How to trade Forex successfully with many strategies.

How to trade Forex successfully is one of the questions that every beginner trader asks daily and looks for the answer. Hello, dear traders, my name is Petko Aleksandrov, head trader at EA Forex Academy! In this lecture, I will share with you why we need to trade with many Expert Advisors, with many strategies in one trading account. It’s a common mistake for every beginner trader to depend on one single strategy. Now obviously every strategy has its losing phase and its winning phase.

The losing phase could be one day, it could be one week, it could be longer. So you really don’t want to sit in front of the computer trading and one week to be on losses. Right? Nobody wants to have consecutive days of losses.

By having many strategies, we diversify the risk. This is the first answer to the question of how to trade Forex successfully.

That is why when we combine many strategies in one trading account when one strategy has its losing phase, the others will compensate for this loss. Because there are different strategies and at that moment they will have their winning phase. So this way we diversified the risk between many strategies and we don’t depend on one single strategy that might lose for some time.

And it’s normal because every strategy has its losing phase, its losing period. And I will show you that. If you look at my chart now, I will show you how to do a backtest for an Expert Advisor.

And let’s make a backtest for any random Expert Advisor. And I will show you how to place one on Meta Trader for the people who didn’t do it so far. I will go to File, Open Data folder, and then I go to MQL4 and I go to Experts.

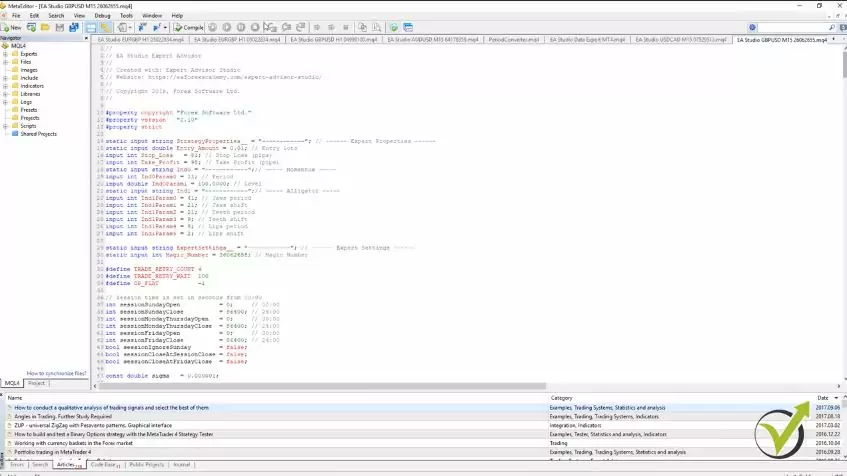

Developers program Expert Advisors on Meta editor.

So this is the place where you need to put any Expert Advisor and the portfolio Expert Advisors that I will provide you with in this course. So I will copy and I will paste here randomly one Expert Advisor for GBPUSD, it is on M15. OK? I will double-click on it.

And here we see the code of the Expert Advisor, all the parameters that we have, and if I scroll down you will see the complete code. Alright? Now I will compile the Expert Advisor. This is very important.

One click, it compiles. So basically, guys, the Meta editor is the place where developers program Expert Advisors and strategies for algorithmic trading.

The problem when coding expert advisors is that developers don’t know if these strategies will be profitable or not. So they spend a couple of weeks to code the strategy and once it is ready they perform the backtest. This way they lose a lot of time and even months to find a profitable strategy. Normally this is possible if they use the optimizer in MetaTrader which leads to the risk of having over optimized strategies.

How to trade Forex successfully if you hire a developer:

- You can automate your trading by hiring a developer with mql experience but you will face a couple of problems

- It will take you a long time to complete a single strategy into an expert advisor because normally the strategies come with a number of errors

- After the expert advisor is ready you will spend time to check how it works and if there are errors you will need to send it back to the developer

- This process might a couple of weeks or even months and in the end, you might end up without having a profitable strategy

- This is expensive because the developers normally take between 30 to $50 for one hour. This means you will spend a couple of $100 for a single expert advisor.

However, I don’t do this anymore. Years back I was hiring developing company too cold my strategies. This was very frustrating moments because it was taking a long time for a single strategy to be automated and the results were very slow. This is how I started to look for strategy builders and I found EA studio to work the best for me.

We use Strategy Builders which I will show you later on. And we get the complete code ready without any errors as you see, without warning words. Just perfectly fine without any issues is the second answer to the question of how to trade Forex successfully.

Enable Auto trading if you want to do actual trading with the Trading Robot.

So all you need to do once you receive the Portfolio experts is to open it, compile it, and close it. And you will see here is the compiled version or this is the ready Trading Robot. Alright? I will close the folder and I will refresh here Expert Advisors and it will display below.

Now if you want to do actual trading with this Robot, you need to enable the Auto trading. It needs to be green. For now, I will disable it because I just want to make a backtest. Alright?

I will drag it over the chart. And here comes the menu where the common settings and the inputs, where you see the Stop Loss to Take Profit, the entry lots that you will be trading with. So, for example, here let’s make a 0.1.

You can change the lot to what fits your money management best.

You can change it to one lot if you wish, whatever size fits your money management or whatever size you want to test. And below are some indicators. In this case, this strategy uses the alligator and momentum and Stop Loss and Take Profit. And I click on OK and the Expert Advisor is over the chart. But you see I have a sad face, which means that the Expert Advisor is not trading because the Auto trading is disabled.

And I keep it disabled because I don’t want to open any trades with this Expert Advisor. I just want to make a backtest. So I will right-click and go to Expert Advisors, and I will click on Strategy Tester.

Here you have the chance to select the data. For example, here is from the 1st of January 2018. So last year, from the beginning of last year till today, let’s make it till today.

One of the methods that I teach my courses on how to avoid trading on a demo account is using the backtest. Let’s say you have historical data from the last 2 years. These are 24 months. When you perform a backtest you can see how the strategy behaves during these 24 months where the trades were opened and closed, what is the profit and what is the Equity chart at the end.

Now if you place end date for the backtest let’s say 4 months ago you will test your strategy over the rest 20 months. With the strategy builder EA studio you are able to generate strategies over these 20 months. After you choose the strategies you want to use you can include back the 4 months (the most recent 4 months) and perform the backtest again. If the strategy profits during these 4 months this is absolutely the same thing as if you have traded their strategy into your demo or live account. And this could be done in a couple of minutes no need to spend 4 months for demo trading.

Performing a correct backtest is the third answer to the question of how to trade Forex successfully

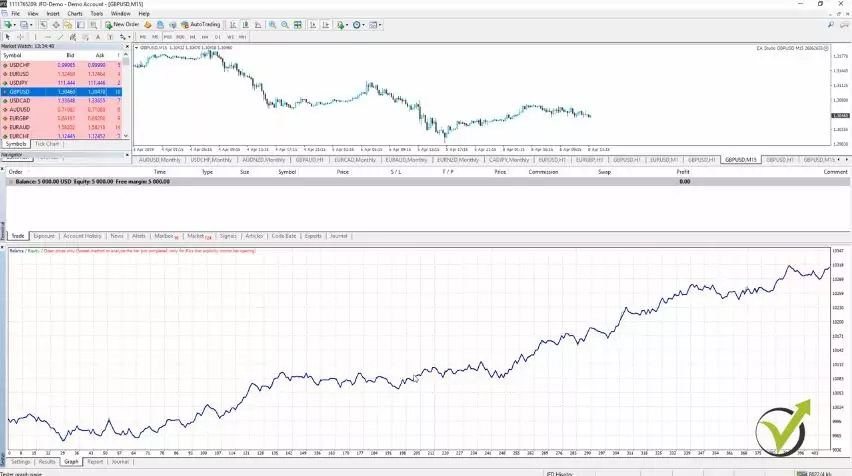

And we have M15, I will use the current spread. And here is the Symbol, the Expert Advisor, and I will just click on Start and you will see the results with the Expert Advisor. Here you see all trades that were opened and closed.

You can see the graph. You can see a pretty stable graph over here and you can look at the Report for some statistics, the Journal. But what we focus is on the graph.

Let’s look at this graph. It is a stable graph. This is the kind of Expert Advisors we want to trade where we have some losses, we have profits. At the end of the day, we have a stable equity line going upwards. Right? Let me make it a little bit bigger so you can see better.

So these are the so-called robust strategies and this is not over optimized strategy. And what you will notice, overall, the strategy is good. It starts from over here and you see it makes a profit with the time.

Each strategy has a profitable phase and a losing phase.

But what you will notice, is that there are these periods when the strategy loses. This is very normal with every strategy. Every strategy will have a losing period, will have profitable periods.

The important thing is that we are having the equity line going upwards and not downwards. Right? But if you focus more on the losing periods, you will see that it might look like very small periods here, but if I put the mouse on any of them, Right over here you will see that this is from 12th of September.

Going down here which is the 20th of September. So this is like one week or even a little bit more. Now let’s have a look at some other period.

It isn’t much you can do about the losing periods.

For example, here we have December 17th to the 24th of December. Another 7 days when the strategy is losing. So if you are trading one strategy, for example, this strategy, you will have these weeks when you see only losses.

And this makes the traders very discouraged. It made me unhappy at the beginning when I was doing algorithmic trading. And I said to myself, “Alright what do I need to do to avoid having these negative periods?”

And the answer is nothing. I cannot do anything to avoid these periods because obviously, every strategy has these losing periods. Could be one week, could be two weeks.

You can see in the beginning here we have an even longer period. Probably it’s a little bit longer like 10 to 15 days or 20 days. But what came to my mind is that I can trade many strategies into one account.

I will teach you how to trade Forex successfully with many strategies into one trading account.

So when this strategy has its losing phase, the other strategies during this time, for example, between 11th of September to the 20th of September. During these days it will have a profitable phase. Because it’s a different strategy it uses different indicators, different entry-exit conditions, different Stop Loss and different Take Profit.

I saw that when I put, not just a couple but many strategies into one trading account, the equity line for the complete portfolio for all the strategies combined together gets much smoother. And there will be a losing phase but much smaller, much shorter. And this way I saw that the equity line of the whole portfolio is much better, much smoother than the equity line of a single strategy of a single Expert Advisor. Alright?

And this is why in this course Walk Forward optimization: Forex trading with Portfolio EAs, I will teach you how to trade not only one Forex Strategy but many strategies into one trading account. And you will see what is the difference when we perform backtest with such portfolio Expert Advisor. Alright?

How to trade Forex successfully is a question that I do my best to answer every day.

My work is to test hundreds and thousands of strategies and expert advisors and to include the best ones in my courses, already above 14000 students joined the Academy and I am very happy that the content we produce is so likable. In every new course, I launch I put all of my new knowledge and experience about expert advisors and I am glad that the course has helped many traders around the world.

Thank you for reading, and if you want to learn more about the robustness testing and the walk forward optimization you can learn it all from the course.