What is Expert Advisor?

What is Expert Advisor? These are Trading Robots. Now, Robot is the slang word and the official name is Expert Advisor. So this is a code that describes the strategy.

All the rules like entry rule, exit rule, Stop Loss, Take Profit, the entry amount, the Magic number which we use to follow the results, everything in the strategy is coded. And you can buy an Expert Advisor from the market. This is quite expensive.

And even for one single Expert Advisor, you will need to pay a lot of money. Second, you can hire a developer which is expensive as well. You need to provide a detailed explanation about the strategy and they will code it for you. Let’s say in a week or two.

If it is a professionalist, it will be faster but it will still cost you a couple of hundred dollars. Now, I use the third option. I use Strategy Builders. These are software, professional programs for algorithmic trading and I’m able to code the strategies without programming skills.

Strategy Builders and the Expert Advisor.

Simply, this software exports the strategy as an Expert Advisor. The code is brilliant without any errors. And this way I can afford to trade with many Expert Advisors. And everyone can do it.

I demonstrate and explain what is Expert Advisor the course Top 5 Gold Expert Advisors in 2020 + 10 EAs included.

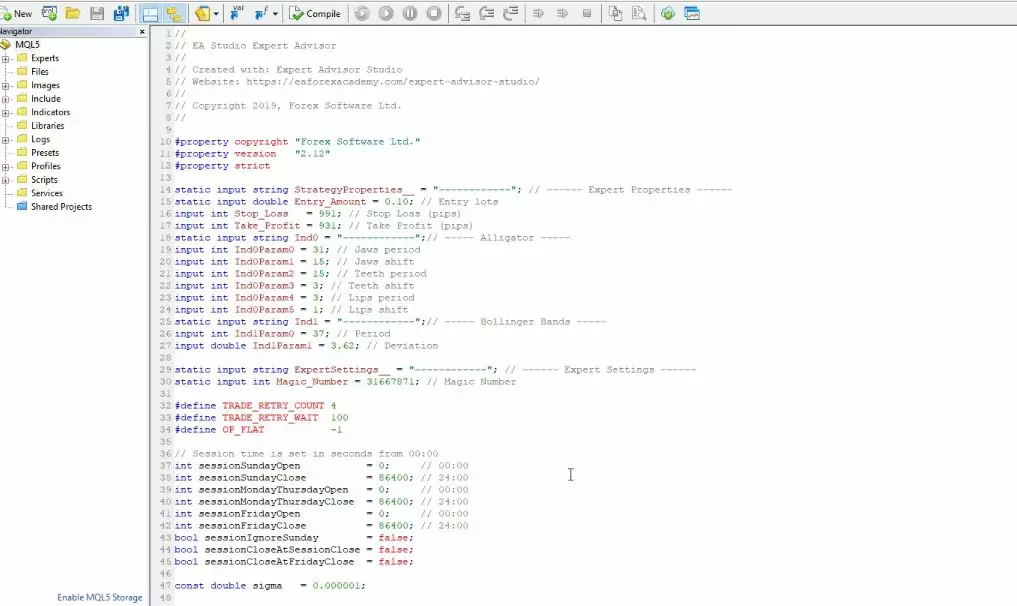

I will show you the method that I’m using so you will understand better the strategies that I will include in this course. This is simply a code where we have all the rules from the strategy.

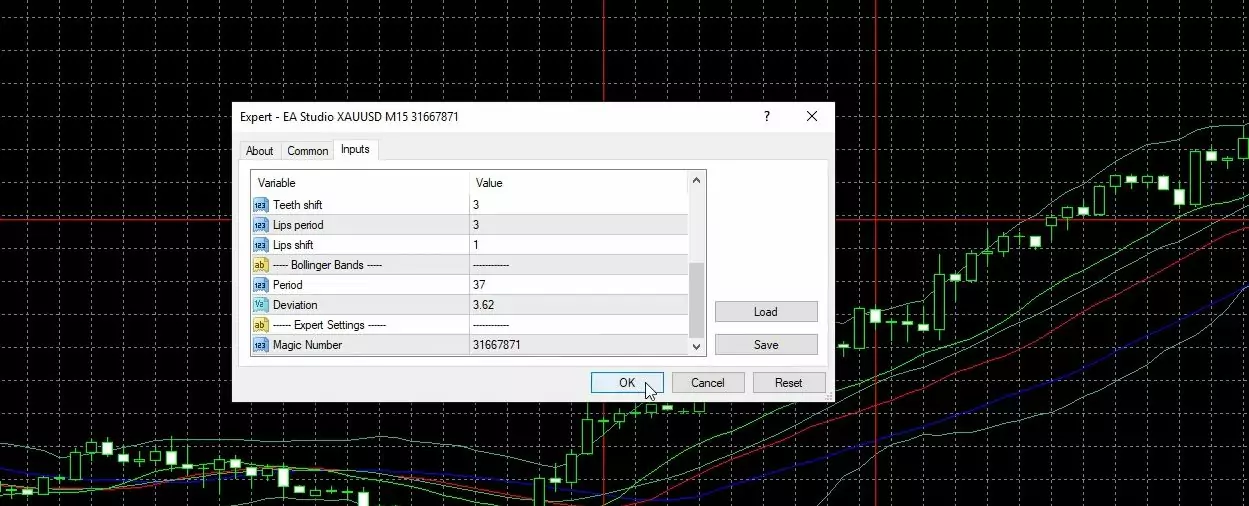

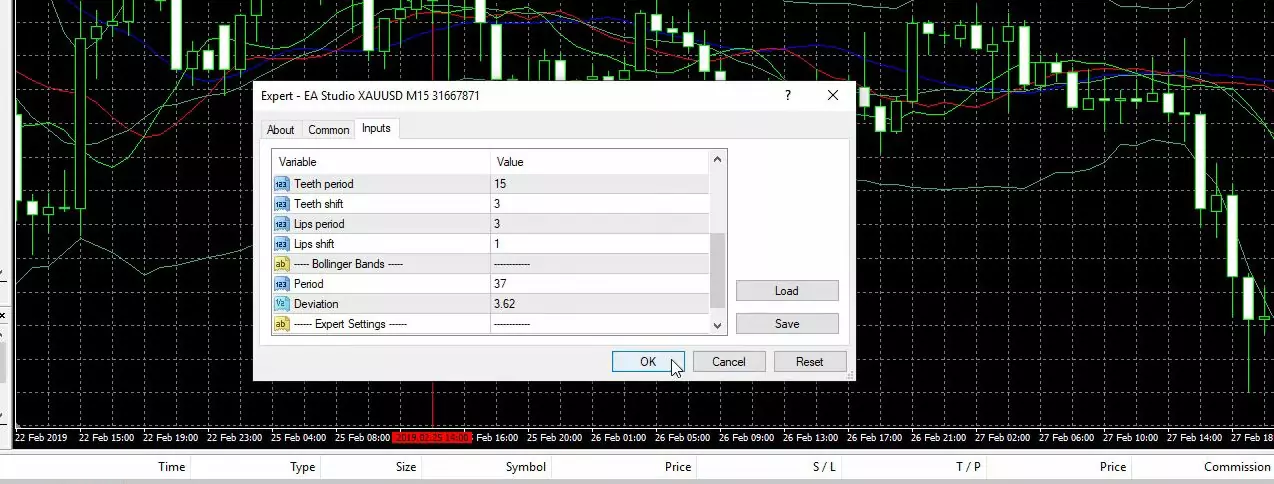

And in this case, I have exactly the strategy that I demonstrated in the course. I have the indicator alligator with the jaws, the teeth, the lips, which was my entry condition. And we have the Bollinger Bands right over here which was our exit condition.

We have the Stop Loss and the Take Profit of the strategy. And below, you can see is the code for the complete strategy which is something that I really don’t understand because I’m not a developer. But I don’t need to do it because I have it as a ready Expert Advisor.

You don’t need programming skills to code an Expert Advisor.

And as well, the strategies that I include in this course, I provide with ready Expert Advisors. The code will be ready without any mistakes or errors. So you can test those strategies by yourself and you don’t need to have any programming skills or any experience in coding Expert Advisors.

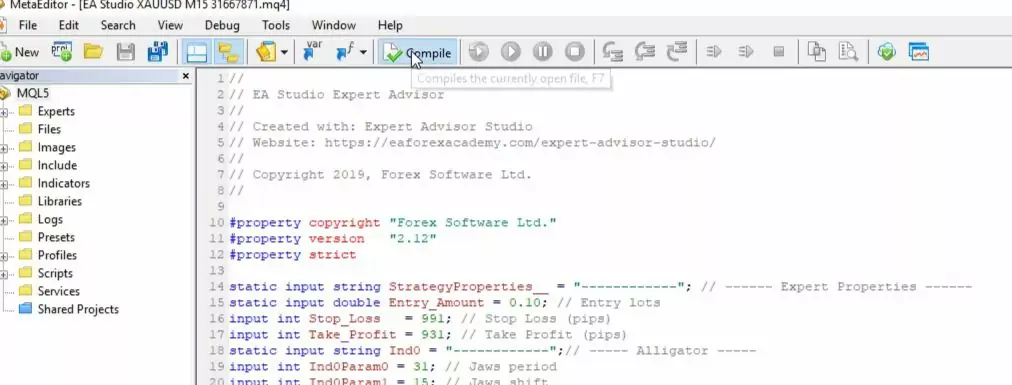

Now, how do we put this code on the Meta Trader? First, we need to compile it

which changes this code to a Trading Robot, we can say, or to a file that we can attach to the Meta Trader platform.

What is Expert Advisor? A code for trading strategy.

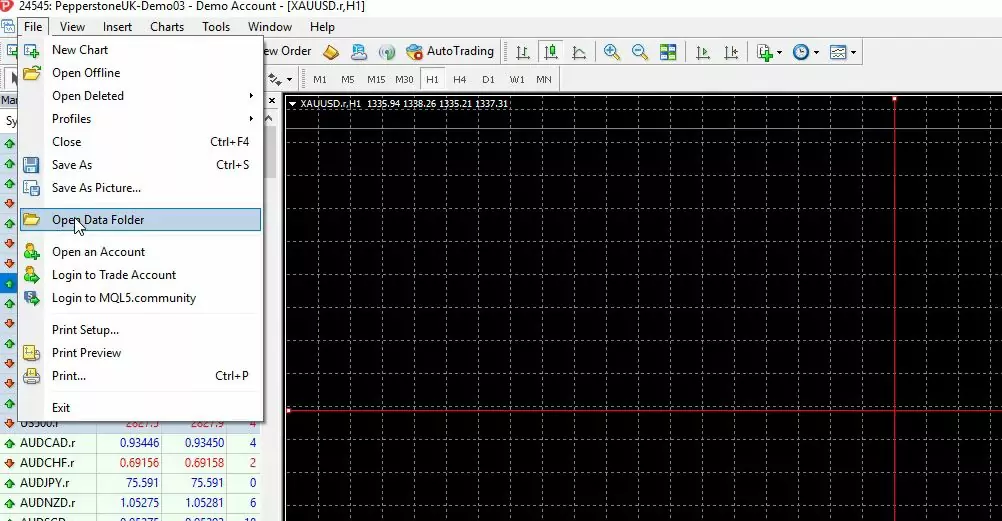

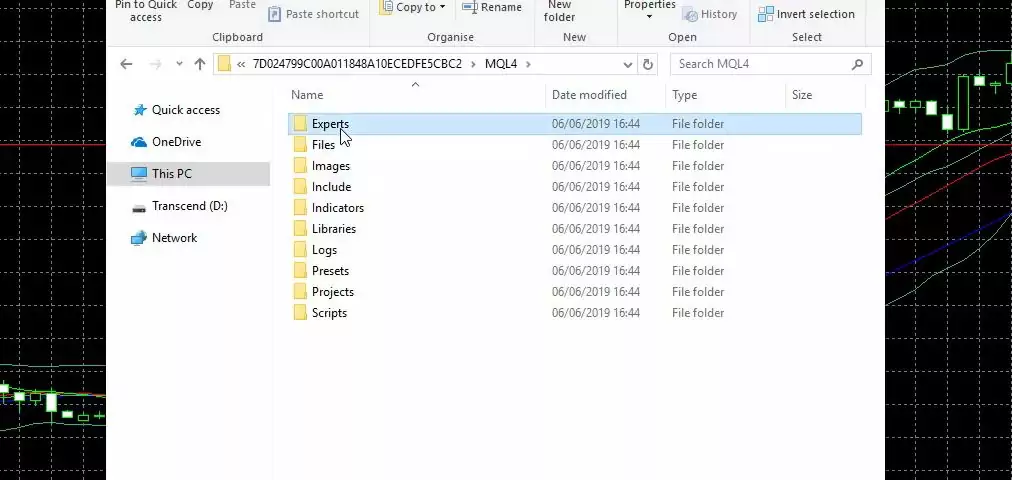

So now I will go to File, Open Data Folder,

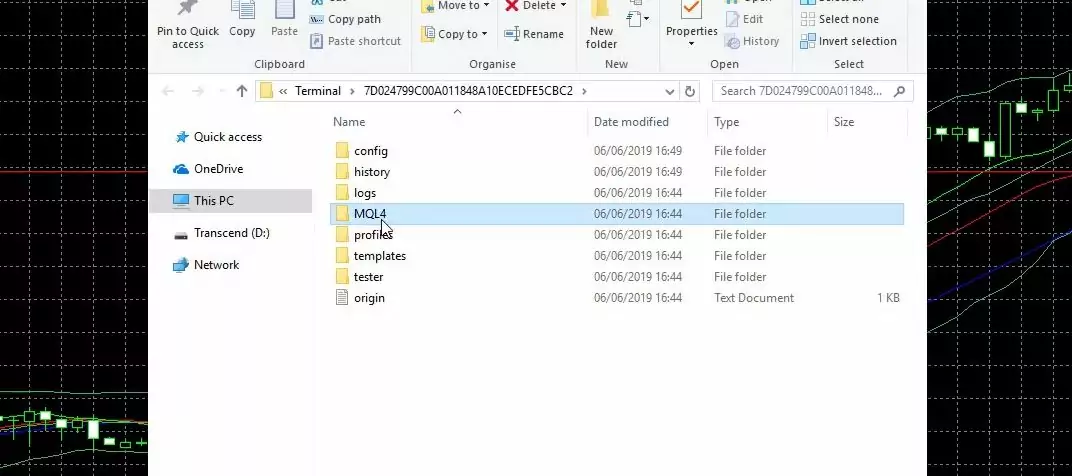

and I will go to MQL4,

and I will go to Experts.

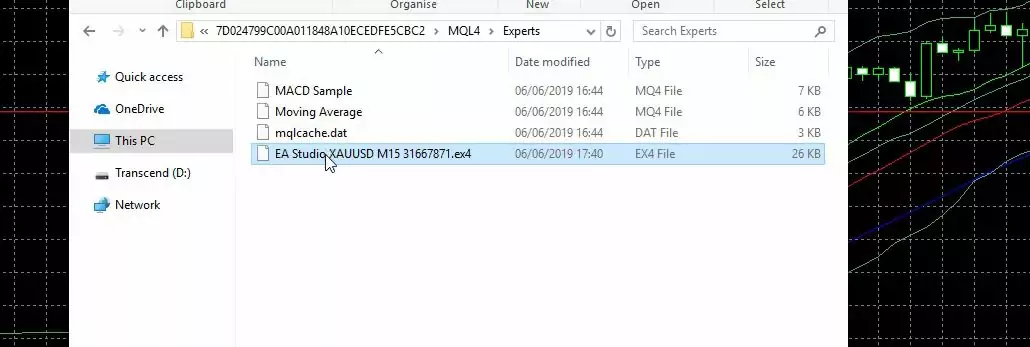

I will paste the compiled file here which is the ex4 file

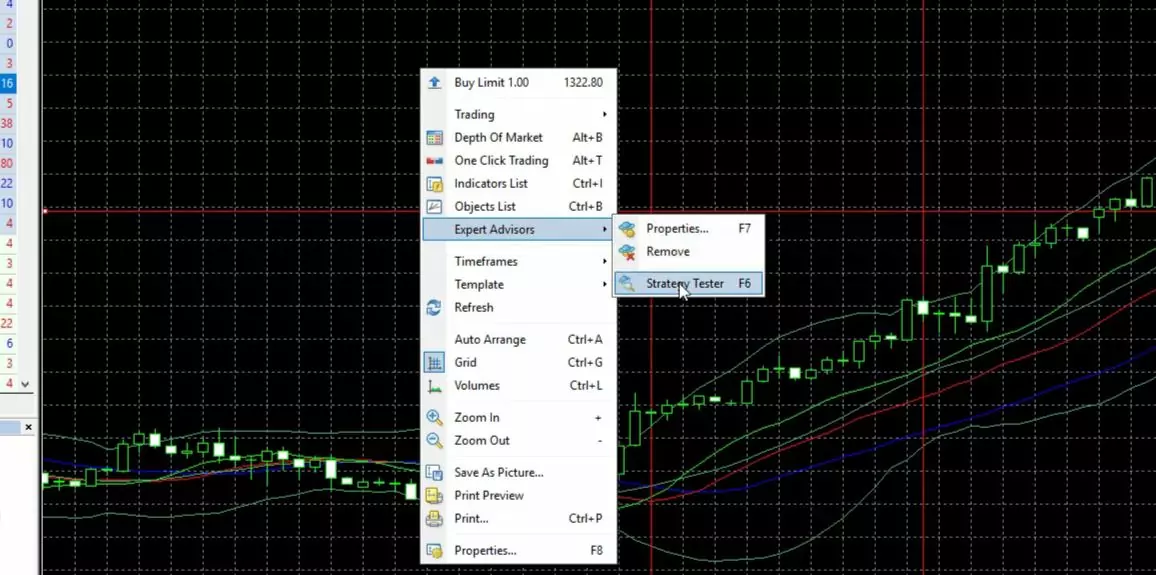

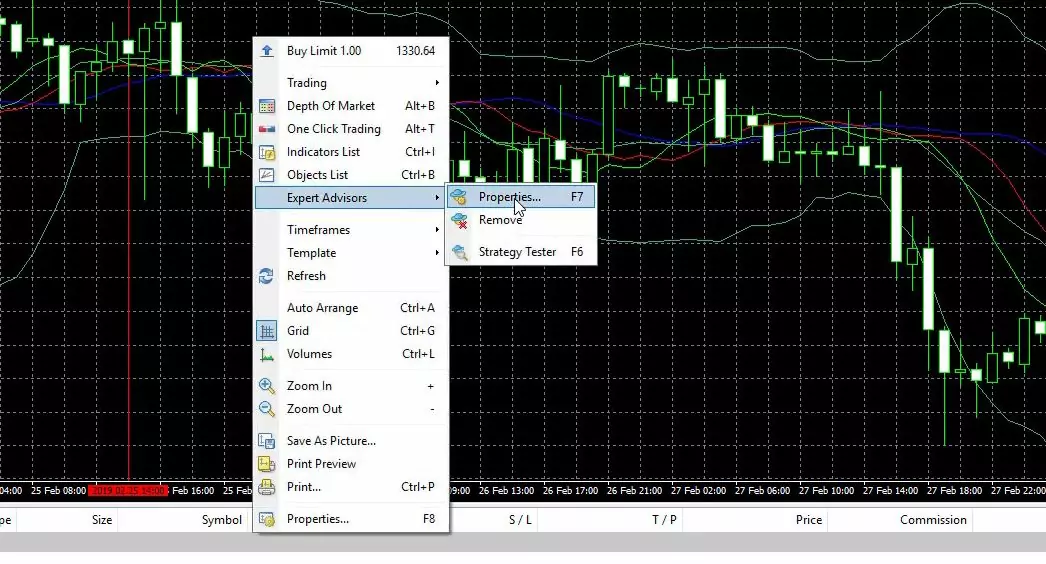

and I will close this folder. Then I will go to Expert Advisors and I will refresh

and it should display below, right here.

What is Expert Advisor Auto Trading in MetaTrader?

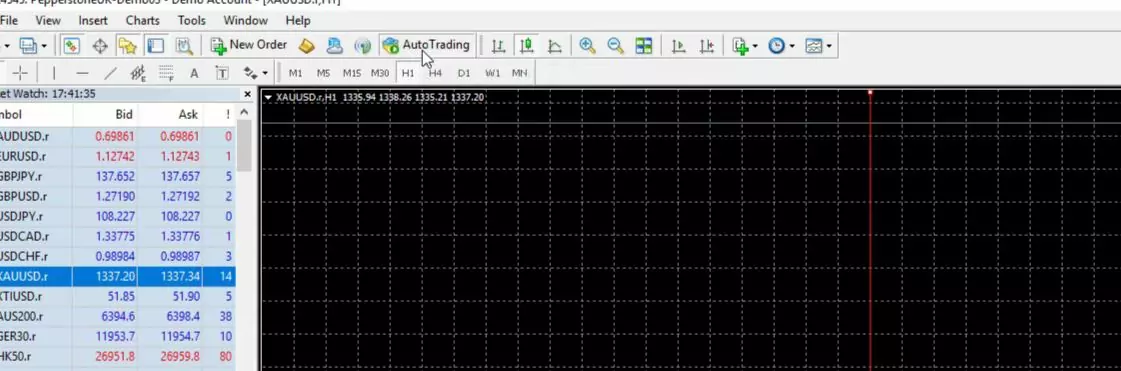

Now, in order to enable the trading with Expert Advisors, I need to enable the AutoTrading.

But right now I am not going to trade with this Robot. I just want to show you how to place it over the chart. So I just drag it and here comes the menu with all the inputs that I have for the indicators for the alligator, for the Bollinger Band.

Enable auto-trading.

And if I click on OK, it will be on the chart.

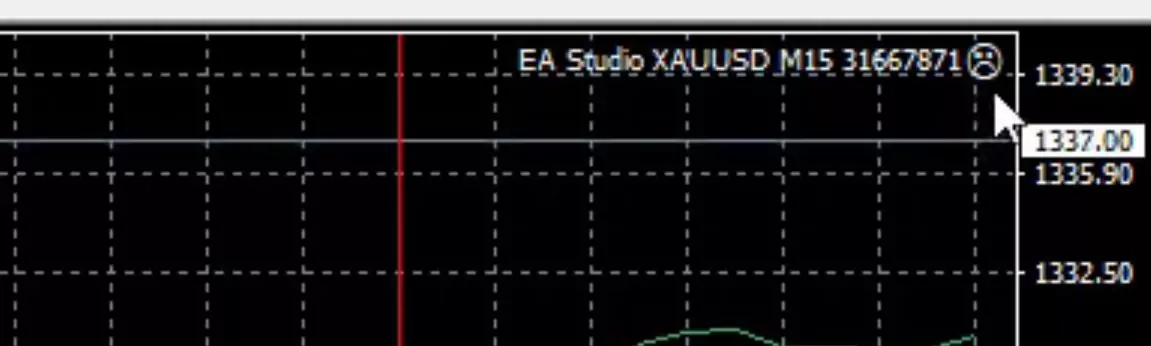

But on the right upper corner, you can see that we have a sad face.

Which means that the AutoTrading is not enabled. But we can perform a backtest which means we will see how this strategy behaved in the past and what result it had.

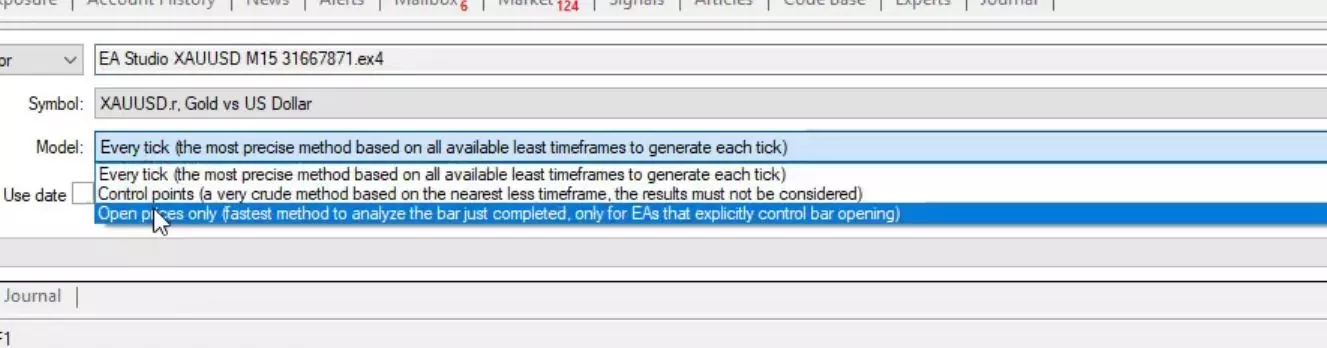

So now I have here the gold versus the American dollar. It is H1 chart. I will use the current spread. As a model, I will use open prices only.

So as we said, the strategy here looks for a bar opening above the upper band of the Bollinger Band.

Whenever the new bar opens, we check if the entry condition is there or not. And I click on start, you will notice how quick is the backtest. And we have here the results which are the results of the backtest. So we can see each trade in the past.

What is Expert Advisor balance?

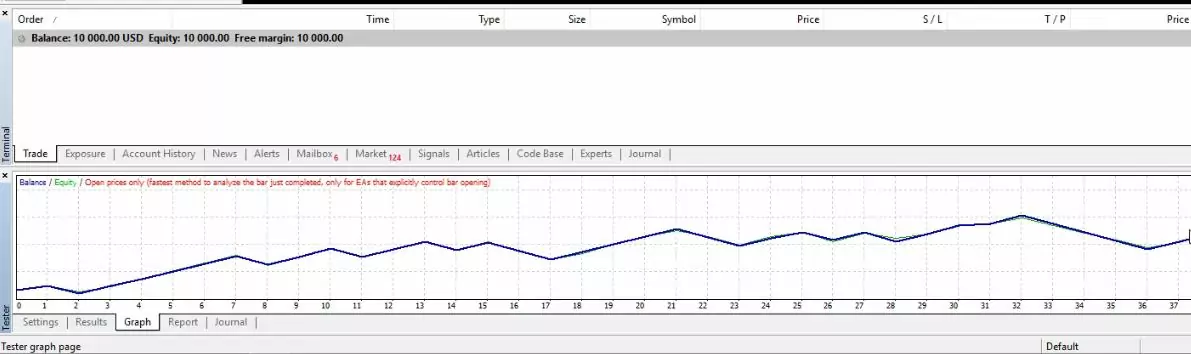

We have a graph that is pretty normal and stable for an Expert Advisor.

Now, I really prefer having such equity lines with the Expert Advisors and the strategies because these are the so-called robust strategies. If you see this perfect line when making a backtest, normally this strategy is fitted to the backtested period.

The journal.

And the sellers of Expert Advisors normally try to have strategies that have these great backtest line. But normally, these strategies fail in the future. Then we have a report.

In the end, we have the journal where we normally look for some errors or mistakes that happened when trading with the Expert Advisor. And now I have only 50 trades. And if you look at the graph, this is above 50 trades.

So I believe I have about 2, 3 months or a little bit more. If I shift to the end of the chart, or to the beginning, or I can press the HOME key, I have it since the 31st of January, 2019. So it’s about 4 months and this is the result of the last 4 months.

In the Gold trading course, I will show you how to get more bars from your broker in order to have a better backtest. And especially I need that when I generate strategies and when I create strategies and Expert Advisors. Because the more bars we have, the more historical data we have from the broker, the more count of trades we will have in our backtest.

What is Expert Advisor trading and manual trading?

And the more count of trades we have in our backtest, the more reliable it is. Because we really want to see a backtest with many trades, not just 5, 10 trades or something like that. If a strategy was profitable only in 5, 10 trades in the past, obviously we cannot rely on it for the future. We want to see more trades.

This is why we need to have more historical data from the broker and I will show you how to do that. So the difference when we have Expert Advisor and manual trading is just a proof for us if this strategy was profitable. If we do this manually going back on the chart, it will be very hard for us to decide if the strategy is profitable or not.

Because we will need to put some vertical lines, to say this was the entry, now here we will enter short, here we will enter long. But when did we start actually? At what point?

And when we do a backtest with the Expert Advisor, the difference is that we see how the strategy performed the whole time. From the whole data that we have from the broker. It doesn’t matter if it was at night or during the day.

We see what strategy parameters to use when trading with Expert Advisors.

Simply we see for all bars or for all candlesticks with these indicators, what the result is. In this example, we see that this strategy was profitable. And when we trade with Expert Advisors, we can see what parameters to use for our strategy.

And normally, we don’t choose the default parameters. So, for example, you can see here the alligator, we have jaws, period of 31, we have shift as well. Teeth period of 15, shift as well right here. And lips period.

The Bollinger Band, 37 and 3.62 of deviation.

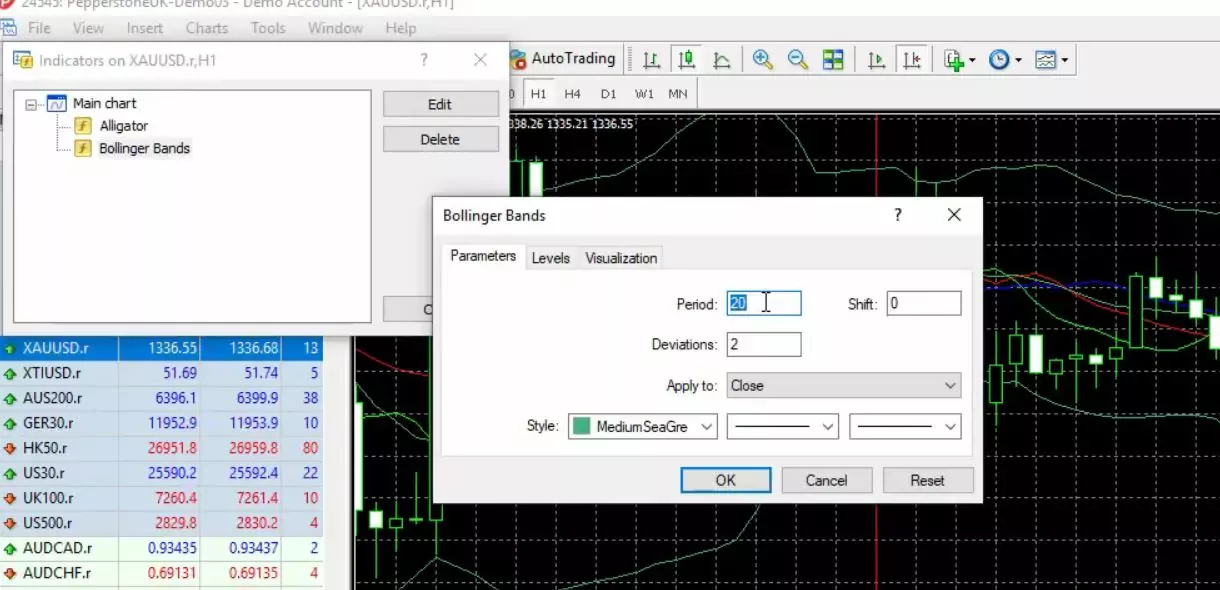

And, for example, you can see the indicators, how they come by default. If I click on edit, the Bollinger Band comes with period of 20 and deviation of 2.

And imagine if we want to trade manually all the different combinations, to test it with 20 and then with 21 and then you test it for a couple of months and you see that it’s not profitable, then you will decrease the deviation, for example, to 1.5. And then you will go to the other indicator and you will get really frustrated.

The advantage of using Expert Advisor.

And even having a look at the indicators chart and especially back in time you cannot really understand when exactly you should open the trade when there was the exit condition. Because keep in mind that the indicators are repeating. What we see right now is not what happened in the past.

Because the indicators move after the price, they are lagging. This is very important but many people, especially beginner traders, don’t understand that. What happens right now, we will see the indicator a little bit different. Now, if the price drops, the Bollinger band will open and we will see the value of the Bollinger Band different after some time.

Because it follows the price like what we see right here. So this is why I don’t like to give examples back in time and to give examples over the chart because it could be very misleading. But while we are trading with Expert Advisors, we actually see what is the result in detail.

These are the benefits that we have with the Expert Advisors, a much more precise backtest and we can see if actually this strategy was profitable so far or not.

If you want to learn more about what is Expert Advisor, have a look at the course Top 5 Gold Expert Advisors in 2020 + 10 EAs included

Thank you for reading and I will continue with the next lecture.

Cheers.