Candle Color Strategy

Dear traders, Candle Color Strategy is the 4th strategy that I will be teaching you. This is one of my favorites trading strategies because it is very easy to follow. And it’s more of a price action trading because the entry rule is not based on an Indicator in MetaTrader, but it is when we have such consecutive candles going down or going up. So when we have bullish or bearish candles formation. And I will explain that in a while.

So let me open one more chart window for the Bitcoin. It will be on H1. I will change the template on black background. Here it is.

So the rule that we have in this candle color strategy is to Buy when we see 4 consecutive candles formed in one direction, I guess this is easier for me to explain.

Or in other words, if we see 4 consecutive bullish candles, 4 consecutive bars, or 4 consecutive candlesticks that are with the same color on the 5th one, we open the trade.

This is a bullish example. I will put quickly 1 horizontal line and 1 vertical line. Let’s make the horizontal lime because this is a Buy trade. It’s all right. Here, we Buy 1, 2, 3, 4, and on the 5th one, we Buy.

So that’s not really an Indicator. But we are just looking for 4 candlesticks with the same color to Buy, 4 candlesticks or bars with the opposite color to Sell with this candle color strategy.

The 4 Candlestick Values

The black bodies are the positive ones and the white ones are the negative candlesticks. And we have 1 condition. We need to see a minimum body height of 50 pips. So for the beginners, one more time.

The body of the candle is the distance between the closing and the opening. We have 4 values. If I put the mouse on any of the candlesticks, we have 4 values open, high, low, and close.

We have the open of the candle. The price goes up and down.

We have the lowest point that it reached, the highest point, and here is the closing.

So with the bullish candles, the body height is the close price minus the open price. For the bearish, this candle, for example, is the opposite thing. We have the open price minus the close price.

So the condition here is that we need to see minimum 50 pips of body height. And now, I don’t want to make you confused about pips and USD here with the Bitcoin for Pepperstone, for example, we have 2 digits after the decimal comma.

So these are the pips.

The Moving Averages

And if I say 50, then it would be 50 cents. So if we have 3 digits, then we have pips and point. But if we have just 2, this is pips or in other words, to make it very simple, we need to see 4 consecutive candlesticks and the body of each one must be minimum 50 cents of the price of the Bitcoin.

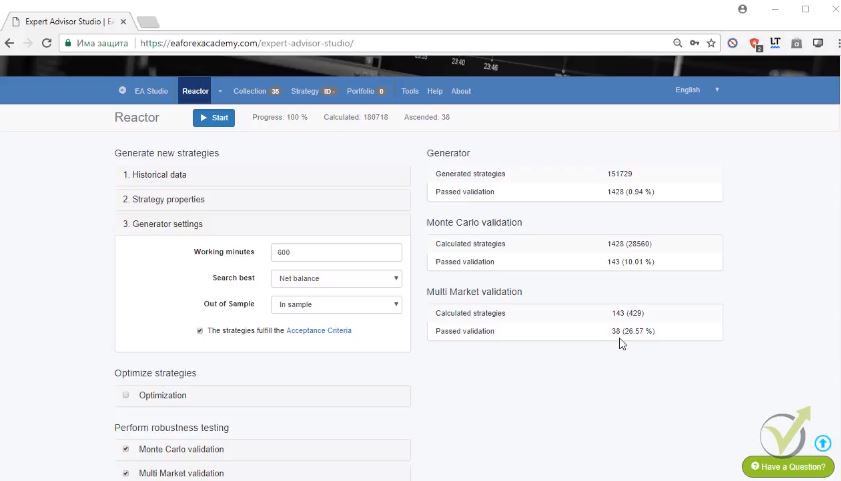

So in this example, the small candle that we have has a close of 10367.01 and it has an open of 10361.51, so it’s much more than 50 pips in this case. So we Buy and then what we have as an exit condition. We have 2 Moving Averages.

I will add them to the chart. From the Insert menu in MetaTrader select Indicators, then Trends, and click on Moving Average.

The 1st Moving Average is with period of 15. I will make it red.

And the 2nd one that I will add to the chart, this is a Moving Average with period of 45 and let me make it blue, for example. I click on OK and here it is.

So when the fast Moving Average or this is the 15-period Moving Average crosses the slow Moving Average in this case, this is the 45 downwards, we exit the trade. And let’s see where this happens, it happens right over here.

OK, I will put quickly 1 vertical line and 1 horizontal line.

Take Profit and Stop Loss

So the exit is again on the next bar. We have the cross and it is confirmed on the opening of the next one. We have 4 consecutive bullish candles with a minimum body height of 50 pips.

And then the price goes up, up, up, up, and then a little bit down. And then when the fast Moving Average crosses the slow Moving Average downwards, we Take the Profit. In this case, it is a profit of 329 or something like that, above 300 USD of a profit.

But again we have Stop Loss and Take Profit. The Take Profit is 240 USD. So first we will have the Take Profit hit I guess somewhere in this candle 240 USD above the open price. So it’s 10505 plus 240. That will be 10745. Actually it’s a little bit earlier, 45.

I guess it will be hit with that candle. Exactly 45. So we have the Take Profit a little bit earlier and then we have a Stop Loss below of 215 USD Stop Loss. This is a great example of this candle color strategy. Now, right here, we see the opposite example. 1, 2, 3, 4, on the opening of the 5th one, we have a Sell trade.

Candle Color Strategy With a Few Indicators

For sure, these candlesticks, they have over 50 pips or as we said, for the Bitcoin, this is 50 cents. We Sell on the opening of the 5th candlestick. And here again, we will have the Take Profit hit because the price is 10688 minus 240 USD of a Take Profit.

That would be 10488, we Sell and then we Take the Profit. So one more time. This is one of my favorite strategy because the chart is very simple and you really don’t need to have a lot of Indicators over it. All you need to look for is 4 consecutive candlesticks with the same color.

And then on the 5th one, you open the trade. And again, I will attach the PDF with a description of the strategy, very simple Candle Color.

And we have bullish candle formed to Buy and bearish candle formed to Sell 4 consecutive candles and minimum body height of 50 pips.

And we have the exit Indicator, which is the Moving Average cross.

Thanks for reading this lecture. I wish you always have a great day.