Professional Forex trading course – the most frequently asked questions

Hello dear traders, it is Petko Aleksandrov, and in this video, I answer the FAQ for the Professional Forex trading course.

Before getting into the 10 questions that I get nearly every day, I will answer questions that most traders ask themselves:

How to master Forex trading?

- like everything else in life you need to practice a lot

- proper education is a must before trading

- learn and copy the best traders you know

- trust yourself and no one else

The first question that I frequently receive is:

1. Can I use the strategy from the professional trading course for different time frames?

Well, I have created this professional Forex trading system, particularly on H1, and there is a reason behind that. With my experience, I have noticed that on H1 the indicators that I have selected with the parameters inside and the values, work the best. If you want to change it, you can, but you need to make sure that you observe well the market. You test it out and see if you will keep the same parameters for the indicators if you go to lower timeframes, for example as M15 or M30.

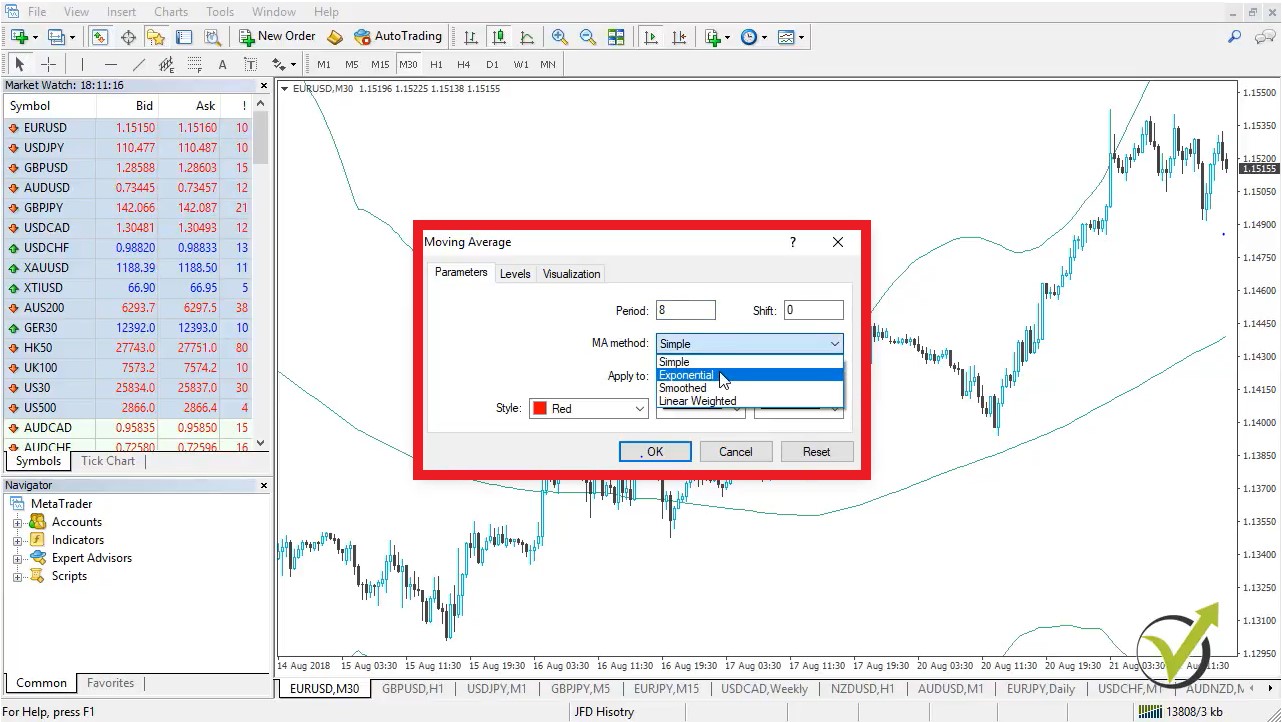

2. Why can I not find EMA indicator in Meta Trader?

EMA stands for Exponential Moving Average and it is available in Meta Trader. If you look at my screen and if I go to insert indicators and I go-to trend, this is where you will find the Moving Averages. Here as moving average method, you can select simple exponential, which is the EMA smooth it or the weighted. If I choose exponential, click on OK, I will have the eighth period of EMA Exponential Moving Average:

So, the Exponential Moving Average, this is just a Moving Average, but the method is exponential. It is available in Meta Trader.

3. Can I use this Professional Forex trading course for cryptocurrency trading?

Of course, this system can be used with many different assets. You can use it, as well, in the cryptocurrency market. It depends again on how you will be using it. If you want to go for cryptocurrencies, you should again observe the market well. And see, if these parameters for the indicators give it a good entry, or the entries are laid there or too early.

So, you need to do a little bit of a job here to see if you will keep the very same parameters for the indicators or you’re about to change it. But yes, the system is based on the price section, which represents the market behaviour, the traders’ behaviour, so obviously it could be used as well on the cryptocurrencies.

4. Should I choose the entry lot first or the Stop-Loss?

If I place an example entry, let’s make it right over here above these highs. And then, if I choose Stop-Loss below, this recent low, let’s say, this is where I would like to have a Stop-Loss:

And, this is a classic example without any analysis I want to demonstrate it. So, if you have your entry somewhere, and you’re planning to place your Stop-Loss over/below the recent lows/highs or support and resistance, or any other, doesn’t matter is it this strategy or not. Avoiding the strategy, the distance of the SL is connected to the trading amount.

How do I calculate the Stop Loss in Forex?

- how much can you afford to lose

- at which price your trade will be disapproved

- what is your money management for the account

- calculate the distance according to the amount

You will learn it all in this professional trading course.

The important thing is that you need to calculate the lots that you can afford to trade, according to this Stop-Loss distance and according to your money management. It’s a common mistake that traders first decide how much they are willing to risk from their account.

So, let’s say the trader has $1,000 of account and he’s willing to risk 5%. So what he can risk is $50. And, he places the trade first and then he places the Stop-Loss. But because he didn’t calculate the distance, it could cost him more, right? If the Stop-Loss with the quantity that he traded cost him $60-$70, he will move the Stop-Loss to unreasonable place.

As I say “because the Stop-Loss should be where it needs to be”

According to this professional Forex trading course or according to the strategy that the trader is following. Doesn’t matter is it the one from the Professional Forex trading course or any other method. The idea is that he will need to put his Stop Loss on a higher place if he bought or on a lower if he sold. But he will tie this distance to his entry because he decided that he will not risk more than $50. So, this is a mistake.

The trader needs first to calculate how much is the distance from the place where he wants to place the Stop Loss. And then, he needs to calculate how much he can afford to trade in a particular trade to fit in this Stop Loss distance. I hope it’s clear here because it’s fundamentally important.

5. Why do we need three entries?

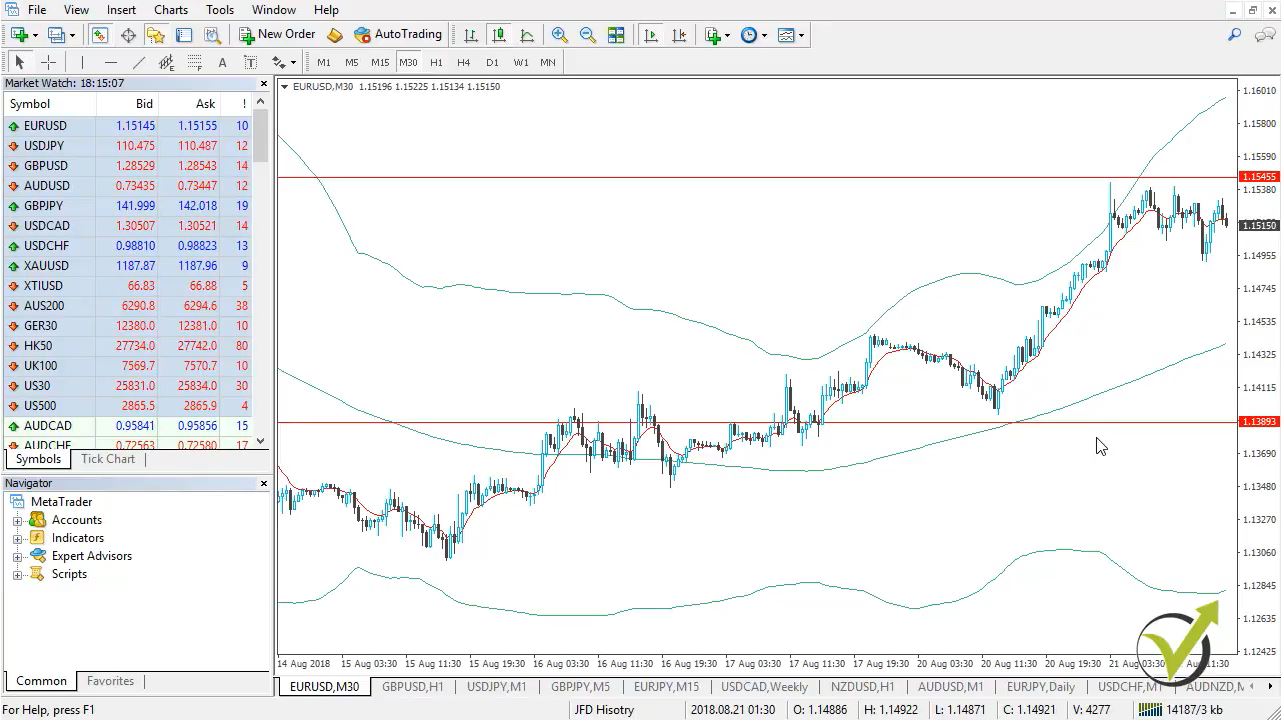

I will try to explain it in a very very simple way why we diversify the risk and why do we need three entries. And basically, this is the answer – we diversify the risk. Let’s say we are in an uptrend. I’m just looking at this chart; we avoid everything else. We avoid the indicators that we have, so I will remove these Bollinger Bands and the Moving Average.

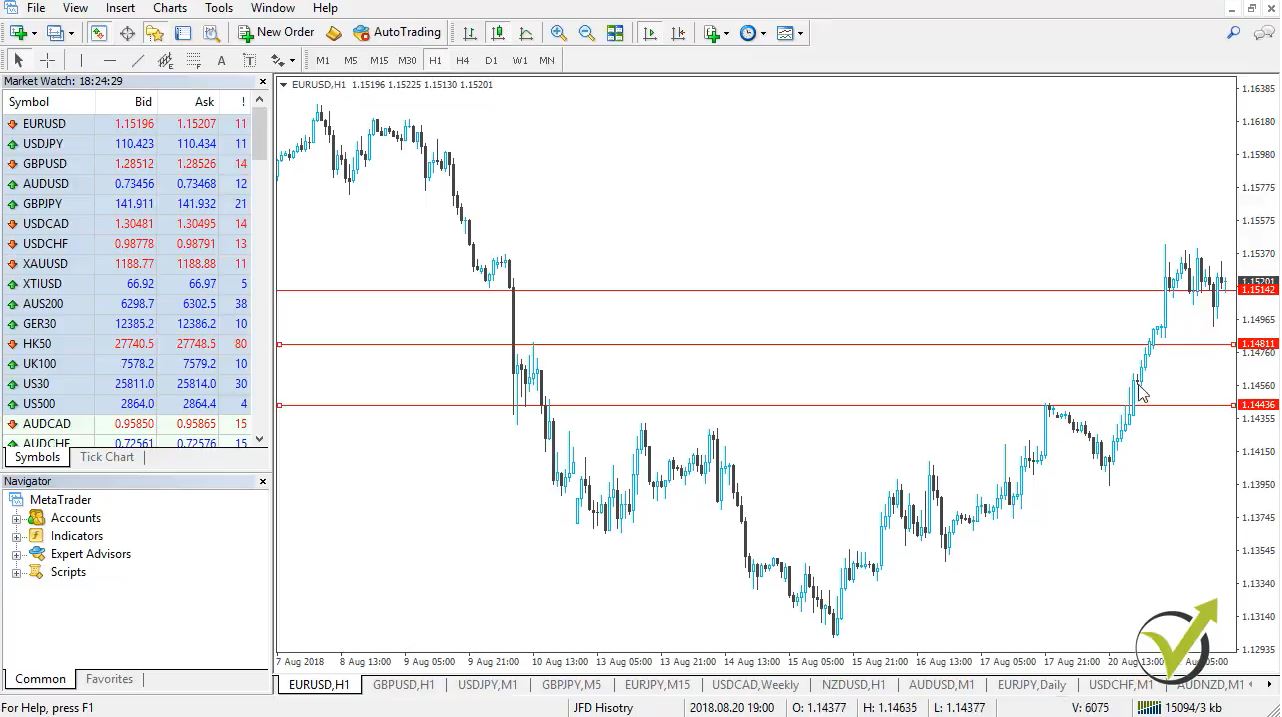

So, we have this pure chart and let’s say we are in a downtrend with the EURUSD. If I look at the hourly chart and on an hourly chart it is going higher, so if I want to sell together with the big trend, if I want to trade, for example, one complete lot. What can I do?

I can do a pending order or sell position or any order, and I will sell one lot.

What if the price continues against me? Now, in this case, I will get into a Loss. But if I divide this entry to three entries, for example, I will be entering 0.33 Lots(and this method is precisely what you will learn in this Professional Forex trading course). If the price goes higher and I have another entry condition, I will enter. And, if the price goes higher and I will enter a little bit higher:

Then, if the price goes into my direction together with the trend, obviously I will have an average price, and it will be a much better price than the one I would have had. Right? So, the other thing is, if from the first entry the price goes together with me if I enter two more times when I have the entry conditions Obviously, I will have a worse price, but at least I don’t place the whole position at one level.

I diversify, I want to make sure that the price goes into my direction before entering the complete position.

If the price goes against me, I enter on a better price and obviously, there is the Stop-Loss to protect my capital. So, with the three different entries, I want to diversify the risk. If the price goes against me and I want to confirm the direction of the price if it goes together with me. So, here I’m using three different entry conditions with a different impact.

I put different values on each one depending on the indicators that I will be using. And you will see this in the course. The idea one more time is we diversify the risk, and we don’t want to place all of the trading amounts that we have decided to use into a single trade into a single position on an individual level. I hope it’s clear here.

6. How long time it took you to create the system?

Exciting question. I had created the system a long time ago when I was studying in London. It took me about three months so this system was the presentation that I had at the end of my education there. It turned out to be a beneficial system, and I’m still using it. Of course, I took a lot from many different traders I can say, I took the best things that I could take from the traders that I met in London. And the result is a great Forex professional trading system.

7. How long should I practice the Professional Forex trading strategy before going on a real account?

Well, that is a personal choice. It depends on you. It depends how long time you practising the system. If one practices a few hours a day it’s one thing if another trader practices let’s say 8 hours or 10 hours a day, he will get used to the system much faster.

The best thing is to put some rule for yourself. Let’s say if you’re trading it one month on a demo account and you have made a target of 10%. Well, if you reach it with the system that is great because you have accomplished your goal. So you can give it a try on a real account. The most important thing as I always say is when you are comfortable trading when you feel safe trading a system.

Then it means you are ready to practice it as well on a live account. I’ll suggest you go with a tiny account in the beginning just to get used, avoiding emotions that are involved in a live trading account.

So if you ask me the question How to master Forex trading for a few days, weeks or month, I will answer you: You can not!

8. Do you wait for the Bar to close to open the trade?

Yes, that’s a lovely question – the closing of the bar. Well, there is something I need to clarify here. The closing of the bar is the very same thing as the opening of the next bar because this is the very same moment, especially with the Forex market. When one bar closes the next one opens, and this is the very same level.

The closing of the bar is a nice confirmation but sometimes when we have a impulsive break, and you will learn this in the course, when we have an impulsive break, for example, the counter-trendline if you’re waiting for the close of the bar. It could be too late. It could be up with 20 with 50 pips, you will be too late to enter into the position. And you will miss the profit!

What do I do personally if I see impulsive movement? I would enter on the break, and I will wait and see if it goes higher by some chance it pulls back. And, I know that it was a dramatic break or a false break, I can close the position and get out. Right? But, if I enter in the right moment and by the end of the bar, I could be already on a profit.

So, sometimes I wait for confirmation. But sometimes I prefer to enter into the trade when I see the break. So I will not miss the move. So, when I see the impulsive movement, I prefer to enter into the trade. If I understand it was false, then I would exit the trade. All right?

9. Can I trade the system on a different platform than the one shown in the Professional Forex trading course?

Well, guys, you can trade the system with any platform that you like to use. The important thing is to have many drawing tools, not to be limited. Because many platforms place a limitation of drawing tools. And it’s tough to order or to arrange your charts and your screen. So, make sure you keep it simple.

Make sure you don’t place too many monitors. I can share with you I used to have 8 to 10 monitors on my table. I realised with the time, the more complicated you make it, the more difficult it will be for you to follow everything:

And, it’s exhausting, so make it simple. If you have 1-2 monitors with a single platform and you follow it, it is enough, and you will get used to it so don’t try to make it complicated. Choose a system and a platform that is suitable for your trading style and that it will be easy for you.

10. Should I do the whole analysis from the professional Forex trading masterclass to enter into the trade?

Well, I do the complete analysis when I’m entering manually into the trade. Don’t try to make compromises because I have seen this so many times in traders. For example, if you’re following five things from your system – Moving Averages, MACD Fibonacci support, and Resistance Counter Trend line.

Then beginner traders start to trade they’re very eager to trade. They want to trade so much. They sit in front of the computer. And they’re just ready to trade. They want to trade, and they have decided that they will trade at this moment. If they see only three or four things they’ll say – okay I have four of the things, I want to get in. I will jump into the trade, and they ignore the last one, which is a mistake.

If you don’t see your set up, if something is missing, take it easy, go out, relax. Come back in a few hours and see if we have your collection up. Or look at the other currency pairs to see if you have your set up. Don’t make compromises to skip some of the analysis that you’re making. Or to skip some of the entry rules that you want to see for your trading system. All right guys? These were the ten most frequently asked questions that I receive in the course Professional Forex Trading.

If you have more questions, I’m here to answer you. Let me know, and I will be glad to assist you in our support forum

If you want to enrol in the course, use the link below:

Professional Forex trading: Masterclass with full analysis

See you inside the class!