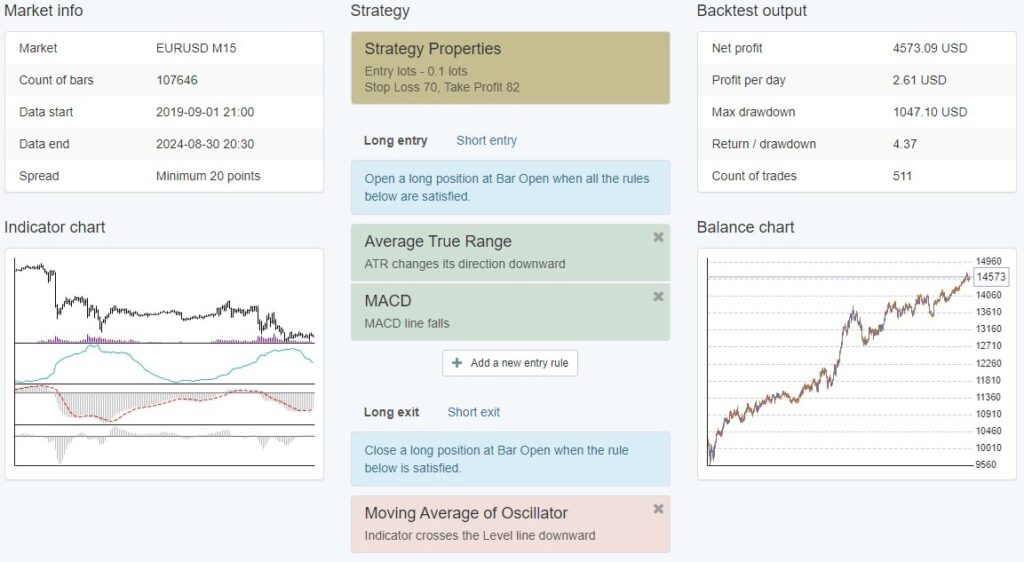

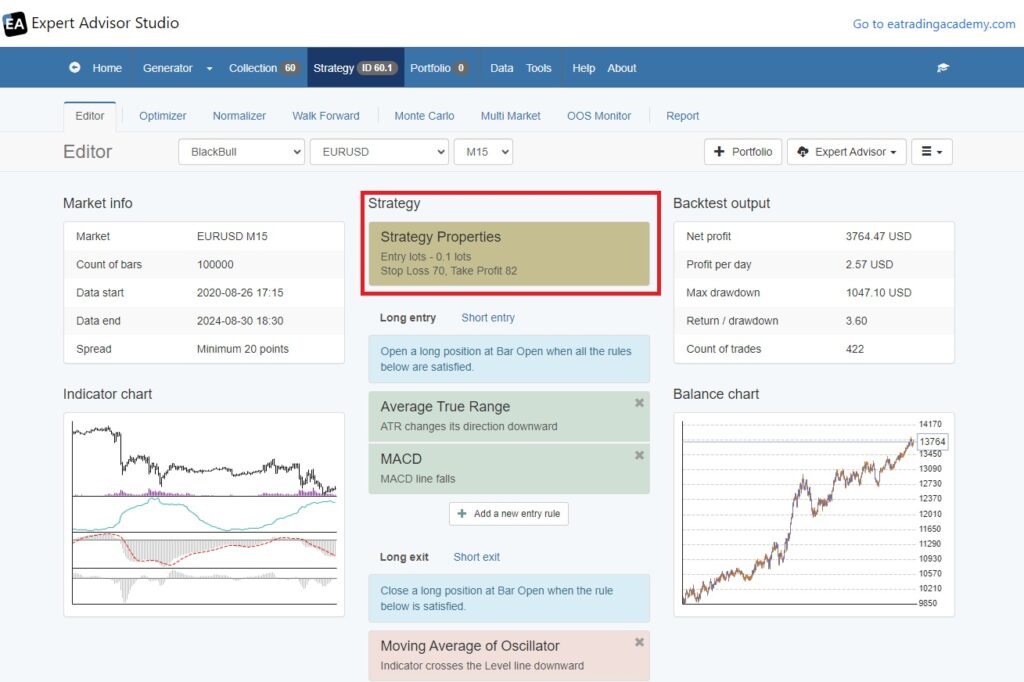

To find a reliable and profitable trading robot can be challenging. That’s why here, at EA Trading Academy, we worked hard to make sure you guys are equipped with the best possible trading solutions. And we created the Top 10 Robots App. A software where we test and present only the most reliable and effective trading bots. So we decided to show you more in depth and analyze one of the apps trading strategies. A trend following expert advisor. It is a specialized trading strategy designed to operate on the EUR/USD currency pair using the M15 (15-minute) timeframe. This review will explore the core components of this trend following EA, including its strategy logic, the indicators it employs, and its effectiveness in the forex market.

Trading Strategy Overview

This trading robot is a sophisticated automated trading system tailored for short-term trading on the EUR/USD currency pair. It operates on the 15-minute timeframe, and it is structured to identify and capitalize on market trends. The trend following EA combines several technical indicators that collectively generate precise trading signals. The strategy is built around the principle of trend-following. It aims to enter trades that align with the prevailing market direction and momentum.

The robot integrates a robust risk management framework, which is critical for protecting capital in the volatile forex market. With fixed parameters for Stop Loss and Take Profit, the strategy ensures that every trade is executed with a clear risk-to-reward ratio. The primary goal of this Trend Following EA is to provide a disciplined trading approach that minimizes risk while maximizing potential returns.

The strategy’s reliance on technical indicators ensures that trade decisions are data-driven, reducing the likelihood of emotional or impulsive trades. In summary, the trend following EA is designed to offer traders a systematic and reliable method of engaging with the forex market, with an emphasis on trend identification and risk management.

Table of Contents:

Key Parameters of the Trend Following EA

We want to ensure consistency and discipline in its approach. So the strategy operates with a set of predefined parameters that govern its trading behavior. These parameters are crucial for managing risk and defining the strategy’s potential profitability. The two primary parameters are the Entry Amount and the Stop Loss and Take Profit levels.

Entry Amount

This trend following EA uses a fixed lot size of 0.10 lots for each trade. This standardized position size is essential for maintaining a consistent level of risk across all trades. This way, the strategy ensures that the potential risk and reward of each trade are predictable. This is vital for effective risk management. This approach also simplifies the trading process. Traders do not need to adjust their position size based on changing market conditions or account balance.

The fixed lot size is particularly important in a trend-following strategy, where the objective is to capture large price movements over time. By keeping the lot size consistent, the EA can systematically exploit these movements without exposing the trading account to excessive risk.

Stop Loss and Take Profit

Risk management is at the heart of the trading strategy. The trend following EA implements a Stop Loss of 70 pips and a Take Profit level of 82 pips. These fixed levels are here to provide a clear risk-to-reward ratio, where the potential reward slightly outweighs the potential risk.

The Stop Loss is set to limit the downside of any trade. It ensures that losses are capped at a manageable level. This is particularly important in the volatile forex market, where price movements can be unpredictable. The Take Profit level, on the other hand, is designed to lock in profits once the market moves in favor of the trade. By setting a Take Profit level that is slightly higher than the Stop Loss, the strategy aims to achieve a positive expectancy over the long term.

Together, these parameters form the backbone of the EA’s risk management framework. They make sure that each trade is executed with a clear plan for both loss limitation and profit realization.

Entry Amount: entry lot size of 0.10 lots.

Stop Loss and Take Profit:

Indicators Used by the Trend Following EA

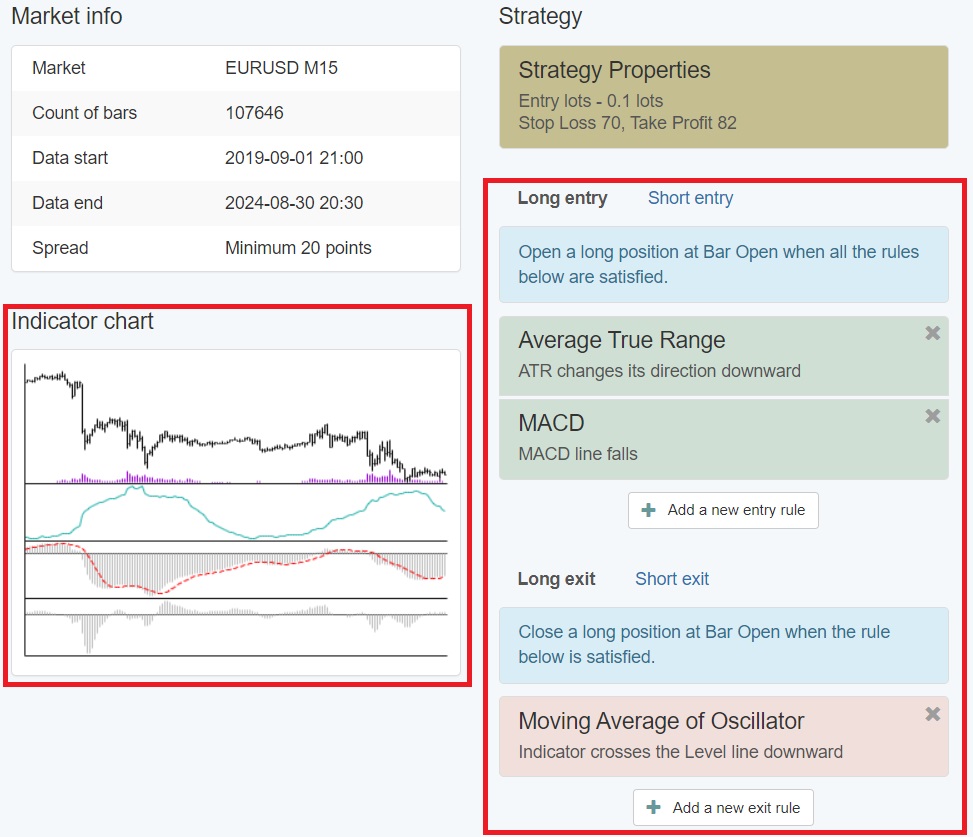

The effectiveness of this strategy largely depends on the technical indicators it uses to generate trading signals. These indicators are carefully selected to complement each other. They provide a comprehensive view of market conditions, including trend direction, momentum, and volatility. The three primary indicators used in this trend following strategy are the Average True Range (ATR), the Moving Average Convergence Divergence (MACD), and the Moving Average of Oscillator (OsMA).

Average True Range (ATR)

The ATR is a volatility indicator that measures the average range of price movement over a specified period. In this trend following strategy, the ATR is set with a Period of 25 and a Level of 0.0045. The ATR helps the trend following EA to determine the optimal placement of Stop Loss and Take Profit levels based on the current market volatility. By understanding the typical range of price movements, the EA can set these levels in a way that reduces the likelihood of being prematurely stopped out due to normal market fluctuations.

Moving Average Convergence Divergence (MACD)

The MACD is a momentum indicator that shows the relationship between two moving averages of a currency pair’s price. In this trend following strategy, the MACD settings are configured with a Fast EMA of 17, a Slow EMA of 44, and a MACD SMA of 9. The MACD is used to identify the strength and direction of a trend, with trade entries typically triggered when the MACD line crosses above or below the signal line. This crossover is a classic signal in trend-following strategies, indicating the start of a new trend or a potential reversal.

Moving Average of Oscillator (OsMA)

The OsMA is an extension of the MACD that further refines the trading signals by confirming trend direction and momentum. Here, the OsMA settings include a Fast EMA of 19, a Slow EMA of 44, a MACD SMA of 6, and a Level of 0.0013. The OsMA helps to validate the signals generated by the MACD. This makes sure that the trend following EA only enters trades when there is strong momentum in the direction of the trend.

By combining these three indicators, the trend following expert advisor is able to generate robust trading signals that are grounded in both trend identification and market volatility. It guarantees that each trade is based on a comprehensive analysis of current market conditions.

If you want to find out more about the Trend Following indicators in MT4 (MetaTrader4), please follow the link.

Strategy Logic behind the Trend Following EA

This trend following strategy employs a logical and systematic approach to trading. It relies on the combination of the ATR, MACD, and OsMA indicators to generate precise entry and exit signals. The strategy logic is designed to identify trends, confirm momentum, and manage risk effectively. This approach guarantees that the trend following EA operates with a clear set of rules. It reduces the influence of market noise and enhances the probability of successful trades.

Entry Signal

The entry signals in this EA are generated when the indicators align to confirm a trend with sufficient momentum. The MACD provides the initial signal. It indicates a trend change when the MACD line crosses above or below the signal line. The OsMA is then used to confirm the momentum behind this trend. It ensures that the trade is supported by strong market dynamics. Finally, the ATR verifies that the market volatility is within acceptable levels. This makes the trade viable in terms of risk management.

Long Trade Example

A long trade is triggered when the MACD line crosses above the signal line. This indicates the beginning of a bullish trend. The OsMA confirms this momentum by staying above the specified level of 0.0013. If the ATR indicates that market volatility is favorable, the EA will open a long position with a lot size of 0.10, a Stop Loss of 70 pips, and a Take Profit of 82 pips. This structured approach ensures that the trade is aligned with the prevailing market trend and that the risk is managed effectively.

Short Trade Example

Similarly, a short trade is triggered when the MACD line crosses below the signal line, signaling a bearish trend. The OsMA confirms the bearish momentum by remaining below the specified level of 0.0013. The ATR then checks that market volatility is conducive to the trade. Once these conditions are met, the EA opens a short position with a fixed lot size, Stop Loss, and Take Profit. This ensures consistency in execution and risk management.

Position Management

Position management is a critical aspect of the strategy. It ensures that trades are managed according to predefined rules that protect the trading account and maximize potential profits.

Closing Positions

Positions are closed automatically when the market price hits either the Stop Loss or Take Profit levels. The Stop Loss is set to close the trade if the market moves against it by 70 pips. This is to limit the potential loss on any single trade. Conversely, the Take Profit is set to close the trade when the market moves in favor of the trade by 82 pips. This secures the profit before the market has a chance to reverse. Such an automated approach to closing positions ensures that trades are managed objectively, without emotional interference.

Entry Protections

To further safeguard the trading process, this trend following strategy includes entry protections such as limiting the maximum spread at which trades can be opened. This prevents the trend following EA from entering trades during periods of high volatility or low liquidity, where the spread might widen and negatively impact trade execution. Additionally, this strategy limits the number of open positions and total lot size, preventing overexposure to the market and ensuring that the trading account remains within acceptable risk parameters.

Risk and Account Management

Risk and account management are fundamental components of any successful trading strategy. This strategy incorporates several layers of risk management to protect the trading account from significant losses. This helps to withstand the inherent volatility of the forex market.

While a maximum daily loss parameter is not in place here, such a feature is highly recommended. Implementing a maximum daily loss limit can help prevent substantial drawdowns in a single trading session. For example, a trader might set a daily loss limit of 3-5% of the account balance, at which point the EA would halt trading for the rest of the day if the limit is reached. This safeguard helps preserve capital and prevents the EA from continuing to trade in adverse market conditions.

Another important aspect of risk management is the use of a fixed lot size for each trade. By maintaining a consistent position size, the EA ensures that each trade carries a predictable level of risk, making it easier for traders to manage their overall exposure. This is particularly important in a trend-following strategy, where the goal is to capture large price movements while minimizing the impact of losing trades.

Additionally, the strategy includes protections such as limiting the maximum spread at which trades can be opened. This prevents the EA from entering trades during periods of high volatility or low liquidity, where the spread might widen and negatively impact trade execution. The EA also limits the number of open positions and total lot size. This prevents overexposure to the market and ensures that the trading account remains within acceptable risk parameters.

In summary, the strategy’s risk and account management features are designed to protect the trading account from significant losses, ensure consistent risk exposure, and maximize the potential for long-term profitability.

Summary of the Trend Following EA

This trend following strategy is a meticulously designed automated trading system. It combines trend-following and risk management principles to trade the EUR/USD currency pair on a 15-minute timeframe. By leveraging technical indicators such as the ATR, MACD, and OsMA, the EA is able to identify emerging trends and confirm their momentum before executing trades. This approach ensures that the EA only enters trades that align with the prevailing market direction and have a high probability of success.

The EA’s strategy is built around a fixed set of parameters, including a consistent lot size, predefined Stop Loss and Take Profit levels, and entry protections against high spreads. These features are crucial for maintaining discipline and consistency in trading, which are essential for long-term success in the forex market.

One of the key strengths of this trend following EA is its robust risk management framework. This includes protections against overexposure and the ability to set maximum daily loss limits. These features help to safeguard the trading account. Also to ensure that the EA can continue to operate effectively even in volatile market conditions.

In conclusion, this trend following Expert Advisor is a powerful tool for traders looking to automate their trading strategy and capitalize on short-term trends in the forex market. With its emphasis on trend-following, disciplined execution, and comprehensive risk management, this EA offers a systematic approach to trading that can help traders achieve consistent results over time.

Get your FREE trend following EA, using the link below.