In our every day life, we always try to make the right choice. This is especially valid when we invest our capital. The forex trading landscape presents numerous opportunities for traders aiming to take advantage of the variances in currency exchange rates. Recognizing which currency pairs to focus on is essential for both beginner and experienced traders. This article explores the best currency pairs to trade, highlighting important features, strategies, and optimal timings that can improve success in the forex market. Also, we will take a look how the algorithmic trading relays to trading the best currency pairs.

Table of Contents:

What Are the Best Currency Pairs to Trade in Forex

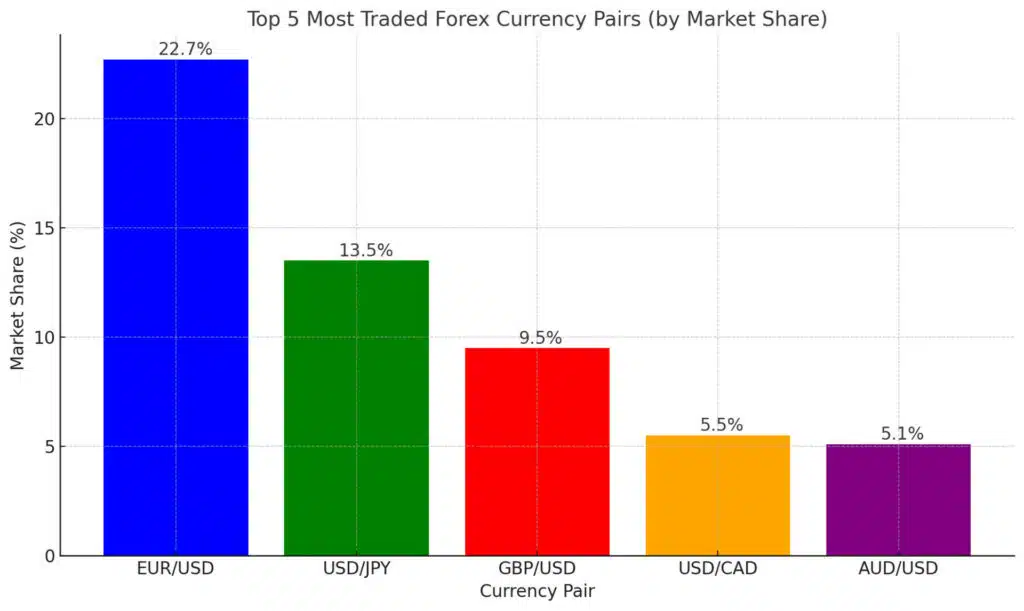

In forex, selecting the best currency pairs is key to aligning with market trends and achieving efficient, cost-effective trades. Below are some of the top pairs:

- EUR/USD – Known for high liquidity, this pair typically offers tighter spreads, making it suitable for day trading and scalping.

- GBP/USD – Known for volatility, it’s ideal for those who trade during the overlap of London and New York sessions.

- USD/JPY – A lower spread pair, influenced by major economic releases from Japan and the U.S.

- AUD/USD – Tied to commodity trends, this pair is popular for trading during the Asian session.

- EUR/JPY – A cross pair that reflects trends in both European and Asian markets, often with good volatility for swing trading.

These pairs are well-suited for different trading styles due to their liquidity and predictable trends, making them accessible and attractive to a range of traders.

Now, let’s look more into details.

Understanding Major Currency Pairs

Major currency pairs are generally recognized as those that feature the US dollar (USD) either as the base or quote currency. These pairs include well-known combinations like EUR/USD, GBP/USD, and USD/JPY. The most favorable currency pairs for trading typically demonstrate significant liquidity and steady volatility, making them suitable for traders who aim to efficiently enter and exit positions. Major pairs see active trading activity, which usually results in narrower spreads and greater trading volumes, thus providing numerous opportunities for forex traders.

Characteristics of Low Volatility Forex Pairs

Low volatility forex pairs are typically characterized by their stable exchange rates and minimal price fluctuations. Here are some key characteristics:

- Stable Price Movements: Low volatility pairs have smaller daily price ranges, leading to fewer sharp price swings. This makes them appealing to traders seeking steadier, less risky positions, especially over longer periods.

- Reduced Risk, Lower Profit Potential: With fewer price spikes, low volatility pairs tend to carry lower trading risks. However, this stability usually means limited opportunities for substantial profits compared to more volatile pairs.

- Strong, Stable Economies: These pairs often involve currencies from countries with robust and mature economies that experience less economic or political uncertainty. For example, pairs like EUR/CHF (Euro/Swiss Franc) and USD/SGD (U.S. Dollar/Singapore Dollar) reflect this characteristic.

- Suitable for Conservative Strategies: Due to their stability, low volatility pairs are ideal for traders who prefer conservative strategies, like carry trading or long-term holding, where small, consistent gains are more desirable than rapid profits.

- Wider Spreads in Minor Pairs: Some low volatility pairs might not be as frequently traded as major pairs, leading to wider spreads, which can impact costs slightly. This is particularly common with certain minor or exotic pairs that experience lower trading volume.

Why Trade Liquid Currency Pairs

Trading liquid currency pairs is crucial for any trader looking to minimize risks and maximize profits. High liquidity means that a currency pair can be bought or sold without causing a significant impact on its exchange rate. This characteristic enables traders to execute trades quickly and with less slippage. Major currency pairs, such as the EUR/USD and GBP/USD, are examples of highly liquid currency pairs that are traded extensively in the forex market. The availability of numerous trading opportunities in these pairs makes them attractive to both beginner and seasoned traders.

For traders looking to leverage algorithmic trading, EA Trading Academy’s Top 10 Robots App offers a suite of high-performance EAs. These tools can greatly reduce the time spent on trade execution and increase the likelihood of capturing profitable opportunities in real-time.

How to Choose the Best Currency Pairs to Trade

Evaluating Trading Volume and Liquidity

When selecting the best currency pair to trade, evaluating trading volume and liquidity is essential. Trading volume refers to the number of transactions executed within a specific timeframe, while liquidity indicates how easily a currency can be bought or sold in the market. Pairs with high trading volume are generally more liquid, making it easier for traders to enter and exit positions without significant price changes. Traders should focus on actively traded currency pairs as they tend to have tighter spreads and reduced trading costs, ultimately leading to more efficient trading outcomes.

Analyzing Volatility in Forex Pairs

Volatility plays a significant role in identifying which forex pairs to trade. Traders must analyze both historical volatility and current market conditions to gauge the potential for price movements. High volatility pairs can offer substantial profit opportunities due to larger price swings, but they also come with increased risk. Conversely, low volatility pairs may provide a safer trading environment but could result in smaller returns. A trader’s choice of currency pair should align with their risk tolerance and trading strategy.

Identifying Your Trading Strategy

Choosing the right currency pair also requires a clear understanding of one’s trading strategy. Different trading strategies, such as scalping, day trading, or swing trading, may necessitate trading specific pairs based on their characteristics. For instance, traders who prefer to scalp might opt for highly liquid pairs like the EUR/USD or GBP/USD, while those utilizing a longer-term strategy may look for pairs that demonstrate consistent movements over days or weeks. Ultimately, identifying a trading strategy will guide traders in selecting the most suitable currency pairs for their trading endeavors.

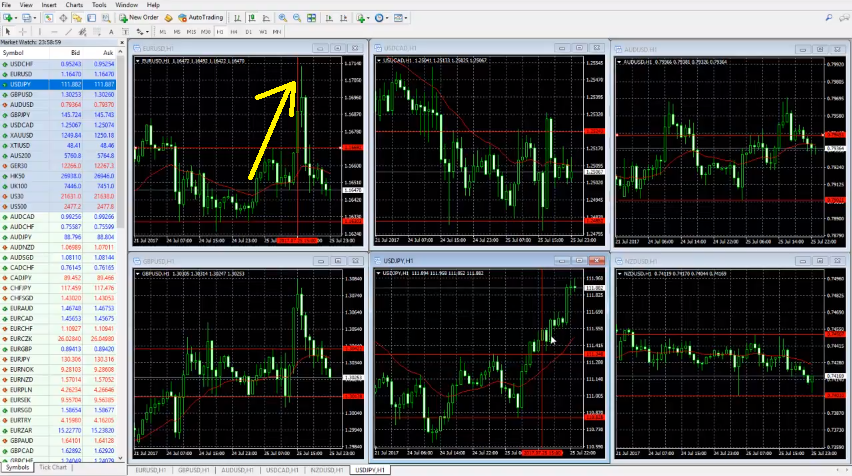

One effective method for selecting currency pairs involves analyzing relative strength and market trends. Here’s a practical example based on a live trading scenario:

Example: Imagine you’re deciding between EUR/USD and USD/JPY as the London session opens. You notice:

- EUR/USD is trending upward, indicating a stronger Euro relative to the USD.

- USD/JPY is also rising, which suggests the USD is stronger than the JPY.

Given these conditions, EUR/JPY might be the best choice, as it combines the strength of the Euro over the Yen. This method can often reveal the most favorable currency pair for the session, maximizing potential gains by aligning with current trends.

This example highlights the importance of monitoring multiple pairs to identify the strongest pair based on relative performance. Check out this video for better understanding on the above example and how to execute it in real world.

Matching Currency Pairs to Trading Strategies

Different trading strategies work best with specific currency pairs. Here are popular strategies and the pairs best suited for each: Here’s a breakdown of common trading strategies and their ideal currency pairs:

- Scalping:

- Ideal Pairs: EUR/USD, USD/JPY

- Why: High liquidity in these pairs supports rapid entry and exit, while tight spreads ensure minimal transaction costs.

- Example: A scalper in the London session could quickly enter and exit EUR/USD based on small price movements, using high trade volume to capitalize on minor fluctuations.

- Day Trading:

- Ideal Pairs: GBP/USD, EUR/USD

- Why: The GBP/USD pair’s volatility during session overlaps gives day traders the quick, profitable moves they need within a single trading day.

- Example: Day trading GBP/USD at the beginning of the London-New York overlap often means riding high volatility, allowing traders to capitalize on intraday momentum.

- Swing Trading:

- Ideal Pairs: AUD/USD, EUR/JPY

- Why: Swing traders aim to capture larger moves over a few days. Pairs like AUD/USD, affected by commodity cycles, and EUR/JPY, with its high volatility, offer sustained trends.

- Example: A swing trader could enter EUR/JPY based on trend indicators, holding the position as it aligns with broader price movements over several days.

- Position Trading:

- Ideal Pairs: USD/JPY, EUR/USD

- Why: Position traders often base decisions on economic fundamentals. The relative stability and response of these pairs to long-term trends make them suitable for multi-week holdings.

- Example: A position trader might buy USD/JPY based on U.S. interest rate hikes, holding the position as broader economic trends unfold over weeks or months.

These matches help traders align their strategies with pairs most likely to provide favorable conditions, optimizing their approach based on market behavior and trading goals.

What Are the Benefits of Trading Major Currency Pairs

High Liquidity and Low Spreads

One of the primary benefits of trading major currency pairs lies in their high liquidity and low spreads. High liquidity ensures that trades can be executed quickly, minimizing the risk of slippage. Low spreads, which represent the difference between the buying and selling prices, mean that traders can enter and exit positions at a lower cost. This combination is particularly advantageous for forex traders who seek to maximize their profitability while minimizing trading expenses.

Consistency in Exchange Rates

Major currency pairs tend to exhibit more consistent exchange rates compared to exotic pairs. This stability is largely due to the robust economic foundations of the countries involved, leading to predictable movements based on economic indicators and geopolitical events. For traders, this consistency can enhance the reliability of trading signals and strategies, making it easier to anticipate market movements and adjust trading decisions accordingly.

Availability of Trading Opportunities

The abundance of trading opportunities available in major currency pairs is another compelling reason for their popularity. With high trading volumes and a variety of factors influencing exchange rates, traders can find numerous entry and exit points throughout the trading session. This constant activity allows traders to capitalize on short-term price movements and engage in frequent trading without the limitations often associated with minor or exotic pairs.

When is the Best Time to Trade Forex Currency Pairs

Understanding Trading Sessions

The forex market operates 24 hours a day, divided into several trading sessions including the Asian, European (London), and North American (NY) sessions. Each session presents unique trading opportunities and characteristics based on the currencies being traded and the level of market activity. Understanding the dynamics of these trading sessions is crucial for forex traders, as it can help them determine the best times to trade specific currency pairs. For instance, the overlap between the London and NY sessions often results in increased volatility and trading volume, making it an ideal time for traders to engage in the market.

If you want to understand how the London, NY & Tokyo Trading System works and take advantage of it, our Forex Trading Learning Course is what you need.

Trading Forex at Night: Pros and Cons

Trading forex at night, particularly during the Asian session, offers both advantages and disadvantages. On the one hand, the Asian session can provide opportunities to trade pairs involving the Japanese yen (JPY), Australian dollar (AUD), and New Zealand dollar (NZD), which may not see significant movement during other sessions. However, the overall trading volume is generally lower at night, which can lead to wider spreads and less favorable trading conditions. Traders must weigh these pros and cons when deciding whether to engage in night trading and should consider their own trading strategies and objectives.

Timing Your Trades for Maximum Impact

Timing is crucial in forex trading, as entering or exiting a trade at the right moment can significantly impact overall profitability. Successful traders often utilize a combination of technical and fundamental analysis to inform their trading decisions, allowing them to identify optimal entry and exit points based on market trends and economic indicators. By understanding the best times to trade specific currency pairs and aligning their strategies accordingly, traders can maximize their potential for success in the competitive forex market.

How to Develop a Trading Strategy for Forex Pairs

Incorporating Technical Analysis in Your Strategy

To develop a successful trading strategy for forex pairs, incorporating technical analysis is essential. This approach involves analyzing historical price data and identifying patterns that can help predict future price movements. Traders often use various tools, including charts, indicators, and trend lines, to assess potential entry and exit points. By leveraging technical analysis, traders can create a systematic approach to trading different currency pairs, enhancing their decision-making process and potential profitability.

Using Fundamental Analysis to Inform Trading Decisions

In addition to technical analysis, fundamental analysis plays a significant role in developing a robust trading strategy. This approach focuses on evaluating economic indicators, geopolitical events, and market sentiment to understand how these factors impact currency values. By staying informed on economic news releases, such as interest rate changes or employment reports, traders can make more informed decisions regarding their trading activities. Combining both technical and fundamental analysis allows traders to create a well-rounded strategy that considers various aspects of the forex market.

Backtesting Your Forex Trading Strategy

Backtesting is an invaluable step in the development of a trading strategy for forex pairs. This process involves applying a trading strategy to historical data to assess its effectiveness and potential profitability. By analyzing past performance, traders can identify strengths and weaknesses in their strategy, allowing for adjustments that can enhance future trading outcomes. Backtesting provides traders with the confidence to execute their strategies in real-time, knowing that they are based on data-driven insights and historical trends.

Conclusion: Building a Successful Forex Strategy

Trading the best currency pairs requires a balanced approach that combines effective pair selection, strategic alignment, and cutting-edge technology. By focusing on major pairs and leveraging algorithmic tools like expert advisors, traders can improve their performance, minimize risks, and achieve more consistent outcomes.

Explore EA Trading Academy’s Top 10 Robots App to see how automated trading can enhance your trading experience. With these EAs, you can streamline your trades, reduce errors, and set the stage for successful trading in today’s dynamic forex market.