Forex trading, also known as FX trading or foreign exchange trading, is a global market for trading currencies. Starting forex trading can be quite an exciting challenge. One needs adequate forex education to be in a place to understand this complex market. With the appropriate forex trading education, traders can decode the market, see the trends, predict currency movements, and make moves accordingly.

Main features of full-fledged forex learning are going through some structured courses, undergoing live trading simulations, and being guided by experts. These elements provide an in-depth understanding of market dynamics, risk management techniques, and trading psychology. This will help you gain confidence and hone your decision-making skills, thereby trading accurately and smoothly.

In short, Forex or FX stands for Foreign Exchange; where instead of you, trading stocks, bonds, or indices – you trade actual currencies like the US dollar (USD), the British pound (GBP) over the Euro (EUR) or Japanese Yen (JPY).

Investing in Forex education will turn into actual money through your trading performance. You can catch opportunities, minimize risks, and obtain returns. Enroll in fx traders academy, which could give you a disciplined learning environment to master how to learn Forex trading properly. Start your path toward this education to reach your fullest potential in trading and attain financial success.

This guide aims to provide an extensive overview of forex trading education, ensuring that newcomers are well-prepared before they start trading with real money.

Table of Contents:

- Getting Started with Forex Education – Why is Forex Education Important?

- Understanding Forex Trading: What You Need to Know

- Key Concepts in Forex Trading

- Setting Up for Success

- The Importance of Online Forex Courses

- Learning About Currencies

- In-Depth Forex Learning

- Practical Steps to Enhance Your Forex Trading Education

Getting Started with Forex Education – Why is Forex Education Important?

When hear first time about Forex trading, many often want to jump right in and want to start making money without having any Forex education. Unfortunately, that can result in losing much more money than you end up making.

Forex trading is highly risky, and without the right knowledge, a trader may suffer losses. Proper forex trading education enables the evaluation of risks and helps make balanced decisions about potential rewards against downsides. Emotions can cloud judgment, but with solid education, traders learn to remain objective and strategic.

For that reason, Forex education is a must before risking any real money. Once you have the skills, you will be able to evaluate your risk versus your reward and make successful trades.

Understanding Forex Trading: What You Need to Know

Forex trading is the process of buying and selling currencies in the global financial market to profit from changes in exchange rates. It is the largest and most liquid financial market in the world, with a daily trading volume averaging US$7.5 trillion as of April 2022. This market operates 24 hours a day, five days a week (except for weekends) involving major financial centers worldwide (trading from 22:00 UTC on Sunday (Sydney) until 22:00 UTC Friday (New York). It is driven by various factors such as economic data, geopolitical events, and market sentiment. Transactions are conducted over-the-counter (OTC) – meaning transactions are executed directly between parties rather than through a centralized exchange – via a global network of banks, brokers, and financial institutions.

In the forex market, participants include central banks, financial institutions, corporations, hedge funds, and individual traders. Each plays a crucial role in determining currency prices through buying and selling activities.

To excel in forex trading, you need to have proper forex education. This involves understanding market fundamentals, technical analysis, and risk management strategies. Enrolling in an fx traders academy can provide structured forex trading education, tailored to enhance your trading skills and profitability.

Therefore, success in FX learning requires a meticulous approach to market analysis and decision-making. Whether you are new in learning forex trading or want to deepen your knowledge, grasping these basics is key to success in this dynamic market environment.

At glance:

- profit from changes in exchange rates

- daily trading volume of US$7.5 trillion

- operates 24 hours a day, five days a week

- over-the-counter (OTC) market

Key Concepts in Forex Trading

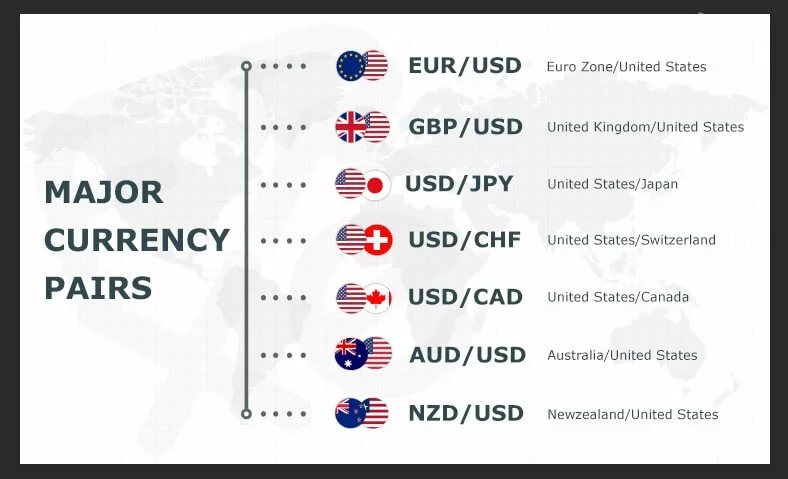

Forex trading involves buying and selling currencies in pairs, with exchange rates indicating how much of the quote currency is needed for one unit of the base currency. Currency pairs are divided into major, minor, and exotic categories based on liquidity and trading volume. Understanding PIPs, lots, and leverage is crucial, as PIPs measure price movement, lots standardize trading sizes, and leverage allows significant positions with minimal capital. The spread, or difference between buying and selling prices, serves as the broker’s commission. Now let’s explain a bit more about the key concepts in forex trading.

Currency Pairs and Quotes

Currencies are traded in pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is the base currency, and the second is the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency. For example, if the EUR/USD exchange rate is 1.20, it means one euro can be exchanged for 1.20 US dollars.

Major, Minor, and Exotic Pairs

Currency pairs are categorized into major, minor, and exotic pairs. Major pairs involve the most traded currencies, such as EUR/USD, USD/JPY, and GBP/USD, and typically have the highest liquidity and lowest spreads. Minor pairs, like EUR/GBP and AUD/NZD, do not include the US dollar but involve other major currencies. Exotic pairs consist of one major currency and one from a developing or smaller economy, such as USD/TRY or EUR/SEK, and often have higher spreads and lower liquidity.

Understanding PIP (Percentage in Points), Lot, and Leverage

A pip, or percentage in point, is the smallest price movement in a currency pair, usually measured to the fourth decimal place. Understanding PIPs is essential for measuring profit and loss. A lot represents the standardized trading size, with a standard lot equating to 100,000 units of the base currency. Leverage allows traders to control larger positions with a smaller amount of capital, amplifying both potential gains and losses. For instance, a leverage ratio of 100:1 means a trader can control $100,000 with just $1,000. To keep it simple, leverage is essentially a virtual multiplier of your account’s balance

Spread

The difference between the buying price and the selling price. This is naturally the broker’s commission. For example if you sell a used car, to a used car dealer, they buy it from you, they mark up the price then they then sell it to someone else. The markup is their profit. If you have a Buying Price at 106.92 and Selling Price at 106.90 when you first start a trade, the two points are essentially your broker’s markup or commission. This is the spread, you must always pay the spread, that’s the cost of doing business in foreign currency trading. Now as your bid starts to climb, you hope to surpass 106.90 which basically means any points over 106.90 will be your profit.

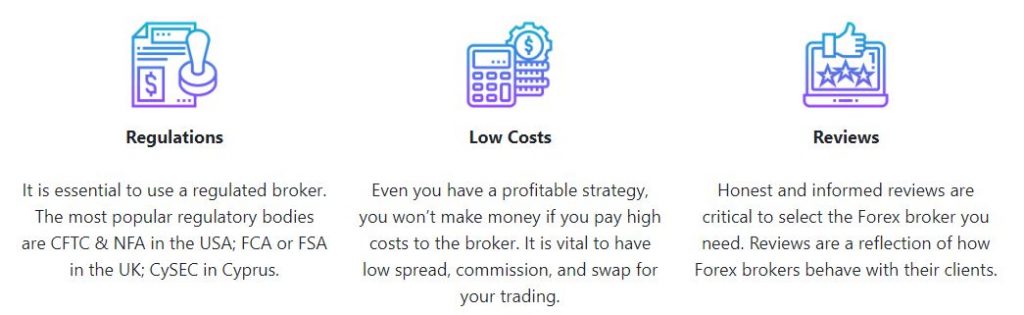

Setting Up for Success

Selecting a good forex broker is one of the significant parts of succeeding in trading. Essential considerations include regulatory status, the quality of the trading platform, spreads, commissions, and customer service. It would be best to choose a broker regulated by an entity with good recognition, such as the FCA or CFTC, to guarantee the safety and security of your funds.

After selecting a broker, setting up a trading account requires an application to be filled out, identity to be verified, and money to be deposited into the account. The trader has options of several kinds of accounts: standard, mini, and micro accounts based on risk tolerance and capital. Proper account set-up is very essential for smooth and efficient trading operations.

Before committing real money, new traders should practice on demo accounts. Demo accounts are a virtual and risk-free practice arena for learners to try out the trading field. If you would like to learn more about Demo accounts and why you need this, follow this link .

Being a successful trader in forex trading starts with a sound basis, which includes looking for a reliable broker in forex trading, opening a trading account, and starting to use demo accounts to practice.

The Importance of Online Forex Courses

Specialized online courses are valuable resources for advancing your Forex education. These courses are designed to provide in-depth insights into various aspects of Forex trading, including advanced trading strategies, technical analysis, and risk management. They often include interactive lessons, quizzes, and practical exercises, allowing you to apply your newfound knowledge in real-world trading scenarios.

Many online courses provide comprehensive forex trading education, catering to different levels of expertise. These courses cover essential topics such as active trading times, remaining objective, and specific trading platforms. A popular choice among our students is the Basic Forex Education course, which offers foundational knowledge necessary for trading.

Learning About Currencies

Understanding the currencies you plan to trade is critical. Instead of randomly buying and selling currencies, you should focus on a few currency pairs and learn their behavior. This targeted approach makes it easier to track relevant economic news and make informed trading decisions. In order to do it, you would perform fundamental analysis. This involves evaluating the economic, financial, and geopolitical factors that influence currency values. Geopolitical events, such as elections, conflicts, and trade agreements, can significantly impact forex markets. Among the economic factors, there several key indicators such as Gross Domestic Product (GDP), Consumer Price Index (CPI), unemployment rates, and interest rates. Also Central banks play a pivotal role in the forex market by setting monetary policy, influencing interest rates, and managing currency reserves.

In-Depth Forex Learning

In this section, we will talk about Types of Forex Markets, Advanced Trading Strategies, Managing Risks and The Role of Forex Trading Platforms.

Types of Forex Markets

There are three types of Forex markets. The most popular market with individual traders is the spot market. It is the market where various currencies are traded based on their current price. When you are talking about individual Forex trading, this usually means the spot Forex market. The other Forex Markets are futures market and the forwards market, which are popular among companies.

- Spot Market: The most popular among individual traders, where currencies are traded at current market prices.

- Futures Market: Involves contracts to buy or sell currencies at a future date. Popular among companies for hedging purposes.

- Forwards Market: Similar to the futures market but involves customized contracts between two parties.

Advanced Trading Strategies

Advanced Trading Strategies include hedging and speculation. Hedging is used to protect against potential losses by opening opposing positions. It is typically only done on the forwards market or the futures market. While common in corporate trading, individual traders may use it to mitigate risk. Companies use hedging when they are trading goods and services, not straight currency. Speculation involves predicting currency value changes based on various factors like trade flows, interest rates, and geopolitical events. Successful speculation can lead to profits, but incorrect predictions result in losses.

Managing Risks in Forex Trading

Understanding and managing risk is a cornerstone of forex trading education. Traders should be aware of the potential risks, including the possibility of incurring debts through leverage and the reliability of brokers. It is advisable to choose brokers regulated by reputable authorities (Tier-1 regulations) to ensure fair trading practices.

The Role of Forex Trading Platforms

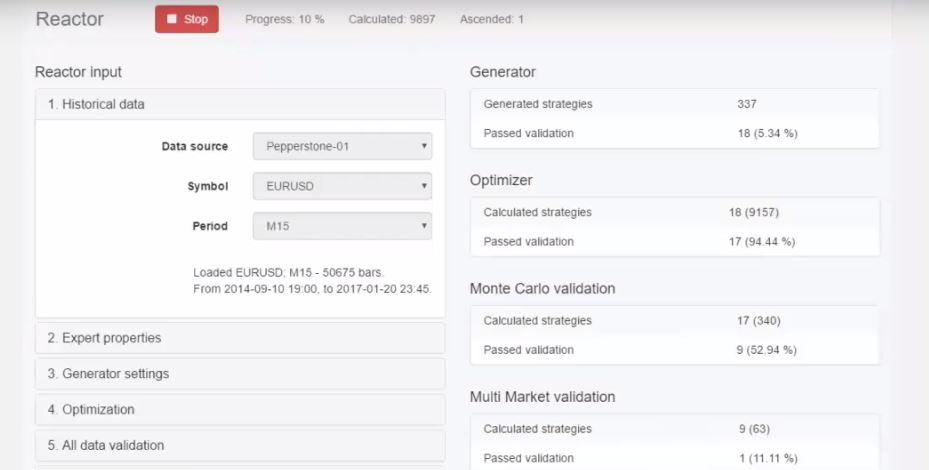

Another very important aspect is choosing the right trading platform. Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) offer user-friendly interfaces and a range of tools for analysis and trading. They provide access to real-time market data, analytical tools, and order execution capabilities. MT4, for example, offers various technical indicators, customizable charts, and automated trading features. These platforms also support automated trading through Forex robots (Expert Advisors), allowing traders to execute strategies without constant monitoring.

Practical Steps to Enhance Your Forex Trading Education

There are several practical steps you should consider when preparing for your forex trading journey.

Join an FX Traders Academy

Enrolling in an FX traders academy can provide structured learning and mentorship. These academies offer courses tailored to different skill levels, from beginners to advanced traders, covering all aspects of forex trading education. They also provide access to a community of traders, facilitating knowledge sharing and networking.

Stay Updated with Economic News

Forex trading is influenced by economic events and geopolitical developments. Staying informed about global news helps traders anticipate market movements and make better trading decisions. Economic calendars and financial news websites are valuable resources for this purpose.

Continuous Learning and Adaptation

The forex market is dynamic, and continuous learning is essential. Traders should regularly update their knowledge and adapt their strategies to changing market conditions. Reading books, attending webinars, and participating in trading forums can enhance one’s understanding and skills.

Conclusion

Forex trading offers substantial opportunities but comes with inherent risks. Proper forex trading education is vital for success in this field. By understanding the basics, practicing on demo accounts, and continuously learning, traders can navigate the complexities of the forex market. Whether you are a novice or an experienced trader, investing in your forex education is the best way to achieve long-term success.

With the right forex education, you can confidently enter the world of forex trading, equipped with the knowledge and skills to make informed decisions and maximize your potential for profit. Good luck, and may your trading journey be both educational and profitable!

For more detailed insights and advanced strategies, consider joining an FX traders academy and accessing specialized courses and resources.