EA Trading strategy – how to start trading with proven results

Trading strategies and their creation are among the hardest things for traders. No matter you are a beginner or advanced trader, trading for 1 or 10 years. The question about the Forex EA strategy is always the same. Do I have an EA trading strategy that I can depend on in my trading?

Many traders use strategies that they have found over the internet, bought in the market place, or developed by themselves. The questions that they do not know if these trading strategies will show robustness in the future. They do not know what results this trading strategy showed in the past.

In this lecture, you will learn how Petko Aleksandrov, the head trader at EA Forex Academy, uses the professional strategy builder EA Studio to generate 100s of trading strategies. That is not the only thing. To select the best performance need some attention and techniques, which he will share in this lecture. Enjoy!

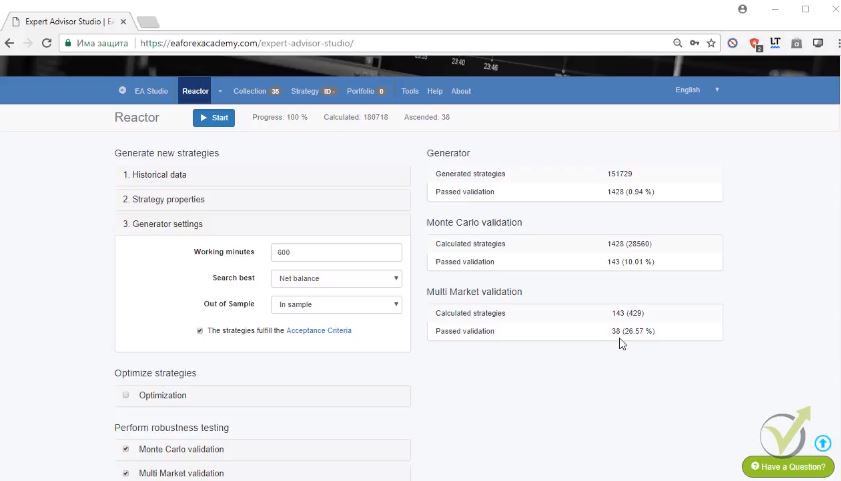

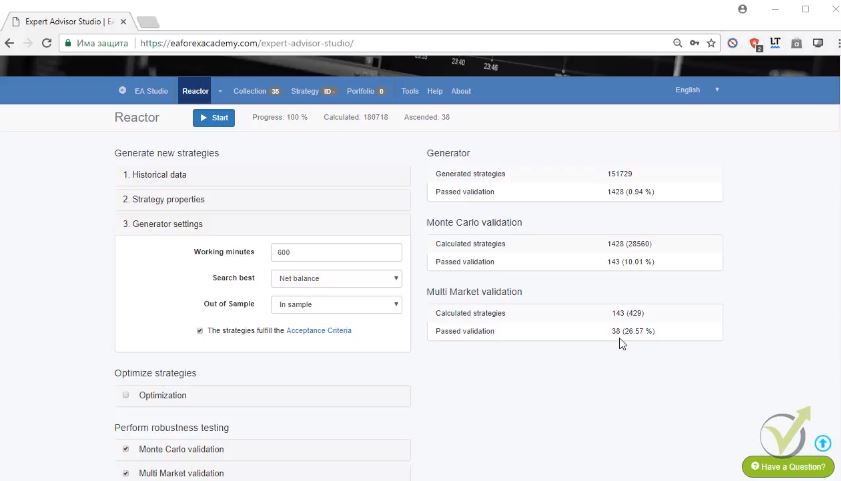

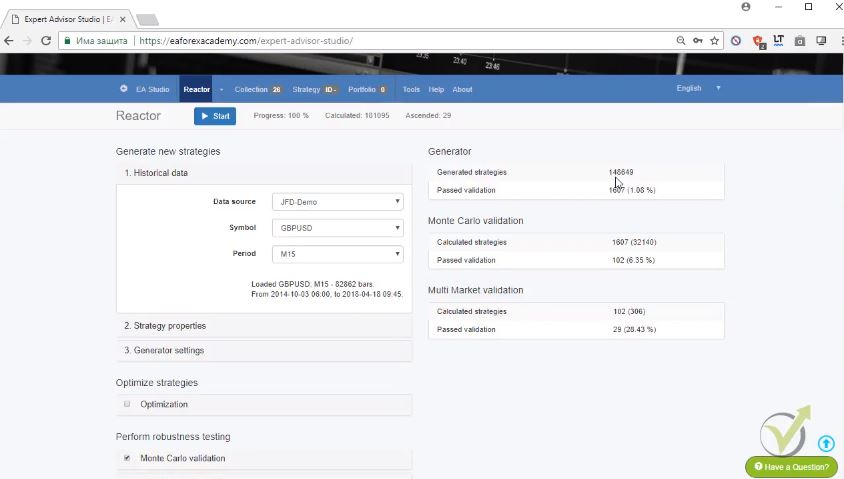

I continue with the results from the Reactor:

As you can see only 38 strategies pass the validation from 151 729 trading strategies, less than 1% passed the validation. And then I have the Monte Carlo which filters more the strategies, totally 143. And from these 143 strategies, only 38 passed the Multi Market validation.

When I go to Collection you will see here that 35 trading strategies are here and this is because we had some resolved correlation.

What is the resolved correlation?

If I go to tools there are the settings. Here below you will see detect balance lines correlation. This means that the collections are filtered with strategies that are having very similar balance lines. Similar trading strategies and they remove.

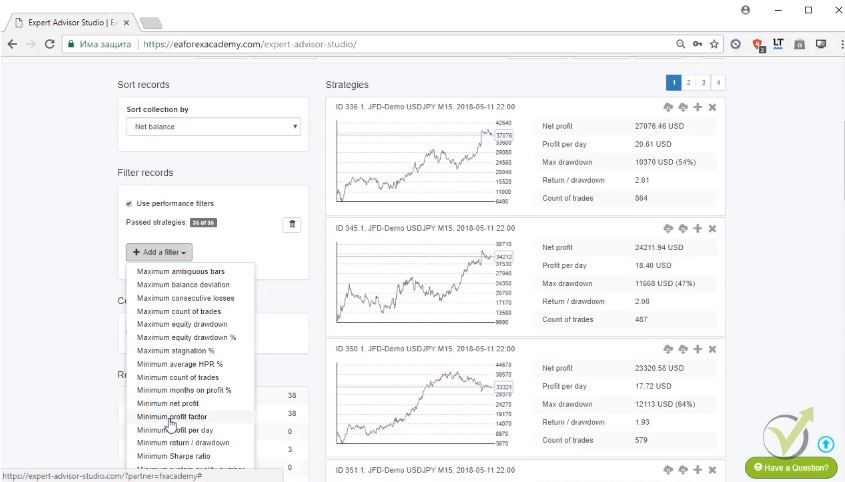

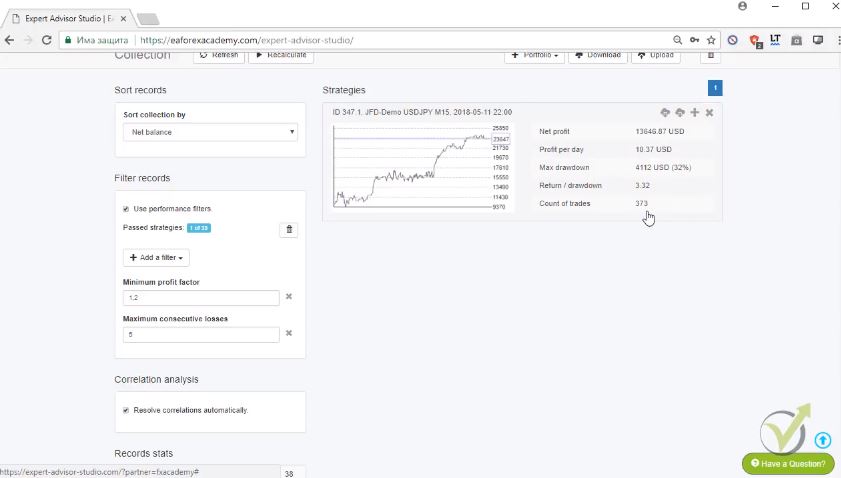

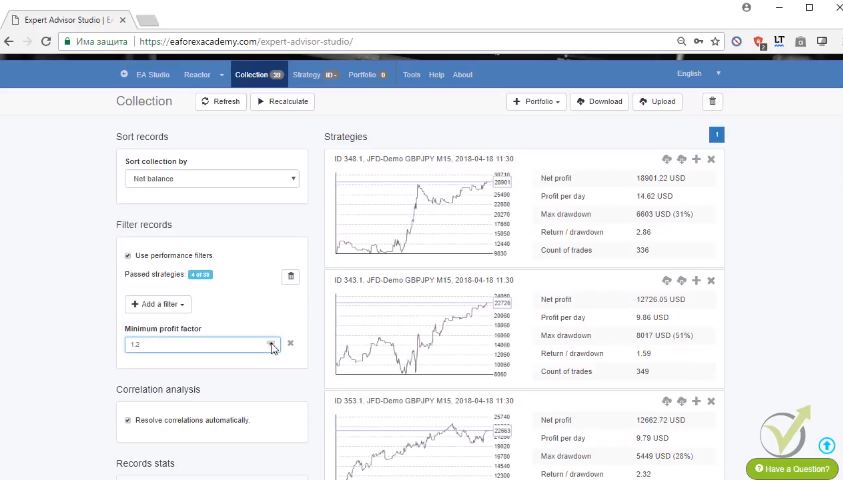

The idea is to have a portfolio of different Forex trading strategies. Anyway, from these 35 I will select only the best performing EA trading strategy. And I will go now to Add a filter. On the left side, you can see here filter records. And I will go to maximum equity drawdown, it’s a very nice filter stagnation. Actually, all of the filters are very useful. One of my favorite to use is the minimum profit factor:

The profit factor is the gross profit divided by gross losses. This is very, very simply said. If I select one obviously all will remain but if I increase it you can see to 1.1, 1.2.

What you can see here?

Only 5 trading strategies out of the 35 are left into the collection. And you can see them right over here.

The next thing is I will add another for example maximum equity draw down in percentage. For example, maximum consecutive losses. If I select 10 you will see 3 trading strategies are left into the collection. And if I decrease the number 987 no change. Let me decrease it more 2 and if I decrease more 1. And you can see 1 EA trading strategy strategy is left now in the collection with minimum profit factor of 1.2 and maximum consecutive losses of 5:

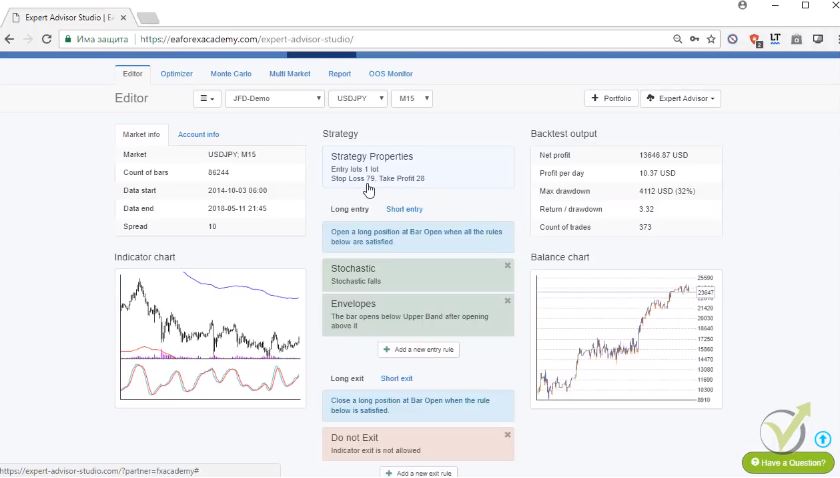

This means that for the 373 trades there are no more than 5 consecutive losses. And this is very important as well. Let me click over the strategy and you will see here are the entry rules, the stochastic and envelopes. We don’t have an exit condition. What we have is actually a Stop Loss and Take Profit.

You can see Take Profit much smaller than the Stop Loss if you remember what I’ve said in the beginning of the course that with algorithmic trading I proved long time ago to many traders that it is better to have a smaller Take Profit than the Stop Loss. Obviously, in any trading strategies, if your Stop Loss is smaller than the Take Profit you give bigger chance that the price will first hit the Stop Loss:

Simply, it is closer to the entry price.

When the Take Profit is close obviously we have bigger chance hitting first the Take Profit.

There is an old rule that the SL should be 3 times smaller the the Take profit. Many people follow it just because this is what they read or saw in some article, video or in some strategy description. Most of the people that start using EA Studio, realize that this is not the reality.

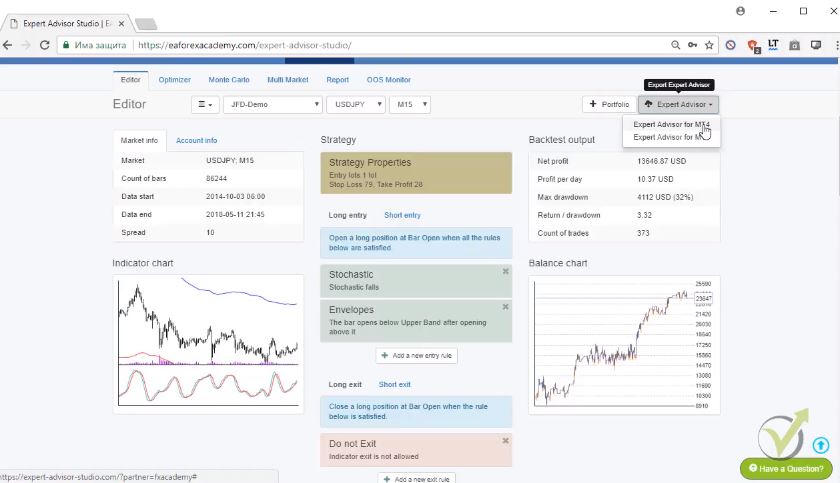

This is the EA trading strategy. And what I do now?

Very simply is I will go to Expert Advisor and I will click this button that says Expert Advisor for MT4. I will click on that and this is the very powerful tool of EA Studio that with one click I can export this strategy as Expert Advisor for Meta Trader 4 and for Meta Trader 5. One click and you will see here is actually the code and we have the Expert Advisor ready.

We don’t need to hire developers, we don’t need to pay any money to someone to develop the trading strategy. Because it just exports very quickly and easily as Expert Advisor and let me now just select the other ones and after that, I will show you how to place them on the Meta Trader in the next lectures of Basic algorithmic trading course + 3 Robots.

What I have here? The GBPUSD.

You can see how many trading strategies were totally generated and in the end of the day I have 29. I’m going to the collection again, 26 that were resolved correlations as well and actually 27, yeah 26, 1 resolved correlation. Here is minimum count of trades, this is actually in our acceptance criteria, so I will remove it.

Minimum profit factor, let’s increase it to 1.2 and you can see 2 trading strategies very quickly into the collection left. And if I compare the profit lines I prefer the first one, because you can see the second one it is recently not losing but going sideways.

It’s not really making profit recently.

I will delete from here from this X button that says remove, I will remove this Forex EA strategy. And here is the strategy that I will select for the GBPUSD. RSI, Bollinger bands, momentum as the exit, there is the Stop Loss and the Take Profit. Another proof here that the Take Profit is 2 times nearly smaller than the Stop Loss. And from here I will just export these trading strategies as Meta Trader 4 expert and Meta Trader 5 expert.

Because I will attach in the course the Expert Advisors and I will attach them for Meta Trader 4 and Meta Trader 5. If you decide to test and see how it’s working on Meta Trader 5 you will have the Expert Advisor.

The last one that I’m having is for the currency. What do we have here?

GBPJPY, we have 82 000 trading strategies here generated and 38 passed all the validations. If I go to the Collection you will see here the strategies. All trading strategies are ordered on pages and on each page you can see 10 trading strategies.

What I have here with these trading strategies?

The minimum profit factor, let me increase it to 1.2.

What I have? 4 Forex EA strategies from the 39.

You can see here the strategies, they are very good trading strategies. This one and this one even recently you can see a small pullback here on the equity but that is just fine. There is a huge drawdown here. So, I normally prefer not to guess which strategy is better but to use another filter. I will go to consecutive losses for example one more time and I will start to decrease them.

If I go down, what is it? 765. I have 1 Forex EA strategy left into the collection and if I click on it you can see again the entry rules. Here we have 3 entry rules and we have 1 exit rule plus Take Profit and Stop Loss.

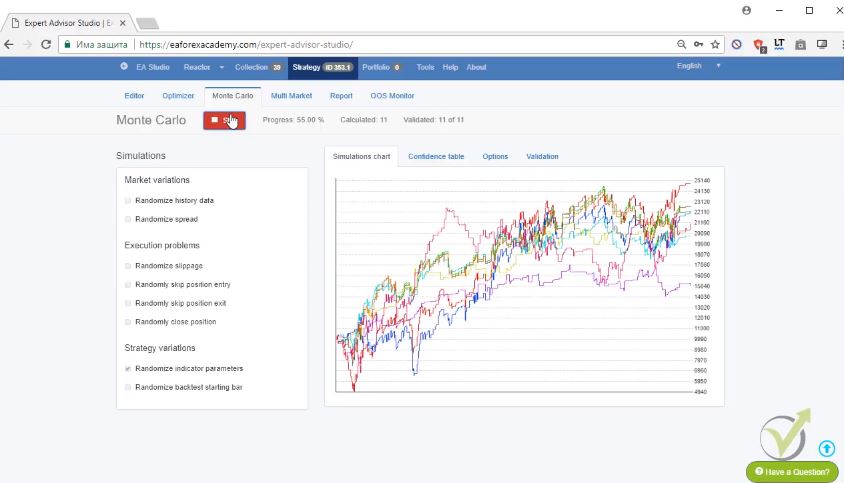

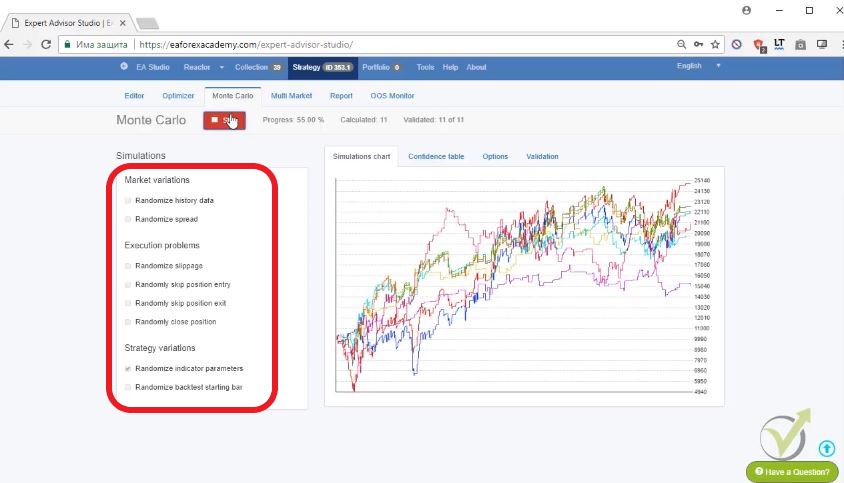

Quickly if I go to the Monte Carlo, if I run Monte Carlo for example as randomize indicator parameters you will see that it will pass this test. Because it already passed it while creation. When the reactor was running automatically it went through the Monte Carlo and you can see we have positive results here, validated tests 20 from 20.

This is the idea of using the Reactor for generating the trading strategies:

Once you have the reactor done you don’t need to do manually Monte Carlo, Multi Market because they went already through these tests and ready trading strategies. I will export as well this strategy for Meta Trader 4 and for Meta Trader 5 and I will attach these Expert Advisors in the Basic algorithmic trading course + 3 Robots.

And as well in the course I will show you how we place them correctly on the Meta Trader. You will see some results after that. You will see that it’s not really a hard process.

Thank you, for reading! If you have questions you can always write in our SUPPORT FORUM where I will answer you as soon as possible.

For more Forex Algorithmic trading courses please visit this page of our web site: https://eatradingacademy.com/courses/algorithmic-trading/

The EA Studio is available also in our website, and you can use it for 14 days free trial. If you are interested in a lifetime license, you can write to our e-mail in**@************my.com, and as our student, you can receive a discount.

More information about EA Studio and its features:

The reactor –

That is a combination of generator and robustness tools as Monte Carlo, Multi Market and OOS. With the reactor, you can redefine rules for the trading strategies, and automate the whole process. Before 2017, we were using the generator. After that we had to go over the robustness tools for each Forex EA strategy manually. This was a time-consuming process. Now it is all automatic. We can generate 100s of trading strategies that are ready for trading because they were tested by the reactor.

The Collection –

as demonstrated in this video, the collection is very friendly to use and the filters help the trader to select the best trading strategies very quickly. The trader can download the whole collection which is very useful and save it. This way he can go back to this collection after time and test it with fresh historical data. All the work this way is combined and with the time, with well organized job, the trader can collect collections with the time and use them continuously.

Monte Carlo –

the robustness tool for proving that the trading strategies are ready for real trading. It nearly eliminates the Demo account. This is because Monte Carlo performs variety of tests that the trader can predefine from the settings. One of those is to run tests with different spread. It can run 20 back tests with variety of 10 pips spread. The trader can select what percentage of past test will satisfy him. If he choose 75%, this means that 15 out of the 20 tests should pass. Same thing for the other tests as Random history data, Randomize spread, Randomize slippage, Randomize back test starting bar and more:

Multi Market –

is the robustness test that shows if the trading strategies are profitable on other trading assets. This is suitable for Forex trading. if the trade has a profitable strategy on one currency as GBPJPY, he can check with Multi Market if this Forex EA strategy is profitable on the other currency pairs. There comes the question: Why should this strategy work on the other markets? This comes as a super interesting debate because this Expert Advisor strategy was created for the asset GBPJPY. It is not necessary to trade on other currency pairs. As a conclusion, we can say, that if a Forex EA strategy is profitable on one asset but it fails on all the others, then probably there is something wrong with it, as over-optimization.

What is the over-optimization i the trading strategies?

These are the trading strategies that perform great in the past and when the trader places them on demo/live trading account, they start to lose. The reason is that he has over-optimized the parameters of the indicators for that past period of time.

How do we avoid that?

By using round numbers in the parameters, id we do optimization. This way we do not allow the optimizer to has the huge variaety of parameters, and to match the parameters according to the Historical data.

The second and better solution are exactly the robustness tools like Monte Carlo and Multi Market.