Algorithmic trading has transformed the way traders interact with financial markets. According to many, it is revolutionizing the financial world. At the heart of this evolution are trading robots (or bots as many call them), also known as expert advisors. They execute trades on behalf of traders, based on predefined rules. This way the trades are executed efficiently and without the need for constant monitoring.

For many aspiring traders, the question is not whether trading robots are useful, but how to make a trading bot that works reliably and efficiently. But how to create a trading bot if you don’t possess programming skills? Contrary to what you might think, building a trading robot no longer requires extensive coding knowledge. Thanks to modern strategy builders, you can create your own trading bot quickly, sometimes without spending a dime. These tools help traders save time, reduce emotional decision-making, and capitalize on market opportunities around the clock.

This guide will take you step-by-step through the process, helping you unlock the potential of automated trading.

Table of Contents:

What Are Strategy Builders

Trading bots automate strategies by analyzing market data and executing trades based on predefined rules. Creating these robots used to require programming expertise, but tools called strategy builders have made the process accessible to everyone.

Strategy builders are software tools that allow traders to design and automate trading strategies without having any programming skills. These platforms provide a user-friendly interface where you can set parameters such as entry and exit rules, stop-loss, and take profit levels. Once configured, the software generates a trading robot that can execute trades on platforms like MetaTrader 4 or 5.There are several strategy builders available today, each catering to different levels of experience and complexity. Let’s briefly explore the strategy builders from EA Trading Academy:

- EA Studio: This web-based platform is perfect for beginners due to its simplicity and speed. It allows you to test and optimize strategies directly in the software. With a 15-day free trial, you can experiment and create a functional trading bot without any upfront investment.

- Forex Strategy Builder Pro (FSB Pro): A more advanced tool that you can download and use offline. While it offers greater customization, its slower interface makes it better suited for experienced traders.

- Express Generator: Unlike the other two, this tool requires some programming skills and doesn’t offer a free trial, making it a choice for professionals.

Among these, EA Studio is particularly appealing for beginners because it simplifies the process of learning how to create a trading bot. Its intuitive interface and fast testing capabilities make it a top choice for those new to algorithmic trading.

Some of these programs obviously are costly but they are costly because they save all of this money that we would spend for buying trading robots and for hiring developers. And if you want to test some strategy builders, the strategy builders that we use in Trading Academy, which we found most appropriate for beginners and advanced traders are Expert Advisor Studio and Forex Strategy Builder Professional.

How to Make a Trading Bot: Step-by-Step Guide

Creating a trading robot might seem like a challenge, but with the right tools and guidance, the process becomes straightforward. However, before you start creating your trading robot, you should first select a strategy builder that matches your needs and skill level. If you’re new to trading robots, EA Studio is an excellent starting point. It provides a trial period, so you can explore its features without financial commitment. Advanced users may consider FSB Pro for more detailed customization, but for simplicity and speed, EA Studio is unmatched.Let’s walk through the process of building your first trading robot in EA Studio:

Step 1: Choose the Right Strategy Builder

The first step is to go to EA Studio home page or you can simply select it from the drop-down menu at EA Trading Academy’s Software section (former EA Builders). If you are not sure about the capacity of this software and want to test it first, you can register for free 15-day trial, or you can securely proceed with purchasing the software, simply because it will not disappoint you and the investment will be worth it.

Step 2: Set Up the Basic Strategy

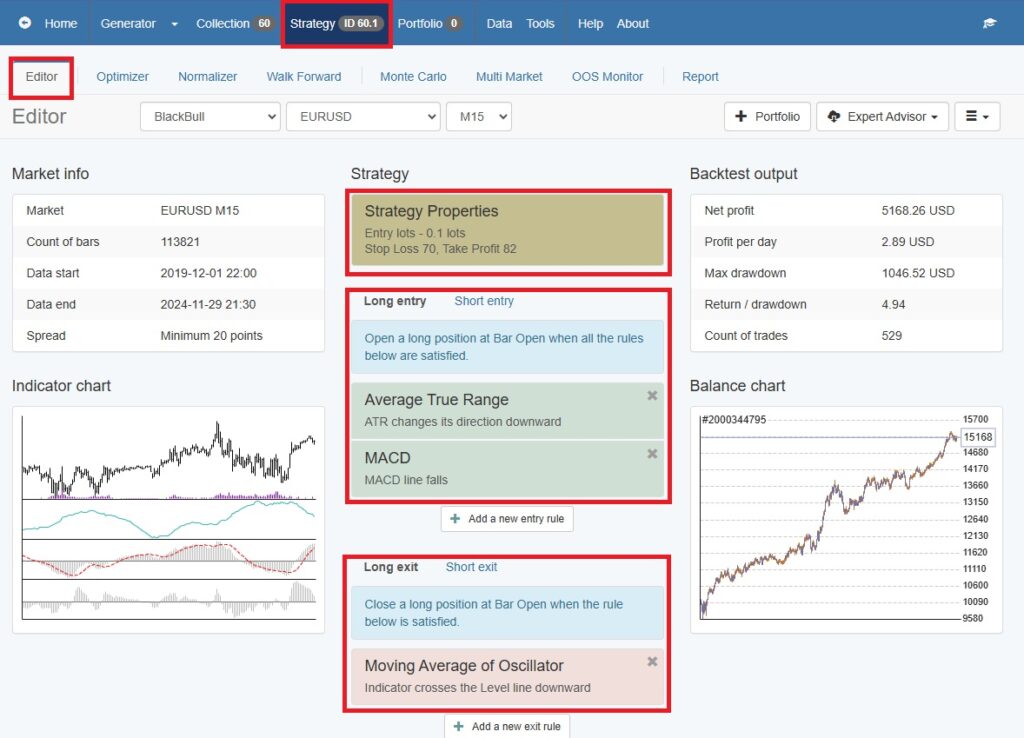

Your trading bot’s success is strictly dependent on the quality of the strategy you define. Once you are at EA Studio interface, just click on “Strategy” tab and you are just minutes away from creating your own trading bot without single code needed. From the “Editor”menu, start by deciding what you want the bot to do—whether it’s trading forex pairs, commodities, or cryptocurrencies. Then set the rules for:

- Entry Conditions: Specify the market signals (indicators) that trigger a trade. For example, you can use indicators like the Commodity Channel Index (CCI) to identify when to enter a long (buy) and short (sell) positions.

- Exit Conditions: Define when the bot should close a trade. For instance, a trade might close when the CCI changes direction or when a set profit target is reached.

- Risk Management: Adjust your stop loss and take profit levels to balance risk and reward. A good range for stop loss might be 10–100 pips, while take profit could be set between 50–100 pips.

- Add Indicators: Customize entry and exit points with popular indicators like the Accelerator Oscillator or Moving Averages. However, avoid overcomplicating strategies with too many indicators.

By using tools like EA Studio’s strategy editor, you can see real-time feedback on your settings, helping you refine your strategy before testing it on historical data.

Step 3: Test and Optimize

Backtesting is an essential step in creating a trading robot. This process evaluates your strategy against historical market data to determine its potential profitability and risks.

EA Studio simplifies backtesting by instantly updating results as you tweak parameters. For example, if your strategy trades gold on the M15 timeframe, you can quickly test how different stop-loss or take-profit levels impact performance. The goal is to find a balance between profitability and consistency, ensuring that your bot performs well under various market conditions.

So, let’s recap this step:

- Run Backtests:

- Use historical data to evaluate how your trading bot performs in past market conditions.

- Example: Backtest a gold-trading strategy on the M15 timeframe.

- Fine-Tune Parameters:

- Modify settings to improve the robot’s profitability.

- EA Studio provides instant feedback, making optimization quick and intuitive.

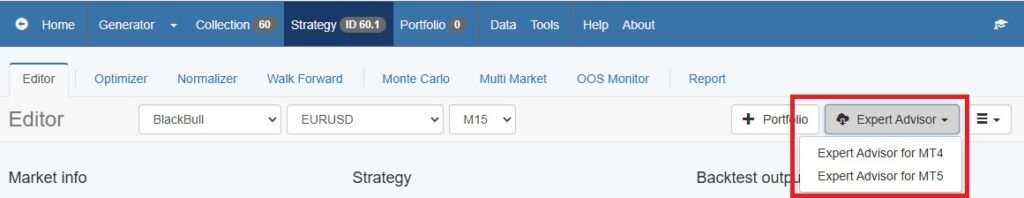

Step 4: Export Your Trading Robot

Once satisfied with the backtest results, you can export the trading robot as an Expert Advisor file. The export process is seamless and the code is precompiled, meaning no programming is required. Simply upload the file to your MetaTrader platform, attach it to a trading chart, and let it run.

Step 5: Validate with a Demo Account

Before deploying your bot on a live account, it’s critical to test it in a demo environment. This allows you to observe how the robot performs in real market conditions without risking actual funds. Use this time to familiarize yourself with managing your bot and fine-tune its parameters as needed.

Test your trading bot in a risk-free environment. This way you will:

- Understand its behavior in live market conditions.

- Compare performance between demo and live accounts.

And voilà, you have your robot ready for trading. And you didn’t have to be a developer or buy a pre-made robot from market place. So the simple answer of how to make a trading bot is use the powerful strategy builder EA Studio and within minutes you can create your own XAUUSD M15 Robot for example. Like the one which you can get for FREE here: https://eatradingacademy.com/robots/trading-robots/commodities/free-m15-gold-robot/.

How to Make a Trading Bot: Tips for Maximizing Your Trading Robot’s Potential

Creating a trading robot is just the beginning. To achieve long-term success, you need to continuously monitor and optimize its performance.

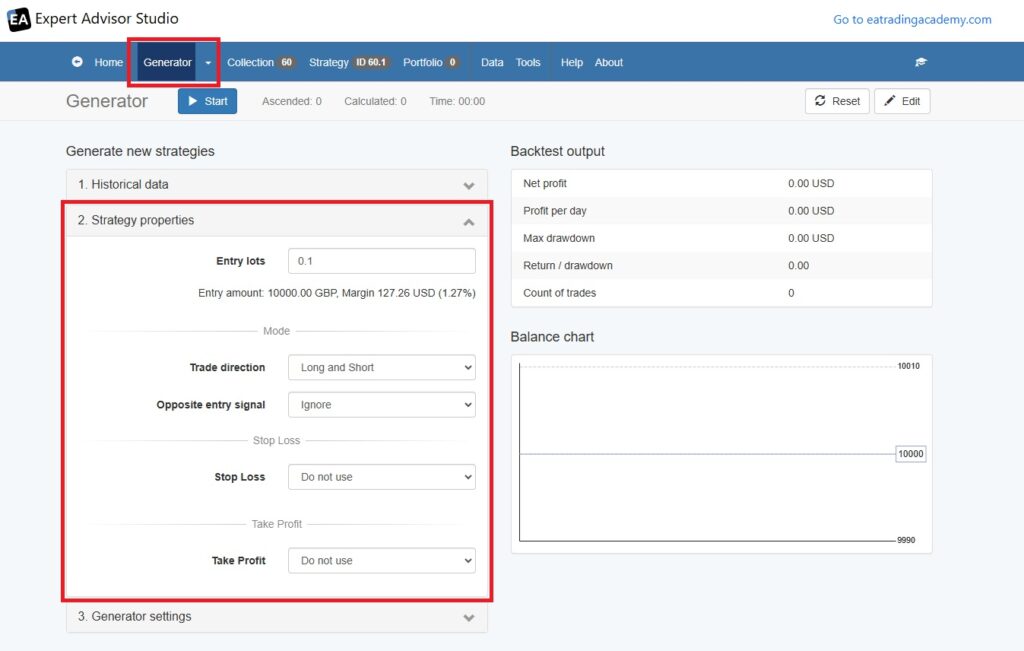

One of the advantages of tools like EA Studio is the ability to generate thousands of strategies simultaneously. By using the generator feature, you can experiment with various market scenarios, timeframes, and trading instruments. This diversification helps you spread risk and identify the most effective strategies.

Additionally, consider deploying multiple trading robots across different markets. For instance, you could have one bot trading forex pairs like EUR/USD and another focusing on commodities like gold. Diversifying your bots not only reduces risk but also increases your chances of finding consistently profitable opportunities.

Key Takeaways:

1. Fine-Tuning Strategies

- Experiment with different timeframes, currency pairs, or commodities.

- Use EA Studio’s generator to create thousands of strategies quickly.

2. Use Multiple Robots

- Diversify risk by deploying multiple trading bots across various markets.

3. Monitor Performance Regularly

- Even well-optimized robots need adjustments to adapt to changing market conditions.

How to Make a Trading Bot: Why Choosing the Right Broker Matters

Your trading bot’s performance can be heavily influenced by your choice of broker. Factors like spreads, commissions, and execution speed play a crucial role in determining profitability.

Testing your trading robot on both demo and live accounts with the same broker is also a good practice. This helps you identify any discrepancies in performance due to server settings or execution differences.

A reliable broker is essential for executing your trading bot’s strategies effectively. Here’s what to consider:

- Regulation: Choose brokers governed by reputable authorities.

- Spreads and Commissions: Opt for brokers offering tight spreads and low fees.

- Leverage Options: Match leverage levels to your trading style and risk tolerance.

Look for brokers regulated by reputable authorities to ensure transparency and security.

How to Make a Trading Bot: Risks and Responsible Trading

Even the best trading robots come with risks. Market conditions are constantly changing, and no algorithm can guarantee consistent profits. That’s why it’s essential to approach automated trading with caution.

Start by trading small amounts and always use stop loss orders to limit potential losses. Keep in mind that backtested results may not always reflect real-world performance, so continuous monitoring is crucial. As you gain confidence in your bot’s performance, you can gradually increase your investment.

While trading robots can simplify trading, they are not without risks.

- Market Volatility: The unpredictable nature of markets can affect robot performance.

- Over-Reliance on Automation: Monitor your bots regularly to ensure optimal functionality.

- Start Small: Use demo accounts and trade with minimal lot sizes to mitigate risk.

How to Make a Trading Bot: Advanced Tools and Future Trends

The future of trading robots lies in further automation and machine learning. As technology evolves, we can expect strategy builders to become even more powerful, providing traders with unprecedented tools to succeed in volatile markets.

For traders who want to push the boundaries of automated trading, tools like FSB Pro and the Top 10 Robots app offer exciting possibilities. These platforms cater to advanced users, enabling more detailed strategy customization and large-scale strategy generation.

Conclusion: Create Your Trading Robot Today

Creating a trading robot has never been easier. With strategy builders like EA Studio, you can design, test, and deploy automated trading strategies without writing a single line of code. By following the steps outlined in this guide, you’ll be well on your way to mastering algorithmic trading and building a bot tailored to your goals.

Take the first step today. Experiment with EA Studio, refine your strategies, and embrace the future of trading automation.

Learning how to create a trading robot without programming is more accessible than ever. With strategy builders like EA Studio, you can develop, test, and deploy automated strategies tailored to your needs. Start small, validate your bots, and grow your expertise in algorithmic trading.

Ready to start? Try EA Studio’s free trial and experience the ease of creating your own trading bot.