In this blog post, I will introduce you to an easy Moving Average Expert Advisor that you can download for free. By testing this Expert Advisor and exploring its source code, you will gain valuable insights into its functionality. But before you dive into the technical details, let’s take a moment to understand how moving averages work in Expert Advisors and explore the advantages and disadvantages they offer.

Easy Moving Average Expert Advisor: Combining Strategies

About two weeks ago, I shared a video with you called “10 EAs in 1 Best Moving Average Robot,” where I combined ten different strategies or Expert Advisors into a single moving average portfolio. If you watched the video and downloaded the robot, you already know that you can trade all ten strategies on one chart. Additionally, I demonstrated how you can connect your trading account to FXBlue to monitor performance.

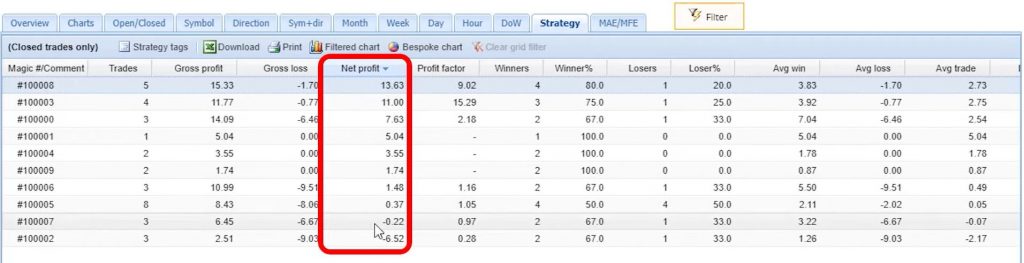

Over the past two weeks, two of the strategies have performed exceptionally well. The top-performing strategy generated a profit of $13 while trading with a volume of 0.01. If the volume had been 0.1, the profit would have been $130. Remarkably, this strategy consistently produced profits in a small account.

Analyzing Strategy Performance

Upon closer inspection of the results from the ten strategies, it became apparent that some were outperforming the others. In this blog post, I will focus on the top-performing strategy and share why it outshined the rest. Now, let’s dive into the details of the best-performing strategy and the easy moving average Expert Advisor.

Understanding the Easy Moving Average Expert Advisor Strategy

The key takeaway from this discussion is that moving averages work exceptionally well in Expert Advisors, especially when combined with other indicators. If you were to use only one moving average, buying when it changes direction upwards and selling when it changes direction downwards, you would generate profits during trendy market conditions with significant up and down trends.

However, you would likely experience losses when the market moves sideways. This is because the moving average lags behind the price, particularly on lower time frames.

The Perils of Relying Solely on Moving Averages

To illustrate the potential risks of relying solely on moving averages, let’s consider a hypothetical scenario. If you were to trade solely based on the moving average, you would enter numerous trades on low time frames. Unfortunately, this approach often leads to unfavorable results.

Later on, I will show you just how many trades you would have executed and the corresponding outcomes using only the moving average strategy.

Exploring the Easy Moving Average Expert Advisor

Now, it’s time to reveal the strategy behind the easy moving average Expert Advisor. Moreover, I will provide you with the source code and guide you through the process of backtesting it with your broker. By gaining a deeper understanding of the Expert Advisor’s inner workings, you will be better equipped to leverage its potential for your trading endeavors.

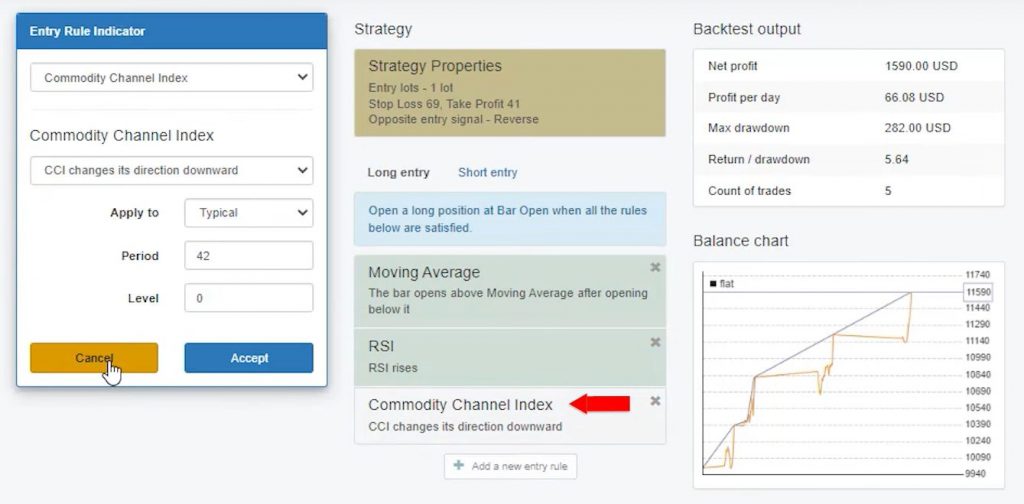

Understanding the Entry Conditions:

The first condition for entering a trade with this strategy is that the bar should open above the 40-period moving average after opening below it. This ensures a long trade opportunity. However, relying solely on the moving average for entries would result in numerous trades, potentially leading to losses.

To avoid this, the strategy incorporates two additional indicators, RSI and CCI, to confirm the validity of the entry signal.

Easy Moving Average Expert Advisor: The Role of RSI and CCI:

In addition, by including RSI and CCI as the second and third entry conditions, respectively, the strategy seeks confirmation beyond the moving average. These indicators help filter out false signals and provide a more accurate entry point.

Without them, the strategy would generate a large number of trades, leading to unfavorable outcomes.

Analyzing the Indicator Chart:

To gain a better understanding of the strategy’s performance, let’s take a look at the indicator chart. Here, we can observe a profitable short trade, a long trade that opened and closed at specific points, and several other trades.

While the results from the portfolio Expert Advisor, combining ten strategies, can be challenging to track, using EA Studio simplifies the process by visually displaying where trades open and close.

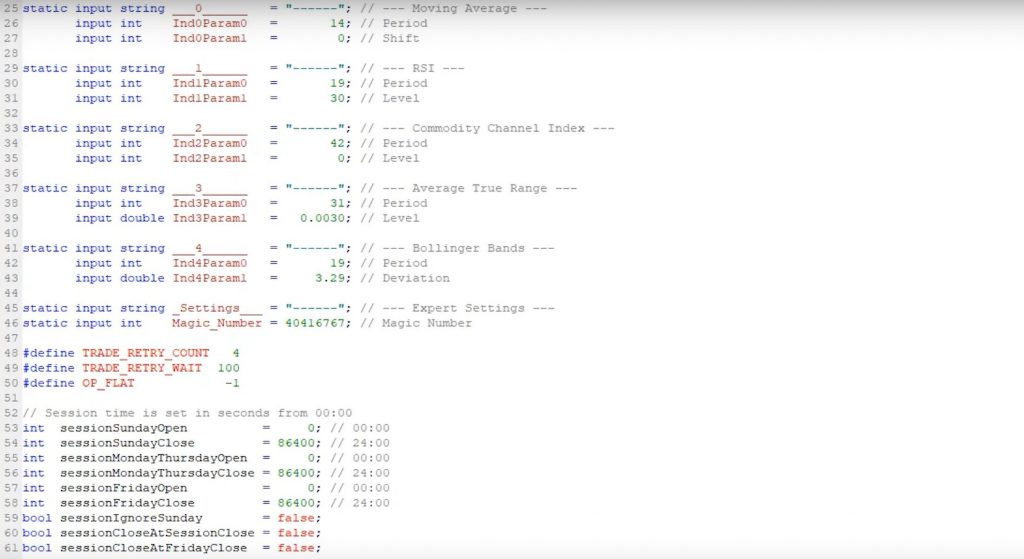

Exploring the Source Code of the Easy Moving Average Expert Advisor:

For advanced developers interested in modifying or adding to the strategy, the source code offers a structured and organized framework. With over 550 rows, the code provides flexibility for customization while maintaining the strategy’s integrity.

However, it’s important to note that modifying source code requires expertise and caution.

The Impact of Indicator Removal:

To highlight the significance of RSI and CCI, let’s consider what happens when these indicators are removed from the chart. In a simulated scenario, with RSI and CCI removed, the strategy generates over 200 trades in less than a month. This influx of trades would likely result in losses, demonstrating the importance of the additional indicators in confirming entry signals and filtering out false trades.

Using the Easy Moving Average Expert Advisor on MetaTrader 4

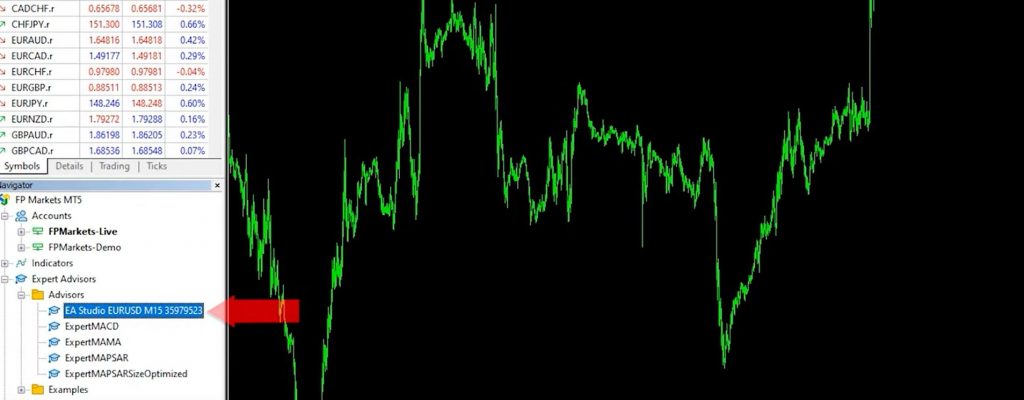

Back to the MetaTrader platform, where I will guide you through the process of using the Easy Moving Average Expert Advisor. By following these steps, you can easily download, install, and backtest this powerful tool. Let’s get started!

Step 1: Download and Installation

To begin, download the Easy Moving Average Expert Advisor and save it to your computer. Next, open the MetaTrader platform and go to “File” > “Open Data Folder.” In the opened folder, locate “MQL4” and then click on “Experts.”

Inside the “Experts” folder, paste the downloaded Expert Advisor. Now, open the source code and click on “Compile” to generate the ready-to-use file. You will find the Expert Advisor in the Navigator window.

Step 2: Placing the Easy Moving Average Expert Advisor on the Chart

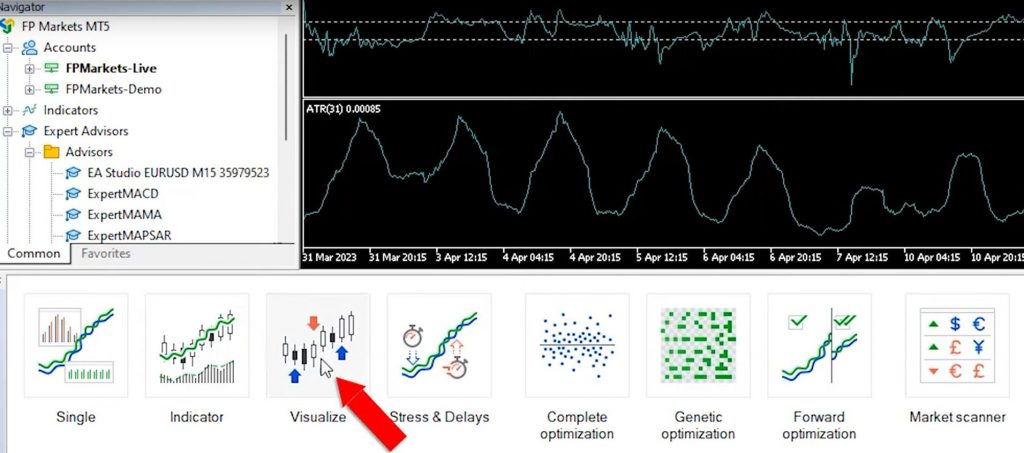

To use the Expert Advisor on a chart, simply drag and drop it onto the desired chart. A window with input settings will appear. Review and adjust the inputs as needed, then click “OK” to apply the changes. A recent update from EA Studio allows you to see the indicators directly on the MetaTrader chart when exporting the Expert Advisor, which enhances the user experience.

Step 3: Backtesting with MetaTrader Strategy Tester

Backtesting with MetaTrader Strategy Tester Performing a backtest is a crucial step for every new strategy and Expert Advisor. To conduct a backtest, go to the “View” tab and click on “Strategy Tester.”

In the Strategy Tester window, select the Expert Advisor and choose the symbol and timeframe you want to test. Ensure that the modeling is set to “Open Prices Only” as the Expert Advisor functions based on bar openings. Click on “Start” to initiate the backtest.

Step 4: Analyzing Backtest Results of the Easy Moving Average Expert Advisor:

During the backtest, you can utilize the visual mode to observe trades being opened and closed. By adjusting the playback speed, you can carefully analyze the performance of the strategy. For example, you can identify short trades that were profitable after the bar opened below the moving average, followed by confirmation. Take note of the final balance achieved during the tested period.

Step 5: Utilizing Backtest Results to Improve Strategies

Backtesting is a valuable tool for refining strategies and Expert Advisors. In addition, by analyzing the entry and exit rules and reviewing good and bad trade entries, you can identify areas for improvement. Strategies often incorporate indicators, stop losses, take profits, and other elements, offering various ways to build an effective Expert Advisor. Moreover, continuously testing and updating strategies based on backtest results is crucial for success.

Easy Moving Average Expert Advisor: Conclusion:

The Easy Moving Average Expert Advisor can be a valuable addition to your trading strategy, enhancing your potential for success. By incorporating multiple indicators, such as the moving average, RSI, and CCI, this Expert Advisor aims to filter out false signals and provide reliable entry points. Remember to download the Expert Advisor and test it on a demo account with a trusted broker like FP Markets. Always conduct thorough due diligence and consider your own risk tolerance before implementing any trading strategies. With the Easy Moving Average Expert Advisor, you can optimize your trading decisions and work towards achieving your financial goals.

Disclaimer: Trading in the financial markets involves risk, and past performance does not guarantee future results.