Starting your trading journey can be overwhelming, but with the right mindset and tools, you can participate in the financial markets confidently. Many beginners jump into trading without understanding the risks, strategies, or platforms available—leading to frustration and very often to financial losses. This article will provide a structured guide on how to start trading for beginners the right way.

You’ll learn about the leading trading platforms, the importance of choosing a regulated broker, and how to avoid common scams. We’ll also explore different trading strategies, algorithmic trading for beginners, and why more traders are turning to Expert Advisors (trading bots) to eliminate emotional decision-making. Additionally, risk management plays a crucial role in long-term success, so we’ll cover capital allocation techniques to help protect your investments.

Whether you’re interested in stocks, forex, or cryptocurrencies, this guide will give you a practical roadmap to profitable trading. By the end, you’ll also have access to trading bots for beginners to test strategies on a demo account before risking real capital. Let’s jump into the fundamentals and set you up for success!

Table of Contents:

How to Start Trading for Beginners: Choosing a Trading Platform

Selecting the right trading platform is essential, especially for beginners looking to trade efficiently. Different platforms are more suitable to different trading styles, whether it’s manual trading, algorithmic trading, or futures trading. Below is an overview of some the most popular trading platforms and the key features to consider when making a choice, ultimately when we are talking about algorithmic trading for beginners.

Overview of the Most Popular Trading Platforms

In order to select the right trading platform for its own needs, trader needs to understand the strengths of each platform. Some platforms focus on technical analysis, while others excel in automated trading and execution speed. Here are the 4 trading platforms, we would like to draw your attention to:

- TradingView – Best for Charting and Technical Analysis. TradingView is a widely-used platform that offers powerful charting tools, real-time market data, and a social community where traders share insights. It supports hundreds of indicators and drawing tools, making it ideal for traders who rely on technical analysis. However, its algorithmic trading capabilities are still developing, making it less suitable for traders who want to use fully automated bots.

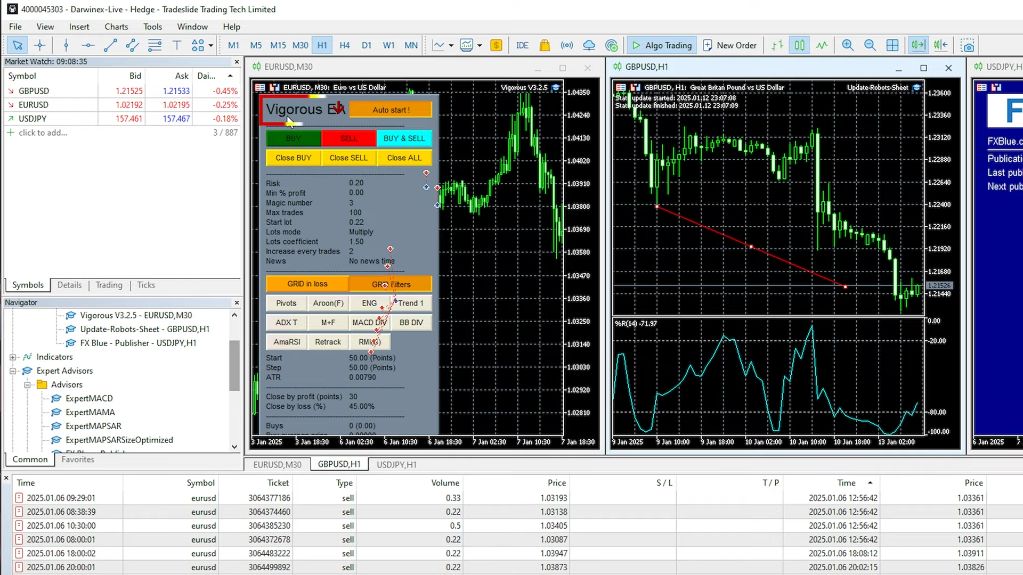

- MetaTrader 4 & MetaTrader 5 – Best for Algorithmic Trading. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the most popular platforms for algorithmic trading, thanks to their support for Expert Advisors (EAs), also known as trading robots. These are the go-to platforms when we speak about algorithmic trading for beginners, due to they allow traders to automate strategies, backtest them, and execute trades without emotional bias. MT4 is widely used for forex trading, while MT5 offers more asset classes, including stocks and futures. For example, you can have a look at one of our accounts where we trade Vigorous EA. With trading bots for beginners, the goal is to trade fully automatically. You would attach the EA on the chart and all you would need to do is just to monitor the performance. Of course, sometimes due to various reasons, some Expert Advisors are not performing well, and if you start trading with such, you immediately need to change to another one.

- cTrader – A Reliable Alternative to MetaTrader. cTrader is another trading platform that provides advanced order execution, depth of market (DOM) features, and an intuitive interface. It supports automated trading through cAlgo, making it a strong alternative for traders who prefer a modern platform with enhanced execution speed.

- NinjaTrader – Best for Futures and Advanced Traders. NinjaTrader is popular among futures and forex traders. It offers advanced charting, strategy automation, and custom indicators. However, it is not free unless you’re using a demo account, making it less accessible for beginners.

Key Features to Look for in a Trading Platform

When selecting a trading platform, traders should focus on features that align with their trading strategy and goals. The following aspects are critical to ensuring a seamless trading experience.

- Charting and Technical Analysis Tools – A good platform should offer customizable charts, multiple timeframes, and a variety of technical indicators. This is very important for traders who rely on technical analysis to make their trading decisions.

- Support for Automated Trading – For those interested in algorithmic trading, choosing a platform that supports Expert Advisors (EAs) or trading bots is a cornerstone. Platforms like MetaTrader and cTrader are great for automated trading for beginners.

- Broker Compatibility – Not all brokers support every trading platform. Ensure that the platform you choose is compatible with a regulated and reliable broker to avoid issues with trade execution and fund security.

- Execution Speed and Reliability – Fast order execution and minimal slippage are vital, especially for day traders and scalpers. cTrader and NinjaTrader are known for their high-speed execution capabilities.

- Cost and Accessibility – While MetaTrader is free for traders (The brokers pay MetaTrader so they can offer it for free to their clients), rest of the platforms require a subscription or paid license. Consider the costs involved and whether they fit your trading budget.

By evaluating these features, beginners can choose the best trading platform that aligns with their goals and trading style, ensuring a smooth and profitable trading experience.

If you’re serious about improving your trading skills and exploring algorithmic trading for beginners, our 21-Day Free Algo Trading Course at EA Trading Academy is the perfect place to start. Learn how to create trading bots for beginners, automate your trades, backtest strategies, and remove emotional decision-making to reach consistency and profitability.

How to Start Trading for Beginners: Choosing a Broker

When it comes to brokers, it is very important to select legit ones. Your broker acts as the intermediary that executes your trades, so selecting the right one is essential to ensuring a secure and smooth trading experience. A poor choice can lead to high fees, withdrawal issues, or even falling victim to scams.

The Risk of Unregulated Brokers

When it comes to brokers, it is very important to select legit and regulated ones. Most brokers are not regulated, despite having MetaTrader platforms, professional-looking websites, and sales teams. Many of these brokers use aggressive sales tactics, calling traders and requesting personal and credit card details over the phone under the pretense of helping them fund their accounts. This is a scam. Never share your credit card details over the phone, even if the caller sounds like a professional trader—they are often just sales representatives trained to pressure you into depositing money.

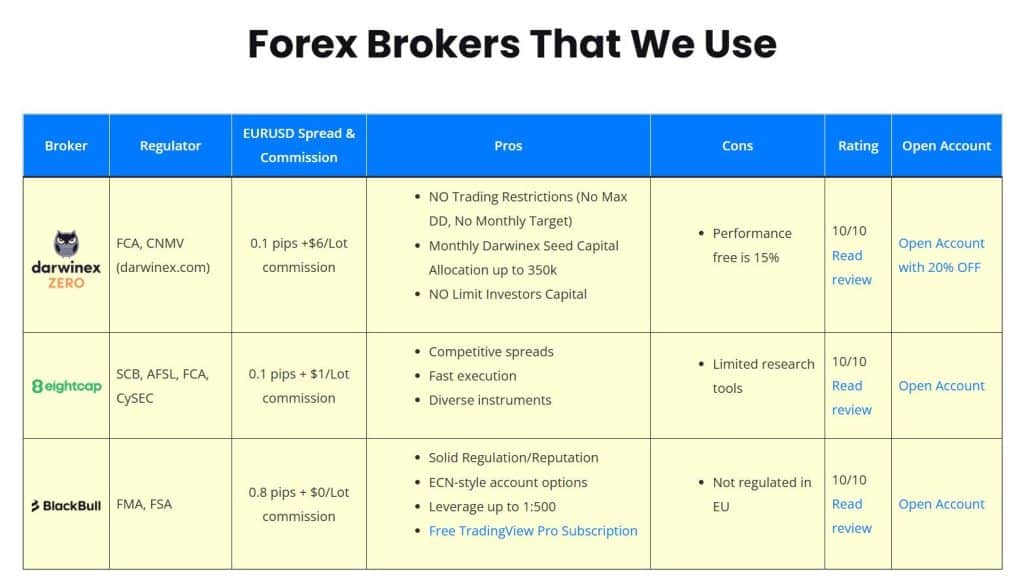

Thousands of people get scammed every day in different industries, and trading is no exception. That is why we at EA Trading Academy have created a dedicated page listing trusted brokers, where traders can monitor which brokers we use. We ensure that only regulated brokers are listed, and while we do not provide direct recommendations, we include detailed pros and cons so traders can make an informed decision.

To avoid falling victim to such schemes, traders should only work with regulated brokers that are licensed by reputable financial authorities like the U.S. Commodity Futures Trading Commission (CFTC), the UK’s Financial Conduct Authority (FCA), or the Australian Securities and Investments Commission (ASIC).

How to Find a Trustworthy Broker

When searching for a reliable broker, there are several key factors to consider:

- Regulatory Compliance – Ensure the broker is licensed and regulated by a reputable financial body. Check their credentials on regulatory websites.

- Transparent Fees and Spreads – A good broker should provide clear information on spreads, commissions, and overnight fees. Hidden costs are a red flag.

- Deposit and Withdrawal Policies – Check the broker’s withdrawal process. Delays or excessive withdrawal fees often indicate potential issues.

- Customer Support – Reliable brokers offer responsive and professional customer service via live chat, email, or phone.

- Trading Platform Compatibility – The broker should support popular platforms like MetaTrader 4, MetaTrader 5, or cTrader.

- User Reviews and Community Feedback – Research user feedback on trustworthy forums like Forex Peace Army, Trustpilot, and Reddit.

Always do thorough research before funding an account, and we do recommend to start with a demo account to test the broker’s reliability before committing real money. By choosing a regulated and reputable broker, traders can protect themselves from fraud and ensure a smoother trading experience.

Funding Your Account and Tracking Performance

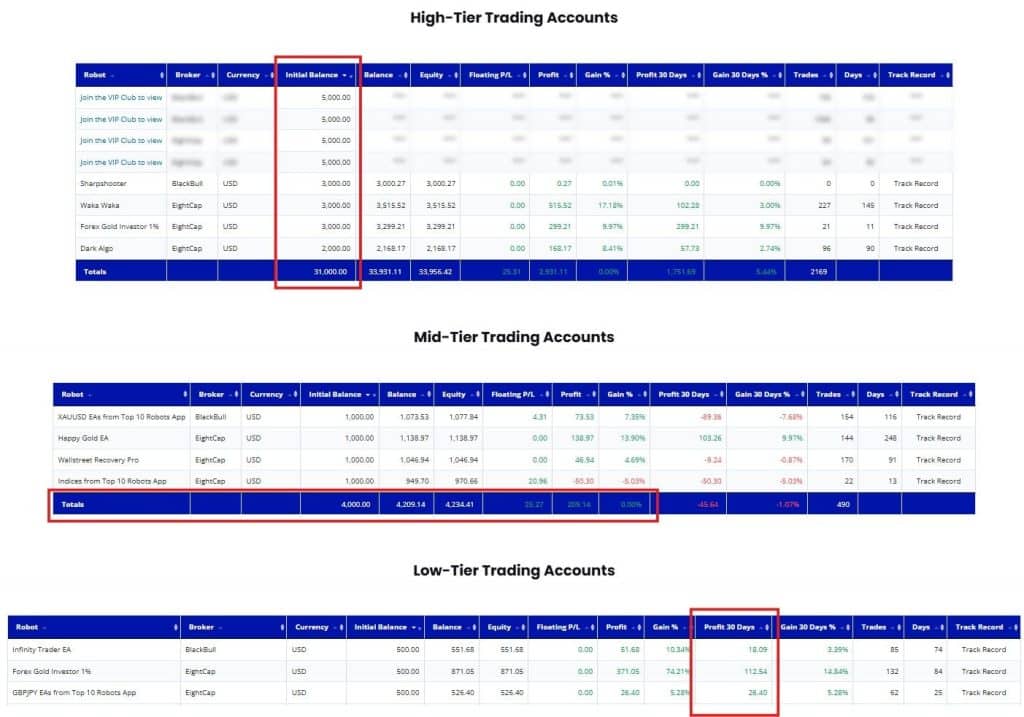

Once you’ve selected a broker, the next step is funding your account. Many brokers allow you to start trading with as little as $200, but for better flexibility, a minimum of $500 is often recommended. At EA Trading Academy, we also use smaller accounts to test different combinations of trading robots.

For transparency, we maintain a live trading results page, where traders can see real-time account balances, profits, and performance metrics over the last 30 days. This helps traders make better decisions by observing how different strategies and robots perform in real trading conditions.

By choosing a regulated broker and funding your account wisely, you can ensure a safer and more structured trading experience, reducing risks and increasing your chances of success in the market.

How to Start Trading for Beginners: Understanding the Prop Firms Model

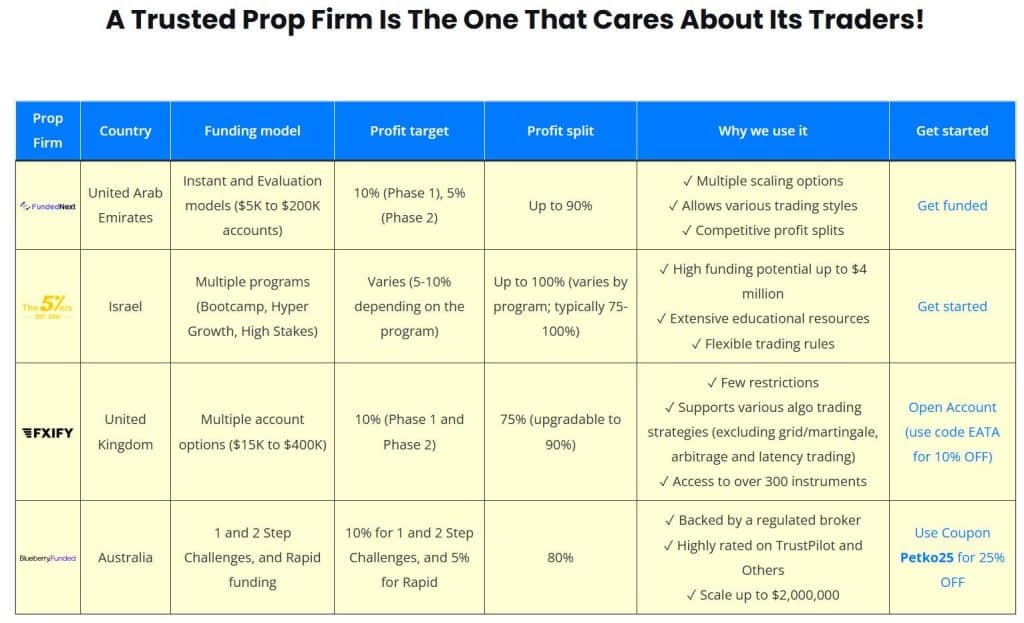

Proprietary trading firms, or prop firms, are companies that provide traders with capital to trade. Instead of using their own money, traders can qualify for funding by passing a challenge or evaluation process. This allows traders to access larger capital allocations while sharing a portion of their profits with the firm.

While prop firms present an attractive opportunity, many lack regulation, which increases the risk of scams. Some firms refuse to pay out traders’ profits, block accounts without explanation, or impose unrealistic trading conditions that make withdrawals difficult. Since there are no regulators overseeing these firms, there is no guarantee of payout.

After extensive testing in 2024, we found that many firms were unreliable, either refusing to pay profits or suddenly blocking accounts. Even when a firm pays one trader, it does not necessarily mean they will pay everyone. Traders must remain cautious when selecting a prop firm and conduct thorough research before committing.

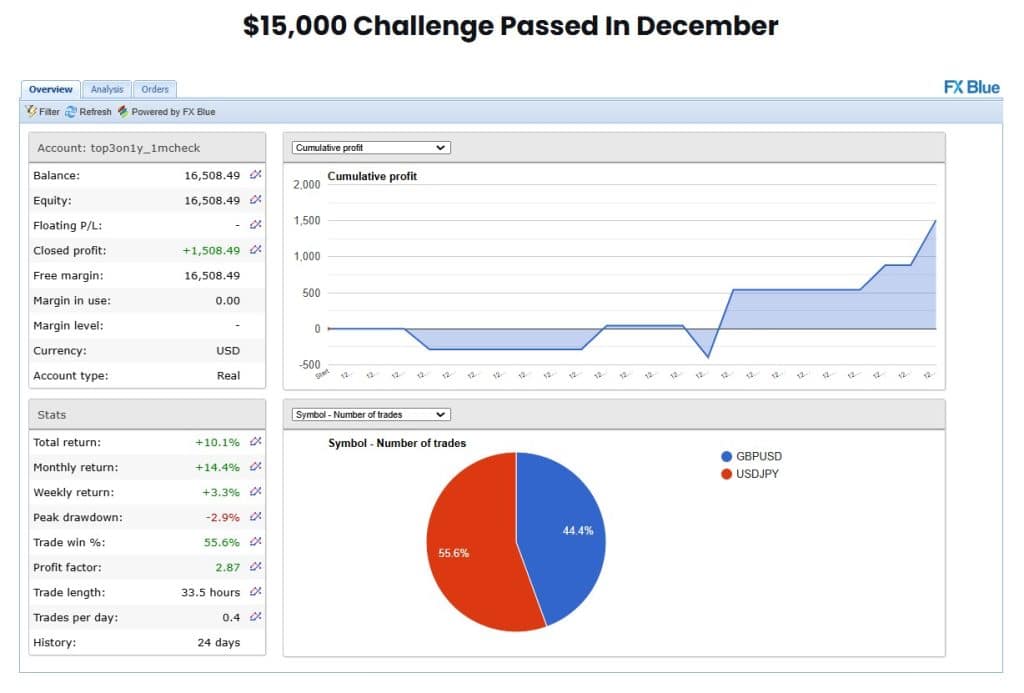

At EA Trading Academy, we have tested multiple prop firms in our attempts to find a reliable one and we listed some which we continue using. One of the latest successfully passed challenges by our traders was in late 2024 with Funded Next. Offers capital after successfully passing an evaluation process. One of our traders completed a $15,000 challenge using USD/JPY and GBP/USD trades with Expert Advisors from our Prop Firm Robots App. During this challenge, we analyzed the past year’s performance and selected the top three Expert Advisors, ensuring they were consistently profitable in the previous month as well.

You can have a look at the ongoing and completed prop firm challenges page on our website for a full breakdown.

How to Start Trading for Beginners: Instant Funding

Instant funding is becoming more and more popular lately. For many, it is much better alternative to the disgraced prop firm challenges practice. In this form of trading, traders purchase a funded account.

Instant funding brokers provide traders with access to funded accounts without requiring them to pass a challenge. Instead of proving trading consistency through an evaluation process, traders can simply purchase a funded account and start trading immediately. This option is appealing to those who want access to larger capital without undergoing strict performance tests.

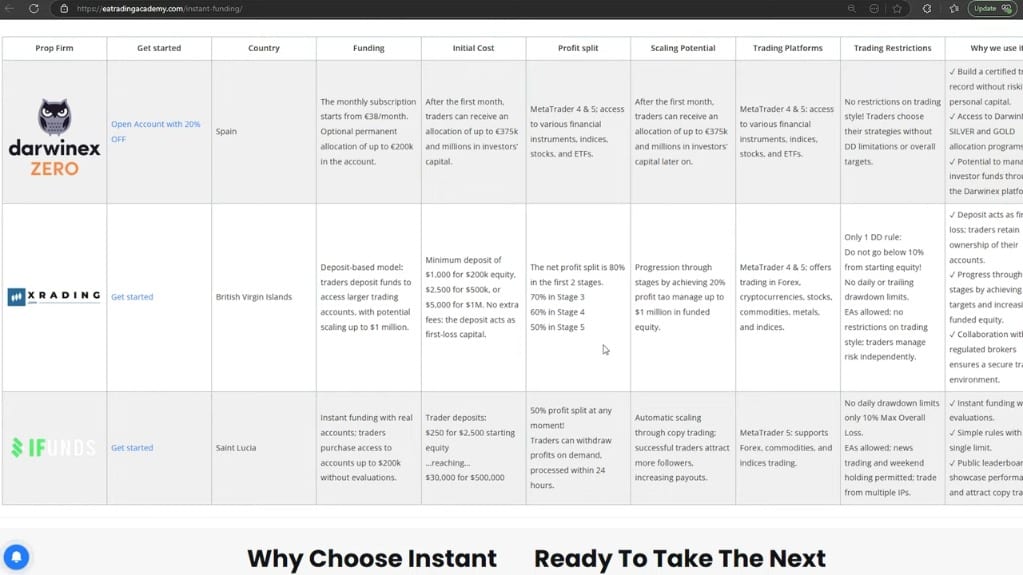

At EA Trading Academy, we have tested multiple instant funding brokers and identified three that have proven to be reliable based on our experience. These brokers offer different funding models, profit-sharing structures, and withdrawal policies.

1. Darwinex Zero

- Subscription-based model with a $38 monthly fee.

- Provides traders with a $100,000 account.

- Allows allocations up to €375,000.

- Traders receive a 15% profit payout.

If you want to learn more how Darwinex Zero works, check this video.

2. Xrading.com

- Requires an initial investment starting at $1,000.

- Features a stage-based funding system.

- Profit split starts at 80% for the first two stages, reducing to 50% at stage five.

- Traders must achieve a 20% profit to progress to the next stage.

- Withdrawals can be made at each stage, making it easier to secure profits along the way.

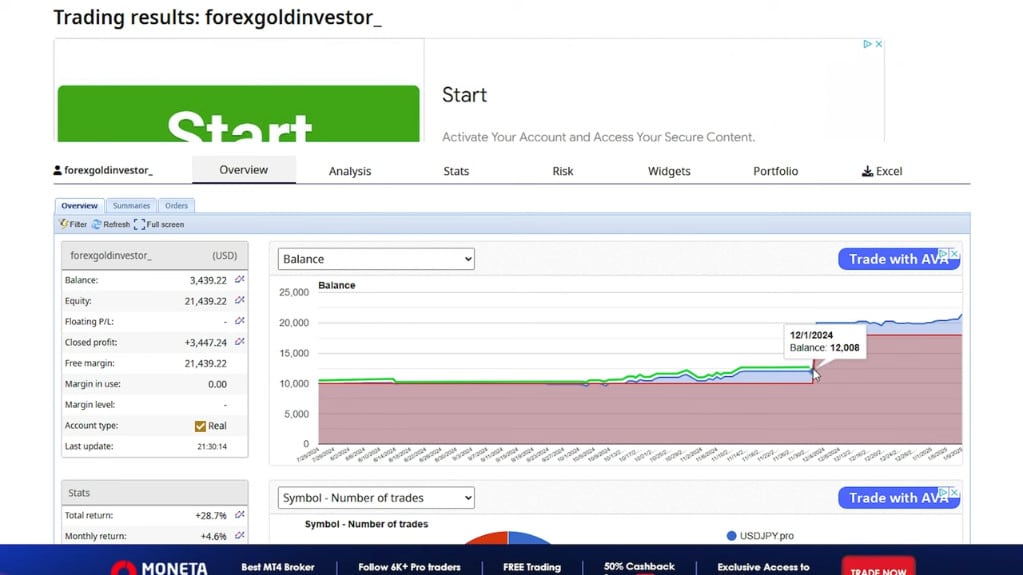

On one of our accounts we trade the Forex Gold Investor (FGI) Expert Advisor and we are now on the second stage. We started with a $10,000 account and when a 20% profit was achieved, the account was upgraded to the $20,000 level. Upon achieving the 20% profit, we could already withdraw $1,600, which covers the initial investment, and leaves traders a larger account to trade with. On the second stage the profit target is $24,000.

3. iFunds

- Offers a simple, profit-sharing model.

- Traders can withdraw 50% of their profits at any time.

- No stage-based progression; traders trade with a set capital allocation.

- Allows the use of Expert Advisors (EAs), providing flexibility for algorithmic traders.

For a comprehensive breakdown of each broker’s pros and cons, visit our dedicated instant funding brokers page.

algorithmic trading for beginners: Effective Trading Strategies and the Role of Expert Advisors

How to Develop a Reliable Trading Strategy

A successful trading strategy involves using a combination of technical indicators, market trends, and risk management principles. For example, traders incorporate common tools such as:

- 20 Simple Moving Average (SMA) – A widely used trend-following indicator.

- Support and Resistance Levels – Identifying key price zones where the market reacts.

- Trend Lines and Counter-Trend Lines – Used to determine market direction and possible reversal points.

Rather than relying on generic trading advice, traders should focus on proven methods with backtested results. Many YouTubers claim profitability based on past trades, but without a track record, such claims remain unreliable.

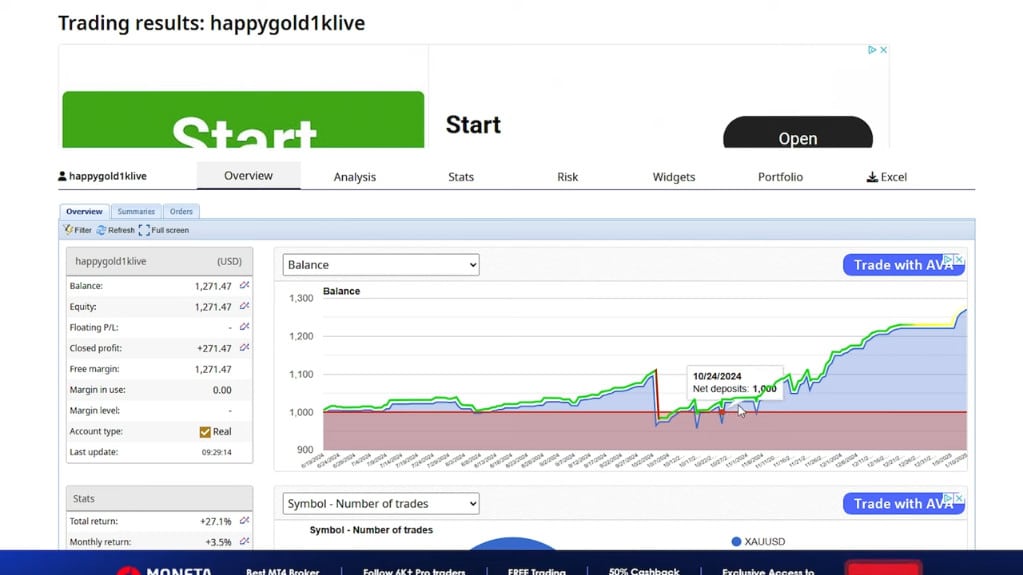

Why Track Record Matters in Trading

A proven strategy should have a historical track record demonstrating its effectiveness. For example, let’s have a look at the live trading results for one of the Expert Advisors we use – the Happy Gold Trading EA on a $1,000 account. Here you can see exactly how the strategy performed, which is a real track record. There was an initial drawdown followed by recovery. And now we see a total return of nearly 30% over time. That shows us consistent performance under different market conditions.

Why Expert Advisors Outperform Manual Trading

Manual traders, including influencers and YouTubers, can only trade within limited hours. Unlike manual trading, Expert Advisors (EAs) trade round the clock, leveraging algorithms to detect profitable opportunities. With the support of a VPS (Virtual Private Server) and constant internet connectivity, automated trading ensures strategies are executed without emotional bias or human limitations.

While some manual traders may show profitable track records, they are likely missing opportunities due to limited availability. The only true way to validate a strategy’s profitability is to backtest and execute it through an Expert Advisor.

To explore our tested and proven Expert Advisors, visit our dedicated EA trading page here.

Trading Bots for Beginners: How to Get an Expert Advisor

Different Ways to Acquire Expert Advisors

Expert Advisors (EAs) are automated trading systems that execute trades based on predefined rules. There are several ways to obtain an EA, each with its own advantages and risks.

1. Buying from a Marketplace

One of the most common ways to get an Expert Advisor is through online marketplaces. The largest and most well-known marketplace is the MQL5 Marketplace, which is the official store for MetaTrader 4 and MetaTrader 5 users. Since MetaTrader is the most popular platform for algorithmic trading, MQL5 has become the biggest hub for Expert Advisors.

However, not all EAs available in the marketplace are reliable. Many are low-quality and poorly optimized, with some even designed to blow accounts instead of generating consistent profits. Prices range from free to several thousand dollars, making it difficult for traders to determine which ones are truly effective.

2. Developing Your Own Expert Advisor

Another option is to program an Expert Advisor yourself. This requires programming knowledge, particularly in MQL4 or MQL5, the coding languages for MetaTrader. However, most traders are not also developers, and attempting to master both trading and coding can be challenging.

As a general rule, traders should focus on trading strategies, while developers concentrate on building and optimizing the automation process.

3. Using Strategy Builders for Expert Advisors

A more practical approach for many traders is to use strategy-building software to create Expert Advisors automatically, without requiring programming skills. At EA Trading Academy, we use three powerful tools:

- Expert Advisor Studio (EA Studio) – A web-based tool that allows traders to create EAs by setting entry and exit rules and exporting fully functional robots with one click.

- Forex Strategy Builder (FSB Pro) – A more advanced desktop-based tool that provides deeper customization options for EA development.

- Express Generator – A tool that requires minimal programming knowledge but allows advanced traders to create custom EAs and then export them into EA Studio.

Automating the EA Creation Process

To streamline EA development further, we have integrated Express Generator with Expert Advisor Studio to automate the process of generating and testing new EAs. This has allowed us to build, test, and optimize trading robots continuously.

Additionally, we maintain two specialized EA repositories:

- The Prop Firm Robots App – Focused on funded trading strategies.

- The Top 10 Robots App – Displays the best-performing EAs across different timeframes and asset classes.

By leveraging these tools, traders can acquire tested and optimized Expert Advisors without the need for coding expertise.

How to Start Trading for Beginners: Risk Management in Trading

How to Manage Your Trading Capital Effectively

A critical part of successful trading is risk management. Without a solid approach, even the best strategies or Expert Advisors can result in significant losses.

One of the key rules we follow at EA Trading Academy is the 10% rule:

- No more than 10% of total capital is risked on active trading.

- 10% is allocated to cryptocurrencies.

- 10% is invested in long-term assets like stocks, indices, and similar investments.

This structure ensures that traders never risk their entire capital on a single strategy or market, reducing exposure to volatility.

When to Stop Trading a Strategy

Even with a strong risk management plan, it’s important to know when to stop using a trading strategy or robot. A key rule we follow is:

- If an account drops 10% below its initial balance, stop trading that specific strategy and move on to a better one.

For example, if a trader starts with $500 and their balance drops to $450, they should discontinue that strategy immediately rather than hoping for a recovery.

By following strict risk management principles, traders can protect their capital, minimize losses, and maximize long-term profitability.

How to Start Trading for Beginners: Conclusion

Successfully navigating the world of trading requires the right tools, strategies, and risk management principles. Choosing the best trading platform and working with regulated brokers or reliable funding firms can make a significant difference in long-term profitability.

Algorithmic trading, when done correctly using Expert Advisors (EAs), eliminates emotional trading and ensures consistent execution. However, selecting the right EA is crucial, as many in the marketplace are ineffective. At EA Trading Academy, we provide tested and optimized trading bots that align with proven strategies.

Finally, risk management is the backbone of sustainable trading. By following the 10% rule and knowing when to stop using a strategy, traders can minimize losses and preserve capital. Whether you are just starting or refining your approach, disciplined risk management and proven trading strategies will help you achieve long-term success.