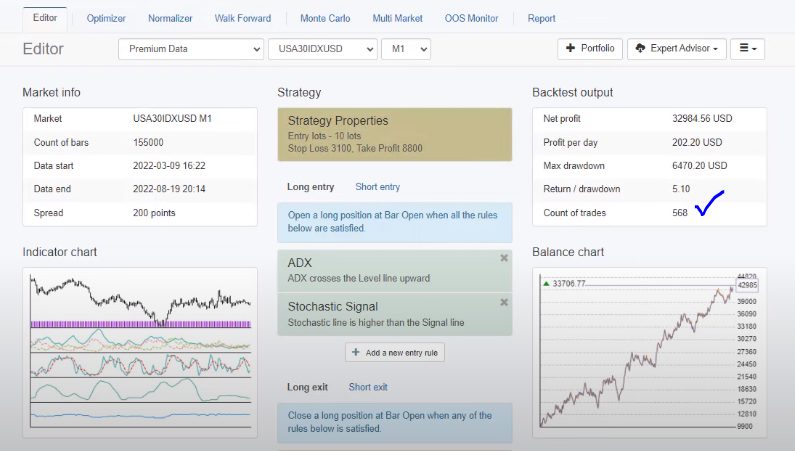

Traders are always looking for the best Dow Jones trading strategy. The best strategy that we’ve been trading at EA Trading Academy uses the M1 (one-minute) time frame.

For the beginners, traders can choose from several time frames on MetaTrader. With M1, each candlestick refers to one minute.

By using the M1 time frame with this strategy, we can enter and exit trades relatively quickly. We’ll share our Dow Jones trading strategy with you in this blog post. We’ve been improving the strategy for quite a long time.

Previously, we had just one exit condition for the strategy. However, we’ve improved that a lot since then. Right now, this is our best Dow Jones trading strategy.

The Dow Jones Is Volatile

It’s hard to find a decent strategy. That’s because the Dow Jones is very volatile.

Since the Dow Jones is volatile, sometimes it’s hard to decide whether we’re in an uptrend or still in a downtrend. Most of the time, when traders look at daily charts, they’ll see the price fluctuate a lot. That makes it hard to trade.

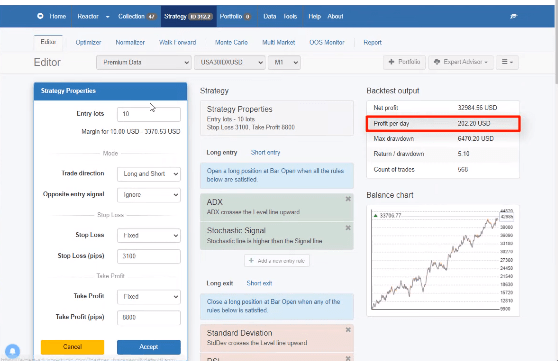

Trading With 10 Lots is what we use (not a piece of advice)

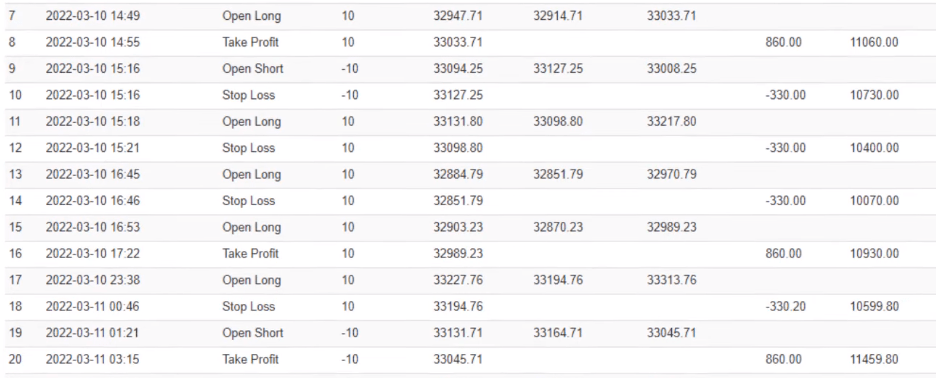

We traded with 10 lots on this Dow Jones trading strategy. That helped us to make a profit of $200 per day. However, that’s because we traded with so many lots.

If we reduce it to one lot, we’ll profit $20 per day.

Although our profit would be lower, we would get the same performance from the strategy. If you decide to use the strategy, you should stick to your preferred risk management rules. So, even if you trade with 0.1 lot, you’ll still get a profit of about $2 per day.

Starting Capital for Our Best Dow Jones Trading Strategy

Our starting capital for trades with our best Dow Jones trading strategy was $10,000. Our leverage was 1:100. If we trade smaller accounts, we have to reduce the lots.

Sometimes we take a huge risk with our trades. For example, we might use nearly all of the money in our account to open just one trade. However, we’ll only do that with a strategy we’ve tested for a long time.

We also look for the count of the trades, which shows how many times we executed the strategy.

This makes our backtests more reliable. In those instances, our trades brought us over 50% profit. In all, we made a profit of over $5,000.

That’s not something that we often do

. We maximize rare opportunities.

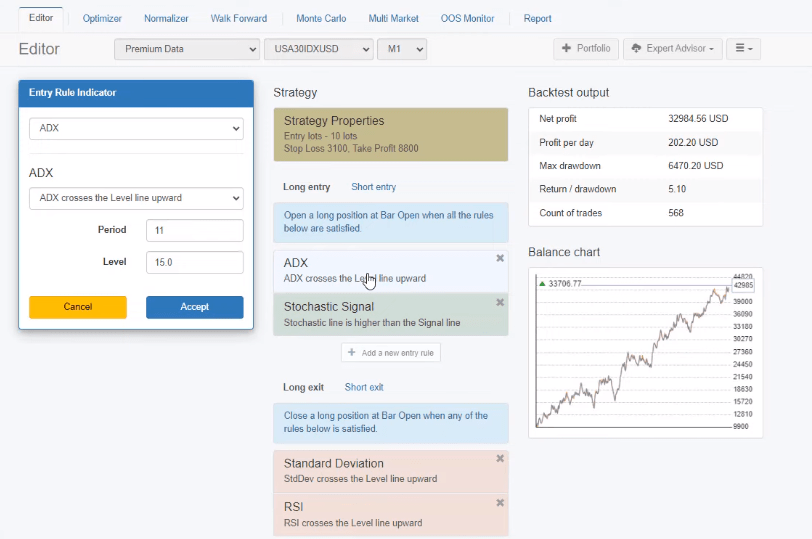

Check Trades With the ADX Indicator

Remember, our best Dow Jones trading strategy works on the M1 time frame. We also use the ADX indicator.

When the ADX crosses the level line, that’s our signal to enter. We use a period of 11 and level of 15.

Our rule to remember is that when the ADX crosses the level line up once and matches the Stochastic signal —where the Stochastic line is higher than the signal line — we can enter.

When all of these things confirm entry, we can enter the trade. Those conditions would apply for a long trade. So if we’re going short, we will look for the opposite.

Partially or Fully Automated Trading

Many algo traders choose to let the robot do everything. It helps them to save time and release stress. However, sometimes you might want to take profits manually. That’s helpful if you think your Take Profit won’t be reached.

If you’re an algo trader, it’s a good idea to choose safe rules and stick to them. That’s how you’ll benefit from the best Dow Jones trading strategy. It’s not a good idea to always manually interfere in your trades.

If you do that, eventually, your emotions will get involved and will start to affect your trades. So, if you set a rule for your Stop Loss, stick to it.

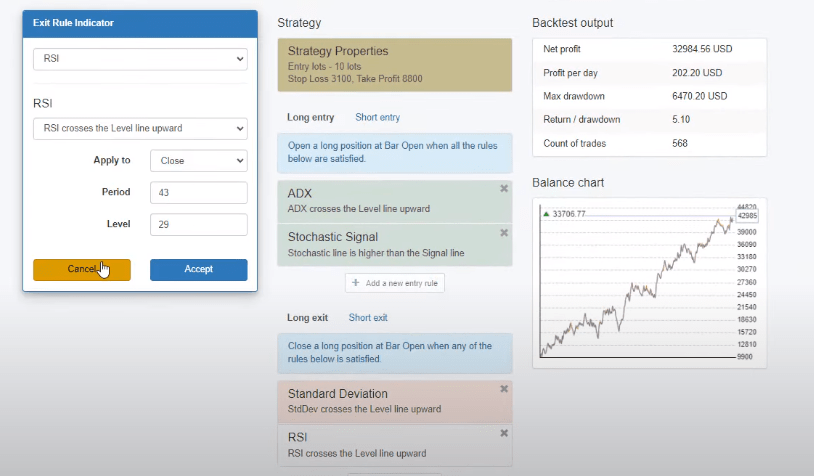

Exit Condition for the Best Dow Jones Trading Strategy

With every strategy, we must have an exit condition. With our best Dow Jones trading strategy, we’ll use the standard deviation to find our exit point.

So, we look for the point at which the standard deviation crosses the level line. We set a period of 25 and level 218.

We should also see the RSI cross the level line upward at 43.29. With this strategy, most of the time either the Stop Loss or Take Profit is hit.

Choosing Your Lot Size

Traders should always choose their lot size carefully. Look back at your Journal to get historical data on your trades.

Your Journal information will help you to decide how much capital you’re willing to risk. Remember, some trades will be losing trades.

If you’re trading with one lot you might lose $33 on a trade. For you, that might be too much money to lose on just one trade.

A losing trade will cost you over $300.

If you decrease the size of your lot to 0.1 lot, you would only lose $3.30. So, always decide how much you’re ready to lose. Remember, you might lose a few times consecutively before you make a profit.

However, if you have a good strategy, you’ll recover from those losses with your winning trades. Our best Dow Jones trading strategy hits the Take Profit more often than others. In other words, if you’re using this strategy, you won’t meet the exit conditions very often.

Final Thoughts – The Best Dow Jones Trading Strategy

This strategy is useful, but you must apply your risk management rules. You can download this robot, attach it to your chart and test it for yourself.

Follow us on YouTube to learn more about our trading strategies for MetaTrader.

Also, if you have any ideas that you would like to share, please do so in the comments below. Have a wonderful day. Take care, and enjoy trading!