Home › Forums › EA Studio › Portfolio EAs › Non Correlated Portfolio

- This topic has 21 replies, 1 voice, and was last updated 5 years, 11 months ago by

Anonymous.

-

AuthorPosts

-

-

December 27, 2018 at 23:07 #7981

Anonymous

InactiveHi guys, I found this forum after taking some of the classes on Udemy witch helped me a lot with my algo jurney, not profitable yet but (or 8% ROI)

but I feel that things will happend during 2019 :-)

I’m working on a non correlated portfolio currently and having a hard time finding more pairs than 6 without paying insane spreads.

My list so far:

GBPJPY

XAUUSD

NOKSEK

AUDSGD

NZDCAD

XAGEUROptional:

(EURPLN)

(AUDCHF)

(EURHKD)Broker: IC Markets

Anyone had any sucess finding good pairs? :-)

-

December 28, 2018 at 1:46 #7984

Anonymous

Inactive@dommech-Hi there! I’m glad this subject came up. I’ve been rearranging my portfolio and I am now working with the following pairs:

GBP/USD, EUR/JPY, AUD/CAD, XAG/USD, XNG/USD, UKO/USD, BTC/USD, ETH/USD

Broker: Coinexx

-

December 28, 2018 at 10:58 #7988

Anonymous

InactiveHello Dommech,

Glad to see you opened new interesting topic.

If you arrange those assets in your market watch and make a picture/screenshot of it showing the third column with the spread, we might compare the spreads, and if anyone(even me) has a broker with lower spreads, we will share it with you.

Now, keep in mind that you do not need to trade all the assets in one broker. When I see that some asset has a lower spread with another broker it worths for me trading it there.

-

December 28, 2018 at 11:32 #7993

Anonymous

InactiveHey Dommech,

I’ve been trying to figure out a portfolio myself, was looking to get a mix of the different sessions. So far I’ve been working on the following but want to add S+P 500, WTI, and Nikkei when I can figure out what parameters I like. Also my laptop is too old so I can only run a few pairs at a time…. want to make the market pay for my new computer ;)

EUR/USD, GBP/JPY, USD/JPY, XAU/USD, DE30Index, EUR/GBP

-

December 28, 2018 at 16:14 #8006

Anonymous

InactiveHi team! Nice feedback! thanks!

@jacpin2002, thx for your share, will look at crypto as well but i think the spread was huge there, but will have another look with EA Studio :-)

@Roman, Is there a way to optimize different trading hours with EA Studio? My laptop is very old as well so I use VPS on live accounts and also looking for mother market to buy me a new one ;-) Would love stocks as well but IC Markets have 1:200 leverage on those And I’m currently low on funds…Here is the FX Blue account over that DEMO portfolio, I will add more pairs the coming days. (hope it’s ok to post links?)

Some extra info about my thinking:

- All my optimizations are from 2016.01.01 (Around 3 years)

- I’m running the opti in EA Studio for 12h (reeeeally slow laptop)

- I would re optimize every 3-6 months.

- I’m lately started focusing more on lower drawdown settings (under 15%) and less higher profits.

- I’m looking for Non correlated M15 Pairs, will maybe add other TF’s for diversification

- I’m trying to stay away from USD pairs as much as I can as I heard that BIG BANKS love to manipulate them (pls share your opinions)

- Playing around with different smaller 1-200usd 1:500 Leverege accounts mostly (Low USD risk high % return) (Because I’m broke :-)

Petko, thank you for your contribution to the Algo Community! you are doing A LOT! :-)

Here the Spread from IC Markets EURSEK is a bit high, but still a good performer if you look at FX Blue.

These are all the pairs I’m looking at for building a portfolio with IC markets, I have Pepperstone aswell but have not looked in to them yet.

I’m just a couple of days old with EA Studio but I’ve been playing around with algo for a year now.

My other EA’s has spread filters and day and time filters, is there some way to us that with the EA’s from EA Studio?

I must say that I’m impressed so far from the results and looks like I’m moving from MT4 (max 17 EA’s/Program) to MT5 to try out the 50-100 EA’s portfolio later on!

I read somewhere here that “broker” VPS services are not recommended how about directly thru MQL5 thru Metatrader (I’ve been using them for a while now)?

-

December 28, 2018 at 18:21 #8009

Anonymous

InactiveHello Dommech,

thank you for the kind words.

The spreads from your broker look just fine I think. It is all right to place any link, only we do not allow broker’s links (affiliate links).

Keep in mind that Portfolio Expert Advisors with EA Studio are allowed only with Meta Trader 4. If you are thinking about placing different EAs on different chart windows than you can go for MT5. Anyway the Portfolio trading with one Expert Advisors is only for MT4. This is not restriction in EA Studio, but in MT5. Simply, the broker do not provide hedging in MT5.

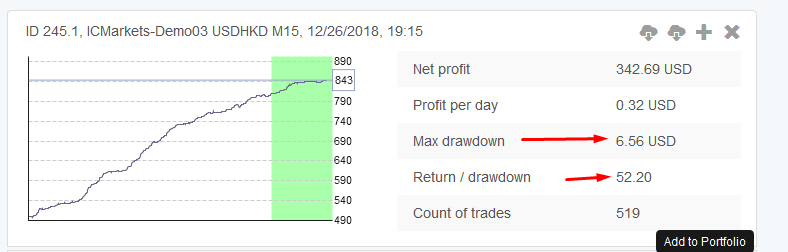

Your strategy equity line looks very good!

Cheers

-

December 28, 2018 at 20:31 #8017

Anonymous

InactiveThank you for explaining that Petko

-

-

December 28, 2018 at 21:52 #8025

Anonymous

InactiveHello Dommech,

if you want to reach better diversification, you better go to other sectors as commodities, stocks, indexes. This way you will achieve great portfolio.

I have been working on such for the last one year, but I want to complete it before I share it here in the Forum.

I would now imagine doing that without EA Studio. Impossible!

-

December 28, 2018 at 22:06 #8030

Anonymous

InactiveHi Domech,

I think you need to re-optimize more often like every 1-2 months.

Yes big banks always interfere the market, but I think it is on all currencies(of course the most in USD).

Now the leverage give you the chance to trade with small capital…basically you borrow money from the broker. BUT be careful because you can lose it all easily :)

-

December 29, 2018 at 9:34 #8036

Anonymous

InactiveDomech, one more thing from me:

you say that you run the optimizer for 12 hours in EA Studio? Did you mean the generator or the reactor?

Anyway even you have the slowest computer, the optimizer is quick and it can not take you so long time ?

-

December 29, 2018 at 14:24 #8045

Anonymous

InactiveThx for the feedback guys! :-)

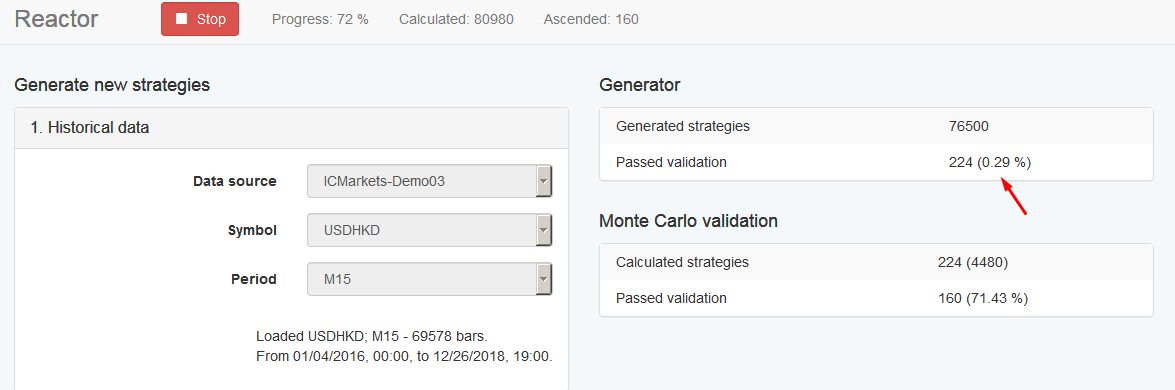

Petko, I use the Reactor with 80-90% Monte Carlo It still goes thru 70-100.000 strategies

-

-

December 29, 2018 at 18:39 #8050

Anonymous

InactiveAll right, than you are using the Reactor, not the Optimizer :)

It is just fine what you have as result.

A small tip: Use the EA studio alone in the browser(no other website in the same browser opened). It will make it a bit faster.

Cheers

-

January 8, 2019 at 10:23 #8285

Anonymous

InactiveI have missed somehow this topic.

Guys, have you tried generating EAs for oil, silver and gold? I know these assets are not so active, but I look for more diversification.

-

January 8, 2019 at 16:13 #8290

Anonymous

Inactive@Andi-I’ve been able to generate strategies for all three. I actually have 1 EA trading live right now for oil and silver each. I would definitely recommend to diversify as much as possible. And also be aware that the lot size for trading these assets may be different for Forex. For instance, trading oil at a lot size 0.01 with my broker and a winning position of about 1 pip will equal 100USD. If I was trading Forex, that same lot size would only give me 10USD. So the potential for nice profit is great with the commodities, but I would stress more cautious risk management in regards to lot sizes when trading.

Also, my broker did not have a lot of history for the commodities so the strategies that are generated may not be ones that will last for a long time. So, I just keep an eye on performance and make sure I have a nice group of back up strategies.

-

January 8, 2019 at 23:48 #8299

Anonymous

InactiveAlso, it is good to keep in mind that the commodities are very volatile around the Hot Economic news concerning each. They might effect some currencies, and they way around, some currencies might be effected from the moves in commodities.

For example, we have a strong move with Oil, it normally effect the CAD(as oil is their main export).

-

January 8, 2019 at 23:58 #8303

Anonymous

InactiveHey Jacpin,

thank you for the answer again!

Yes, I will look to diversify the risk with some commodities and stocks.

Oooo I see your broker uses a lot of leverage or what is it? I mean what is the reason moving one pip will cause 100$ with 0.01. Are you sure about that?

-

January 9, 2019 at 0:17 #8306

Anonymous

Inactive@Petko-You are absolutely right and I am seeing how that move right now. My live EA hasn’t done anything with it yet, but I have a couple of EAs in demo that is taking advantage. I’m eager to see how it plays out.

@Andi-Sorry about that. I wrote it wrong. 0.1 lot size moving 1 pip equals 100USD. I have an oil EA going on right now in demo and is trading 0.01 lot size and the asset has moved 0.7 pips in my favor, so it is giving me a profit of 7USD right now. So, if this was 0.1 lot size the profit would be 70USD or 1 standard lot would be 700USD. :) I believe that this is because the commodities move in points vs pips. So FX Blue live converts the movement of points into pips for us.

I will stress caution only because I can’t get a lot of history to create robust strategies, so these are most likely used for the short-term.

-

January 9, 2019 at 11:21 #8313

Anonymous

InactiveThanks for making this clear, Jacpin. I do believe this is from the broker. They decide how much size to be the trading lot.

For example if you look at the oil specifications with my broker:

You see one contract size is 100 barrels. This means that 1 lot is 100 barrels(around $5000).

And I see with different brokers it is different for every asset.

-

January 9, 2019 at 19:03 #8325

Anonymous

Inactive@Andi-Yes, you’re right. I compared your brokers specs on WTI vs. mine and they’re very similar except for contract size. 1 lot is 1000 barrels. Maybe this is why I prefer Brent Oil vs. WTI right now. ;-)

-

January 9, 2019 at 22:40 #8330

Anonymous

InactiveGood point here, Andi!

All brokers decide for themselves the trading size for one lot, so you need to be careful specially if trading on live.

-

January 10, 2019 at 10:27 #8341

Anonymous

InactiveYes, and the bad thing is that on some assets the brokers do not allow 0.01 as trading size. Which is ridiculous – this is CFD trading. They just force the traders to take higher risks.

-

January 11, 2019 at 14:03 #8375

Anonymous

InactiveHello Andi,

yes, but the brokers define their rules. It is up to you if you will trade with this broker or not :)

-

-

AuthorPosts

- You must be logged in to reply to this topic.