Bitcoin bot is the only profitable way to approach Bitcoin trading in 2020

Bitcoin bot is a top choice of many traders, and of course, there are many questions. Hello traders! This is Petko Aleksadnro, a trader that uses Bitcoin bot trading system and today I will share with you the secrets behind Bitcoin trading, and why it is better to trade with a Bitcoin bot.

During the years I have created many bots, hundreds of them and in my online courses I attach many. The one that is most attractive and the people love trading with it is the Bitcoin bot that I include in the course Bitcoin Trading Robot – Cryptocurrency Never Losing Formula.

There are many detailed I want you to bare in mind before trading with a Bitcoin bot. And today I will make the things clearer for you.

The cryptocurrency never losing formula combined with the Bitcoinbot

The formula is a mathematical equasion that I have calculated for the Bitcoin bot trading. As you know, every Robot has Stop Loss and Take Profit. Well, I do not like the Stop Loss. Because it is a loss. So using the Formula you will learn how to exit the losing trades with 0 losses.

The never losing formula can be used with any cryptocurrency. I have another course about Ethereum. There I explain the formula even in more detail. I can say because it’s focused more on beginner traders. But it’s a similar course called “Cryptocurrency never losing formula – Ethereum trading robot course.”

So yes, it is suitable for the Ethereum. Just if you’re trading a cryptocurrency with a smaller price, lower price, and you should look at the daily volatility. So you should place realistic Take Profit and make sure always when you place the Take Profit to be practical. Because we always want the take profit to be hit first and not to get into the formula.

How much money do you need to trade with the Bitcoin bot?

Please do not take any of the information below as piece of finencial advice. We do our bes to create useful content, share with you trading robots as this Bitcoin Bot, but it is a personal choice how you will be trading and investing.

This is one of the most common questions I can say that I get for all of the courses. And I avoid suggesting started capital. It’s up to you with how much you want to start. What I would suggest you do is to open a demo with the same amount of money that you are planning to trade on the live account. And see if you will be able to manage your trading with this capital.

Now, having the Never Losing Formula, of course, there is a risk that we will buy and sell many times to get out of the wrong trade. That’s why you need capital. And you’ll need to start trading with a small volume and to have averaged a big account as I can say. So you can handle big positions if it happens. So open the demo account, see how much you will feel comfortable trading.

If I have to give an answer to the questions, I would say nothing less than $10 000. That is a Bitcoin bot, and it requires capital.

Using Bitcoin trading bot for long and short?”

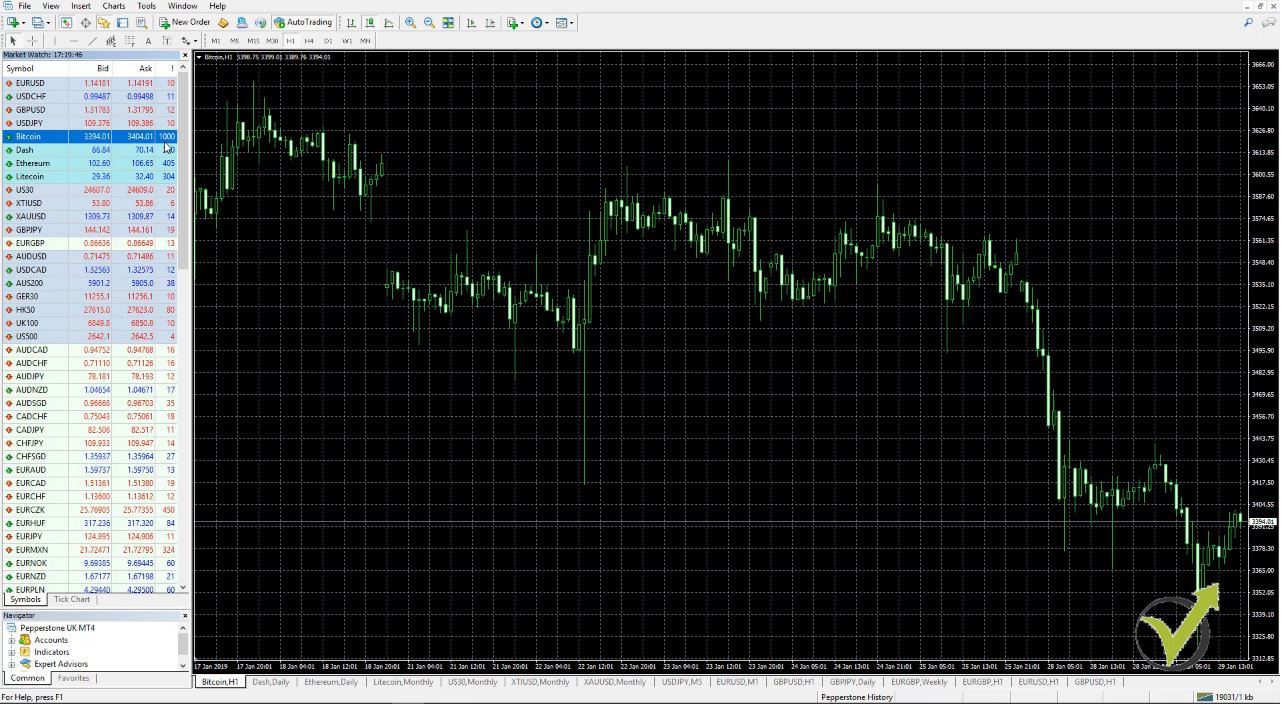

Yes, I already have recorded many examples for the short market. Because in 2018 the market for the bitcoin got very negative:

So I have recorded examples for the short market. We switch between only long and only short in de inputs of the Bitcoin bot. And you can use it in both directions.

Bitcoin bot works only if you have interent

Now, this is for all Expert Advisors on MetaTrader. You need to be connected to the server of your broker. This means you need to be connected to the Internet. You can not switch off your computer and leave it and expect that the Robot will work.

Because obviously, it needs to be connected to the Internet. So this way, you will be connected to the server of the broker and the bot will be able this way to place trades. Anyway, if you switch it off, you can not do it. So:

What might be the reason that your Bitcoin bot trading does not open trades?

- not connected to the brokers’ server

- auto-trading is not enabled

- internet connection is interrupted

- the broker does not allow algo trading

The spread and swap are important when trading the Bitcoin

Now the spread I can say is into the Never Losing Foruma formula because we are always buying on the asking price, and we are selling on the bid price. So you understand that this difference between the bid and the ask price is the spread. And when we buy the first time, for example, and the ask price and we go in the other direction, and we sell on the bid price — obviously, this way we pay the spread. So the spread is into the formula.

Now the swap is not into the formula with a precise number or any percentage. Because it’s hard to calculate it, and I will tell you why. What we don’t know is how long the trade will last. We never know that. It could take the Take Profit within the same day. It can reach it basically after a couple of days. You can stay in the formula longer time. So we don’t know what swap finally will be paid to the broker.

That’s why I can not put it to a hundred percent into the formula. But this is why I leave a little bit extra when we are out of the formula. A little bit of a positive. Which usually covers the swap, except, of course, if your broker has this massive swaps that most of the scam brokers have. We can not handle it, and it will be tough for you to use the never losing formula with such a broker.

The Bitcoin bot trading strategy is not hedging.

The bitcoin bot that I use is not hadging. If it opens a buy trade, it will ahve to close it before opening a second trade.

But if you combine it with the Forumla then it is considered as hedging because we are buying on one side, and we are selling on the other side. This is the formula. Now if you are a US citizen because I get this question most of the time from the US citizens. Because probably you know that in the US, it is forbidden to hedge.

There is the FIFO rule, which stands for the first one in the first one out, meaning that if you open trade with one asset, you need to exit this early trade before exiting the second trade that you opened.

Now because the formula at the end exits all the trade, it is considered as hedging and most of the brokers will not allow it, but in the US as far as I know, from many students I have there, there are brokers already who allow hedging with different lot size.

So you can buy for example 1 lot and sell 1.4 and then buy a different lot. And this is precisely what the formula is, right? And one of the regulated brokers there allows hedging, which means it can be used by anyone.

If this is your case, the only thing you need to change is the first three lots. So we go with one lot, and then we sell 1.4. And then we should buy 1.01, for example. To make it a little bit different from the first entry and then the second sell should be 1.01, for example.

So again, you will have a small difference from the first sell. And I’m talking in a situation when we are going to buy it. So this

way you will have every order with a different lot. And as I said, there are already brokers in the US who allow this.

The Bitcoin bot works on MetaTrader 4 and MetaTrader 5

Yes! I attached the Bitcoin bot for MetaTrader 4 and MetaTrader 5, so it’s up to you which one you want to use. Now keep in mind as well that most of the MetaTrader 5 brokers don’t allow hedging.

Is there hedging whrn I use the Bitcoin bot?

- the bot itself opens only one position in time, so no hedging with it

- the hedging appears if you use the nEver Losing Formula

- For the US it is not a problem if you use different lots in the formula

The backtesting with the bot might show a loss

The backtesting could show a loss for many reasons. Number one is the spread, especially with the Bitcoin. The brokers offer so many different variations of spread and taxes that I have seen. Especially in 2018, there were brokers with spreads above one hundred, two hundred, three hundred dollars. Now you can see the spread is back to normal with ten dollars with most of the brokers. Which makes the trading much easier for the system:

The other reason that you might see bad backtesting with the bot is the historical data of your broker. Basically, we do backtesting over the past chart. The information that we get from the candlesticks. This is the opening, the closing, the high and the low of each candlestick or of each bar.

If your broker does not have good historical data that might affect the backtest. And you will be surprised if you perform backtesting with different brokers for one and the same Bitcoin trading bot what a difference you will see. It is a huge difference just because one more time, the brokers provide different historical data.

9. “Can I use the never losing formula from the Bitcoin bot trading course to Forex?”

The never losing formula can be used with any asset. The question is, we’re looking for volatile assets as the cryptocurrency. Because we don’t want to stay a long time into the formula. In Forex, sometimes the market remains a long time into a range. I’m testing it. I want to see really what are the best parameters for Forex.

And once I have like a clear solution to that, I will launch a course about it. And I will demonstrate how it should work on Forex, but I always want to test it a lot before sharing it with other people.

Managing the Never Losing formula daily and combining it with the Bitcoin bot

Now it depends on your free time when you’re trading. Are you working, do you have access to your account on your work, are you able to get up during the night to watch the trades. Because this is part of

the never losing formula.

Personally me, this is my job. I’m staying in front of the computer for more than 12 hours daily. I can tell you honestly. So I’m monitoring all the time. And many times I wake up during the night. Especially when I’m using the never losing formula, and I’m into the trade. Now the more often you look at it, the better.

Because if you look at it every two-three hours, you might miss a trade. You might miss the entry. And then really the solution is hard. You need to recalculate the whole formula to get out of it. So basically, you need to recalculate the levels according to what you have missed. And probably this will make your range bigger. Which actually will cause you more difficulties.

That’s why if you miss a trade with the never losing formula, it’s not very good.

You need to recalculate the formula, or you need to take the loss. Or wait to see the price at the same level that you missed. So it’s not good to look at the formula every two-three hours.

Guys to make it clear here, you should use the never losing formula if you’re able to do it. If you have the time if you can look at your chart every thirty minute or one hour or let’s say you’re able to wake up during the night if you are into the trade. So one more time, use the formula if you’re ready to use de formula.

To spend time on it. If not, there are so many algorithmic trading systems. I have many courses now about fully Algorithmic Trading where you don’t need to touch anything over the chart.

These were the ten most important aspects when trading my Bitcoin bot

If you have any others, don’t hesitate to ask me. Look at the Trading Forum that we have in EA Forex Academy. You will find answers to so many questions there. There are already many experienced traders who share their experience. And of course, you’re very welcome to drop your question into the forum. I will answer you within 12 hours. Many people have experienced it already, and they will answer you as well.

If you want to optimize the Bitcoin bot, you can use the EA Studio strategy builder.

I always wish you to enjoy the trading! Cheers!