Forum Replies Created

-

AuthorPosts

-

Alan Northam

ParticipantTOP 10 ROBOTS / OANDA DEMO ACCT

Hi Guys!

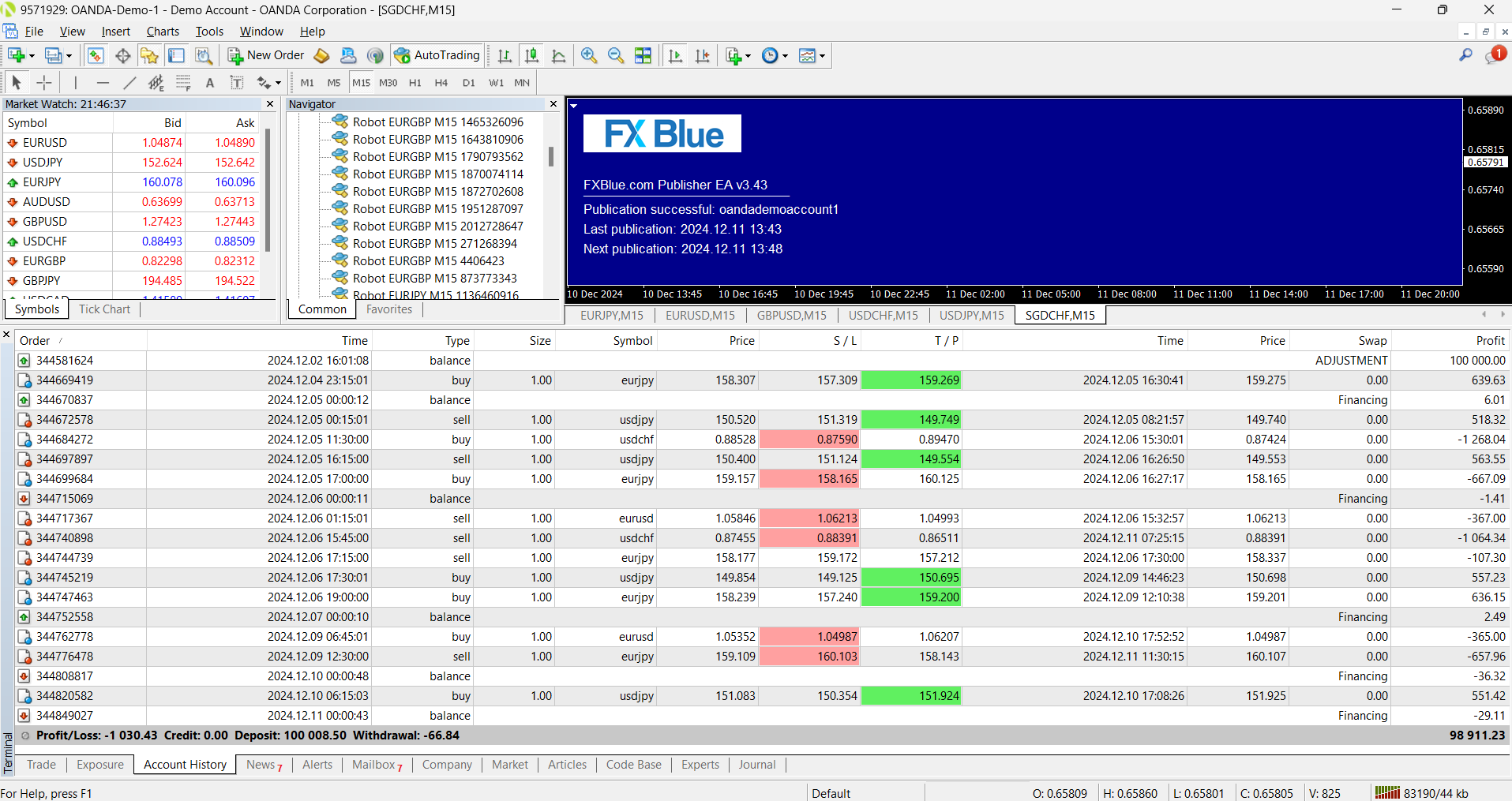

Ten days ago I started a new demo account with my Oanda dot com broker. The one bad thing with Oanda is you only get about two week worth of historical data. The good thing is; this will be a good test demo account. So what I did was to load all the Top 10 app robots into MT5. I then backtested all the robots using the MT5 Strategy Tester. Then selected the best performing robot from each symbol. As a result I found 5 symbols EURJPY, EURUSD, GBPUSD, USDCHF, and USDJPY. Since the account size is 100K I set the lot size to 1.0.

This first graphic shows MT5 with all the closed trades after 10 days. It also shows I have all the Top 10 robots installed. The tabs show the 5 symbols I am trading.

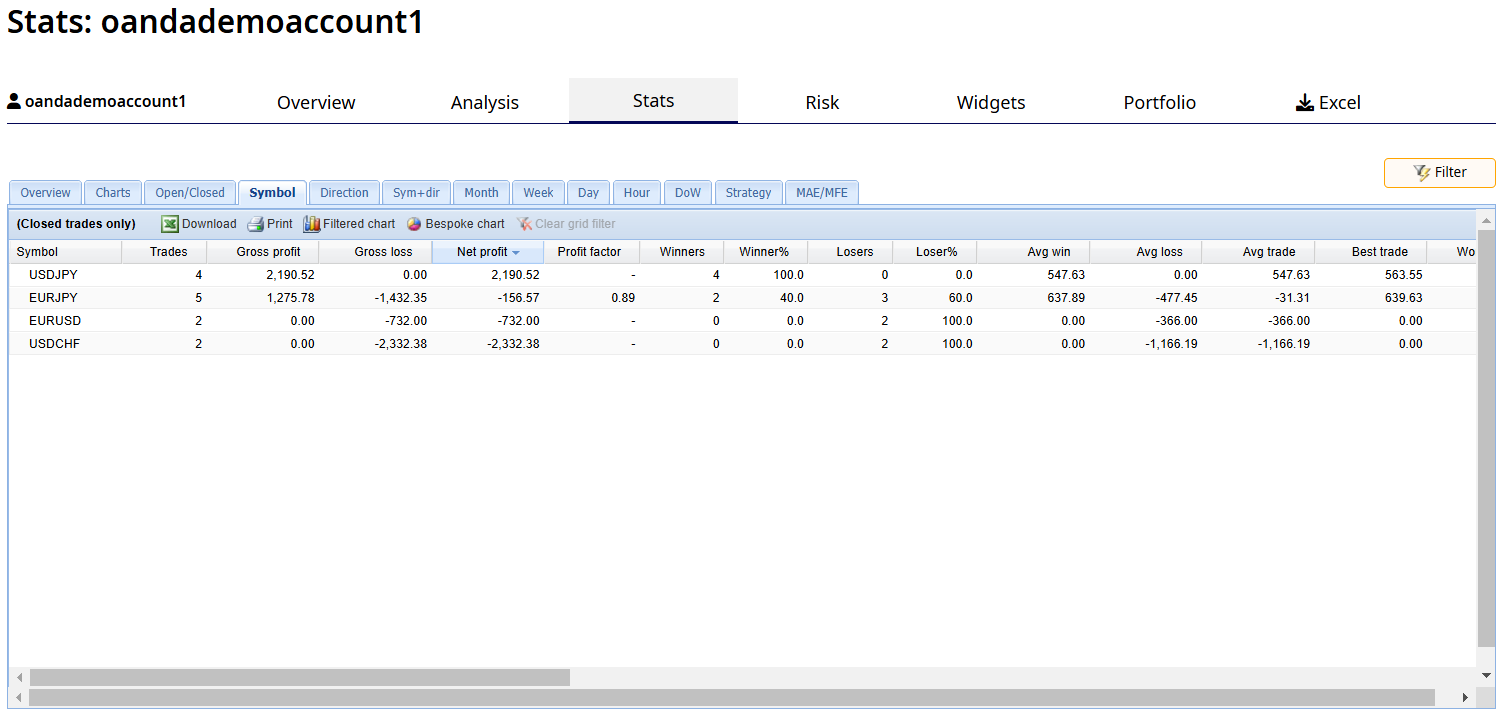

This next graphic shows all the closed trades filtered using FXblue. As you can see USDJPY had a nice profit of $2190 or 2.1%. The other three symbols have all closed with losses. Note USDCHF has been the biggest loser. I may decide to removed it this next weekend if I don’t see any new profitable closed trades from this symbol.

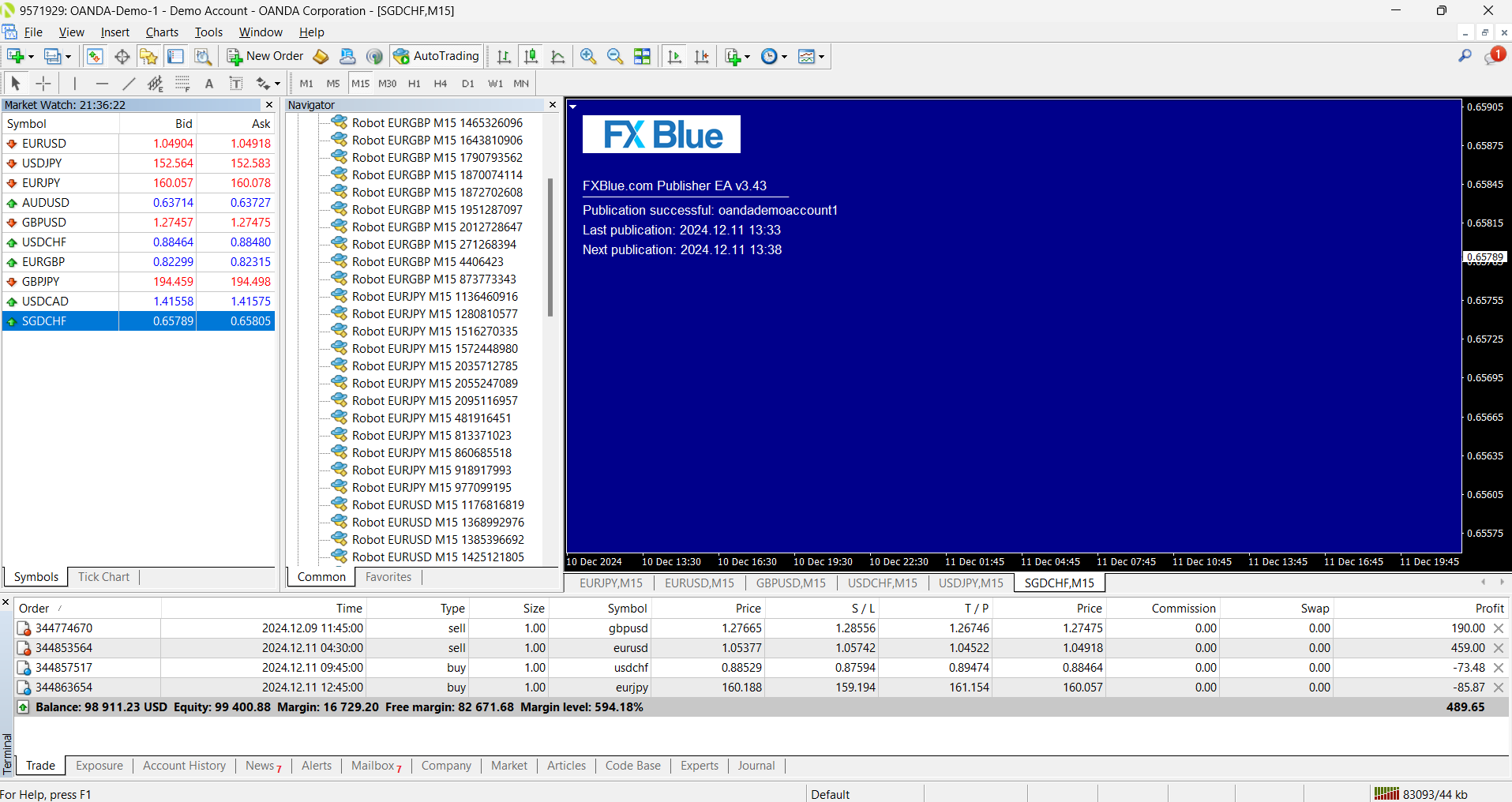

This final graphic shows the open trades. From this graphic you can see two of the four symbols are now in profit. GBPUSD currently is showing a 0.2% open profit and EURUSD about 0.4%. This is encouraging as these two symbols could potentially close with a profit. If these two close with a nice profit in the next several days I think this may be encouraging for this demo account. I will have to wait and see!

Note: The blue screen is an EA that ports all the trade results to FXblue where I do my account filtering.

Right now what I am showing is the development of a trading portfolio. Once this portfolio proves to be a good profitable trading portfolio I may decide to use it for trading. As you can see from this, my process is to first develop good trading portfolios and then use them for live trading.

Alan,

December 9, 2024 at 15:10 in reply to: Trading Robots from EA Studio: Experience and Results #383018Alan Northam

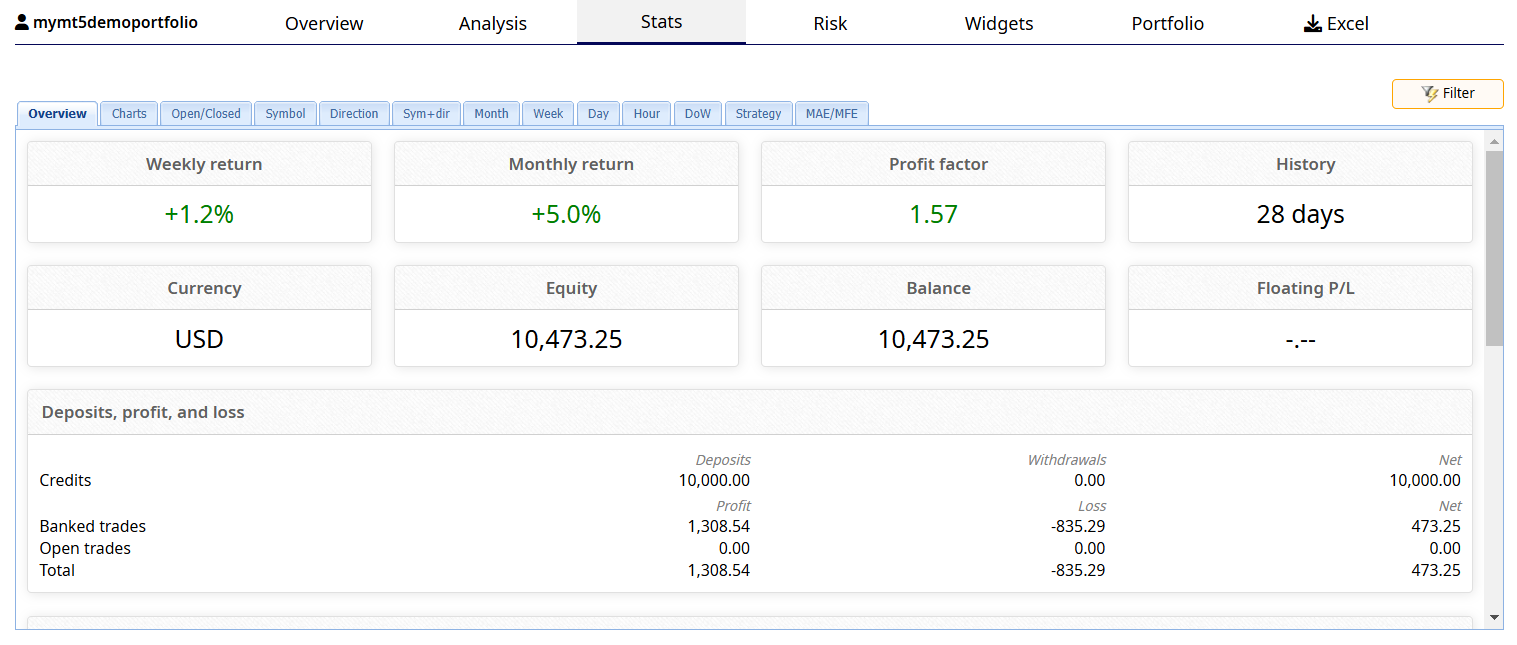

ParticipantThis first graphic shows the balance line of the top 4 selected EA’s over the last 28 days. This last week was not kind to my portfolio. I believe this was due to the markets waiting for the Non-Farm Payroll report that comes out on the first Friday of the month. This report can and often does result in extreme market volatility. This volatility can then hit Expert Advisors stop losses which is what happened causing the balance line to fall.

This last graphic shows a nice calculated monthly return of 5.0% based upon the last 28 days performance. Even with the portfolio retreating this last week this graphic shows the calculation the portfolio should still be able to gain 5% on a monthly basis. This is still sufficient for the portfolio to hit a prop firm profit target within a two month period.

This weekend I filtered the EA pool and selected the top five EA’s, one for each symbol, and added them to my portfolio. I will report the results of this next weeks portfolio performance next weekend. I will continue to monitor this portfolio until the end of this year. Based upon its portfolio I will determine whether or not to use this portfolio to copy trade to a prop firm early next year.

Alan,

Alan Northam

ParticipantHi Sandor,

I like the idea of you switching out the robots once a week as this should help to minimize drawdowns, at least in theory. However, once in a while you will still suffer drawdowns as you experienced. For this reason it is a good idea to keep risk under control. So, again I liked the idea you reduced risk after having undergone a large drawdown. In the future I would suggest keeping risk low. To keep risk low when you first place the robots in MetaTrader look at the drawdowns for the EAs in the Prop Firm or Top 10 app for each robot you plan to trade and make sure their total drawdowns to not exceed the loss limit you are willing to accept. If total drawdown is greater than the loss limit you can accept adjust the lot size. Good job!

Alan,

Alan Northam

ParticipantThis is a result of the computing power of your computer. All my computers run Intel processors. With an i5 processor I am able to run just one reactor and with an i7 processor I can run 3 reactors. There is a process you can use to test how many reactors you can run on your computer. I used this process to see how many reactors I could run on my computers. This link will show how it is done.

Alan,

December 2, 2024 at 12:13 in reply to: Trading Robots from EA Studio: Experience and Results #381876Alan Northam

ParticipantHi Sandor,

I have a separate workstation pc I use for creating EAs’. I run 10 instances of EA Studio, one for each symbol, for a week and then download the best 10 EA’s. I repeat this every week. At the end of the month I will select the best 10 EA’s, one for each symbol, and add them to my pool of EA’s. I also eliminate the 10 worse performing EA’s from my pool once a month.

Alan,

Alan Northam

ParticipantHi Richard,

Sounds like you have found a methodology that works great for you. Congratulations! The only thing I can suggest is that you might look at the EAs in your account and purge out the ones that are not performing well. Then maybe replace these EAs with better performing EA’s in prop firm and top 10 apps. I do this with my accounts once a week. The other thing you could do is to create a demo account and put all the prop firm and top 10 robots in it and let it trade for at least one month and then start selecting the EAs from it instead of from the prop firm and top 10 apps. In my demo account, which I call my pool of EAs, is to the 5 year performance of my EAs. Then when I select EAs from this pool once a week I use the last one month performance.

Alan,

Alan Northam

ParticipantHi Angel,

No I am not suggesting buying EA Studio. What I am saying is I use EA Studio to create my EA’s. You do not need to create EA’s if you already have EA’s from the Prop Firm app. What you are missing is that the Prop Firm robots were created using BlackBull historical data. When using other data sources other than BlackBull the EA’s will perform differently. To have direct success with the Prop Firm robots it is necessary to use prop firms that are compatible with the BlackBull historical data. It looks like Petko is having success using FTMO and the 5ers and maybe one or two others. But if you are using other prop firms or brokers you might not have success with the top performing Prop Firm robots. So how do you determine which prop firm EAs to use if your prop firm / brokers historical data is not compatible with BlackBull? The way I have found to determine the best performing prop firm EAs with the broker / prop firm I intend to use is to test the prop firm robots myself.

The prop firm robots are not the problem, the problem is the way you are using them. I have simply offered a solution. It will take you some time to discover which robots work best with the broker/prop firm you want to use but the results will be worth it. Again you can follow my methodology and you will most likely have success. Again, since you already have prop firm robot EAs you do not need to create them with EA Studio or use EA Studio in any way.

Follow my methodology shown in the above link using the robots from the prop firm app or the top 10 app instead of creating EAs with EA Studio and you should have success.

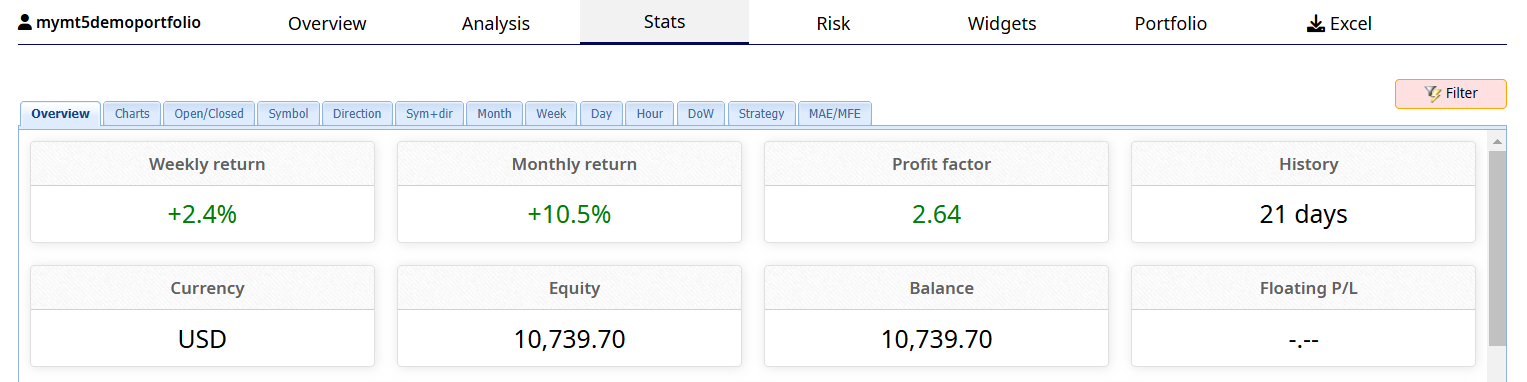

When following my methodology my account has gained 10.5% in 21 days which is good enough to have passed a prop firm challenge. What I am going to do after one more week of trading in the demo account is to start using my demo account to copy trade to a prop firm account.

Learning to trade successfully is not a sprint, it is a marathon!

Alan,

December 1, 2024 at 16:14 in reply to: Trading Robots from EA Studio: Experience and Results #381717Alan Northam

ParticipantThis first graphic shows the balance line of the top 4 selected EA’s over the last 21 days.

This final graphic shows a nice calculated monthly return of 9.0% based upon the last 21 days performance.

Over the last 21 days this demo account shows a monthly return of 10.5% with a profit factor of 2.64.

Note that if I were trading this account with a prop firm I would have passed the challenge within 21 days.

This weekend I filtered my EA pool (see previous post to learn about the pool) For each of the 10 symbols I trade over the last 30 days. I then selected the top 4 EA’s to trade this next week. For example: I set FXblue to filter the pool for AUDUSD. It then gave me all the EA’s magic numbers for AUDUSD. I then filtered these magic number for the best Net Profit. I then selected the top EA. I then did this same thing for all ten symbols. I then took all then magic numbers, one for each symbol, and filtered them for best Net Profit. I then selected the top 4 to trade this next week. As it turned out two out of the four magic numbers were the ones I traded last week so I will continue to trade those this next week. Two of the magic numbers were not traded last week. So I will add these to my portfolio and remove two of the worse performing magic number from last weeks trading.

I will now trade my demo portfolio for another week.

Note my demo portfolio is a MT5 demo account. Once I have traded this demo account for one month I will then start using it to trade my FXIFY 25K demo account.

Alan,

Alan Northam

ParticipantHi Richard / Guys!,

I am a successful trader using EA’s I created using EA Studio. You might consider following how I use EA’s successfully. Click here! You can use the same method with Prop Firm robots or the Top 10 robots. The problem is not the EA’s, it is how you are using them. Fifty percent of all the EA’s I create are losers. The secret is for me to find the ones that are profitable. To do this I create a demo account with the SAME broker/Prop Firm I plan on using and put all my EA’s into it. I then let the EA’s trade for one month in the demo account. I then filter the demo account using FXblue.com to find the top performing three or four EA’s. I then trade these EA’s.

Alan,

November 23, 2024 at 4:31 in reply to: Trading Robots from EA Studio: Experience and Results #379881Alan Northam

ParticipantThis first graphic shows the balance line of the top 4 selected EA’s over the last 14 days.

This final graphic shows a nice calculated monthly return of 9.0% based upon the last 14 days performance.

Today I replaced three of the EA’s with new EA’s selected from the pool of EA’s and kept one EA. The EA’s selected from the pool were the top performing EA’s for each Symbol based upon their performance over the last 30 days. For this next week the portfolio will continue to contain four EA’s.

I will continue to monitor and make necessary updates to the EA’s in the portfolio for the next one month. This one month testing period will validate the strategy I am using in selecting the EA’s from the pool and are added to the portfolio. At the end of the one month evaluation period I will evaluate the portfolio and decide to move it to a live account.

Note: A am also adding 10 new EAs to the pool this weekend. For more about the pool see previous postings above in this topic.

Do you want to learn how to use EA Studio so you too can create your own EA pool? Click here!

Alan,

Alan Northam

ParticipantHi Bruce,

It has been a long time since I used the prop firm robots, but as far as I can remember there is no way to change the set files to only allow the EA to trade in one direction. If you had EA Studio you would be able to add a long only or a short only indicator to the source code then you could select the direction in the set file.

The EA’s are created using 5 years of historical data that includes many periods of upward and downward trends. The indicators in the EA’s have been chosen so that overall the EA’s would be profitable.

This is where using multiple EA’s help to minimize risk. The idea is that when one EA is going through a countertrend the other EA’s will be compensating for the EA going through a losing period.

In my opinion if you just want to have an EA that will just trade long or short would require you to determine the trend and then set the EA to trade only in that direction. If this is what you want to do then you really don’t need the EA you can just determine the trend and manually enter a trade in that direction.

Alan,

Alan Northam

ParticipantYes you can do that, but then you distort the true trading performance of the EA and you will not learn to trust it will be profitable over the long term without your intervention. The idea of using EA’s is to let them do the trading without your intervention. But, that is your choice!

I would like to invite you to take a look at the new portfolio of EA’s I am working on so you can see what I am doing. The link shows the performance after 7 days without my intervention. It has now been trading for 11 days. I will update the performance this weekend. This is what you want! This way you don’t have to sit in front of the computer all the time waiting to manually close a trade. It also allows you to work on new portfolios in the future to further diversify your overall trading risk. If the portfolio proves to do well by the end of the year I will use it to copy trade to a 200K or greater prop firm account.

Alan,

Alan Northam

ParticipantYou don’t have profit yet as you only have one data point. Let’s see what profit your demo account has after 10 completed trades and how many of the ten trades were profitable. Then we can calculate your overall profit factor.

https://www.babypips.com/forexpedia/profit-factor

Alan,

Alan Northam

ParticipantSounds perfect!

I use to moderate the forum but gave it up so I could concentrate more on my own trading accounts. I am still a team member with EATradingAcademy. You can see my mugshot on the team members link at the bottom of the website. I have been trading since 1985. You can click on my name under my blank picture to read a short version of my bio!

Alan,

Alan Northam

ParticipantJust trying to be a good mentor!

The one thing that causes traders to end up losing their account is the lack of patience!

Where are you? I am in the Dallas Tx area!

Alan,

-

AuthorPosts