Royal GER30: A DAX Trading Strategy EA

Is it possible for a robot to trade the DAX index with consistent profits? That’s what I wanted to find out when I came across and started using the Royal GER30 EA. I’ve been testing it in a demo and live account, and at this stage, I have good feeling about it’s potential. In this review, I’ll share my personal experience with the Royal GER30 EA. I’ll cover everything I believe you need to know, from installation and setup to live trading results. Whether you’re interested in day trading DAX, you’ve been looking for a DAX scalping strategy, or simply curious about automating your trades, this review will be worth investing a little time into.

What is the Royal GER30 EA?

The Royal GER30 EA is a trading robot that has been designed to trade the DAX Index specifically. The DAX Index is linked directly to the to-performing companies in Germany. Some of the more experienced traders probably know that in 2021, the DAX went from tracking the top 30 companies (GER30) to the top 40 companies (GER40). 10 more companies were added to the index. This change doesn’t affect the EA trading the DAX in any way. You may find some brokers still list the asset as GER30, while other have it on their systems as GER40. The EA can work with either, as it is the exact same asset or index.

The EA has been designed for and runs on the H1 time frame. Generally, it holds trades anywhere from a few hours to a day or two . It’s definitely not a high-frequency trading bot, and the EA doesn’t continuously open trades unnecessarily. Instead, it focuses on carefully selecting high-probability trades based on very specific rules and confirmations from the indicators in the strategy. If you prefer steady and controlled trading, this EA might be the perfect fit for you.

DAX Trading Strategy: Who Is It For?

The Royal GER30 EA is ideal for traders who prefer a calculated approach to trading CFDs on Indices. If you enjoy day trading DAX and other Indices, but don’t want to constantly monitor the charts, this EA could be an excellent choice. It seems perfect for medium-term trades and won’t overwhelm your account with high-frequency orders and potentially suffocating your margin. This makes it suitable for traders who want a balance between risk management, profitability and the freedom of having additional margin in their trading accounts. There is always a risk of unexpected dips from other EAs they may be trading in the same account.

Easy Setup and Installation

Step-by-Step Installation Guide

Setting up the Royal GER30 EA is quick and straightforward. I have only been able to find a MetaTrader 4 version, and it was created in 2021. This is important to note if you use MetaTrader 5 exclusively and would like to test or trade the robot. Like all robots from the MQL5 Marketplace, once you log into the site, you can download the EA, which will confirm that you have MT4 installed, and the EA will then be automatically added to your platform, once you’ve signed in with your MQL5 credentials. To make things a little easier you you, you can find the Royal GER30 here.

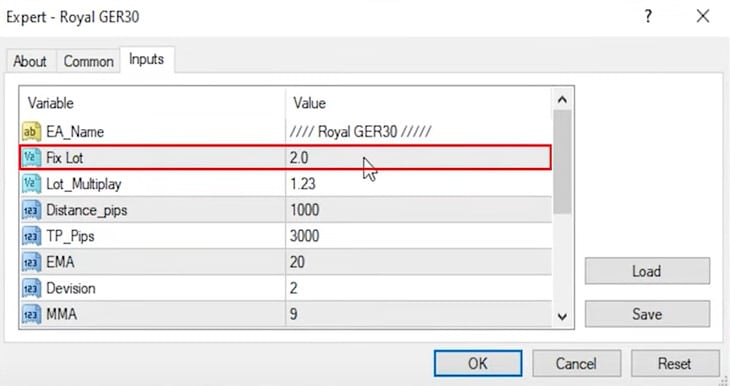

I had it running within 10 minutes on my MT4 platform. Once you’ve installed it, you can customize the EA to match your trading style, particularly the risk settings, however I chose to run it using default settings, as I normally do, to get an idea of the performance using it as is.

Customizing the EA to Match Your Risk Tolerance

One of the standout features of the Royal GER30 EA is its customization options. You can adjust lot sizes, set a trailing stop, and modify other parameters based on your risk appetite and account size. I prefer trading conservatively, so I adjusted my starting lot size to 0.2 lots on my live account. However, if you’re open to taking on more risk, you can modify these settings for higher potential returns.

DAX Trading Strategy: Why You Should Start With a Demo Account

It’s vital to test any new EA on a demo account before trading live. It gives you the opportunity to get an idea of how an EA would perform in real market conditions without risking any of your own money. I ran the Royal GER30 EA on a $10,000 demo account with a starting lot size of 2 lots, which is the default.

Real-World Results

Demo Testing: Zero Losses

The Royal GER30 EA performed well in testing In my demo account, it didn’t post a single losing trade. Every trade ended in profit, which is especially impressive considering the volatility of the DAX index.

This EA doesn’t place trades every day, which might seem slow to some traders. I’ve often been asked my mostly new traders who place an EA on a chart for 2 or 3 hours, why it hasn’t executed any trades yet. The Royal GER30 opens and later, closes trades only when very specific rules and conditions are met.

As mentioned, after running it for a few months, the EA performed very well, with no losses. Of course, this doesn’t mean it will continue to, but for testing purposes, it gave me the confidence to install it on a live account.

Live Trading with the DAX Trading Strategy

After a successful demo test, I transitioned to a live trading account with a broker that offers spreads starting from 1.5 pips—which is ideal when trading indices like the DAX. Tight spreads make a big difference, and can be the difference between a profitable and unprofitable outcome.

On my live account, I started with $1,000 and adjusted the lot size to 0.2 lots to match my smaller balance. I wanted to see if the Royal GER30 EA could trade as well in my live account as it had in my demo account, with potentially different trading conditions.

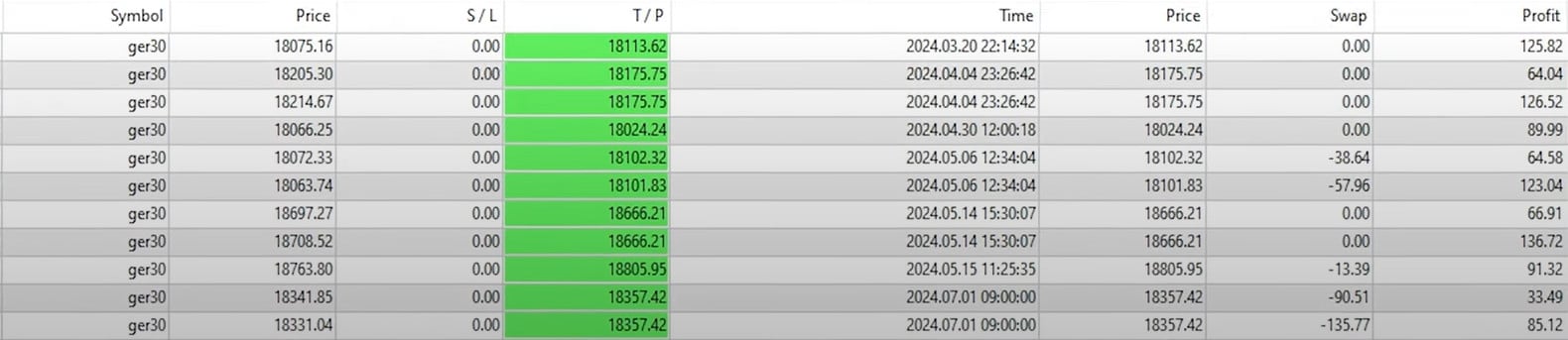

Live Results: 10 Consecutive Wins

Within just two weeks of live trading, the EA delivered 10 consecutive winning trades. Here’s a quick breakdown of some of the trades:

- First trade: $125.82 profit

- Second trade: $64.04 profit

- Third trade: $126.52 profit

The subsequent trades were all profitable and by the end of the two-week period, my account had almost doubled. I was blown away that a free EA could deliver this kind of performance. It’s rare for an EA to deliver such consistent results, especially when trading indices, particularly the DAX.

Key Features of the Royal GER30 EA

1. Adjustable Lot Sizes

The Royal GER30 EA allows you to customize the lot size based on your risk tolerance and account balance. This flexibility makes it ideal for both small and large accounts. For instance, if you’re more conservative, like I am, you can keep the lot size small. If you want to maximize profits, you can increase it accordingly.

2. Trailing Take Profit

One of the key risk management tools in this EA is the trailing take profit. This feature locks in profits as the trade moves in your favor. As the market price rises, the EA adjusts your stop loss, ensuring you lock in gains without having to monitor the market constantly. If the market turns, you’ve already secured your profits.

3. Low Drawdown

In my tests, the Royal GER30 EA recorded a maximum drawdown of less than 4%, which is impressive, however as I have said many times, this can change and it’s always best to exercise caution and trade with a more low-risk approach. Greed is the biggest danger in trading.

4. No Losing Trades

Throughout both my demo and live tests, the Royal GER30 EA didn’t register a single losing trade. That kind of performance is very rare in automated trading, particularly with free EAs. Having said that, many developers offer a free to prove their strategy works, and could give you an EA for 1 currency pair for free, with the option to buy the full pack for more assets.

Risk Management and Drawdown Control

DAX Trading Strategy: Strong Risk Controls

Risk management is crucial when trading, and the Royal GER30 EA does this exceptionally well. There are a number of adjustable settings that you can tailor to suit your account size, risk tolerance and frankly, the amount of time you want to spend monitoring your trades.

Is the Royal GER30 EA Suitable for Scalping?

While the Royal GER30 EA isn’t a traditional scalping robot, it can work for traders looking to take advantage of short-term price movements. It doesn’t place frequent trades like a typical scalper, but its ability to capture smaller market movements makes it potentially suitable for day trading DAX or even a DAX scalping strategy, depending on how you configure the risk settings.

Performance in Different Market Conditions

DAX Trading Strategy: Handling Volatility

The Royal GER30 EA performed exceptionally well in varying market conditions over the time I tested it. It ran during times of increased volatility as well as more stability and the EA continued to close trades on profit. The built-in risk management features seemed to work well, which is evident from the final results of my testing, and so far, live trading.

Advanced Strategies with the Royal GER30 EA

DAX Trading Strategy: Scaling Across Multiple Accounts

One of the benefits of the Royal GER30 EA is that, because it’s free, you can use it on several accounts. You can configure different risk settings for each account—experimenting with both conservative and aggressive risk profiles. You’re able to adjust settings, change entry lot sizes, Take Profit settings, and others to find the setup that works best for you and suits your particular trading style and goals. You can also run various setups to get a more balanced and diverse portfolio. But remember to do this all on several demo accounts first. And do it for a while to really get a good understanding about how the settings affect performance in different market conditions and volatility. This approach works especially well if you are managing several funded accounts and want unique entries for each or want to test the EA on different brokers.

Using Leverage Responsibly

While the Royal GER30 EA performs well with what I would consider a higher leverage, it’s essential to use leverage responsibly. I used 1:100 leverage from my broker. This is my preferred leverage level because it allows me to place trades without using too much of my margin. Higher leverage can amplify both profits and losses, so while the EA performed well and I might feel tempted to increase leverage and profits, I also risk facing bigger losses if trades go against me.

Final Thoughts: Is the Royal GER30 DAX Trading Strategy Worth It?

The Royal GER30 EA is certainly worth looking at as an additional trading tool in your portfolio. It’s consistent performance and low drawdown to date, as well as a fair amount of customizable settings including risk management features, makes it a strong contender in the niche of algorithmic indices CFD trading. Whether you’re new to trading or have years of experience, this free EA is easy to download, install and set up and offers many attractive features.

In my account, the EA delivered 10 consecutive wins and nearly doubled my account in two weeks. For the reasons I mentioned above, I believe it’s an excellent tool for traders who are looking for steady, reliable growth. Personally, I’ll keep it on my live account and I’m looking forward to seeing how it performs there, while testing it with different settings on several more demo accounts. I’m always looking for new EAs to trade Indices, and I hope I can find more with this kind of performance.

If you’re interested in automating your DAX trading, I recommend giving the Royal GER30 EA a try. Start with a demo account, adjust the settings to suit your risk profile, and once you’re comfortable, transition to live trading. But remember, trading conditions can differ between demo and live trading accounts, so don’t jump in with both feet. Rather, find settings that you’re comfortable with in your demo account and replicate these in your live account, but with smaller entries until you see if the performance matches your demo account.

As always, I wish you safe and profitable trading and I’ll see you in the next post.