I recently discovered an exciting Pin Bar Trading Strategy. Every month, I delve deep into the world of trading robots. This month, I stumbled upon a gem that uses the “pin bar trading strategy”. Let’s dive into this fascinating topic.

A Monthly Ritual: Reviewing Trading Robots

Every time the month wraps up, I have a routine. I take a close look at all my trading robots. This regular check-up ensures I’m not missing out on any new trends in the trading world. On this particular review, something stood out. There was one robot that really grabbed my attention. What made it special? It employed the “pin bar trading strategy”. This isn’t just any strategy; it’s based on a distinct chart pattern. And while this pattern is certainly interesting to look at, what’s more impressive is its performance. It consistently sends out strong and reliable trading signals, making it a standout in my collection.

A Special Announcement: The EA is yours – FREE

Exciting news for my followers! I’m sharing the robot for free. You’ll find the link to download the robot at the end of this blog post. I would strongly suggest you read the entire post to get a better understanding of how it was created, how it works, and how to correctly backtest it.

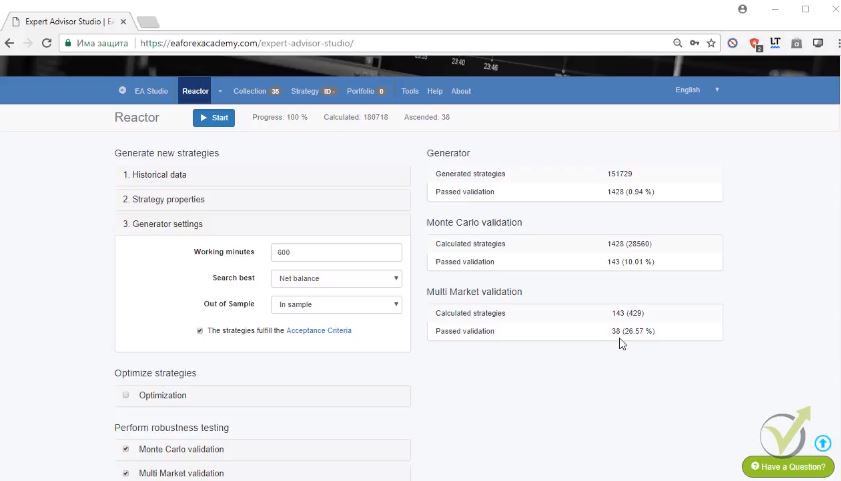

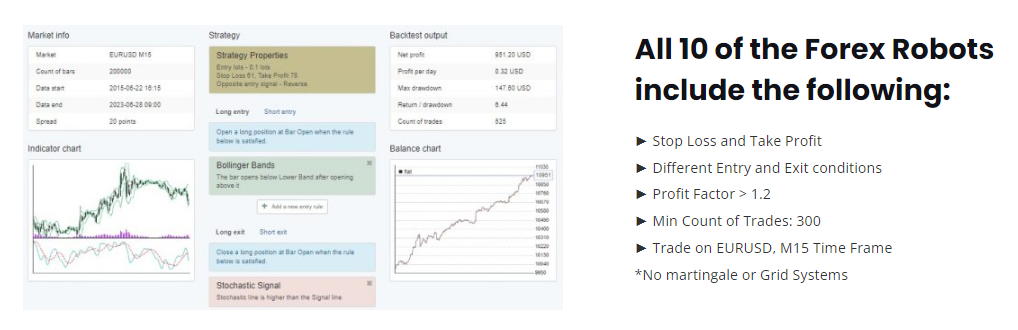

Top 10 Forex EAs: A Monthly Update

Each month, I take the time to carefully handpick a list of the top 10 Forex Expert Advisors (EAs). To come up with this list, I don’t just pick randomly. Instead, I dive deep, conducting thorough testing and detailed analysis of various EAs. After all that hard work, one particular robot stood out. This robot employs the “pin bar trading strategy”. Earning a spot on this prestigious list is no small feat. So, the fact that this robot made it clearly speaks volumes. It’s a shining example, showing just how efficient and effective this strategy truly is.

Introducing the 21-Day Online Program

I have more exciting news! After months of hard work, I’ve launched a 21-Day online program. And the best part? It’s absolutely free. By enrolling, you’ll gain access to three of my premium courses. Plus, you’ll get numerous free EAs and learn to use strategy builders. It’s a comprehensive package that encapsulates everything we teach at the EA Trading Academy. I’ve dropped below this blog post for those interested.

Decoding the Pin Bar Trading Strategy

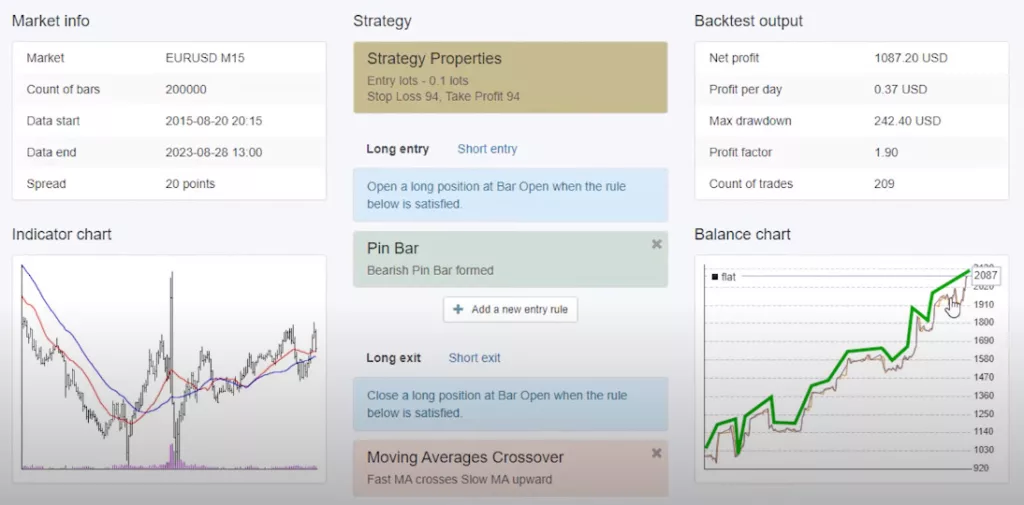

Now, let’s talk about the star of the show – the “pin bar trading strategy”. What is it exactly? In simple terms, it’s a specific chart formation that traders use to predict market movements. This strategy has proven its worth, emerging as the top performer this month. And the most astonishing part? It achieved this feat with just two trades.

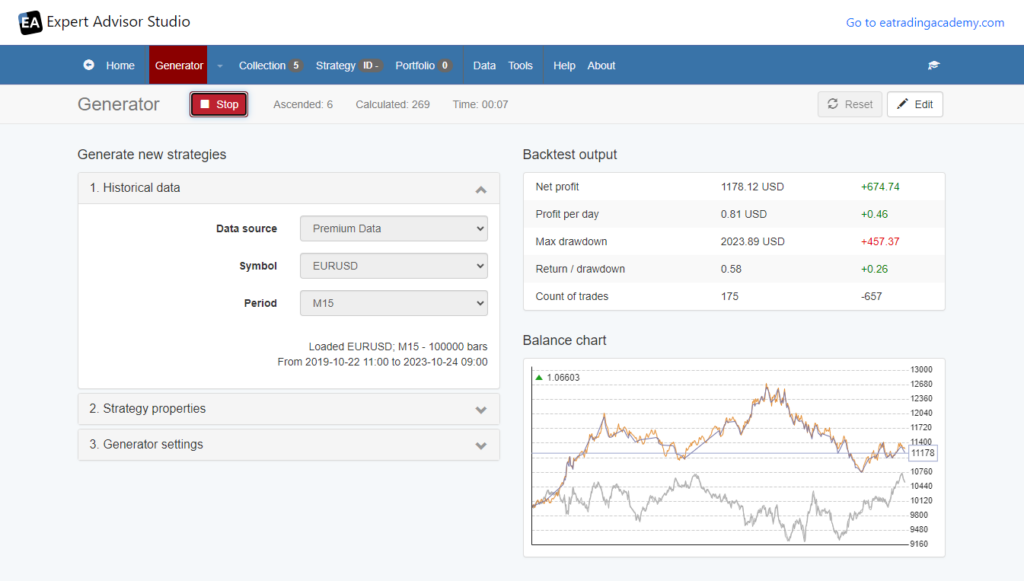

Pin Bar Trading Strategy: Trading with EAs: Metatrader vs. EA Studio

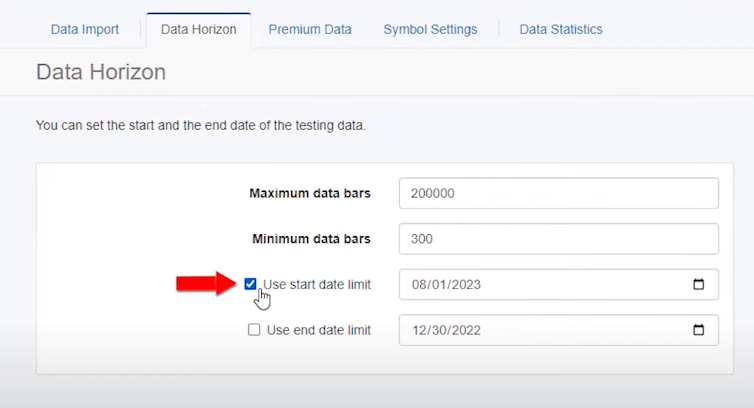

When it comes to trading, I predominantly use EAs on Metatrader. However, EA Studio offers a unique advantage. It simplifies the process of recalculating performance. By employing the “start date limit filter”, I can easily assess the performance of various strategies. Without this filter, the balance charts display data since 2015. But what if I want to pinpoint the top-performing strategy for a specific month?

Zooming into Monthly Performance

To focus on a month’s performance, I head to the ‘Data’ section. Here, I click on ‘Data Horizon’. By selecting ‘Use Start Date Limit’, I can specify a date range. For instance, to analyze August’s performance, I set the range from the beginning of August to the 28th. Upon recalculating, the top strategies for the month become evident. Intriguingly, the top strategy this month executed only two trades. Yet, it yielded the highest net profit when trading with 0.1. And guess what? Both trades were influenced by the “pin bar trading strategy”.

Pin Bar Trading Strategy: Deciphering the Pin Bar Formation

The pin bar, in essence, is a candlestick formation. A bearish pin bar emerges when the candlestick’s upper shadow surpasses its lower shadow. This might sound a tad complex, but a glance at a chart clarifies things. On the chart, you’ll spot a minuscule bar with a pronounced upper shadow. Noticeably, it lacks a lower shadow. At the onset of the subsequent bar, a buy order was placed, culminating in a profit. Earlier this month, a similar bar appeared, further underscoring the efficacy of the “pin bar trading strategy”.

A Glimpse into Long-Term Performance

To get a clearer, more expansive view, we need to make a small adjustment: let’s do away with the start date limit. By doing this, we’re not just looking at a snapshot; we’re seeing the whole movie. Moreover, we can watch the “pin bar trading strategy” unfold over time. And what we see is impressive. This strategy doesn’t just spike up and plummet down; it shows a steady, reliable climb in profits. It’s like a hiker who finds a rhythm and sticks with it, making steady progress up the mountain. For traders, including myself, that’s the golden ticket. We don’t want wild rides and unpredictability. We’re after that consistent growth, the kind that can help us plan for the future with confidence.

Pin Bar Trading Strategy: Diving Deeper into the Pin Bar Formation

As we delve further into the “pin bar trading strategy”, specific patterns emerge. For instance, a bullish pin bar is characterized by a longer lower shadow, often devoid of an upper shadow. Conversely, a bearish pin bar showcases a pronounced upper shadow, dwarfing the lower one.

Understanding the Strategy’s Nuances

A key rule in this strategy is the body’s proportion. The body, from the candlestick’s low to its high, should constitute a mere 4% of the entire movement. Meanwhile, the wick (or shadow, as some traders term it) should represent at least 28% of the candlestick. This distinction between the body and wick is crucial for the strategy’s success.

Pin Bar Trading Strategy: Strategy Mechanics: Stop Loss, Take Profit, and Exit Indicators

The strategy employs a stop loss and take profit, both set at 94 pips. Additionally, it uses the moving average crossover as an exit indicator. When the fast-moving average surpasses the slow-moving average, it signals an exit point. For instance, a trade initiated post a pin bar concludes once the two moving averages intersect.

Grab Your Free Expert Advisor

Exciting news for my readers! I’ve extracted this expert advisor from my top 10 EAs. And I’m offering it for free. You’ll find the download link in the description. While it may not be the most active strategy (with only two trades this month), its profitability is undeniable.

Strategy Builder: A Game-Changer

The Strategy Builder truly shines in its straightforwardness. Gone are the days when you needed a developer or deep coding knowledge to craft a trading strategy. With this tool, all it takes is one simple click, and voila! You have the expert advisor ready for both Metatrader 4 and Metatrader 5 platforms. For someone like me, who isn’t a developer, this is nothing short of a blessing. It makes the whole process smooth and hassle-free.

Pin Bar Trading Strategy: Choosing the Right Broker

Selecting a regulated broker when trading forex is of paramount importance for a multitude of reasons. Firstly, a regulated broker adheres to stringent guidelines and standards set by financial authorities, ensuring the safety and security of traders’ funds. This regulation acts as a safeguard against potential fraud and malpractice. Secondly, brokers that offer multiple account types cater to a diverse range of traders, from novices to seasoned professionals, allowing them to choose an account that best suits their trading style, capital, and risk tolerance. Additionally, having access to various trading platforms provides traders with flexibility, ensuring they can trade efficiently and effectively, regardless of their preferred device or interface. In essence, choosing a regulated broker that offers a variety of account types and platforms is crucial for a seamless, secure, and tailored forex trading experience.

Conclusion: Test Before You Invest

The “pin bar trading strategy” holds a promise of potentially lucrative returns, but it’s vital to tread carefully. Instead of hastily jumping into live trading, take a step back. First, initiate a trial run by testing the waters with a demo account. This practice phase is crucial. It acquaints you with the strategy’s subtle aspects and quirks, preparing you for what’s ahead. By taking this precaution, you’re not just gambling on chance but strategically enhancing your prospects of trading success. So, embark on this journey with wisdom. Safe trading!