As one of the most dynamic financial markets globally, Forex trading offers countless opportunities for those looking to diversify their investment portfolios. However, for successful trading, it is essential to understand the concept of trading lots. Whether you’re just starting or have some experience, understanding how lot sizes work will significantly impact your trading strategies and risk management. In this guide, we will go through what Forex trading lots are, why they matter, and how to choose the right lot size for your trading approach.

Table of Contents:

What is a Forex Trading Lot?

In Forex trading, the term “lot” refers to a standardized unit of measurement for currency trading. When you place a trade in the Forex market, you do so in a specific amount, and that amount is defined by the lot size. Simply put, a lot determines the number of units of the base currency (the first currency in a pair) you are buying or selling.

The concept of lots is central to Forex trading because it standardizes trade sizes, making it easier for traders to manage their positions and risk. Unlike other financial markets where you can trade any amount you like, Forex trading uses these fixed amounts to ensure liquidity and ease of trade execution. The lot size also plays a crucial role in determining the value of a pip (the smallest price move that an exchange rate can make) and, consequently, the potential profit or loss on a trade.

Why Does Forex Trading Lot Size Matter?

Understanding lot sizes is vital for several reasons. First, the lot size you choose directly influences the amount of capital you need to invest in a trade. A larger lot size requires more capital and carries higher potential risk and reward. Conversely, smaller lot sizes involve less capital but also offer lower risk and reward.

Secondly, the lot size impacts the pip value, which is essential in calculating your potential gains or losses. For instance, a standard lot has a pip value of $10, meaning that a one-pip move in the currency pair’s price would result in a $10 change in your trade’s value. Smaller lot sizes, such as mini, micro, or nano lots, have proportionately lower pip values, reducing both potential profits and losses.

The Four Major Types of Forex Trading Lots

Forex trading offers various lot sizes to accommodate different levels of trading experience, risk tolerance, and capital availability. The four main types of Forex trading lots are Standard, Mini, Micro, and Nano. Each of these lot sizes has a specific number of units, and understanding the differences between them will help you choose the most suitable one for your trading needs.

The table might be useful for understanding how much of the units of base currency each lot size represents and the corresponding volume (in lots) that traders typically use:

| Lot Size | Units of Base Currency | Volume |

| Standard Lot | 100,000 units | 1.00 lot |

| Mini Lot | 10,000 units | 0.1 lot |

| Micro Lot | 1,000 units | 0.01 lot |

| Nano Lot | Below 1,000 units | 0.001 lot |

1. Standard Lots in Forex

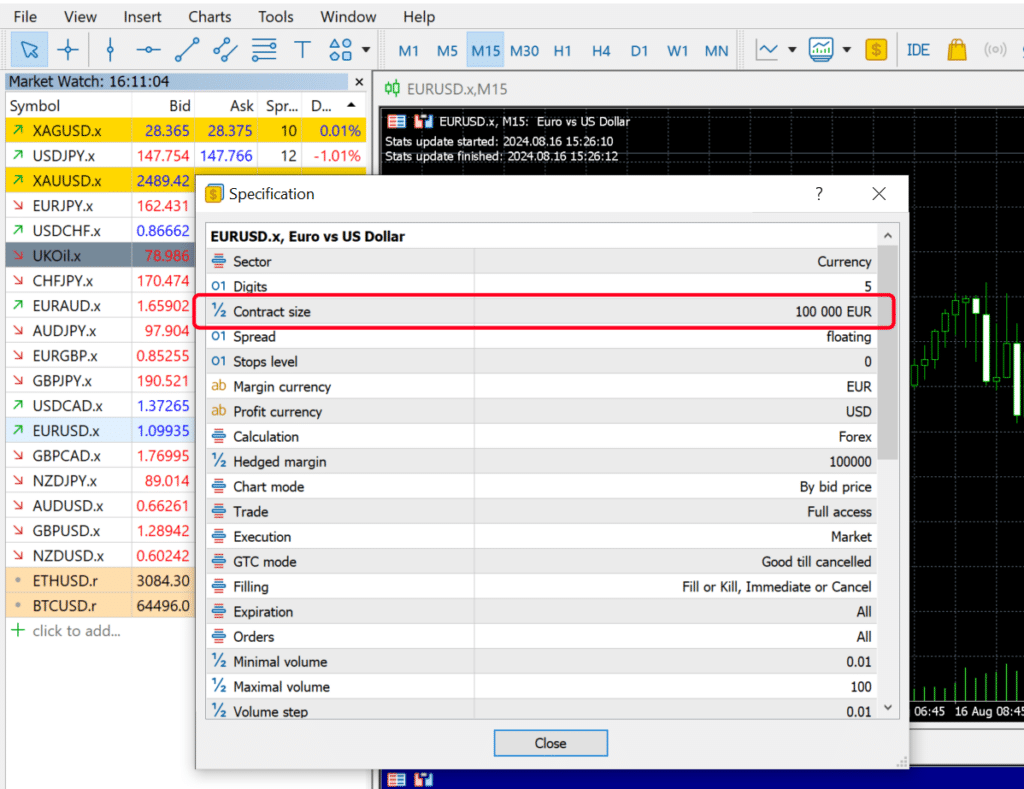

A standard lot is the most commonly used lot size in Forex trading, especially among professional and experienced traders. It represents 100,000 units of the base currency in a currency pair. This means that if you are trading a currency pair such as EUR/USD (Euro vs. US Dollar), a standard lot would involve buying or selling 100,000 euros.

Why Choose a Standard Lot?

Standard lots are typically chosen by traders with substantial capital and a solid understanding of the market. The pip value for a standard lot is approximately $10, meaning that for every pip the currency pair moves, your trade’s value will increase or decrease by $10. This can lead to significant profits or losses, depending on the market’s direction and volatility.

For example, let’s say you decide to buy a standard lot of EUR/USD at an exchange rate of 1.10. In this case, you are purchasing 100,000 euros, and the trade’s value in US dollars would be $110,000. If the price moves in your favor by 50 pips, your profit would be $500 (50 pips x $10 per pip).

Who Should Use Standard Lots?

Standard lots are best suited for traders who have a well-established Forex strategy, a deep understanding of the market, and the ability to manage significant risk. This lot size is not recommended for beginners or those with limited capital, as the potential for large losses is high if the market moves against your position.

2. Mini Lots in Forex

A mini lot is the next step down from a standard lot, representing 10,000 units of the base currency. This lot size is popular among beginner traders who want to start with smaller investments and lower risk. Despite being smaller than a standard lot, a mini lot still requires a considerable amount of capital and can yield significant returns.

Why Choose a Mini Lot?

The pip value for a mini lot is $1, making it a more manageable option for those who are still honing their trading skills. With a mini lot, each pip movement in the currency pair’s price will result in a $1 change in your trade’s value. This lower pip value reduces the risk of large losses while still providing the opportunity for reasonable gains.

For example, if you buy a mini lot of EUR/USD at an exchange rate of 1.10, you are purchasing 10,000 euros, and the trade’s value in US dollars would be $11,000. If the price moves in your favor by 50 pips, your profit would be $50 (50 pips x $1 per pip).

Who Should Use Mini Lots?

Mini lots are ideal for beginner traders who want to test their strategies in the live market without risking too much capital. This lot size is also suitable for traders who are transitioning from a demo account to live trading and want to gradually increase their trade sizes as they gain more experience.

3. Micro Lots in Forex

Micro lots are even smaller than mini lots, representing 1,000 units of the base currency. This lot size is particularly appealing to new traders who want to start with the smallest possible investments while still participating in live market conditions.

Why Choose a Micro Lot?

The pip value for a micro lot is $0.10, making it an excellent choice for those who want to minimize their risk while gaining practical experience. With a micro lot, each pip movement in the currency pair’s price will result in a $0.10 change in your trade’s value. This low pip value allows you to test different trading strategies with minimal financial risk.

For instance, if you buy a micro lot of EUR/USD at an exchange rate of 1.10, you are purchasing 1,000 euros, and the trade’s value in US dollars would be $1,100. If the price moves in your favor by 50 pips, your profit would be $5 (50 pips x $0.10 per pip).

Who Should Use Micro Lots?

Micro lots are perfect for novice traders who are just getting started in Forex and want to build their confidence before moving on to larger trade sizes. This lot size is also beneficial for traders who want to experiment with new strategies or trading styles without putting a significant amount of capital at risk.

4. Nano Lots in Forex

Nano lots are the smallest lot size available in Forex trading, representing just 100 units of the base currency. Trading nano lots is almost like trading with a demo account, but with real money. The financial risk is minimal, making it an excellent choice for complete beginners or those looking to trade very small amounts of money.

Why Choose a Nano Lot?

The pip value for a nano lot is $0.01, meaning that each pip movement in the currency pair’s price will result in a $0.01 change in your trade’s value. While the potential profits are small, so too are the potential losses, allowing traders to engage in the market with virtually no financial stress.

For example, if you buy a nano lot of EUR/USD at an exchange rate of 1.10, you are purchasing 100 euros, and the trade’s value in US dollars would be $110. If the price moves in your favor by 50 pips, your profit would be $0.50 (50 pips x $0.01 per pip).

Who Should Use Nano Lots?

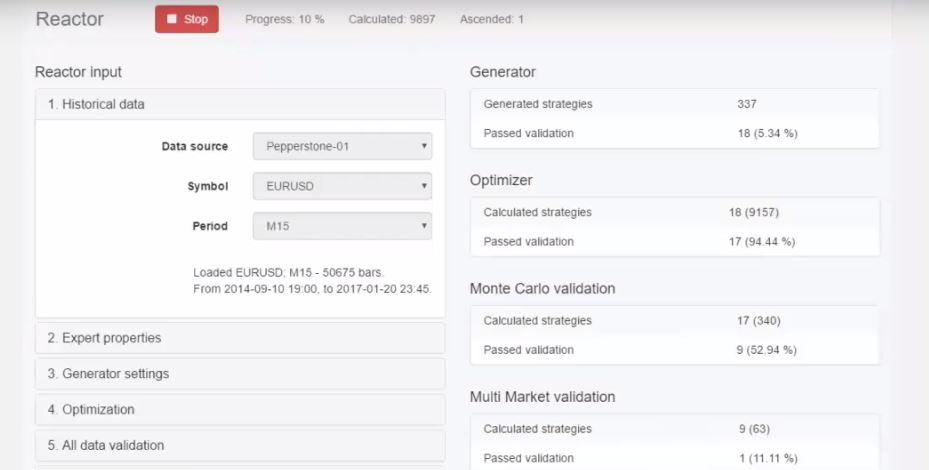

Nano lots are designed for traders who are entirely new to Forex trading and want to start with the smallest possible risk. They are also useful for experienced traders who want to test new strategies or automate trading systems with minimal financial exposure.

How to Choose the Right Lot Size in Forex Trading

Choosing the right lot size is a critical decision that depends on several factors, including your trading experience, risk tolerance, and financial goals.

Here are some key considerations to help you make an informed choice:

1. Assess Your Risk Tolerance

Your risk tolerance is one of the most important factors to consider when choosing a lot size. Larger lot sizes, such as standard lots, carry higher risk because each pip movement has a more significant financial impact. If you have a low risk tolerance or are new to trading, it’s wise to start with smaller lot sizes like mini, micro, or nano lots. As you gain more experience and confidence, you can gradually increase your lot size.

2. Consider Your Trading Capital

The amount of capital you have available for trading is another crucial factor. Forex brokers often recommend having at least the equivalent amount of the lot size in your trading account. For example, if you plan to trade a standard lot, you should have at least $100,000 in your account to cover potential losses and maintain sufficient margin. Similarly, for a mini lot, you should have at least $10,000, and so on.

Starting with smaller lot sizes allows you to trade with less capital while still gaining valuable experience. As your trading capital grows, you can consider increasing your lot size to take advantage of larger market movements.

3. Develop a Solid Trading Strategy

Your trading strategy should align with the lot size you choose. For example, if you are using a scalping strategy that involves making multiple small trades throughout the day, smaller lot sizes like mini or micro lots may be more suitable. On the other hand, if you are a swing trader who holds positions for days or weeks, larger lot sizes like standard lots may be more appropriate, provided you have the capital and risk tolerance to support them.

4. Practice with a Demo Account

Before committing to a particular lot size, it’s a good idea to practice with a demo account. Most Forex brokers offer demo accounts that allow you to trade with virtual money in real market conditions. This is an excellent way to test different lot sizes and see how they impact your trades without risking any real money. Once you feel comfortable with a specific lot size in the demo account, you can transition to live trading with greater confidence.

Conclusion: The Importance of Lot Size in Forex Trading

Lot size is a fundamental concept in Forex trading that directly impacts your risk, profit potential, and overall trading experience. Whether you choose a standard, mini, micro, or nano lot, the key is to select a lot size that aligns with your trading goals, experience level, and risk tolerance. By understanding how different lot sizes work and how they affect your trades, you can make more informed decisions and improve your chances of success in the Forex market.

As you continue to develop your trading skills and strategies, remember that the Forex market is highly dynamic and constantly evolving. Stay informed, keep practicing, and always manage your risk effectively. With time and experience, you’ll be better equipped to choose the right lot size for each trade and achieve your financial objectives in the exciting world of Forex trading.