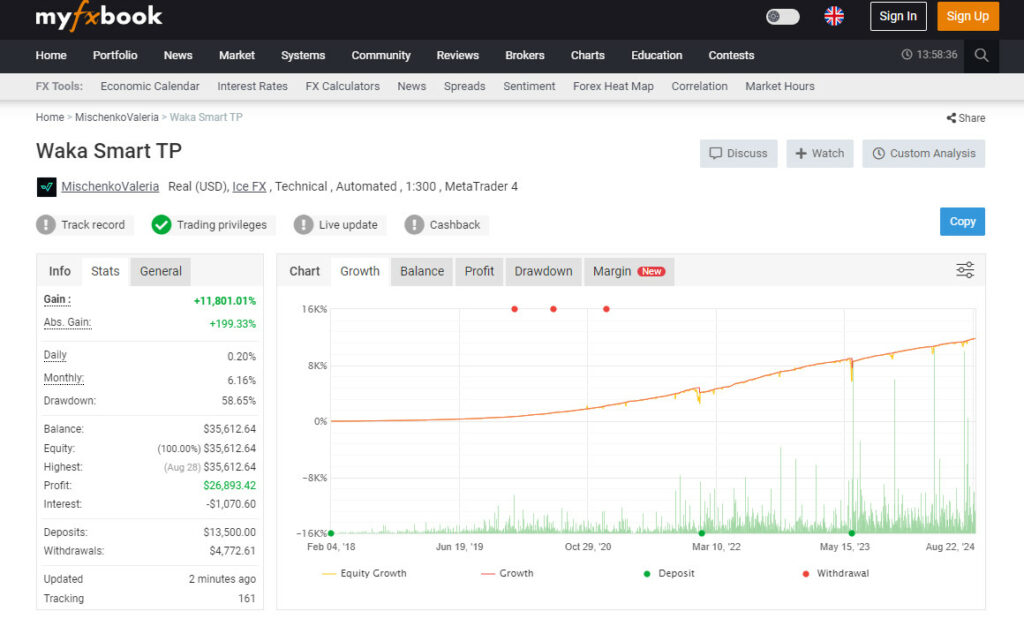

Can a fully automated trading robot really make over 11,000% profit? This is the claim that the developer of the Waka Waka EA makes. After extensive research and testing, the claims appear to be true. In this Waka Waka EA Review, I will share my personal experience with Waka Waka. What it is all about, its performance in my account as well as the developer’s, and explain why it might just be the best robot for Forex trading.

What is Waka Waka EA?

Waka Waka EA is an advanced trading robot that has been on the market for several years. It is designed to trade the less popular currency pairs such as AUDCAD, AUDNZD, and NZDCAD on the M15 time frame. It was created by Valeria Mishchenko and works on both the Metatrader 4 and Metatrader 5 platforms. It’s particularly known for it’s consistent and steady profits and for holding the record for the most consecutive months on profit.

Simple Installation and Setup

One advantage of Waka Waka EA is its straightforward installation process. The download includes installation and setup instructions. The EA works on the M15 chart. It is highly recommended for trading the Aussie Dollar, New Zealand Dollar, and Canadian Dollar pairs. You can fine-tune the settings to match your risk appetite. Because it is a grid trading system, it’s advisable to trade cautiously to protect your capital in the event of a long move in the direction opposite to your trades.

Proven Track Record

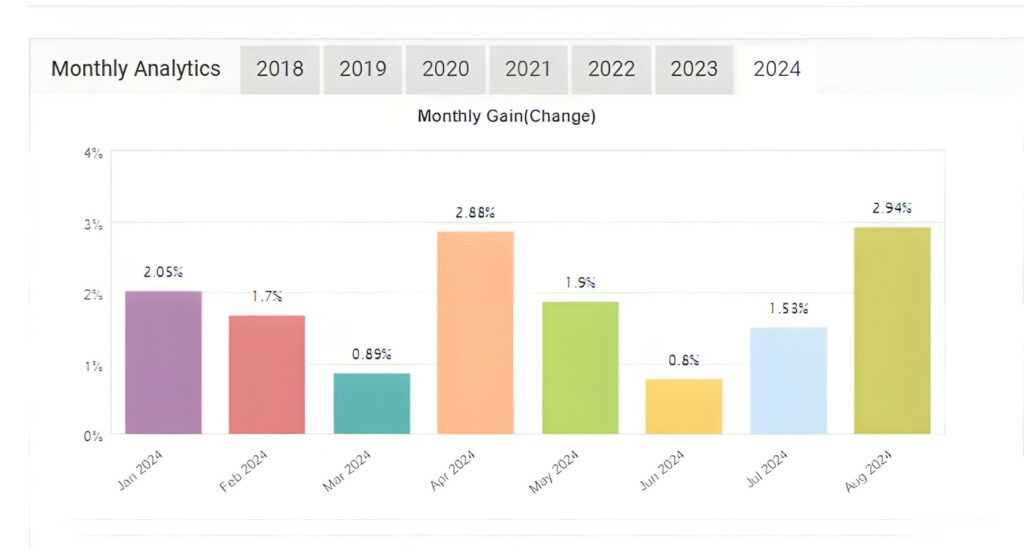

What truly sets Waka Waka EA apart is its verified track record on MyFXBook. The EA has shown consistent profits in the developer’s account for over 6 years, starting from February 2018. At the time of writing this post, the EA has gained over 11,500% in profit. Except for 1 unprofitable month, every month since February 2018 has closed on a profit.

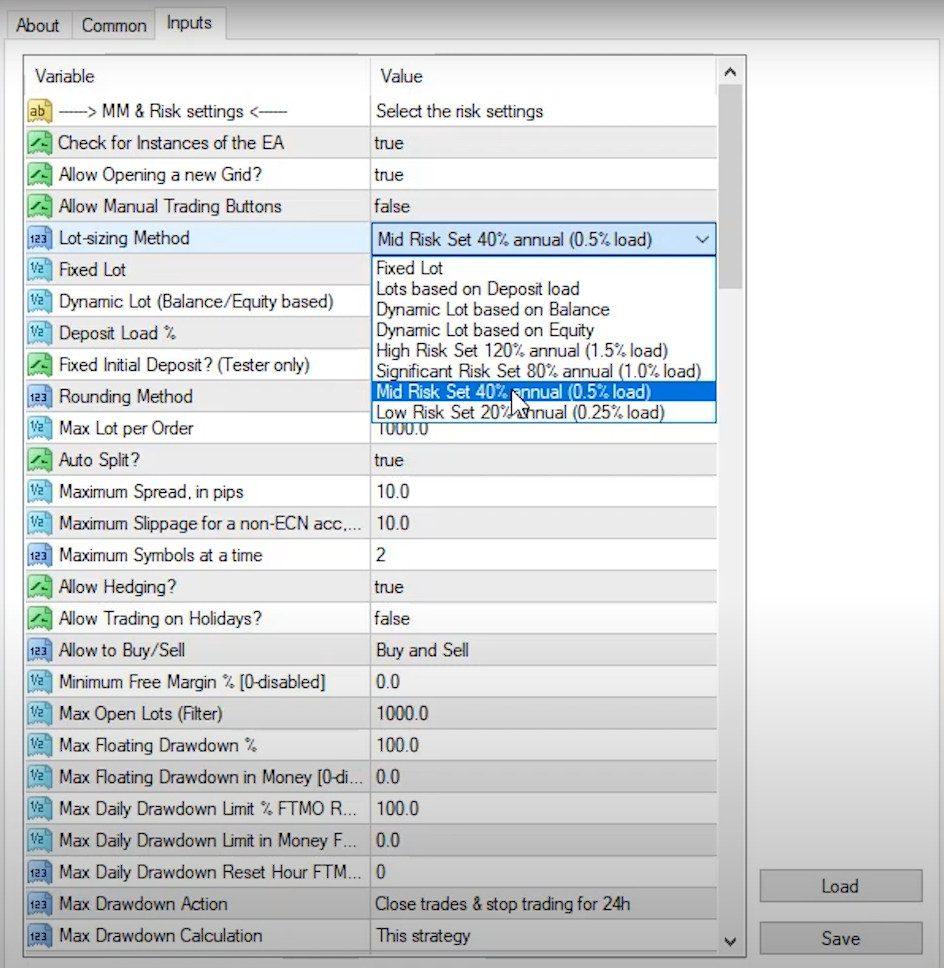

Waka Waka EA Review: Ease of Use and Customization

As mentioned above, one of Waka Waka EA’s advantages is its ease of installation. Traders can customize the risk settings according to their preferences, making it suitable for traders with differing risk appetites. Personally, I prefer to trade low-risk, and I aim for 2 – 3% per month. One trader reported profits of 436% in a year, which is truly incredible, but equally risky. Waka Waka EA offers several input options, including lot sizing methods and risk levels. Traders can choose between low and mid-risk settings, depending on their profitability goals. The flexibility to adjust these settings allows traders to align the EA’s performance with their specific trading strategy.

Selecting the Right Broker

As with any trading strategy or robot, it is crucial to have a trading account with a regulated broker that offers the best possible trading conditions. These include tight spreads, low or no commissions, easy withdrawals and good customer support. If you don’t already have an account, check out the brokers we’re using in the Academy. If you plan to trade with Waka Waka, Metatrader 4 or 5 is required, and is offered free of charge by most brokers.

Testing Waka Waka EA Before Going Live

Before using Waka Waka, or any EA on a live account, it’s crucial to test it thoroughly on a demo account. Regulated brokers will almost always have this option for you, and it allows you test the robot in a variety of conditions and with different settings to find the option that suits you best. Open a demo account with the same balance you plan on trading with in your live account, so you can simulate you planned live trading as accurately as possible. The Waka Waka EA also has a free 14 trial available, so you really can test it risk-free. More on this later.

Waka Waka EA Review: In-Depth Analysis of Indicators and Risk Management

While the secret behind the Waka Waka is…well a secret, it includes a combination of advanced technical indicators and parameters to enter and exit trades. These include standard deviation, RSI (Relative Strength Index), and ADR (Average Daily Range), twice, with different parameters. The EA uses a grid system that adds new positions whenever the price moves against the initial trade, with the goal of improving the average price. The strategy aims to hit the take-profit level once the price recovers. Grid systems are inherently risky, so setting it up correctly is crucial.

Risk Management Features

Risk management is a critical aspect of Waka Waka EA’s design. The EA allows traders to set maximum drawdown limits, ensuring that trading stops if losses exceed a certain threshold. This feature is particularly important for traders who are risk-averse, prefer controlling losses, and those trading in environments with drawdown limits, like prop firm challenges, where exceeding the limit can result in losing the account.

Waka Waka EA Review: Real Account Application and Live Trading Results

To really put the Waka Waka EA to the test, I installed it on a few of my accounts, including a $3000 live account and several FTMO funded accounts. The performance has been as expected with a steady 1 – 3% per month. While many newbie traders believe this is a too small and not worth the effort, I disagree. A steady 2 – 3% per month equates to 24 – 36% per year, which by any standard is a solid investment. There are of course EAs, including this one, that can yield much higher returns, but the risk exposure is equally higher, and at least for me, not aligned to my long-term trading goals

Expanding Possibilities with Multiple Accounts

One of the significant advantages of purchasing Waka Waka EA is the ability to use it on multiple accounts simultaneously. The EA provides 10 licenses, allowing traders to trade with different risks in their different accounts. This is very useful if you plan to use the Waka Waka on a live account and a few funded accounts, for example. Getting multiple licenses really gives you more flexibility and changes the value considerably.

Consistent Profitability Over Time

Waka Waka EA’s performance history is proof of its ability to generate steady profits. Looking back from 2018 to today, the EA has a remarkable track record with almost no losing months. Its consistent growth of around 1% – 3% per month (using conservative settings more recently) works well within the requirements of funded accounts. This makes it an great choice for traders looking to grow their accounts steadily over time. This is in line wit the results I’ve been achieving in my live account.

Leverage Requirements

As with all grid trading systems, a higher leverage is recommended, and often, required. With grid trading, when the market moves against you, instead of closing the losing trade, the EA opens another trade, often in the same direction as the previous trades, at a new price level. The idea is that when the market eventually moves back in your favor, all those trades will close on profit.

As the market keeps moving against your initial trade, the system opens more trades, which means you’re using more and more of your available money to keep these trades open. Without higher leverage, you’d run out of money (or “margin”) to keep opening these new trades. Leverage from your broker lets you trade with a larger amount of money than you’ve actually deposited into your account. This means that even as the grid-based EA adds more trades, you can continue trading without getting stopped out. This process helps you avoid a margin call, which would otherwise occur if your account’s equity falls below the required margin level.

But, and this is a big but, this also means there’s a higher risk of blowing your account if the market doesn’t turn around before there is a margin call. Higher leverage gives the EA some flexibility to withstand the move against you. But it also increases the risk, which is why it’s crucial to use it carefully. Your settings are critical to protect your account while staying profitable.

This also means that not all accounts are suitable for the Waka Waka to perform at it’s best, and it’s a factor that needs to be taken into account. Some brokers offer a maximum leverage of 1:30 which would limit the performance of the Waka Waka.

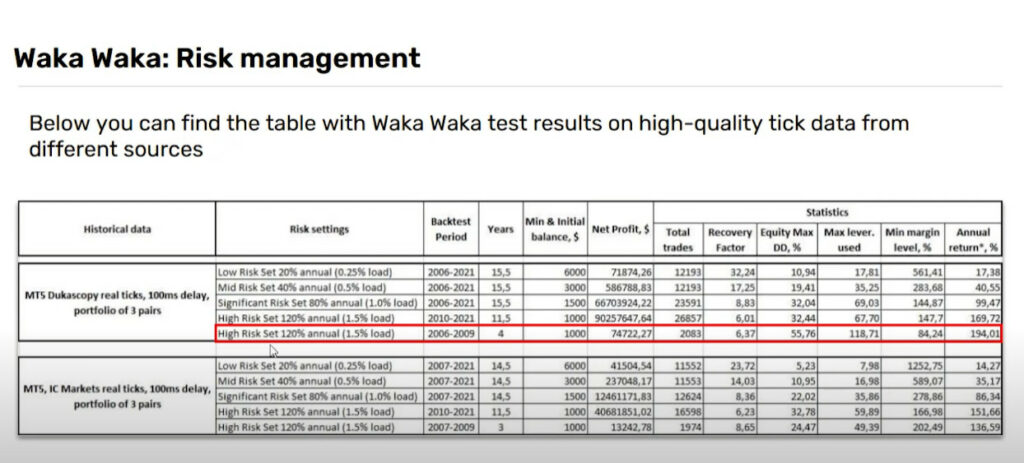

Understanding Risk and Drawdown

The included guide provided with Waka Waka EA, provides valuable information on risk management. The guide includes a table that suggests the minimum account balance for different risk settings.This helps traders choose the most suitable risk level based on their goals and risk tolerance. As with all aspects of trading, balance is key. The drawdown, or maximum equity drawdown, is a setting that protects the trader against a loss that they may not be able to recover from, and as such, should be carefully considered. And again, testing this and all other settings is best done on a demo account with no risk.

Waka Waka EA Review: Why Choose Waka Waka EA?

There are several reasons why Waka Waka EA is one of the most popular Expert Advisors (EAs) available on the market today.

Sophisticated Trading Strategy

Waka Waka EA uses an advanced algorithm combining technical and fundamental analysis to identify trading opportunities. It doesn’t just rely on quick profits but focuses on long-term stable growth. The EA’s strategy is designed to take advantage of opportunities in the market, allowing it to trade in all kind of market conditions successfully.

How Much Could You Make with Waka Waka EA?

This depends on many factors discussed throughout the post. As mentioned several times, settings, broker choice, your deposit amount, leverage and your risk tolerance are the determining factors. And of course, market conditions. While traders like me prefer a more conservative, long-term view aiming for 2% – 3% per month, the more aggressive trader will put it all on the line, and aim for 20, 30 or even 50% per month. While it is possible to achieve these kinds of returns, the risks are exponentially higher.

Constant Updates and Support

The developer of Waka Waka EA is committed to maintaining its performance. The EA is regularly updated to ensure it remains effective under changing market conditions. Additionally, the exclusive Telegram group provides a place for users to share their experiences and get support directly from the developer. There is also a dedicated support section on the developer’s website with the most commonly asked questions ranging from how to install the EA onto your preferred platform to dealing with licensing errors.

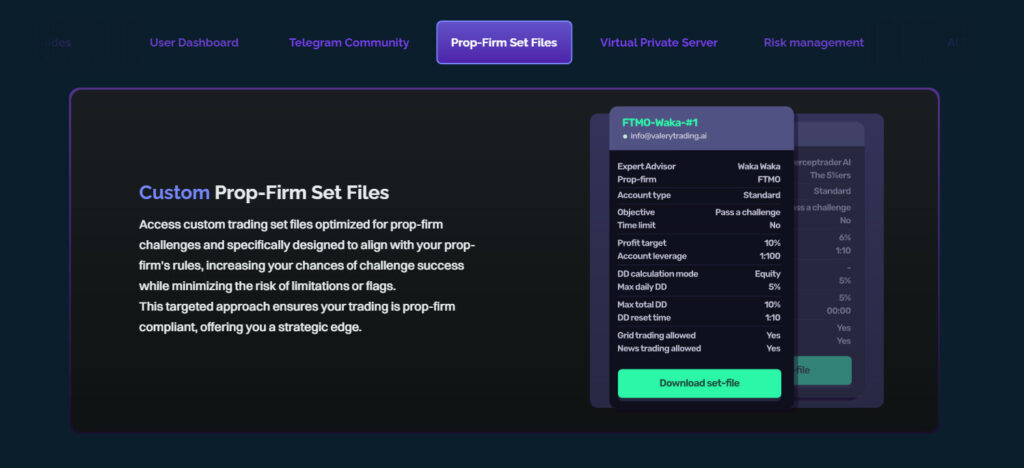

In addition to the community support, users can also request a custom set file that is suited to their particular trading style and goals. This is in an of itself a massive advantage and can save a trader months of testing to find the right settings.

Waka Waka EA Review: About the Developer

The developer behind Waka Waka EA is a top-ranked MQL developer and has created some of the best-performing MetaTrader EAs on the market. With over 13 years of experience in retail trading and a proven track record, the developer has created sold thousands of copies of various EAs with different strategies and suitable for different assets and markets. Moreover, she has received hundreds of 5-star reviews from customers around the world. This experience has allowed her to create and continuously update the Waka Waka EA with the most current parameters to keep the winning record going.

How to Get Started with Waka Waka EA

After buying a permanent license, you will receive the MetaTrader files and a step-by-step guide via email and access to your user dashboard. The installation process is simple: install Waka Waka on your MetaTrader 4 or 5 terminal following the prompts, activate your license, enable Auto or Algo Trading on your platform and drag Waka Waka onto your trading charts. Be sure you have selected the correct assets and time frames (M15). If you have received a custom set file, load it. From there, the EA will open and close trades fully automatically. It is of course important to keep an eye on your account and make any adjustments you’d like to.

I’ve mentioned this before, but I can’t mention it enough. Run the Waka Waka on a demo account first. Even as an experienced trader with more than a decade of trading under my belt, every time I trade with a new EA, or with new settings, I ALWAYS test it on a demo account first.

Money-Back Guarantee

Even after a 14 day trial, The developer of Waka Waka EA is includes a 100% money-back guarantee. If you are not satisfied with Waka Waka, the developer promises to refund every cent you paid, no questions asked, within 30 days of purchase. This is unusual in the industry. EA developers usually offer a 7-day conditional refund, or in most cases, no refund option at all. What this means is that between the 14-day trial and 30-day refund policy, you get 6 weeks to trade with the Waka Waka EA, risk-free.

Conclusion: The Final Verdict on Waka Waka EA

If you’re looking for a reliable and proven automated trading solution, the Waka Waka EA could be a great option for you. With its record-breaking performance, extensive risk management features, community and developer support, he Waka Waka EA offers more than most other EAs. Slow and steady profits, or aggressive, risky trading. The choice is yours. The combination of a proven track record, continuous updates, and a money-back guarantee makes it an investment option with the potential for high rewards.