Forum Replies Created

-

AuthorPosts

-

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi @Ali, there are video guides that you can access on the order confirmation page and from the order confirmation email. Also on the top right section of the app (where’s the YouTube icon), you can follow the link to watch the video guides as well. You can read this article which covers the process as well.

Don’t forget that you need to compile the robots before you place them on the trading account.

Marin StoyanovKeymaster

Marin StoyanovKeymasterThe graphics show the backtest of each strategy for the selected period – 1 Day, 1 Week, 1 Month, 1 Year or 5 Year. This works the same way as the backtest in MetaTrader and updates every 30 minutes. If you’re looking at a shorter period, e.g. 1 Day, it’s very likely that there are not trades from some strategies.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi @Flyhigh430, there are video guides that you can access on the order confirmation page and from the order confirmation email. Also on the top right section of the app (where’s the YouTube icon), you can follow the link to watch the video guides as well. You can read this article which covers the process as well.

Let us know if there is something unclear so me or Ilan can elaborate on this.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi Zafar, the 5 losing trades are from 5 different days as you can see from the chart. Also before and after that there were profitable trades. Another thing to keep in mind is that a strategy may close the position before reaching the SL if it receives confirmation from the indicators. Also some strategies have trailing stop loss.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHey Richard, the EAs from the Prop Firm Robots App/Top 10 Robots App/EA Studio all trade at the opening of the bar so for the backtest you should use the “Open Prices Only” model like it’s shown below. You can adopt your leverage and account size as per your needs but for the purpose of this post, I used the below settings which are the default in my accounts. Also I ran the backtest for the last 5 years because this is the maximum period that we can see in the apps so this will make the comparison more reliable.

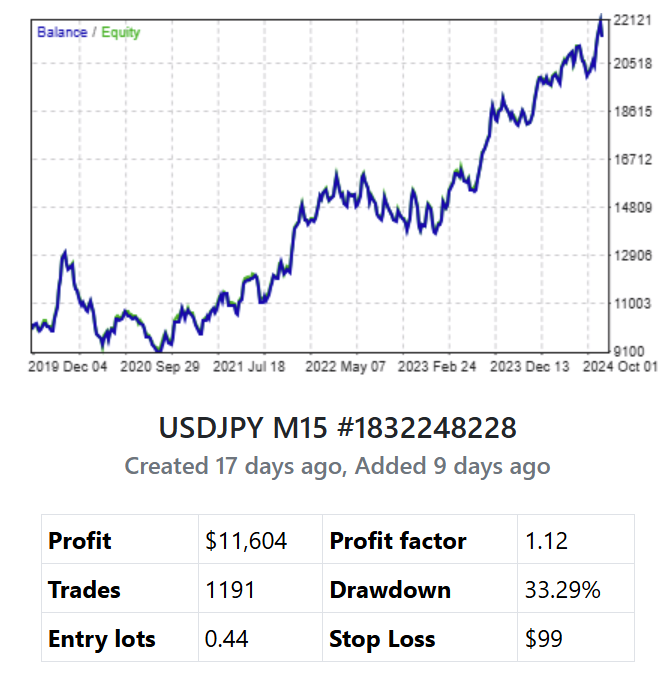

So I performed several tests to show the results of a random strategy from one of the apps. For the tests I picked the below strategy from the Prop app, and I downloaded it for a $10,000 account size.

<span style=”text-decoration: underline;”>Prop Firm Robots app 5Y stats</span>

<span style=”text-decoration: underline;”>Expert Advisor Studio 5Y backtest (EightCap)</span>

<span style=”text-decoration: underline;”>Expert Advisor Studio 5Y backtest (BlackBull)</span>

<span style=”text-decoration: underline;”>Expert Advisor Studio 5Y backtest (Darwinex)</span>

<span style=”text-decoration: underline;”>MetaTrader 5 Backtest on EightCap</span> (beacuase of the wider image the balance chart looks more flawless but you can obviously see the drawdown at the beginning similar to what you see in EA Studio’s backtests)

<span style=”text-decoration: underline;”>MetaTrader 5 Backtest on BlackBull</span>

As you can see from all backtests, with the proper settings, the strategies show very similar performance. The difference comes from the count of trades that is different with different brokers because they use different liquidity providers and have different quotes and commissions and spreads.

Thanks to Alan and Sandor for sharing their strategies and systems. It’s always nice to see how different users are using the robots from the apps as the way we use them is our own system but it doesn’t mean that this is the only way to manage the robots.

The system we follow with the robots from the apps is shown in every video and on the challenges or live accounts pages, but I’ll write it here once again to have more context for future readers of this thread. We start by picking 3 to 5 EAs and trading them on our accounts. We keep an eye on how well these EAs are performing both in the app and in our trading accounts by tracking their magic numbers. If we notice that one of our EAs is no longer among the top 3 performers in the app, we swap it out for a new top performer to keep our trading strategy effective. This way, we always use the best-performing EAs. We check the EAs performance daily and the highest success we had by picking the top performing EAs from the monthly or yearly charts. We see ups and downs in the accounts and this is quite expected as market is not a straight line and the strategies also show losing trades in the backtests and on the apps charts as well. It’s normal to have such periods in trading.

There is also one other thing which can have impact on the actual performance compared to the backtest and this is valid for absolutely every EA out there. To understand the differences between backtest results in the app and actual performance, it’s important to consider the role of order flow in live trading. Backtests use historical data to simulate market conditions, but they don’t account for real-time factors like order flow and market liquidity, which impact actual trade execution. In a live trading environment, other traders’ orders affect price movements and can lead to slippage (difference between expected and actual trade prices). These factors often cause discrepancies between backtests and live trading results, especially in fast-moving markets or with larger positions. So, while backtests are a useful tool for evaluating a strategy, actual performance will inevitably differ due to these dynamic market influences. You can expect a similar performance but it won’t be the same as the backtest (that’s applicable to the MetaTrader strategy tester as well).

Still, until we find a better system to manage the EAs for ourselves, we will keep using the system that works well for us at the moment and we have plenty of live accounts and passed challenges so far that prove for us that the system it’s working. I know a lot of users who have success with our robots because they write to us via email but when we ask them to share this publicly in the forum, many refuse because they prefer to have some privacy. You all know that many people use VPNs, fake/hidden emails, proton emails and etc. to hide themselves, and I can assure you from my experience in the Academy, that in trading the number of such people is very high.

Kudos to Alan and Sandor who shared their success, I know other users who passed challenges and have great performance with our robots. Recently we launched a reward program for the Prop Firm Robots App users to reward their performance and stimulate them to share their experience and by the end of the year we will do a similar thing for the users of the Top 10 Robots app as well.

Marin StoyanovKeymaster

Marin StoyanovKeymasterThank you for pointing this out. I understand that seeing a downtrend can be concerning, so let me provide some context.

First, as I already explained in other topics, nothing is changed in the strategy generation process. It’s the same since the launch of the app.

The recent downtrend is a result of the market moving in both directions, which is a normal part of how financial markets behave. No market trends in one direction forever, and periods of uncertainty or choppiness can cause temporary dips in performance. Drawdowns are a natural and unavoidable part of trading. They’re not a sign of failure but rather a characteristic of a strategy that trades in dynamic markets. If you look at the charts in the Prop Firm Robots app, you will see downtrends there as well, and if you look at the stats, you will see what % is the drawdown for the stats period. Of course, past performance doesn’t guarantee future results but it’s a sign of what you might expect from a strategy.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi Tim, there are many ways to make your EAs unique. Changing the magic number is just one step of the process but it’s not mandatory, you can change the SL or TP or indicator values and this will give make your trades unique. With the randomization feature in the app you can keep the first or last 4 digits but even if you use your own system for the magic numbers, we can still cross-check the trading activity with our trading accounts and verify that you used the robots from the app. I can assure you that if you’re using our robots and pass a challenge and complete the above steps, you will get your first challenge fee covered by us.

Marin StoyanovKeymaster

Marin StoyanovKeymasterNo, nothing is changed in the generation process. The market is in huge downtrend lately and this might be the main reason why some assets don’t perform well at the moment.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi, I already replied to this here.

Marin StoyanovKeymaster

Marin StoyanovKeymasterSome prop firms offer very low leverage for crypto, which makes trading these assets with robots impossible. For example with FundedNext, their leverage for crypto is 1:1 which makes it impossible for the crypto robots to open any positions as there isn’t any margin at all.

Marin StoyanovKeymaster

Marin StoyanovKeymasterThanks Sandor, indeed most of the EAs have a few trades per week. One can estimate that by looking at the count of trades on the 1W (weekly) charts and have a better understanding of what to expect.

Another way to debug any potential issues is by looking at the Experts and Journal tabs in the MetaTrader terminal where warning or error messages would point to any potential issues.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi, without more context it’s difficult to say what happened. I suppose the account is closed and we can’t look into it in detail to understand the issue.

You might have global variables (under Tools > Global Variables) that affected the protections or if you were disconnected from the Internet (if trading on a local PC, or for some reason your VPS was disconnected) this would also prevent the EAs from working.

Without looking into the account, I can only guess.

Marin StoyanovKeymaster

Marin StoyanovKeymasterThe robots will close the trade either when they hit the TP, SL or they receive a signal from the indicators from the underlying strategy. In your case the last happened and that’s why the trade was closed.

Marin StoyanovKeymaster

Marin StoyanovKeymaster@dominikdorner, the EAs from the app open trades at the opening of the M15 bar so you should use the Open Prices Only for the backtest. Also when you run the backtest, check how much bars the broker offers for the asset you’re backtesting. Another thing to double-check is that the account size you’re backetsting on is the same there robots are created for – for example if you downloaded EAs for a $100k account, you should backtest them on such account.

Marin StoyanovKeymaster

Marin StoyanovKeymasterHi, you can see the last activity next to each post. We reply to all posts in the forum. If you publish in the relevant topic, your post will be replied much faster but if you just open a new topic it might take some time to reply as the correct support member must be assigned to this topic first. That’s why we recommend to use the present structure of the forum.

-

AuthorPosts