Introduction: In today’s blog post, we’re going to dive into the exciting world of Bitcoin trading robots. Specifically, we’ll compare a free Bitcoin robot that I recently created using EA Studio with a paid Bitcoin robot I found on the MQL5 marketplace. Our goal is to see which one performs better in the world of cryptocurrency trading. Please remember that the robots I showcase in this post are for informational purposes only, and I am not a financial advisor.

The Free Bitcoin Robot I Created

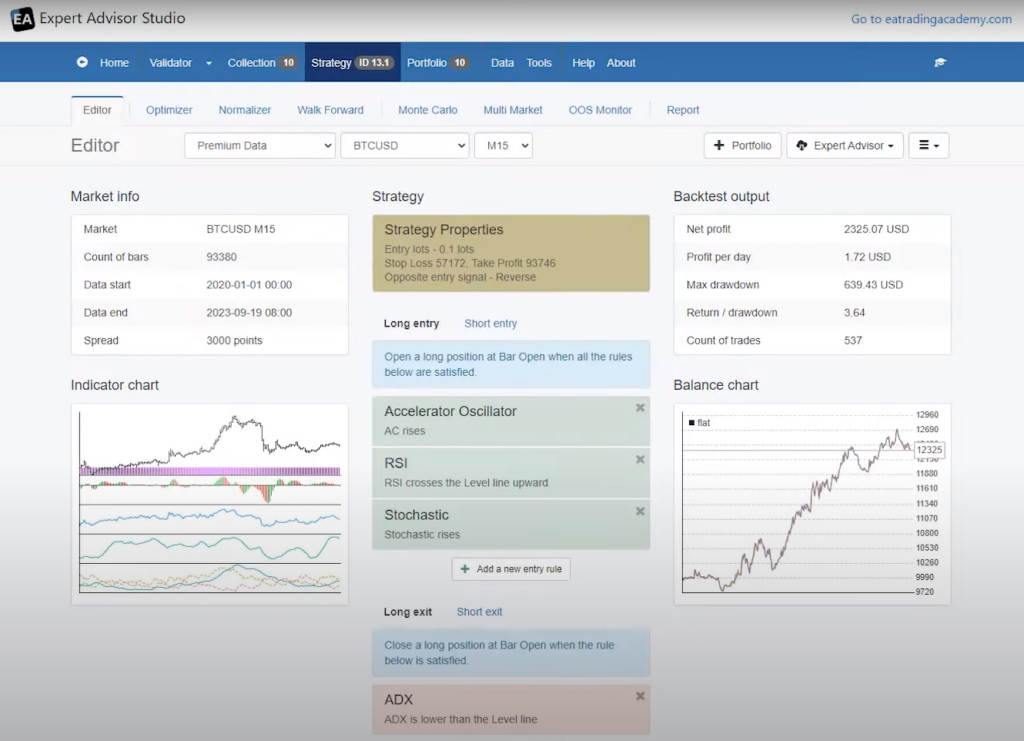

Let’s start by taking a closer look at the free Bitcoin robot I developed. I have a collection of 10 expert advisors (EAs), and for this experiment, I randomly selected one of them. This particular EA employs three entry indicators and features a single exit indicator. The process of creating this robot was fairly straightforward, thanks to EA Studio.

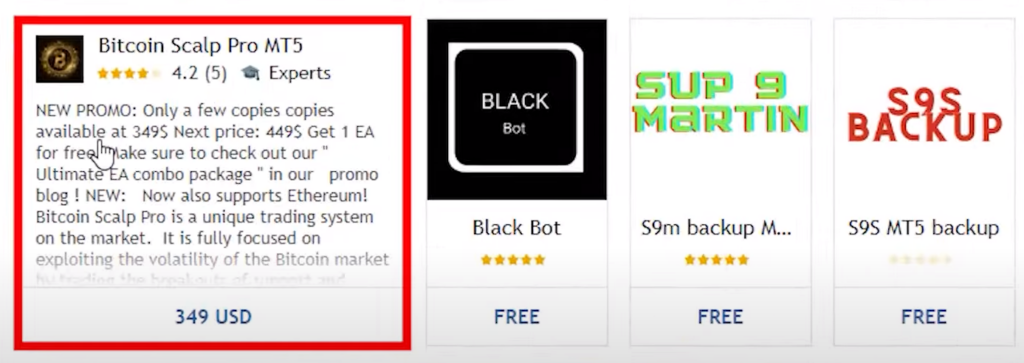

Exploring the MQL5 Marketplace

Now, let’s head over to the MQL5 marketplace, where I discovered a variety of Bitcoin robots. Among the options, one particular robot caught my eye. It’s a scalping robot that comes with a price tag of $349. However, what makes it more accessible is the option to rent it for a month at just $99.

Free Bitcoin Robot: Comparing Performance

To really get a solid grasp of how well both robots performed, I put them through a series of tests using historical data. So, I’m talking about tests where we looked at a few important things. First off, we considered how profitable these robots were, then we dove into how good they were at managing risks, and finally, we checked out how easy they were to use. This way, we could take a close look at their strengths and weaknesses from different angles and make a well-rounded assessment.

Profitability

The primary objective of using a trading robot is to maximize profitability. I executed multiple backtests on both the free Bitcoin robot I created and the paid MQL5 marketplace robot. Surprisingly, the results were quite competitive. The free robot demonstrated impressive profit potential, while the paid robot, although strong, did not significantly outperform it.

Free Bitcoin Robot: Risk Management

Effective risk management is crucial in cryptocurrency trading. I assessed how well each robot handled risk during the backtesting phase. Both robots proved to be effective in managing risk, with minimal drawdowns. However, the free robot had a slight edge in this department, showing more consistency in preserving capital.

Ease of Use

For traders, ease of use is a critical factor when choosing a trading robot. The free Bitcoin robot I created with EA Studio was incredibly user-friendly. The process of setting it up and running it was straightforward, making it suitable for traders of all experience levels. On the other hand, the paid robot from the MQL5 marketplace required a bit more technical expertise to configure.

Cost Considerations

Now, let’s discuss the cost aspect. While the paid robot comes with a price tag of $349, the option to rent it for a month at $99 can be a cost-effective choice for traders who want to test it without a significant upfront investment. The free robot, of course, is entirely cost-free.

Free Bitcoin Robot: Robot Features and Testing

Now, let’s dive deeper into the features of the free Bitcoin robot I’ve created. This robot is designed with a focus on risk management and does not employ grid or Martingale strategies. It incorporates stop loss and take profit mechanisms, ensuring a favorable risk-reward ratio, a characteristic shared by all the robots I develop using EA Studio.

To evaluate its performance, I ran the Bitcoin robot on the M15 time frame with a trading lot size of 0.1. The testing period covers the time from the beginning of 2020 until the present, encompassing roughly the last two years and nine months.

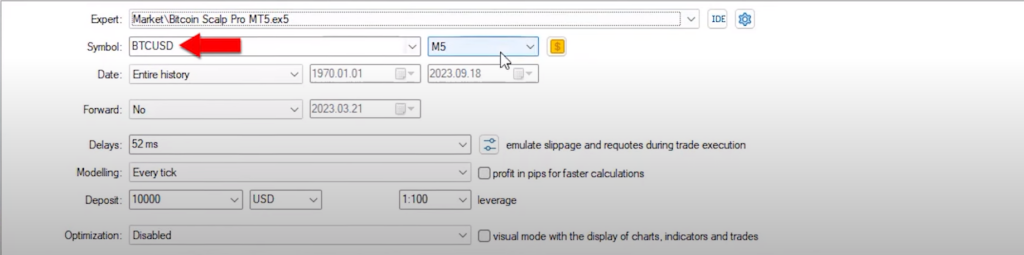

Backtesting on MetaTrader

To conduct a thorough analysis, I used MetaTrader, specifically on the BlackBull Markets platform where I have the Perceptrader running. Here’s how I performed the backtest:

- Open your MetaTrader platform and navigate to the “Experts” section. This is where you can download and backtest trading robots.

- Search for the “Bitcoin Scalper Pro” and locate it in the available experts.

- Open the strategy tester and ensure that the expert advisor is selected.

- Choose the trading symbol. In this case, I switched to the H1 time frame.

- Click on the “Start” button to initiate the backtest.

Please note that if it’s your first time conducting a backtest, it may take a few seconds to download the historical data. Once the green bar reaches the end, your backtest will be completed.

The results of this backtest will provide valuable insights into how the free Bitcoin robot I created performs under various market conditions over the specified time frame.

Free Bitcoin Robot: Analyzing the Results

After completing the backtest, we can analyze the results to better understand the robot’s performance. We will assess factors such as profitability, drawdown, and consistency in achieving the desired risk-reward ratio.

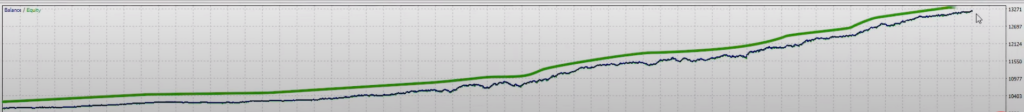

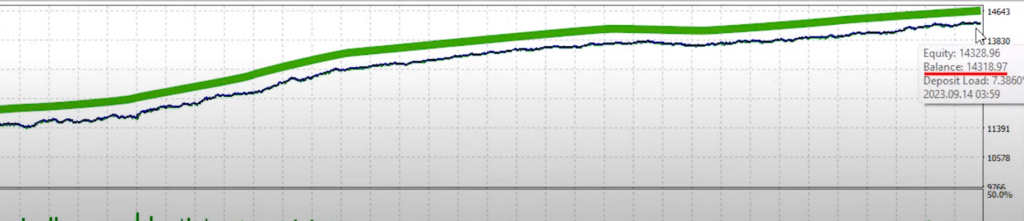

Steady Equity Growth

When you click on the graph, you’ll notice the equity line steadily increasing, indicating a positive trend in performance.

Optimizing Lot Size

To ensure consistency in our assessment, I reviewed the input parameters, confirming that the lot size is set at 0.1.

Free Bitcoin Robot: Impressive Profit Accumulation

Returning to the equity graph, you can observe that the robot has already accumulated a total profit of thirteen thousand dollars. This suggests that if the robot maintains its performance without significant drawdowns or losses during the backtest, it may outperform the expert advisor from EA Studio.

Comparing Results

Comparing the results, the backtest of the free Bitcoin robot shows a net profit of $12,325, while the expert tester reports an ending balance of $14,318.

Assessing Drawdown

The backtest output reveals a total net profit of $4,287, with an equity drawdown of 186 or 1.71%. This performance indicates that the robot is likely not using Martingale strategies, and its overall performance is commendable.

Free Bitcoin Robot: Portfolio Approach

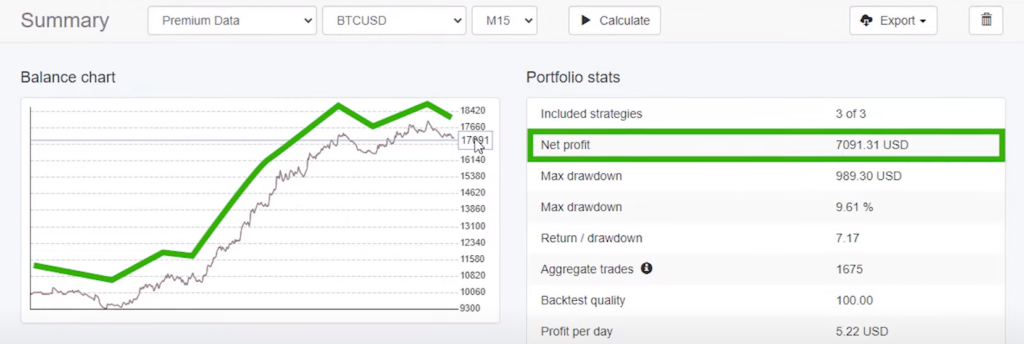

Diversifying for Enhanced Returns:

Having a collection of 10 Bitcoin robots comes with several benefits. For starters, it provides the opportunity to build diversified portfolios, which can be quite advantageous. By combining multiple expert advisors, you can significantly improve the overall performance of your investments. Moreover, it’s worth noting that this approach can also help in reducing the level of risk associated with your cryptocurrency holdings. In other words, having a variety of these robots working together can lead to more stable and potentially profitable outcomes.

Free Bitcoin Robot: Top-Performing Trio

For instance, by adding the top three performing robots from my collection to a portfolio, I achieved a significant improvement in performance. The net profit increased to seven thousand dollars, surpassing the individual robot’s performance in the backtest.

Practicality for Traders:

Because practicality matters, I’ve included the top three Bitcoin robots in one portfolio for your convenience. You can find the download link for both MetaTrader 4 and MetaTrader 5 below. This allows you to test and potentially benefit from the combined performance of these robots in your cryptocurrency trading journey.

Free Bitcoin Robot: Setting Up a Portfolio Expert Advisor

Now, let me guide you through the process of setting up and using a portfolio expert advisor. With a portfolio expert advisor, you have multiple strategies contained within a single robot. Here’s how to get started:

- Download and Copy: Once you download the portfolio expert advisor, all you need to do is copy it.

- Access MetaTrader Data Folder: Go to your MetaTrader platform and click on “File.” Then, select “Open Data Folder.”

- Paste in Experts Directory: Inside the data folder, locate and click on “MQL5.” Then, open the “Experts” folder. Paste the copied portfolio expert advisor into this directory.

- Compile the Expert Advisor: After pasting the expert advisor, double click on it. This action will open the source code, which contains the three strategies included in the portfolio. Click on “Compile.”

- Open a Bitcoin Chart: Open a new chart for Bitcoin and switch to the M15 time frame.

- Add the Expert Advisor: Drag and drop the compiled portfolio expert advisor onto the Bitcoin chart.

- Configure Trading Parameters: In the inputs, you can customize how much you want to trade and set other parameters to your liking. Click “OK” to proceed.

By following these steps, you can begin trading with the three Bitcoin robots that are part of my collection. This portfolio approach makes it easy to track the performance of individual strategies and remove those that do not meet your expectations.

Free Bitcoin Robot: Conclusion

In this blog post, we’ve explored the world of Bitcoin trading robots, comparing a free Bitcoin robot created with EA Studio to a paid robot from the MQL5 marketplace. We assessed their performance in terms of profitability, risk management, and user-friendliness. While both robots demonstrated strengths, the free robot excelled in user-friendliness and cost-effectiveness.

Furthermore, we delved into the advantages of using a portfolio expert advisor, which combines multiple strategies within a single robot. This approach offers enhanced performance and easier strategy management.

Remember that the choice between a free and paid Bitcoin robot depends on your preferences and goals. Always conduct thorough research and testing before using any robot in live trading. With the right approach and a diversified portfolio, you can navigate the volatile world of cryptocurrencies with confidence and strategy.