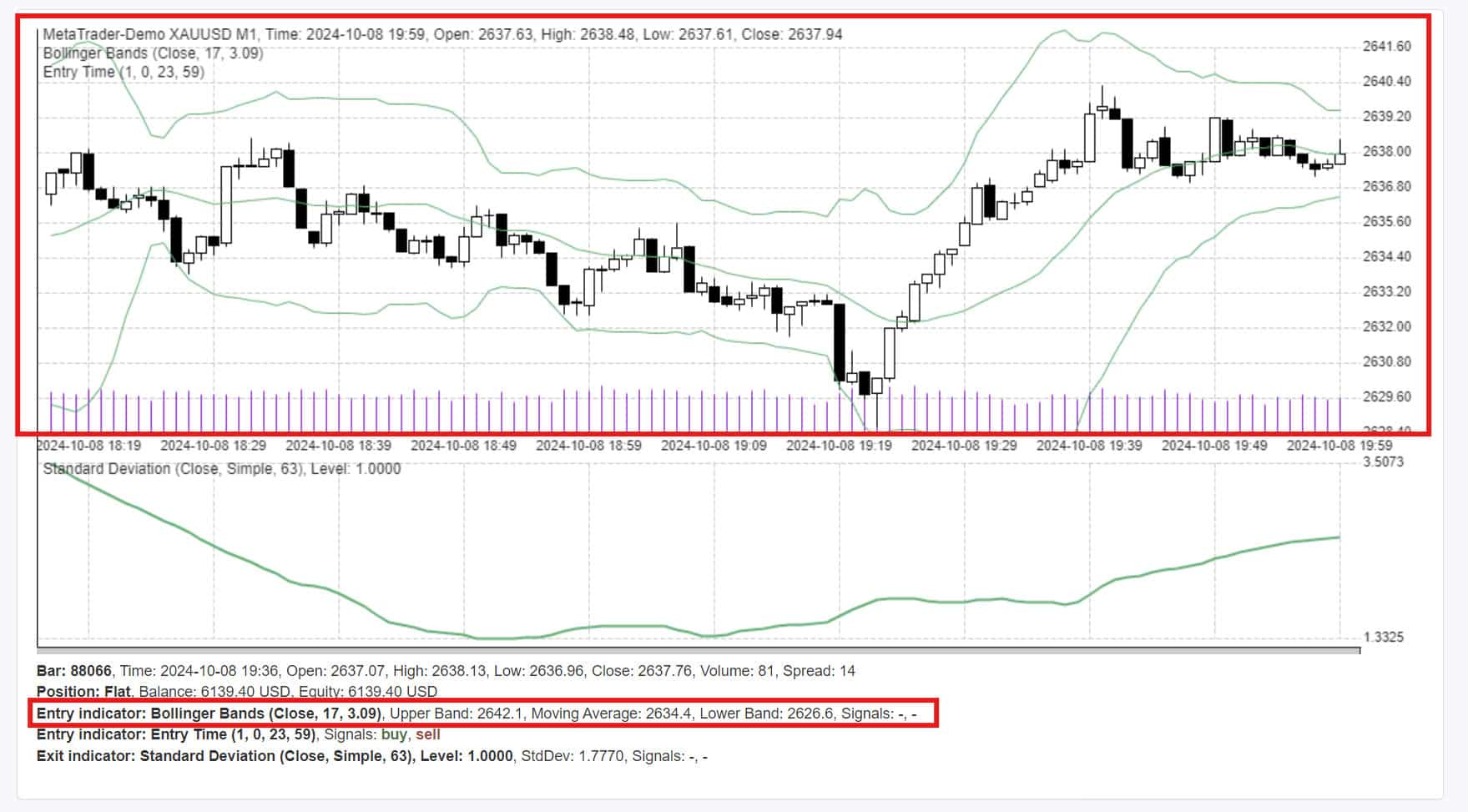

In addition to moving averages and the RSI, several other indicators can significantly contribute to effective technical analysis in gold trading. Tools such as Bollinger Bands and MACD (Moving Average Convergence Divergence) can provide valuable insights into market volatility and trend strength.

If you want to see also how the Bollinger Bands indicator works in practice, you can download and test yourself the Best Robot for Gold Trading for FREE. Also you can check out this video (with Gold Trading Strategy explained).

Bollinger Bands define price ranges and highlight potential breakouts, while MACD assists traders in identifying changes in momentum and trend direction.

If you want to test a FREE ready-to-use robot, using MACD indicator, we suggest you try the Small Account Gold EA. Or check out this video if you want to know How to Trade Gold in a Small Account (with MACD Strategy Explained).

Combining these indicators with price action analysis allows traders to create a comprehensive trading strategy that maximizes their ability to capitalize on price movements in the gold market. Ultimately, selecting the best gold trading indicators will depend on a trader’s unique trading style and objectives.

Best Practices for Trading Gold

How to Start Trading Gold Effectively

Starting to trade gold effectively requires a solid understanding of the market dynamics and the implementation of best trading practices. New traders should begin by choosing a reliable trading platform that offers access to gold trading products like futures and spot trading. Additionally, developing a comprehensive trading plan that incorporates risk management strategies, including setting stop-loss and take-profit levels, is crucial. Analyzing market trends through technical indicators and staying informed about economic events that affect gold prices can also enhance decision-making. By establishing a disciplined approach and continually refining their strategies, traders can improve their performance in the gold market.

Scalping Strategies for Gold Traders

Scalping is a popular trading tactic in the gold market, involving quick trades aimed at profiting from small price movements over short time frames. Traders employing scalping strategies often rely on technical indicators such as the moving average and RSI to identify rapid entry and exit points. By closely monitoring market conditions during active trading hours, scalpers can capitalize on minute fluctuations in the gold price. It’s essential for scalpers to maintain a disciplined approach, utilizing effective risk management practices to safeguard their capital while maximizing potential returns. This fast-paced trading style can be rewarding but requires a keen understanding of market volatility and price action.

Using MT4 for Gold Trading: A Trader’s Guide

MetaTrader 4 (MT4) is a widely used trading platform that offers robust features for gold trading (you can get here our gold trading dedicated course where we shod how to use MetaTrader for manual and algo trading), making it an essential tool for traders (check out this guide about trading XAUUSD on MT4). Its user-friendly interface allows traders to access a variety of technical indicators, including moving averages and the RSI, directly on their charts. MT4 also supports automated trading strategies, enabling traders to execute trades based on predefined criteria. Additionally, the platform provides real-time market data and comprehensive charting tools, helping traders analyze the gold market effectively. By leveraging the capabilities of MT4, traders can enhance their trading experience and improve their chances of success in the competitive world of gold trading.

Do you want to trade with 5 Gold Expert Advisors at the same time ? Learn how and get your 10 Expert Advisors for Gold Trading included!

Analyzing Gold Market Trends

Gold Signals and Their Impact on Trading Decisions

Gold signals play a pivotal role in shaping trading decisions for both novice and experienced traders. These signals, derived from various technical indicators, provide insights into potential price movements in the gold market. For instance, traders often analyze the Relative Strength Indicator (RSI) to determine whether the price of gold is in an overbought or oversold condition. When combined with moving averages, these signals can enhance a trader’s ability to identify optimal entry and exit points. By accurately interpreting gold signals, traders can make informed decisions that align with their trading strategies, ultimately increasing their chances of success in gold trading.

Evaluating Economic Indicators Affecting Gold Prices

Economic indicators play a significant role in influencing gold prices, making fundamental analysis essential for traders. Factors such as inflation rates, interest rates, and geopolitical events can dramatically impact the demand for gold as a safe haven asset. For example, a rise in inflation may lead traders to flock to gold, driving up its price. Additionally, currency fluctuations, particularly in the U.S. dollar, can affect the price of gold, as it is often traded in USD. By evaluating these economic indicators, traders can better understand the underlying factors that affect the gold market, allowing them to anticipate price movements and adjust their trading tactics accordingly.

Trading Hours and Their Influence on Gold Trading

The trading hours of the gold market can significantly influence trading strategies and price volatility. Gold is traded globally, with major trading sessions taking place in London and New York. This overlap creates heightened volatility, particularly during the London trading hours, where high trading volumes often lead to rapid price movements. Traders need to be aware of these trading hours to optimize their strategies, whether they are day trading or implementing longer-term tactics. Timing trades during these active periods can increase the likelihood of encountering favorable trade opportunities, as market participants react to economic news and other developments affecting the gold price.

Gold Trading Hours: Best Time to Trade XAUUSD

Identifying the best time to trade XAUUSD (gold against the U.S. dollar) is crucial for maximizing trading opportunities. The most favorable trading hours often coincide with the opening and closing of major global markets, particularly during the London and New York sessions. During these times, liquidity and volatility tend to increase, allowing traders to execute trades more efficiently. Additionally, significant economic announcements and geopolitical events often occur during these hours, leading to substantial price movements. By strategically planning trades around these peak hours, traders can enhance their performance and capitalize on the dynamic nature of gold trading.

How to choose the best gold trading strategy?

Choosing the best gold trading strategy involves a combination of understanding market dynamics, setting clear trading goals, and utilizing effective indicators. First, traders should evaluate their trading style—whether they prefer day trading, scalping, or longer-term investments. Each style requires different strategies and indicators. For example, a day trader might focus on short-term price movements and employ technical indicators like moving averages and the Relative Strength Indicator (RSI) to identify trade opportunities. Additionally, traders must keep abreast of economic indicators and news that can influence the gold market, ensuring their strategies are aligned with current market conditions. Ultimately, a well-defined trading plan that incorporates these elements will enhance a trader’s ability to make informed decisions and maximize profits in gold trading.

Conclusion: Mastering Gold Trading Techniques

Recap of Best Indicators for Gold Trading

In summary, mastering gold trading techniques requires a strong grasp of the best indicators available. Moving averages and the RSI are essential tools that help traders assess price momentum and identify overbought or oversold conditions. Additionally, Bollinger Bands and MACD serve as valuable indicators for gauging market volatility and trend strength. By effectively combining these technical indicators within a well-structured trading strategy, traders can enhance their analytical capabilities and improve their decision-making processes. Understanding how to utilize these indicators not only aids in identifying potential trade opportunities but also equips traders with the insights necessary to navigate the complexities of the gold market confidently.

Final Thoughts on Trading Strategies for Gold

Trading strategies for gold must be adaptable and grounded in both technical and fundamental analysis. As the gold market is influenced by various factors, including economic conditions and geopolitical events, traders should remain vigilant and flexible in their approach. Utilizing tools like MT4 can enhance trading efficiency by providing access to real-time data and multiple indicators. Successful gold trading is not solely about following a fixed strategy but also about learning to read market signals and adjusting tactics accordingly. With the right mindset and diligent practice, traders can develop a nuanced understanding of the gold market that serves them throughout their trading journey.

Next Steps for Aspiring Gold Traders

For aspiring gold traders, the next steps involve a commitment to continuous learning and strategy refinement. Starting with a demo account can provide valuable hands-on experience without financial risk, allowing traders to test various gold trading strategies and indicators. Engaging with educational resources, such as webinars and trading forums, can also enhance understanding of market intricacies. Moreover, setting specific trading goals and regularly reviewing performance will help in identifying areas for improvement. By fostering a disciplined approach and remaining informed about market developments, aspiring traders can position themselves for success within the dynamic world of gold trading.