In the foreign exchange markets (commonly known as forex), understanding how pips work is a must for anyone who wants to participate successfully in this environment. Whether you are at the beginning of your journey as a forex trader or already an experienced investor, understanding the concept of pips lays the groundwork for making the right decisions at the right time.

Pips are the framework upon which traders assess profitability, manage risk, and execute trades effectively. You put yourself at risk of making costly errors and missing out on opportunities if you lack a clear understanding of the forex pip definition. And you will not be able to navigate the markets with confidence.

In this article, we will explore thoroughly the world of pips, looking into the forex pip definition, significance, calculation methods, and practical applications in forex trading. From debunking common misconceptions to analyzing real-life case studies, you will be presented with the knowledge and tools you need to master pips and improve your trading strategy.

Table of Contents:

- What Are Pips? Forex Pip Definition

- The Significance of Pips

- How Pips Are Calculated

- Types of Pairs and Pip Values

- Pip Analysis Techniques

- Common Misconceptions About Pips

- Tips for Mastering Pips

- Real-Life Examples of Pip Analysis

- Strategies for Capitalizing on Pip Changes

- The Future of Pips in Forex Trading

What Are Pips? Forex Pip Definition

So what is the definition of forex pip ? Pips, short for “percentage in point” or “price interest point” are the pillar of forex trading. A forex pip is the smallest price movement in a currency pair. Typically, one pip represents a 0.0001 change in the exchange rate for most currency pairs. It is used to measure price fluctuations and calculate profit or loss in forex trading. In simpler terms, they are the digits after the decimal point in currency pairs.

The term “pip” originated from the days of open dispute trading on the futures exchanges. Back then, traders would verbally quote prices in fractions rather than decimals. A pip was used to indicate the smallest price movement in these fractions, making it a universal term in the world of finance and trading.

In forex trading, pips play a decisive role in determining the value of a currency pair and assessing potential profit or loss. Precision in pip measurement is a necessity for successful trading. Mastering it is a fundamental skill for any forex trader. It involves understanding the exact value of each pip movement in relation to your trading position. Every pip matters and knowing its precise value allows traders to make informed decisions about when to enter or exit a trade, where to set stop-loss orders, and how to adjust their trading strategy based on market conditions.

The Significance of Pips

Now since you are already familiar with forex pip definition, let’s have a look at pip importance. Pips serve as the standardized unit of measurement in forex trading, allowing traders to determine price changes and assess the value of their trades accurately. They form the basis for calculating profit and loss at the end of the day, evaluating risk-reward ratios, and setting stop-loss orders.

The importance of pips to traders is huge because they directly impact the profitability of their trades. Even small fluctuations in pip values can have a significant effect on trading outcomes. This makes it vital for traders to understand and monitor pip movements closely.

To demonstrate how important pips are, picture a hypothetical scenario where you enter a long position on the EUR/USD currency pair at 1.2000 and the pair moves to 1.2020. In this case, you have gained 20 pips, which could equal a pretty good profit depending on the size of your position.

How Pips Are Calculated

In the financial markets, currency pairs are quoted with specific decimal point conventions. For most major currency pairs, the rule is to quote prices to four decimal places. For instance, let’s a have a look at the EUR/USD pair, where prices are quoted to four decimal places. If the exchange rate moves from 1.2500 to 1.2501, it forms a one-pip movement. However, there are pairs, predominantly including the Japanese Yen (JPY), which are quoted to two decimal places. If the exchange rate changes from 110.50 to 110.51, it also indicates a one-pip movement. But, due to the difference in decimal point conventions, the actual value of each pip varies between these currency pairs. This variation in decimal points affects how pip values are calculated and requires careful attention to detail.

Pip movement is calculated by subtracting the initial exchange rate from the final exchange rate and multiplying the result by the pip value. For example, if the EUR/USD pair moves from 1.2000 to 1.2010, the movement is 10 pips, and for a standard lot, the profit or loss would be $100.

Types of Pairs and Pip Values

There are a few distinct kinds of currency pairs, such as major pairs, minor pairs, and exotic pairs.

Currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, are called major currency pairs, and they are the most actively traded pairs in the forex market. Those pairs normally have the tightest spreads and the most fluid markets, making them popular among traders.

Pairs that do not include the US dollar as one of the currencies are known as minor currency pairs, also known as cross-currency pairs. EUR/GBP, AUD/JPY, and GBP/CHF are some of the examples for minor pairs. Although less fluid than major pairs, cross-currency pairs still offer large trading opportunities.

And there are also the exotic currency pairs, which consist of one major currency and one currency from a developing or emerging market. Such pairs include USD/TRY, EUR/TRY, and USD/ZAR. Exotic pairs tend to have wider spreads and higher volatility compared to major and minor pairs.

Pips come to quote the currency pairs, and their values often shift based on market demand and supply dynamics. Across different currency pairs, pip values can be notably different and affected by exchange rate fluctuations and currency denominations. For example, one pip movement in EUR/USD may be equivalent to $10 for a standard lot, while the same pip movement in USD/JPY could be worth $8. Traders must be aware of these variations when calculating profit and loss and managing risk in their trades.

Another factor that determines pip values is the size of the currency pair and the lot size traded. For standard lots, which represent 100,000 units of the base currency, a pip movement is typically worth $10 for most currency pairs. However, for mini and micro lots, pip values are proportionally smaller.

Even small changes in pip values can send shockwaves through the forex market, affecting currency pair valuations and trade dynamics. And for you to feel confident while exploring the markets, definitely make sure to understand the forex pip definition and the importance of the pips.

Pip Analysis Techniques

Finding patterns, determining entry and exit points, and gauging market sentiment all depend on the analysis of pip movement. In order to monitor pip changes and make the right call, you need to employ a variety of technical and fundamental analytical techniques.

Pip analysis techniques will equip you with the knowledge and tools you need to make informed trading decisions and achieve your investment objectives.

Commonly Used Techniques

- Pip Trend Analysis: By analyzing pip trends, traders can identify patterns and predict future price movements. This allows traders to enter and exit trades at the most opportune moments.

- Volatility Assessment: By understanding how pip movements correlate with market volatility, you can adjust your trading strategy accordingly to navigate through unstable market conditions with confidence and assurance. Traders seeking a more in-depth understanding of how market sentiment impacts volatility may find it helpful to explore what the volatility index is, which is a crucial indicator that reflects current levels of fear and uncertainty in the stock market.

- Correlation Studies: The forex market is composed of various instruments (currency pairs) that can play in harmony or discord. By studying the relationship between different currency pairs’ pip movements, traders can determine how they influence each other. Analyzing this correlation, they can minimize risk by avoiding overexposure to highly correlated pairs, thus ensuring a more balanced and resilient portfolio.

- Integration of Pip Indicators: Incorporating into your analysis various technical indicators that utilize pip data to generate trading signals, such as moving averages, Bollinger Bands, and Fibonacci retracements, can give you a competitive edge in the forex market.

- Support and Resistance Analysis: This analysis is conducted by observing historical price data. Identifying key support and resistance levels based on pip movement patterns traders can anticipate potential market reversals or breakouts.

- Range Analysis: Assessing the range-bound movement of currency pairs by analyzing pip values within specific price ranges.

- Breakout Analysis: Monitoring pip movements to identify potential breakout opportunities when currency pairs breach predefined price levels.

- News Impact Analysis: Evaluating the impact of economic news releases and events on pip movements to anticipate market reactions and adjust trading strategies accordingly.

- Sentiment Analysis: Gauging market sentiment based on pip movements and trading volume to assess the overall market mood and potential direction.

- Historical Data Analysis: Examining past pip movements and trading patterns to identify recurring trends and develop predictive models for future market behavior.

Managing Risk with Pip Analysis

There are also strategies for reducing losses during adverse pip movements. Techniques such as stop-loss orders, trailing stops, and hedging strategies. They can help protect your capital and minimize the impact of unfavorable market conditions. Because preservation of capital is key to long-term success.

Risk management is an important aspect of forex trading, and pip analysis helps to minimize risk. By setting stop-loss orders, calculating risk-reward ratios, and monitoring pip movements, you can protect your capital and preserve your profit.

Common Misconceptions About Pips

One common misconception is the confusion between pips and points. While both terms refer to price movements in the market, they have different meanings and implications for traders. As we know from the forex pip definition, pips refer to price movement in a currency pair. Which means they are strictly related to the forex trading. On the other hand, points are used to measure price movements in other financial markets, such as stocks or indices. Unlike pips, points can have different values depending on the market being traded.

Another misconception is the belief that pip values are fixed across all currency pairs. In reality, pip values can vary significantly depending on factors such as exchange rate fluctuations and currency denominations.

There are also several myths about pips in forex trading. One such myth is the belief that more pips equals more profits. Or that trading with smaller pip values is less risky. By debunking these myths, you can gain a clearer understanding of how pips truly impact your trading outcome.

Tips for Mastering Pips

Here are few tips for Mastering Pips:

- Practice Calculating Pip Values: Once you know the forex pip definition, one of the best ways to master pips is by practicing calculating pip values using different currency pairs and lot sizes. By honing this skill, traders can become more confident in their ability to assess profit and loss accurately.

- Stay Informed About Market Conditions: for successful pip analysis, you should always stay informed about market conditions. Traders should keep abreast of economic indicators, geopolitical events, and other factors that may influence currency prices and pip movements.

- Utilize Pip Analysis Tools and Resources: pip calculators, economic calendars, and technical analysis software are some of the numerous pip analysis tools and resources available to traders. Using these tools, traders can optimize their analysis process and make more informed trading decisions.

- Continuous Learning and Adaptation: traders must adapt their strategies accordingly because financial markets are constantly evolving. By continuously learning and adapting to new market conditions, traders can stay ahead of the curve and maximize their trading potential.

Real-Life Examples of Pip Analysis

Now let’s have a look at couple examples of how pip analysis affects trade results. With the first example, we will see the positive impact of the pip analysis and with the second, the negative. Both cases are common part of trading activities so they should be examined carefully.

Example 1: Successful Trade Using Pip Analysis

In the first example, we will examine a successful trade where pip analysis plays an important role in identifying a profitable trading opportunity.

Imagine you are a forex trader who is closely monitoring the USD/EUR currency pair. After conducting thorough pip analysis, you identify a potential trend reversal based on significant pip movements.

You observe that the USD/EUR pair has been trending downward for several days, with consistent bearish pip movements. However, you notice a sudden increase in bullish pip activity, indicating a potential shift in market sentiment.

Using technical analysis tools and chart patterns, you confirm the emergence of a bullish reversal pattern, supported by strong pip momentum. You calculate the potential pip gain based on historical data and market conditions.

With confidence in your pip analysis, you decide to enter a long position (buy order) on USD/EUR at 1.2000 with a stop loss set at 1.1970, which means you are risking 30 pips on this trade.

Over the next few days, the market moves in your favor as expected. The price starts climbing steadily as the USD/EUR pair experiences a significant bullish rally. You closely monitor pip movements and market dynamics and decide to close your trade when the price reaches 1.2200, a profit of 200 pips from your entry point.

By analyzing pip movements and market trends, you have been able to enter the trade at an optimal price and capture significant gains.

Example 2: Mistake Due to Misinterpreting Pip Movement

In the second example, we will explore a common mistake made by traders due to misinterpreting pip movement.

You decide to trade the GBP/JPY currency pair in the forex market. You conduct your analysis and identify a potential breakout in the market. Based on your analysis, you believe that the price will continue to rise further.

You enter a long position (buy order) on GBP/JPY at 150.00 with a stop loss set at 149.50, which means you are risking 50 pips on this trade.

However, you misinterpret the pip movement and mistakenly calculate your risk-reward ratio based on a different decimal point.

Instead of calculating the pip movement as 0.01 (which is correct for most currency pairs), you miscalculate it as 0.001 since you mistakenly assume that GBP/JPY has an extra decimal point.

Due to this misunderstanding, you wrongly believe that you are risking only 5 pips on this trade instead of the actual risk of 50 pips.

As the price starts moving against your position, you become concerned but decide not to exit as you think your potential losses are minimal because of misinterpreting pip movement.

Unfortunately for you, as GBP/JPY continues its downward trend, it eventually hits your stop-loss level at 149.50. You end up losing much more than anticipated due to incorrectly interpreting pip movement. By misunderstanding the significance of pip values and failing to account for spread and slippage, you suffer unnecessary losses.

This example highlights how misinterpreting pip movements can lead to significant mistakes in risk management and trading decisions if not properly understood and calculated accurately before entering trades.

From these real-life examples, traders can glean valuable lessons about the importance of accurate pip analysis, risk management, and adaptability in forex trading. By learning from both successes and failures, traders can refine their strategies and improve their overall trading performance.

Strategies for Capitalizing on Pip Changes

In foreign currency exchange, timing is critical. Traders use a variety of strategies to capitalize on pip changes, including scalping, day trading, swing trading, and long-term investing. Each strategy has its own set of principles and techniques for increasing profits while reducing losses.

- Scalping Strategies: Scalping is a short-term trading strategy that aims to capitalize on small price movements in the market. By focusing on rapid-fire trades with tight stop-loss orders, scalpers can accumulate small gains over time. If you want to explore this strategy, test our free EURUSD scalping strategy robot.

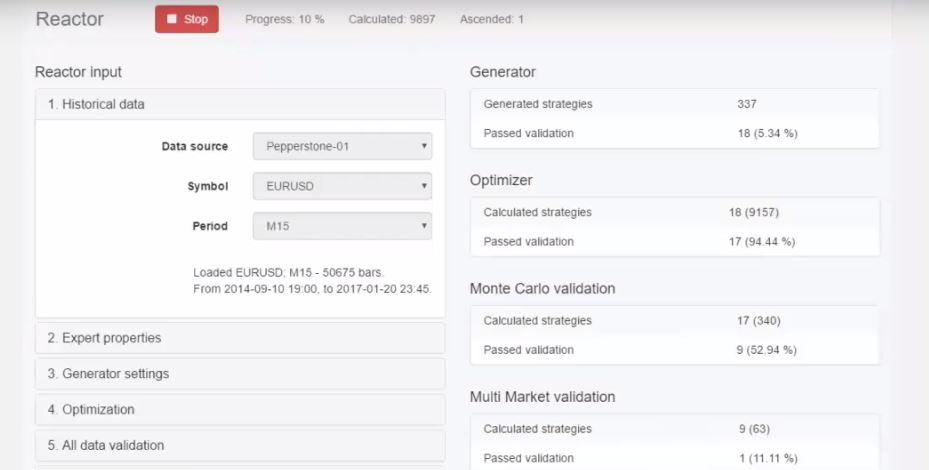

- Day Trading Strategies: This strategy involves buying and selling financial instruments within the same trading day. Day traders rely on technical analysis, including pip analysis, to identify intraday trading opportunities and maximize their profits. If you want to learn different day trading strategies, check out our Algorithmic Day Trading Course where you will find several ready-to-use Expert Advisors.

- Swing Trading Strategies: This is a medium-term trading strategy that aims to capture larger price movements over several days or weeks. Swing traders use a combination of technical and fundamental analysis to identify trends and enter trades at opportune moments.

- Long-Term Investment Strategies: Long-term investment strategies involve holding positions for extended periods, ranging from months to years. While less focused on short-term pip movements, long-term investors still consider pip analysis when entering and exiting positions.

The Future of Pips in Forex Trading

As the market continues to evolve, traders must adapt their strategies for utilizing pips effectively. Automated trading algorithms and advanced risk management techniques allow traders to be innovative and stay ahead of the curve. Advancements in technology, such as artificial intelligence and algorithmic trading, are revolutionizing pip analysis in forex trading. These tools enable traders to analyze large amounts of data in real-time and make more accurate predictions about future price movements.

Looking ahead, pips will continue to play a central role in foreign currency exchange, standing as a universal unit of measurement for price movements. As markets become increasingly interconnected and volatile, accurate pip analysis will become even more critical for success.

Final Words

In conclusion, pips are the lifeblood of forex trading, providing traders with the tools and insights necessary to navigate the complex and ever-changing markets. By understanding the definition, significance, and calculation methods of pips, traders can make more informed decisions and achieve greater success in their trading endeavors. We encourage traders to continue exploring and learning about pips, as they are essential for unlocking the full potential of the forex market.

Check out our article about pips in cryptocurrencies if you are curious to learn a bit about this topic.

And for those interested in algorithmic trading, consider joining our completely FREE 21-Day Ultra Algo Trading Program.