Stop Loss and Take Profit in EA Studio

Stop Loss and Take Profit are part of Strategy Properties

Stop Loss and Take Profit are an essential part of every trading strategy and Expert Advisor. EA Studio has the capability to build in easily the two in the strategies.

When you open the Strategy Editor in EA Studio you will see the Strategy box which consists of three columns:

- Strategy Properties

- Entry rules

- Exit rules.

Strategy Properties

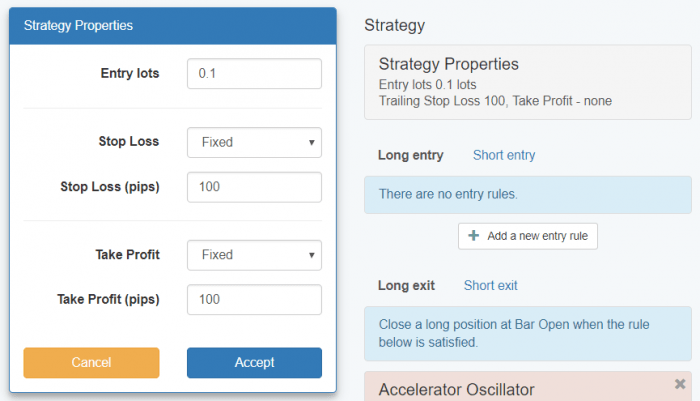

When you click on the Strategy Properties (check the image below), a panel will be displayed on the left side. There you can set the trading amount, Stop Loss and Take Profit for your positions.

While it’s open you can’t make changes to the rest parts of your trading strategy. You will need to close the panel first: either by clicking on the Cancel or the Accept button at the bottom of the panel.

Cancel – if you choose this option, the changes that you have entered will not be applied. But your trading strategy will keep using whatever Stop Loss and Take Profit you have set previously.

Accept – the changes that you have set will be applied to your strategy.

Furthermore, the EA Studio is going to use the new values and perform a new backtest automatically. Immediately it will show you the new results and updated charts for your strategy.

Entry Lots

The trading amount is always set in lots (“lot” represents the smallest available trade size that you can use to open trades on Forex).

One lot equals 100 000 units of a currency. If you set your lot size to 0.01 (which is preferable when you are a beginner), the EA Studio will open a position of 1000.

Stop Loss and Take Proft

The Stop Loss and Take Profit are there to protect your trades. You can decide not to use them if this is what you really want. In case that you set values for them, the EA Studio will use them for the Expert Advisors that you will later add in your MetaTrader account.

If you open a position that turns out to be unsuccessful and the price goes against you, the Stop Loss will protect your capital. You will not lose more than what you have set as a maximum.

Without a Stop Loss, you have no control over the losses. No matter what trading strategy you have decided to use, money management is key to your trading success. It will help you stay longer in the markets.

The right way to set a Stop Loss is to always put it at the low of a buy position and to have it at the high of a short position.

The other methods of Stop Loss are to have it Trailing (it will move at a certain distance away from the current price) or Fixed (a certain amount of pips for every trade).

The “pip” is a unit of measurement that shows you the change in value between two currencies.

When you are in a winning trade, and the price is moving in your direction, it is very important to always set a Take Profit. This will secure your gains.

Otherwise, the price might pullback (in this case your profit will decrease) or even reverse (this can cause you a loss instead of a profit). The take profit will also be set as a number of pips (or “points”).

It will be useful for you to learn about the pip value of the different currency symbols and specifically the one that your broker provides.