Today, I am thrilled to introduce you to an incredible trading system that utilizes the power of the Martingale strategy. In this post, I will share the remarkable results achieved using the Martingale EA and provide you with an opportunity to test it for yourself. However, it is important to note that while the Martingale strategy can be highly profitable, it carries substantial risks. So, let’s dive in and explore this innovative trading robot together!

The Birth of the Martingale Trading System

My journey with the Martingale EA began when I recorded two videos about a $10 robot I purchased from the marketplace. After testing it on a demo account for over a month, I observed that it yielded a decent profit using Martingale principles. However, I was not completely satisfied because the robot lacked transparency in terms of its underlying strategy. To address this, I turned to the FSB Pro Strategy Builder, a tool I have been utilizing for over five years to automatically construct expert advisors.

The Martingale EA: The Simple yet Effective Strategy

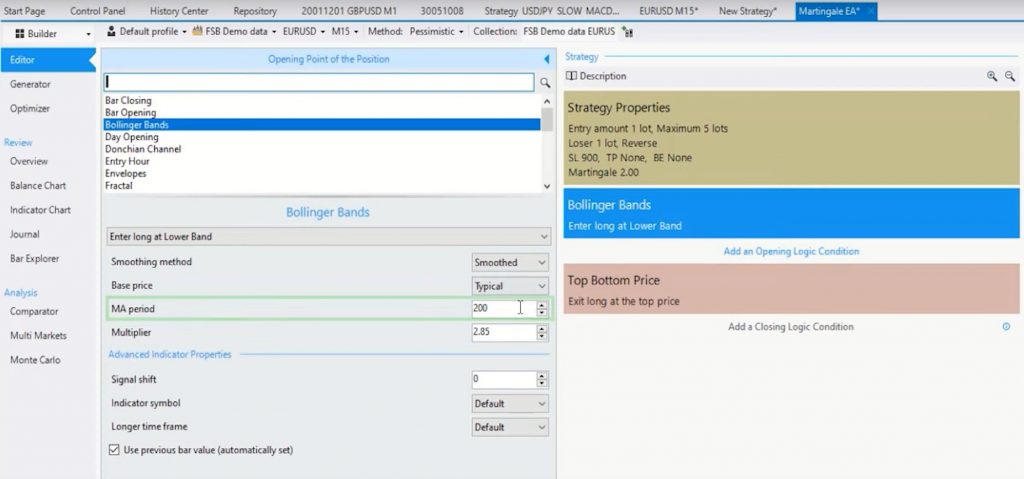

In designing the Martingale EA, I employed a straightforward approach that revolves around the utilization of Bollinger Bands. The primary rule of this strategy is to enter long trades when the price touches the lower band and short trades when it reaches the upper band. The key parameters used are a Moving Average Period of 200 and a Multiplier or Deviation of 2.85, which have proven to be optimal during my testing phase.

Smart Exit Indicators

To ensure timely exits, I incorporated a top-bottom price indicator. This exit mechanism functions by closing a long trade when the price reaches the top of the previous week or its highest point. Additionally, I implemented a Stop Loss of 900 points (equivalent to 90 pips) to protect against excessive losses.

The Martingale Element

To enhance the potential profits of this strategy, I integrated a Martingale multiplier. If a position is closed at a loss, the next position will open with double the size. This multiplier adds an element of exponential growth to the system. To illustrate this, let’s take a look at the account history.

The Martingale EA: Journal Analysis

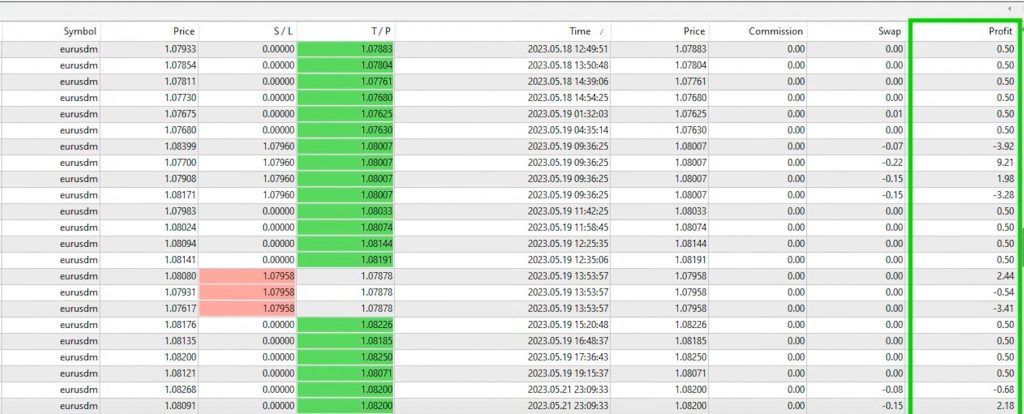

In the account history, we can observe the trades made by the Martingale EA. When a new signal occurs while a trade is still open, the system automatically adds to the position at a lower price. This strategic move aims to recover losses incurred by the existing trade. The Martingale multiplier ensures that subsequent positions are opened with increasingly larger lot sizes.

Ultimately, this approach allows for the potential accumulation of substantial profits.

Understanding Position Reversals

In our previous discussion, we focused on entering long trades when the price touched the lower band of the Bollinger Bands. However, it is essential to note that if the price reaches the upper band, the EA will reverse the position.

This means that the EA will add to the trade several times, experience reversals, and sometimes close trades at a loss. The Martingale strategy comes into play here, and it’s crucial to comprehend its implications.

The Martingale EA: Take Your Time to Observe

To fully grasp the workings and potential risks of the Martingale EA, I encourage you to observe the trades displayed on the screen for a longer duration, and reflect on how the strategy operates. This will provide you with a better understanding of the potential risks associated with this approach.

Setting Up with MetaTrader and Demo Account

Once you have selected a regulated broker, you can download the MetaTrader platform, open a demo account, and start exploring the Martingale EA. It is important to remember that testing should be conducted in a demo account environment to avoid any potential losses. As we test together, we can gather more results and valuable feedback to refine our strategies.

Testing the Martingale EA on Demo Accounts

If you decide to test the Martingale EA, I strongly advise downloading it using the button below and using it on a demo account. I cannot stress this enough. As mentioned earlier, the Martingale strategy carries inherent risks, making it imperative to thoroughly test and evaluate its performance before deploying it in live trading.

I genuinely value your feedback, so please share your thoughts and experiences in the comments section. Your input will help me improve the strategy and the robot.

Setting up the Martingale EA on MetaTrader

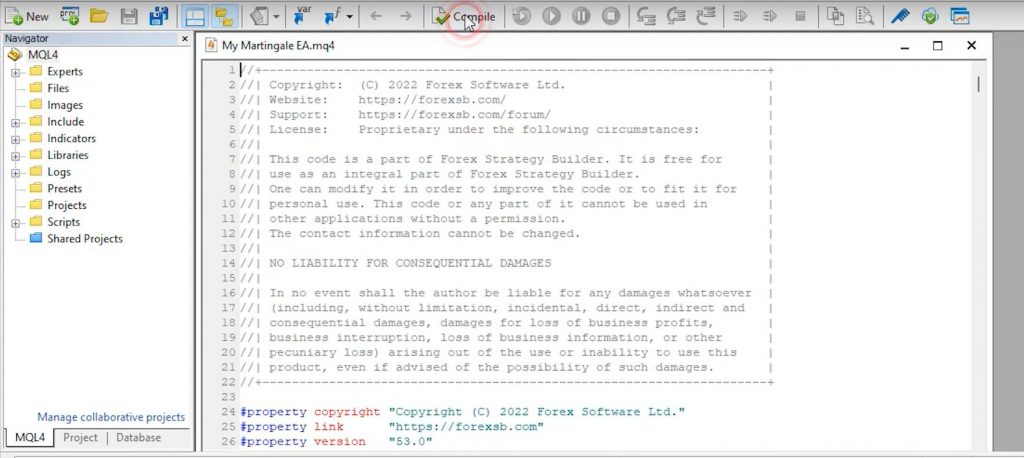

Let’s now explore the process of installing the Martingale EA on MetaTrader. Once you have downloaded the EA, follow these steps:

- Open MetaTrader and navigate to “File” and then “Open data folder.”

- Within the data folder, locate the “MQL4” directory, followed by “Experts.”

- Paste the Expert Advisor file into the “Experts” folder.

- If you are using MetaTrader 5, double-click on the EA to open the Meta Editor. If you are MetaTrader 4, proceed, to step 7.

- In the Meta Editor, you will find the EA’s code, which is transparent and accessible for your examination.

- You can compile the code by clicking on the “Compile” button. This will generate a ready-to-use robot.

- Right-click in the Expert Advisors section, select “Refresh,” and you will see the EA listed below.

- Drag and drop the EA onto the chart of your choice.

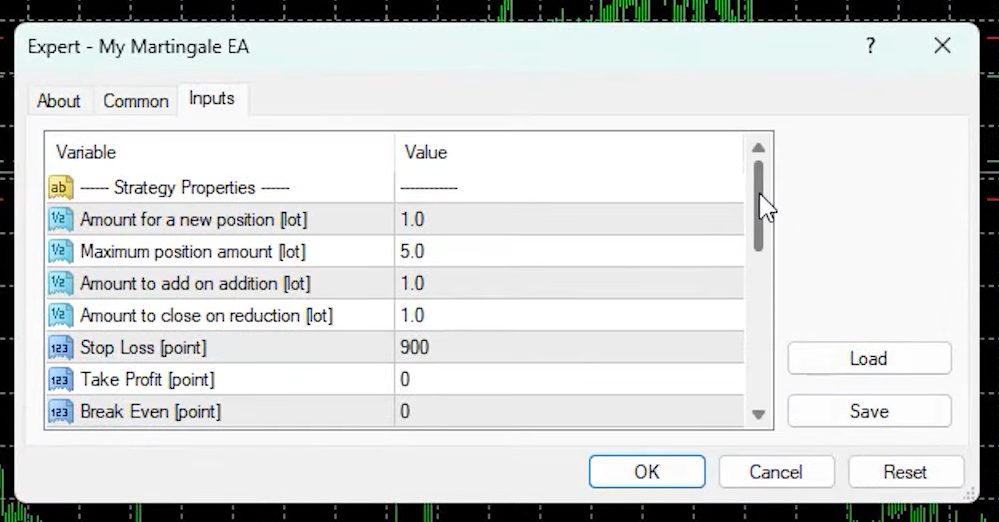

- From here, you have control over the testing parameters, allowing you to customize the testing process.

Account Sizing Considerations

In my testing, I have chosen a $50,000 demo account. On this account, I will be utilizing a 1 Lot position size. However, please note that you have the flexibility to adjust the position size according to your risk appetite.

If you prefer a lower demo account size, you can decrease the lot size accordingly. For instance, with a 2.1 demo account, the maximum position size would be 0.5, and the amount to add would be 0.1. The choice is yours, and I encourage you to select the sizing that suits your testing needs.

The Martingale EA: Testing with a Regulated and Trusted Broker

It is crucial to conduct your tests with a regulated and trusted broker that offers competitive spreads. When using Expert Advisors like the Martingale EA, low spreads play a significant role in achieving optimal results. Regardless of the asset you are trading, a good spread can make a substantial difference in your trading outcomes.

The Martingale EA: A Word of Caution: The Risks of Martingale Strategy

Before we proceed, it is vital to acknowledge the risks associated with the Martingale strategy. While this approach can yield profits, it is notorious for potentially blowing accounts. This is why thorough testing, risk management, and responsible trading practices are essential. As we embark on this testing journey, let’s exercise caution and maintain realistic expectations.

The Martingale EA: Conclusion

The Martingale EA presents an exciting opportunity for traders seeking significant profits. Its integration of the Martingale strategy, along with the utilization of Bollinger Bands and smart exit indicators, creates a powerful trading system. However, it is essential to recognize the associated risks. The Martingale strategy operates on the assumption that losing trades will eventually be offset by profitable ones. While this can be the case, it is important to exercise caution and manage risk effectively.

I invite you to try the Martingale EA for yourself and experience the potential it holds. Remember, proper risk management and thorough testing on demo accounts are crucial before deploying this strategy in live trading. To access the FSB Pro and explore other trading strategies, I have provided a link below for a free 15-day trial.

Trading involves inherent risks, and it is important to make informed decisions based on your individual circumstances. The Martingale EA offers great potential, but it is vital to understand the strategy and its associated risks before incorporating it into your trading routine. Happy trading!