Investment in Cryptocurrency

Hello investors. I am writing this article just before the halving of the Bitcoin, we will see what will happen during this halving. And today I have decided to share one more trick about the aggressive counter trend line which you can use before investment in cryptocurrency.

It’s a little bit more advanced technique that I share in my Cryptocurrency Investment Strategy course, but it gives us better opportunities to buy at a cheaper price and to sell at a more expensive price when we are actually selling the Bitcoin.

Now, for the long opportunities when we are buying an asset, the aggressive counter-trend line gives us a better price. And that is very important when we do investment in cryptocurrency. So I will explain to you how that works. I have explained it in some of my courses and I will try to make it as clear as possible.

The aggressive counter trend line

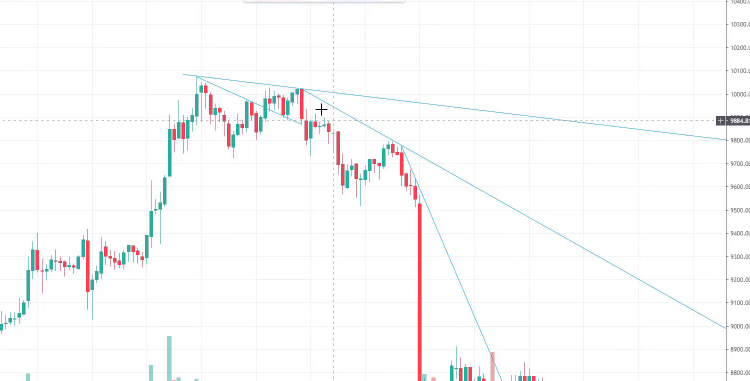

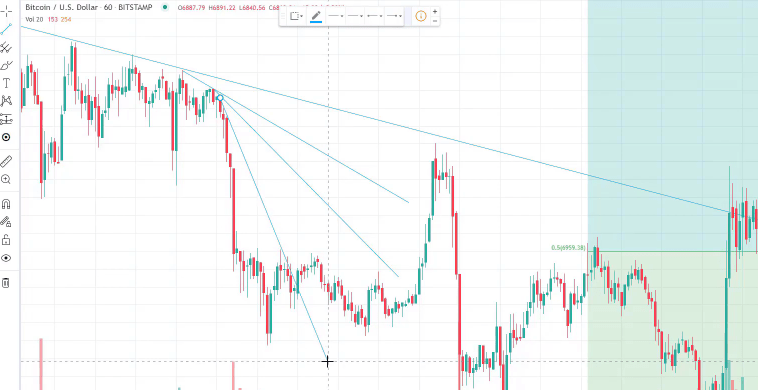

We had a huge drop on the 9th of May for some reason. There were a lot of reasons described over the internet, I will not talk about them. It doesn’t really matter, the price dropped and it gives me better opportunities to buy at a cheaper price.

Now, one more counter trend line could be drawn here.

We have a lower high so we have another counter trend line. Now, what happened, the price fell down and it gives me the chance to draw this aggressive counter trend line.

This is how I call it. So I take the last high from where my last counter trend line was drawn and I connect it to the next lower point.

I have the chance to draw another aggressive counter trend line going through the tops of the candlesticks. So the aggressive counter trend line is from the last top, I connect it with the next point.

The lowest point of the drop in Bitcoin

I want the counter trend line or this aggressive counter trend line to be on the top of the price so no price will be breaking it on the point where I’m drawing.

So this is the point where it should be going from. And from there, I take another one which goes through this candlestick and it went through where I actually bought another portion of Tezos because we have a failure of the recent low. This was my next investment in cryptocurrency.

This was the lowest point of this huge drop in the Bitcoin and then the price failed one time.

It was very far at this moment to break the counter trend line so I waited. So we have the failure of the recent low. And the price broke it last night and I took another portion of Tezos and now the price is going just sideways.

This is how I use the aggressive counter trend line and I just want to give you one more example with an aggressive counter trend line so you can understand how exactly I do the investment in cryptocurrency. Let me see some of the previous examples that I demonstrated to you.

The importance of the aggressive counter trend line

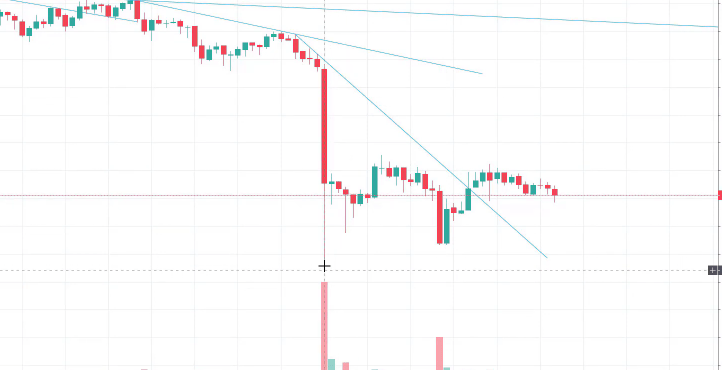

And actually there are quite many examples of the aggressive counter trend line but I just want to make it clearer. For example, below is a very good example of a counter trend line because we have a failure of the recent low. And what you can draw is aggressive counter trend line this way.

So we have the counter trend line but from the last top, you can take another line connecting a lower point, a lower top to draw the aggressive counter trend line. And that’s not really a great example, I will try to look for some more.

Basically, the aggressive counter trend line comes useful when we have a huge drop just what we had the last days and we can draw another line which will give us a better entry.

I saw an opportunity while investment in cryptocurrency

So first it will go through the tops and then we can have another one going through the candlesticks.

From this candlestick, we can take another aggressive counter trend line and draw it through either of the tops, depends on where you catch it.

I mean if you are at this moment and you have the opportunity to draw such aggressive counter trend lines, you can have a better entry if we have a failure of the recent low. So we have the aggressive counter trend line fails to take the low and we can have the entry right over here.

As the name says, aggressive counter trend line is for the more aggressive investors and traders who are looking to buy the cheaper price. And, one more time, going to the current example, it gave me the opportunity to buy at a much cheaper price.

Bring any question about investment in cryptocurrency you have to my attention

Because if I didn’t have it here and I had this counter trend line and if I wait for the price to reach again these levels, to enter right over here, that is a huge move. And I want this to be profit, not to wait to buy at these levels.

Otherwise, we will see what happens with the Bitcoin halving.

I am not looking for buying opportunities at the moment because we are still in a downtrend, that’s the most important thing. If I switch to the daily chart, we have still a downtrend. If the price forms a lower high and then a lower low, then we are in a downtrend, and investment in cryptocurrency might take longer.

For any questions about it let me know in the comments below. Make some drawings over the chart, send it to me and I will let you know if that is a good counter trend line or not.

Thanks for reading.

Cheers.