Forex Algorithmic trading – the newest Expert Advisors from EA Forex Academy.

Forex Algorithmic trading is the thing, I will be talking about in this article. Hello, dear traders, it’s Petko Aleksandrov from EA Forex Academy. Today I will talk about the recent course that I have launched about Forex Algorithmic trading. It is in our algorithmic trading section.

If you click on “Courses” you will find it just right down. This is the ninth course that I have launched for algorithmic trading and included again 10 Expert Advisors. This time this is for USDJPY. If I click on the course you will see the description. You will see the landing video, where we can learn much more about the course.

And as you can see already 356 students joined the course for less than one month.

This makes me very happy. There is a huge interest in this course and it’s another Forex Algorithmic trading course where I am showing new methods on how to build Expert Advisors.

So what you will see is that this time I have used the Forex Strategy Builder Professional and this strategy builder gives us some more possibilities that we are missing in EA Studio.

What we have here is we have the possibility to add to the position.

Inside the Expert Advisor’s inputs, you will have the stop where you can select how much to add to the position, and how much to be the maximum trade. Of course, as a beginning, I would not suggest you add many times on a trade. You will need to be careful about increasing the position. Also, keep in mind that when we add to the positions, the backtest results would be different.

Once you have, for example, a buy signal and then you have the next same directional signal you can add to the position and when there is an opposite signal you can actually reverse the position.

And then again, if we have another sell signal we can add to the position. Then another one we can add and same on the other side. If we have a buy we reverse this whole sell position. All of the trades from the sell position and then we buy and then on the next same directional signal we add another buy. This is the most logical method in Forex algorithmic trading.

I have made the Expert Advisors in such a way that you will be able to choose how many times you want to add to the position. For example, if you choose three this means that you will add three times maximum. On the fourth one (if there is a fourth same directional signal) it will not add the position. Basically, this way you describe how much you want your maximum lot to be.

Forex Strategy Builder Professional gives us some more possibilities.

As we see great indicator chart and we are using the longer the time frames. What you see below is that I am using M15 for this strategy as a major time frame to trade on, but what I have below is two different time frames. So I have MACD on M30 chart and I have MACD on H1 chart.

This MACD indicator filters the entries.

In Forex Algorithmic trading it is easy to create Expert Advisors that are very active, scalping and open many trades daily. The good trader looks for the better entries and makes his best to eliminate the losing ones.

The idea here is to have stronger entries at the right moment and with the indicator chart, you can see exactly where were the entries and where is the next one.

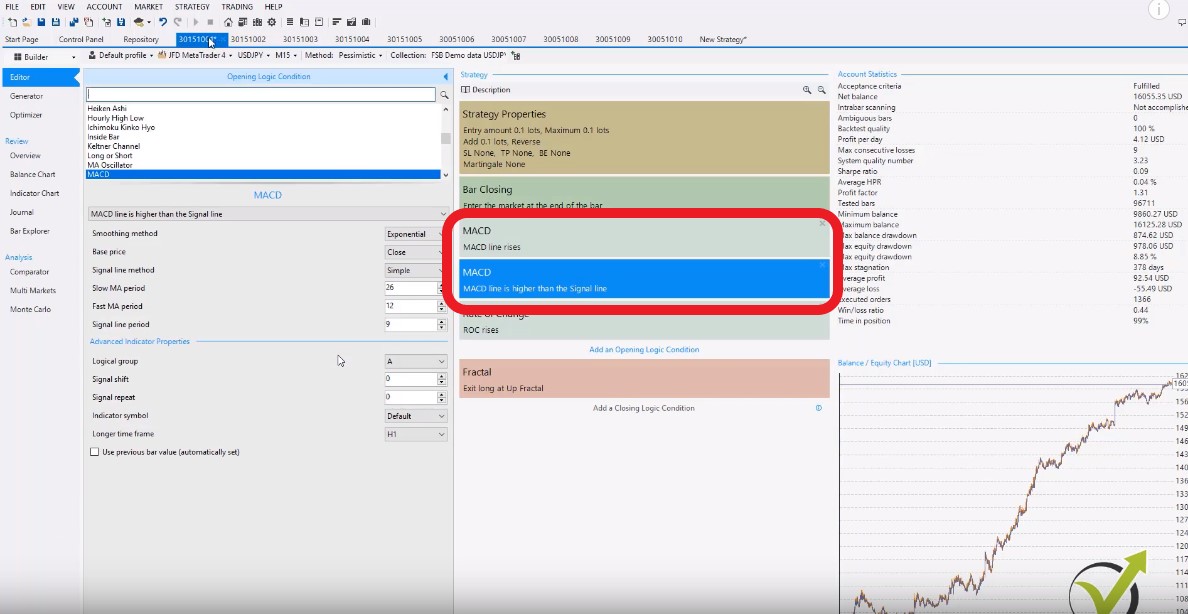

This is how Forex Strategy Builder Professional looks like.

If you want to use it, there’s 15 days free trial that you can take advantage of. You need to install it on your computer and you will be able to use it. So basically here in the middle we have the entry rules and we have the exit rules, the logic conditions, this is again the indicator chart, that I am showing over here.

In this case, talking a little bit more about the MACD

I am using the MACD in a way that I want M30 and H1 to match and this is the moment when I am entering. You can see here is the sell signal because both MACD confirm that it is alright to go short, right?

And if I just go back a little bit earlier to the video from the lecture and I pause it you will see the ad three conditions:

- MACD line rises

- MACD line is higher than the Signal line

Okay so, I have one and the same indicator but with different entry conditions:

- MACD rises

- MACD line is higher than the Signal line

I have confirmation on M30 to go in the same direction.

And this way the Expert Advisor has the confirmation to execute the trade on M15, of course, if the other rules are there. Now I will just go a little bit more over the video and I will show you the other strategies.

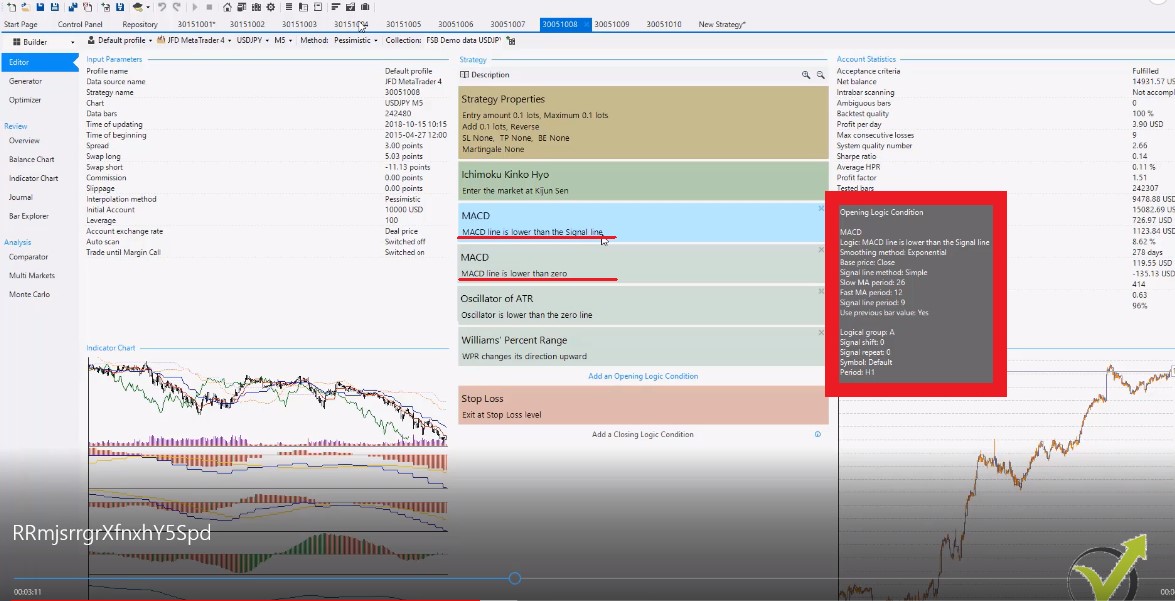

Here the first five that I have created are trading on M15 and then the next five are on M5. Now on M5 I am using the MACD indicators but with different conditions:

- MACD line is lower than the Signal line

- MACD line is lower than the zero line

On M5, what I have aimed, is to create Expert Advisors that are actually trading on the sideways market. I want to buy when the price is cheap and I want to sell when the price is expensive. Now I have the indicator chart, I have the MACD lines, I have the other indicators so the other indicators are still on M5 but the MACD is on H1 and M30.

Alright, here I want to go long when the price is cheap. You see here I have this move down and here is the long entry. When I have the confirmation from the MACD and I am buying basically after the move down

The Expert Advisor aims to take the trade on the long side when we are having a cheap price. This is typical for Forex Algorithmic trading.

Now obviously here this didn’t happen. You can see the price just went sideways. But not so much sideways. You can see it goes a little bit higher up to here and then I have a sell signal.

See this red line below, the price over here, this shows that we are having short trade. Then when we have green one this means we are having the long trade:

Now one more time here the idea is that we want the MACD to be down. This will confirm that the price is down and we want to buy it. Same thing on the other side we are looking to sell it when the price is expensive.

This way I create Expert Advisors that are trading exactly over the sideways market.

While those on M15 are catching the move. As the old saying in Forex Algorithmic trading says: “We want to jump into the train, we want to go with the direction of the major price”

These are the two different market conditions in the trending market:

- buy when the price is going up

- sell when the price is going down

The sideways market:

- buy when the price is cheap

- sell when the price is expensive

Five of the Expert Advisors are on M15 and five are on M5. Аll of them are being filtered with the MACD indicator on H1 and M30.

I will talk a little bit more about the FSB Pro as a strategy builder.

Of course, again I have created hundreds of strategies, I have filtered those and I’ll show how I’m doing it during the course but it’s great if you want to practice just what you can do is to download it from right over here on our website.:

Here you will see the download trial button and there are 15 free videos over here from the developer Mr. Popov, who has developed this software for many many years.

And now I can say it’s a top product in Forex Algorithmic trading. Personally, I wouldn’t imagine trading without it. It makes it so much easier.

Now I will focus a little bit more on a Forex Strategy Builder Professional in my next courses because if I go one more time to our Forex Algorithmic trading section in the courses you will see that in most of my courses I have used EA Studio. The web-based strategy builder. This is for a reason actually, because it’s a much easier strategy builder. It’s much more convenient for the beginner traders and everyone can get used with it pretty quickly.

While FSB Pro is a bit more advanced. It takes a little bit more time to set it up. But those videos, from the developer, will guide you through each step. It will be very easy for you to set up the strategy builder. Of course, in this course that I have been talking about in this video: “The top 10 USDJPY Expert Advisors Forex Algorithmic Day trading”.

I have shown briefly how to set it up and you will be able to do it. What I wanted to say is that from the nine Forex Algorithmic trading courses what I have been doing with the top five – I use FSB Pro. Then with one of the strategies I used EA Studio. Then with the Forex strategy course, I have used both again.

With Тop 10 EURUSD strategies, the Top 10 GBPUSD strategies, the Forex Expert Advisors course, London, New York, and Tokyo Algorithmic Trading. With the Automated Forex trading, the Algo trading course, which is the basic course, and with the Trading Portfolio Expert Advisors.

In all of these six courses, I have used EA Studio and not Forex Strategy Builder. I want to balance it a little bit and I’m planning to make a few more courses on FSB Pro.

I wanted to create more courses in EA Studio because most of our students are beginners. EA Studio is much more appropriate for beginner traders. If you have watched some of these courses you will have an idea about Forex Algorithmic trading. It will be much easier for you to give it a try with FSB Pro.

Many ask me what is the difference between EA Studio and FSB Pro?

First of all, there are many differences because these are two different strategy builders, but here I will point out some of the main.

What is the main difference between EA Studio and FSB Pro?

- the EA Studio is web-based and you can use it from any device with an internet connection

- while FSB Pro needs to be installed on the computer

- with EA Studio we have the default indicators from Meta Trader

- with FBS Pro we have custom indicators and if any are with C# can be imported

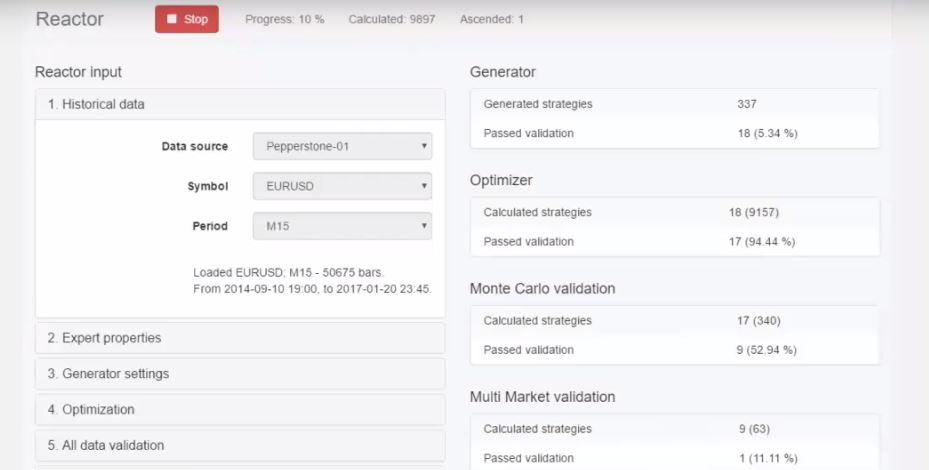

- EA Studio has the reactor tool which automatically generates and performs robustness tests

- FSB Pro gives the opportunity to the trader to use it the software as a trading terminal

- EA Studio works much faster as it is web-based and you can use it on different browsers simultaneously

So these two are just different software for algorithmic trading. It depends a lot on your trading style and what type of strategies you want to build. I always say that the best results are coming when both are used together. This way the trader is capable of creating different strategies which bring better diversification of the risk.

The strategy builders improve the Forex Algorithmic trading to anyone who wants to trade automatically. Most of all, they help the trader to avoid the emotions which is the main reason why manual traders lose money.

Alright guys, thank you for reading! This was the recent course that I have launched about Forex Algorithmic trading. I wish you always to enjoy trading.

If you have any questions don’t hesitate to ask me.

Recently OUR FORUM is getting pretty interesting. Many traders are joining.

I have opened one topic which is – “Forex Strategy for EA cryptocurrency EA – share with everyone”. So there you will find some free Expert Advisors.

For more cryptocurrency trading courses please visit our website.

Cheers!