Forum Replies Created

-

AuthorPosts

-

Alan Northam

ParticipantHi Brendan,

You can try to use your MT5 setup file and install another MT5 terminal and see if that works. However, I don’t know if it will install the previous version or look for the latest version to install. I suspect it will install the latest version, but give it a try.

Alan,

Alan Northam

ParticipantWhen I download MT5 from the metatrader website now I get the error message. The MT5 I used from DarwinxZero is an older version of MT5. The version I downloaded from the metatrader website is the latest version. So, I suspect a bug in the latest release.

Alan,

Alan Northam

ParticipantHi Brandan,

Did you close MetaTrader and reopen? Did you re-download the XAUUSD file and reload? Reboot PC (cold start)? I used Darwinx version of MT5 so I don’t know if that is the difference. I will try it on another version.

Alan,

Alan Northam

ParticipantHi Noah Tan,

I am not getting the error.

Aan,

Alan Northam

ParticipantHi David,

I cannot say for sure if that would work as I do not know the algorithm they use to detect if expert advisors are highly correlated.

Alan,

Alan Northam

ParticipantHi David,

Sorry I do not know. I am in the United States and FTMO has not allowed US traders for quite some time. I have been spending my time trading my own accounts using US forex brokers.

Alan,

Alan Northam

ParticipantHi Jordyn,

Outside the US there are many brokers traders can subscribe too. This makes it possible to take the Expert Advisors EATradingAcademy offers and test them with these brokers to find out which ones provide the best profits and then use them as llan suggested. Unfortunately in the US the selection of brokers is quite limited. I have not had success using the EATradingAcademy robots on US brokers. As a result, I have had to learn how to create profitable robots using EA Studio.

As to the the broker I use: I use Oanda as it gives me 19 demo accounts where the other brokers limit from one demo account to three demo accounts. I like Oanda as it gives me a lot of demo accounts so I can test out my robots. I prefer to use real demo accounts to test out my robots instead of just relying on the back-test and Out Of Sample testing with EA Studio. It takes longer to test the robots but I have found the results are worth the time spent.

As to creating robots using EA Studio: I have 100’s of robots being tested all the time. Once every month I will review these robots and delete the losers. This way I keep a good quantity of profitable robots. I will then select the robots to trade from this pool of profitable robots.

I have quite a few robots that have performed well over the longer time frame I use for my trading. I have thought about offering them for sell to US traders but have not decided to do so as I am not sure it is worth my time as it takes considerable time to build up a client base. I think it is unfortunate US traders do not have a good source of robots that are profitable when used with US forex brokers.

Hope this helps!

Alan

Alan Northam

ParticipantHi Gabe,

Trading Third-Party Robots in the U.S. – Workarounds and Broker Comparisons

I agree—trading third-party robots in the United States can be a challenge due to FIFO rules and leverage restrictions. One of the few viable options available to U.S. traders is DarwinxZero, which allows access to MT5 accounts for U.S. residents. The team at EA Trading Academy showcases how to use several third-party robots with DarwinxZero.

👉 [Click here to review their setup.]My FIFO Workaround Using Oanda Accounts

To work around the FIFO rule when trading robots I’ve built in EA Studio, I use multiple accounts with Oanda. For example, if I’m trading multiple strategies on EURUSD, I run each one in a separate account.

What I like about Oanda—and what most other U.S. brokers don’t offer—is the ability to create up to 19 demo and 19 live accounts. This gives me the flexibility to demo-test many different strategies for each currency pair I’m trading.

Oanda vs. Forex.com – Cost Comparison

If you’re comparing Oanda.com to Forex.com, keep in mind the difference between spread and commission:

Oanda: No commissions, but wider spreads.

Forex.com: Tighter spreads (about half of Oanda’s), but charges a per-trade commission.

When you combine spread and commission costs, the total trading cost is roughly the same for both brokers. So if you’re using Oanda, there’s no need to feel like you’re overpaying.High Leverage Discussion

I’ve also shared my thoughts on using high leverage in another forum thread.

👉 [Here’s the link if you’d like to check it out.]Alan,

Alan Northam

ParticipantHi valentinozerus,

EA Studio only applies the commission at the closing of a position. Since the commission is only applied once you should include the full commission amount of 11.oo euro’s.

Alan,

Alan Northam

ParticipantHi devgabriel300,

I thought I would follow up on your comments. Can you share some detail about what you are referring too as limited information and the several US restrictions so I can address them?

Alan,

Alan Northam

ParticipantHi Steven,

I live in the US and use FXIFY.com as my prop firm broker. The problem with using prop firm brokers in the US is they do not offer MT4 or MT5. So it is not possible to use Expert Advisors. So what I have done in the past was to use oanda.com demo account to launch my Expert Advisors and then copy trade to FXIFY. Currently I have a 50K account with FXIFY but am using it to manually trade. Gotta keep them manual trading skill up! LOL. For trading with Expert Advisors I am using DarwinxZero.com which uses MT5.

Alan,

Alan Northam

ParticipantHi devgabriel300,

I have been trading in the US since the 1980’s so I have lots of experience. Unfortunately there are not many US traders on this forum anymore. When I add content to the forums I do not get any responses. It’s like I am just talking to myself. So I decided not to continue adding content.

Alan,

Alan Northam

ParticipantHi devgabriel300,

The broker Blackbull does not allow for US traders.

The problem I have found with VPS’s is they only allow for about 4 or 5 Metatrader terminals.I have over 20 Mt4 and MT5 terminals running continuously so to have 4 or 5 VPS’s is extremely costly. I found it more economical to run my Metatrader terminals on my own pc. So what I did was to purchase a separate pc. I actually bought a used pc off the internet. I have it connected to a battery backup. I also use T-Mobile Home internet connected to my pc connected to the battery backup. This device gets its internet from the cell tower instead of a hard wired internet connection. The problem with hard wired internet connections is they go down a few times a year. Cell towers hardly ever go down! Even if you just use your normal internet connection and it goes down a couple times a year and stays down for 24 hours each time that is still an uptime of 99.24%.

Hope this helps!

Alan,

Alan Northam

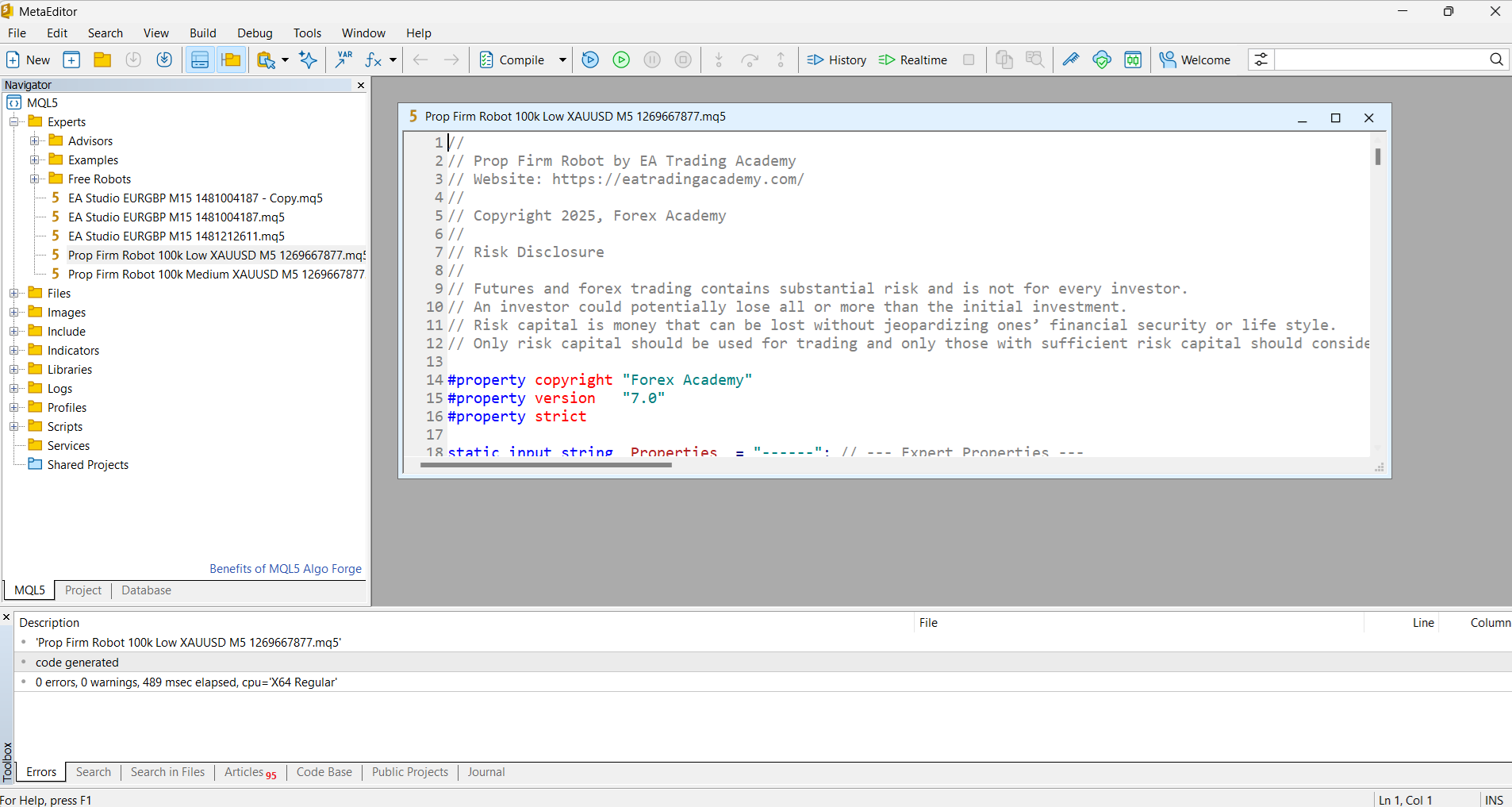

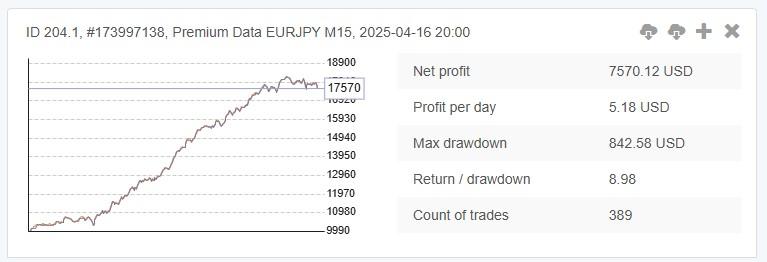

ParticipantI have tested all 3 EA’s over the last 5 years. They all pass Monte Carlo 100% robustness test. Here are results. Pay attention to the historical data for each EA as these are the historical data used in creating these EA’s and are the historical data used to test them today:

Alan,

Alan Northam

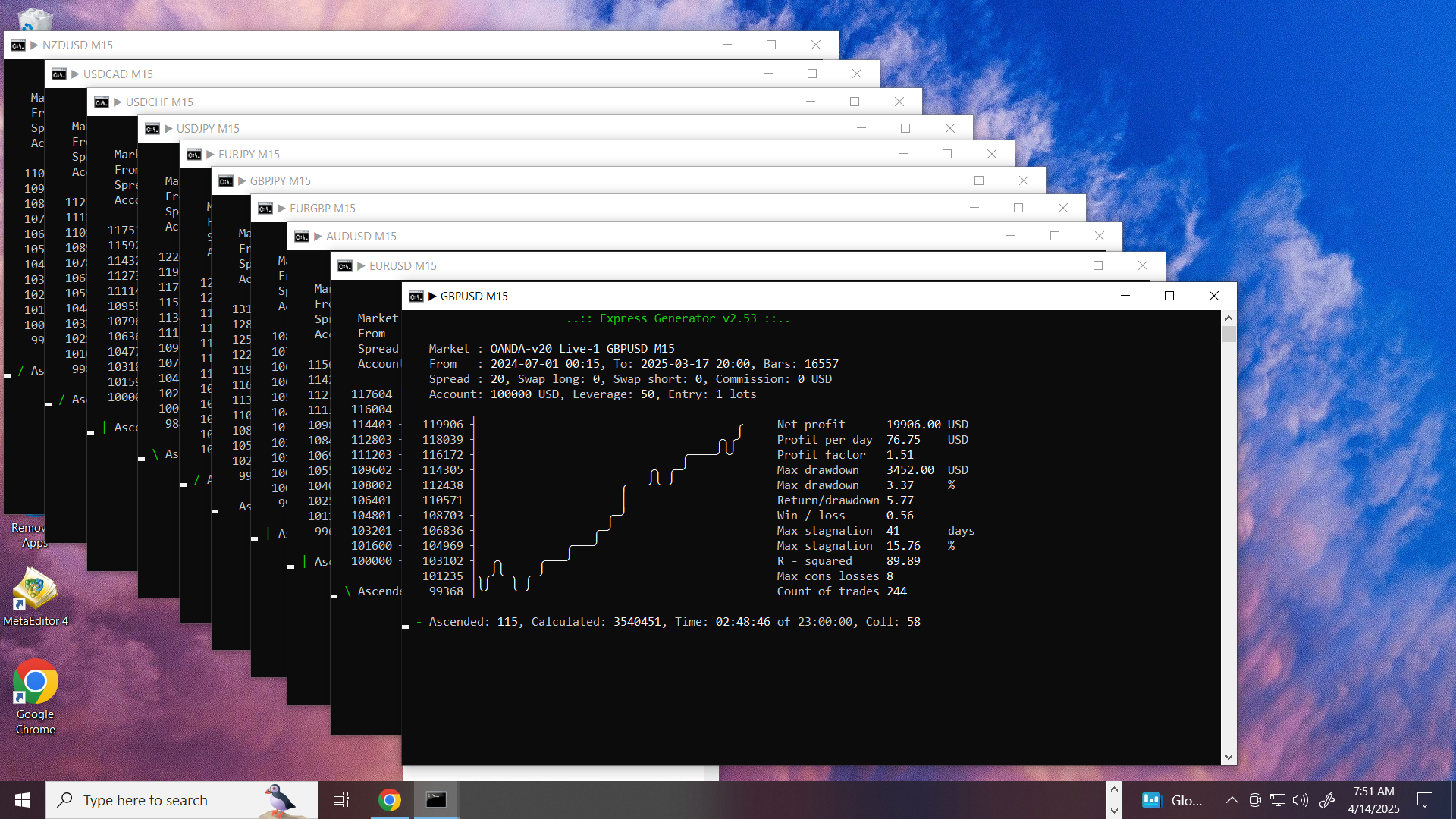

ParticipantThis graphic shows the Express Generator creating strategies for ten different currencies. The Express Generator runs for 23 hours. It then stops and saves all collected strategies. Then at the beginning of the next hour the Express Generator automatically starts collecting new strategies for the next 23 hours. Then the process repeats. The Express Generator runs 7 days a week collecting thousands of strategies.

See description on how I use Express Generator with EA Studio

Alan,

-

AuthorPosts