Dow Jones Algorithmic trading.

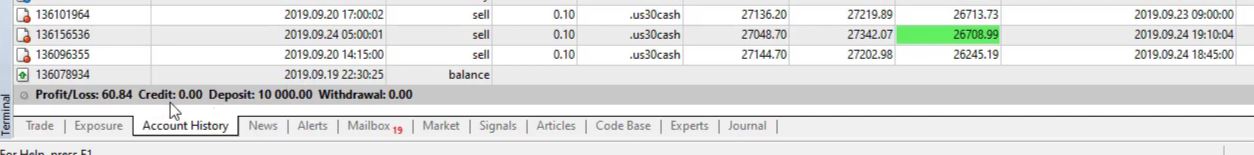

Hello, dear traders, this is Petko Aleksandrov and today I will show you some results from my Dow Jones Algorithmic trading which I have captured in a course. You can see already I have $60.84 as a profit into the account and I have more trades open and closed.

So let’s have a look at what we have in FX Blue. Right here we have the same total Net profit. And you can see the strategies opened more count of trades.

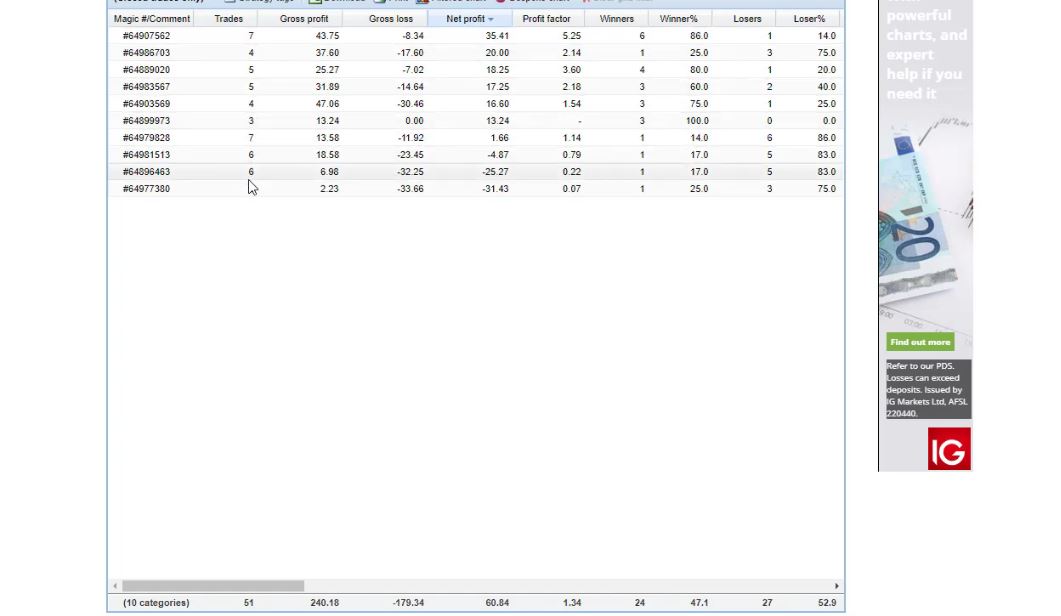

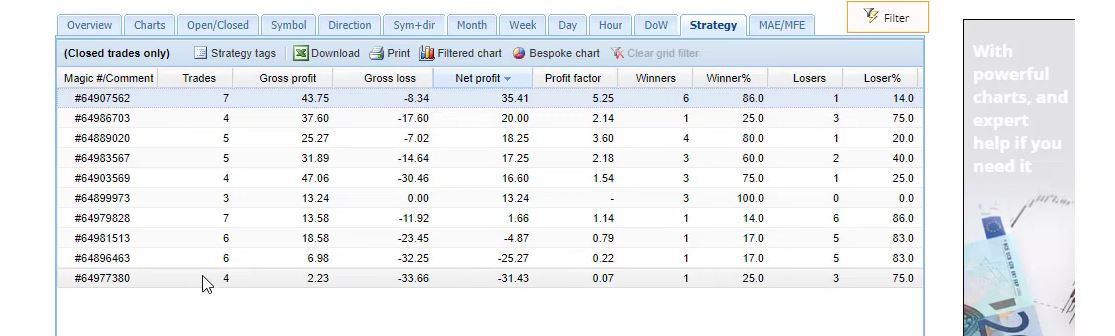

So what more we have as a statistic from the Dow Jones Algorithmic trading, if I scroll to the right side you will see that I have the numbers of winners, losers, these are the numbers of trades. We have it in percentage as well.

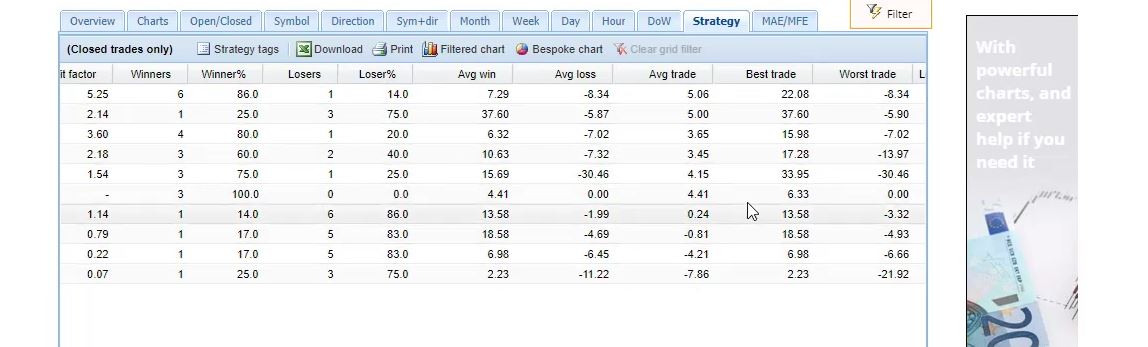

And we have the best trade, worst trade, a lot of statistics.

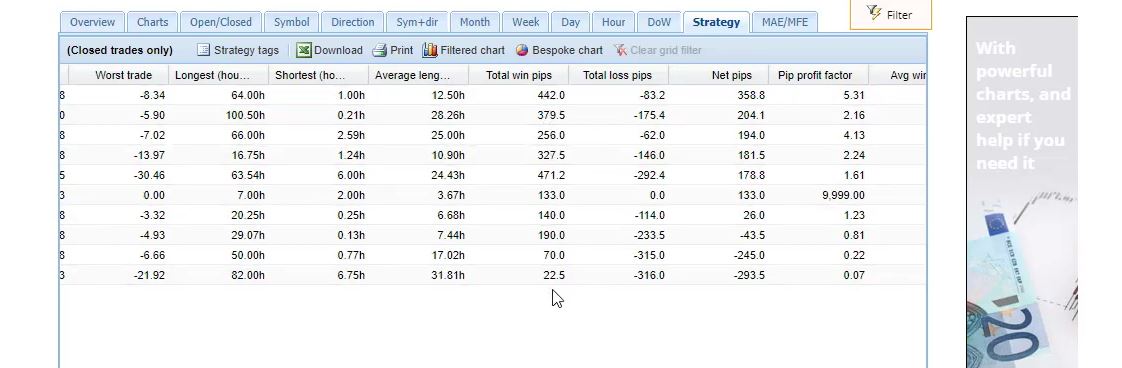

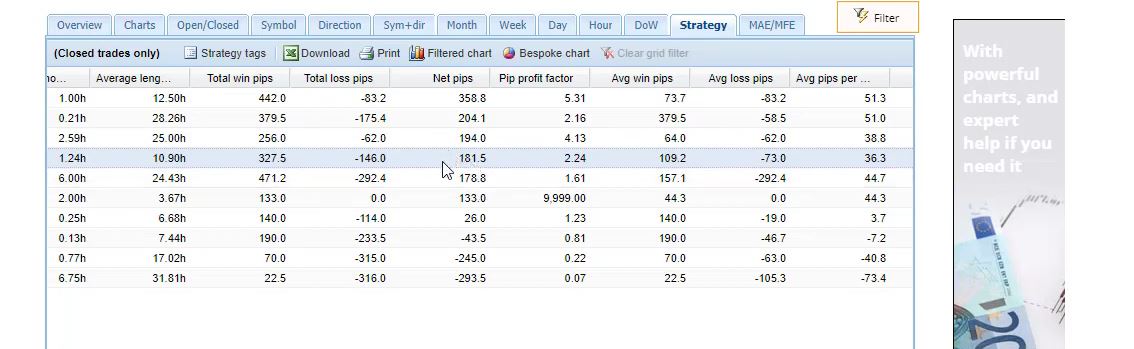

We have as well the length of the trades like the longest, the shortest, the average length of the trades. You can see some trades last just a couple of hours, some last overnight. And on the right side, we have the pips which are very interesting for me.

You can see there is a huge difference when we’re trading index like Dow Jones and when we are trading with the Forex currency. So I have total win pips here, total loss pips. As net pips, I have 694.2. And I have at the same time a total Net profit of $60.84.

The pips in Dow Jones Algorithmic trading.

So there is a huge difference over here when we’re talking about the pips in Forex trading and when we’re talking about the pips with Dow Jones or the other indexes.

Basically here the pips are much more. And I always like to have a look at the pips. I will share with you how I’m using those later with Dow Jones Algorithmic trading.

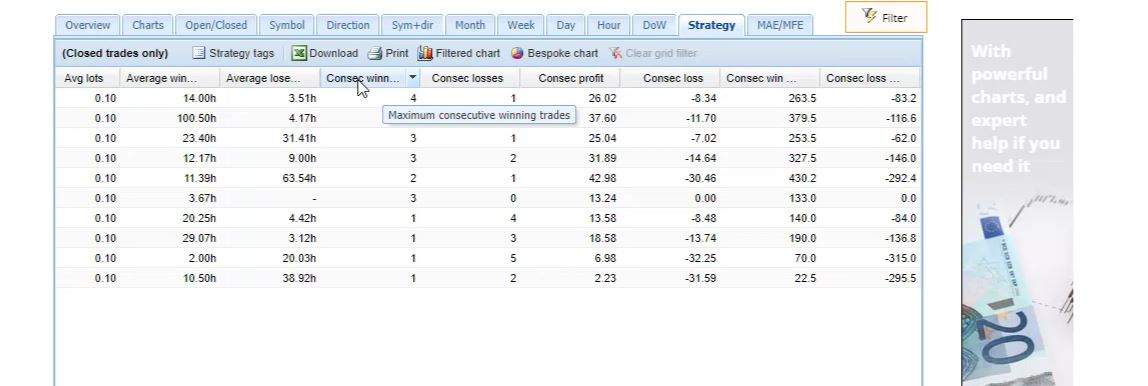

We have pip Profit factor, we have as well the total lots traded and some other statistics till the end as consecutive losses, consecutive wins, maximum consecutive winning trades and so on. A lot of statistics.

First, I am looking at the Net profits to see which are the profitable strategies and which are the ones that are currently losing. And then I have the Profit factor and the number of trades.

Now, as we said, every strategy has a losing period. If you remember when we generated the strategies, on their balance chart there were these drawdowns, stagnation periods, then it’s profit again, stagnation period, and so on.

Very normal for every strategy. The thing is I want to trade the strategies into my live account only when they are in their profitable phase.

Recognizing the profitable strategies.

And how do I recognize the good strategies when I do Dow Jones algorithmic trading?

Simply, I test them on a Demo account and I see which ones are making a profit at the current moment. Because this is like the real thing we have at the moment.

Having a backtest is very useful because we see how the strategy performed in the past, but this is in the past. It’s not in the future. There is never a guarantee that this strategy will continue profiting in the future.

So this is why I test the strategies for the current moment, for the current market conditions and I want to see which strategies are currently profiting, which strategies are currently in their profitable phase.

So one thing is I wait for a minimum 5 count of trades. You can see the first one got already 7, then the second is still with 4, then the third and the fourth, they have 5 already. And then you can see the rest, some already have above 5, some below 5.

So I wait for 5 to make sure that the equity line of this strategy is going upwards at the moment, And I combine it with the Profit factor.

I am looking for a Profit factor above 1.2. So you see that the first 5 strategies, they have Profit factor above 1.2 but only 3 of those are having already 5 trades.

The first one, the third and the fourth one. The second is still with 4. So these 3 strategies are ready for real trading.

Combining count of trades with net pips.

Another method that I am using is to wait again for 5 trades, 5 counts of trades and I combine it with the net pips. So you can see the first one did 358, then 204, 194, 180, 178.

So I’m looking for strategies that have above 100 pips. And you can see that in this case, I have the first, the second, the third, the fourth, the fifth and the sixth one.

Now, here I will have the very same strategies. Because these are the ones that have above 5 trades and they have above 100 pips and they have Profit factor above 1.2 at the same time.

And the third method I am using is the winners and the losers.

The 3 methods I use in Dow Jones Algorithmic trading.

In this case, I wait for 10 trades minimum, and then I want at least 7 out of the 10 to be winners, then I would consider these strategies trading for my live trading account.

So, one more time, 3 methods, 3 different methods I use. The first one is having a minimum of 5 trades and a Profit factor above 1.2.

The second one, having 5 trades as a minimum and above 100 net pips. Here they are. And the third one is a minimum of 10 trades and then 7 out of the 10 to be winners.

Now, it doesn’t matter which method you choose. Actually, you’re very welcome to create your own method, how to filter the strategies, and how to select which ones to place on a live account.

I just want to share with you my methods, how I am doing it. But I combine the 3 methods with the different accounts, with the different assets, because this way again I achieve better risk diversification.

So I use different approaches and it’s the same thing having a good risk diversification when we’re trading with many strategies.

Risk diversification.

You can see I am trading many strategies, even if some are having losses at the moment, the others compensate for it. Now, another important thing is, if you select strategies for your live account, make sure to select a minimum of 3 strategies.

Because if you select just 1, for example, the best one at the moment and you put it on your live account, there is the chance that this strategy might turn into its losing phase and it will bring you some losses. But when you place 3 strategies, they will compensate each other, just what the 10 strategies are doing now.

We want to trade not one, but many strategies together in 1 account. And for me, it’s a minimum of 3. It really took me a lot of time to come up with this conclusion that I have to trade with many strategies, not only 1.

Because this way, when any of the strategies lose, the others compensate for it and you can see it very clearly here.

Moving strategies to the live account.

So now, I will be using the first method that I shared with you and I will use the Profit factor above 1.2 and Minimum count of trades 5. This means that the first one, the third and the fourth are ready for my live trading account.

And one last thing, when you move your strategies to your live account, make sure to follow the results there as well.

And if you are following Profit factor above 1.2, you will have to remove the strategies from the live account if their performance goes below 1.2. So it’s the same criteria that you should be following there. So this is how I select the strategies and I will move those to my live account now.

And when any of the other strategies reach 5 trades and Profit factor above 1.2, I will move them as well. The best thing you can start with is to open another Demo account and simulate it as it is your real trading account.

Just open another Demo account with the same broker that you have selected to use and place there the 3 strategies that are making a profit for you currently.

Use another Demo account for simulation the Dow Jones Algorithmic trading.

Follow the performance of the 2 accounts. And just move from one to the other according to your method that you want to use. This way, you will practice the process and just don’t hurry with trading with the live account until you are sure, until you’re confident with the method you will select to use.

Thank you very much for reading this post. If you have any questions, let me know at any moment. I will be updating these strategies from the Dow Jones Algorithmic Trading course whenever it is needed. And, of course, I will let you know when I update the course.

I wish you safe trading and always enjoy when you are trading with Expert Advisors. It’s really not hard. It removes the stress, the emotions that traders have in manual trading and it’s very easy.

Just be patient to practice sometimes. I’m sure you will find your own method which will bring you some confidence in trading and stable results.