Trading has evolved dramatically with the advent of Expert Advisors (EAs). These automated trading systems allow traders to execute trades seamlessly without constant monitoring. Whether you are looking for the best EA for MT5, the best expert advisor for MT4, or the overall best expert advisor, this guide provides insights into identifying, utilizing, and maximizing the potential of these trading systems.

Table of Contents:

What Are Expert Advisors

Expert Advisors are automated trading systems (trading robots) designed to execute trades based on predefined entry and exit rules. Therefore, you can follow the trading strategies even without steering in front of the screen. Installed on MetaTrader platforms, EAs enable traders to automate their trading processes, removing emotional biases and ensuring consistent strategy execution.

Key Benefits of Using EAs:

- Round the Clock Trading: Operate continuously during market hours: 24-hours a day, 5 days a week.

- Emotion-Free Trading: Decisions are purely data-driven.

- Backtesting Capabilities: Evaluate performance using historical data.

- Multi-Strategy Execution: Simultaneously manage several trading strategies.

- Diversification: Reduce reliance on single strategies by trading multiple EAs.

EAs are indispensable for traders seeking efficiency and diversification. They minimize human error, enable multi-asset trading, and allow traders to focus on strategy optimization rather than execution. Due to that, the quest to find the best expert advisor becomes a crucial step in maintaining sustainable performance across diverse market conditions.

How to Identify the Best Expert Advisor

Critical Factors to Consider when Looking for the Best Expert Advisor

The “best” EA varies depending on individual needs, but here are critical factors to consider:

1. Platform Compatibility

- MT4 vs. MT5: MetaTrader 4 (MT4) remains a favorite due to its simplicity, extensive user base, and compatibility with numerous third-party tools. However, MetaTrader 5 (MT5) offers more advanced features, such as multi-asset trading, integrated economic calendars, and a more sophisticated backtesting environment with multi-threaded processing. Traders should select an EA compatible with their chosen platform while considering the additional benefits MT5 provides, especially for advanced strategies and portfolio diversification.

- Ease of Integration: Verify whether the EA integrates smoothly with the platform’s architecture, ensuring seamless execution without errors.

- Future-Proofing: As MT5 gains more adoption, investing in EAs compatible with this platform might ensure long-term usability.

2. Performance Metrics

- Profitability: Assess historical performance records to ensure the EA has consistently generated gains over different market conditions. Profitability should not rely solely on short-term trends but demonstrate robustness over extended periods.

- Drawdown: This metric measures the peak-to-trough decline in an account balance. Lower drawdowns are indicative of safer EAs that manage risks effectively, ensuring capital preservation during volatile market conditions.

- Risk-Reward Ratio: Evaluate the EA’s ability to balance potential rewards against risks. A favorable ratio—where expected gains outweigh potential losses—is critical for long-term success.

- Sharpe Ratio: This advanced metric measures risk-adjusted returns, providing insights into the EA’s overall efficiency.

3. Customization Options

- Parameter Adjustments: Look for EAs that allow users to fine-tune key settings such as lot size, stop-loss levels, take-profit targets, and trading timeframes. This flexibility ensures that the EA can align with individual trading styles and risk appetites.

- Market-Specific Tuning: Some EAs are optimized for specific currency pairs or assets. Customization options should accommodate adjustments for different markets or conditions.

- Scalability: An EA with scalable parameters allows traders to adjust their strategies as their account size or market exposure grows.

4. Transparency

- Accessible Performance Data: Ensure the EA provider shares detailed performance reports, including historical trade data, win rates, and profitability metrics. Avoid EAs that make unverifiable claims.

- Trading Logic Disclosure: While full algorithm disclosure is rare, credible EAs often provide a high-level explanation of their logic and strategy, allowing users to understand how decisions are made.

- Risk Metrics: Look for transparency in how the EA manages risk, including stop-loss placements, maximum drawdown limits, and trade frequency.

By focusing on these factors, traders can avoid scams and untested promises commonly associated with low-quality EAs. A diligent evaluation process ensures that the chosen EA not only meets technical requirements but also aligns with the trader’s goals and risk tolerance.

Also, the “best” Expert Advisor is not determined solely by market promises but by rigorous testing and performance validation. In our course, Automated Forex trading + 99 Expert Advisors, we demonstrate a systematic approach to identify top-performing EAs.

Key Steps to Finding the Best Expert Advisor from a Portfolio of 99 EAs:

1. Leverage Comprehensive Testing

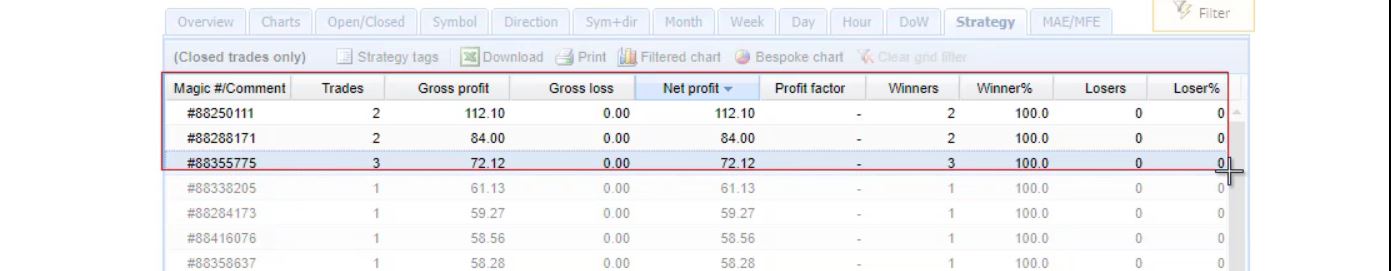

Begin by deploying all 99 EAs on a demo account. Using platforms like FX Blue, analyze key metrics including profitability, drawdown, and risk-adjusted returns. This ensures that the top-performing EAs are not based on assumptions but actual statistics.

2. Consistently Monitor Performance

Monitor EA results multiple times weekly. Typically, this involves reviewing performance on Mondays, Wednesdays, and Fridays or over the weekend. Regular updates ensure the portfolio adapts to market dynamics.

3. Separate and Optimize Top Performers

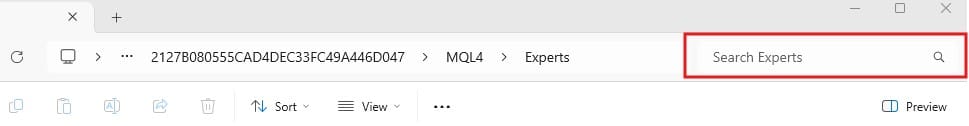

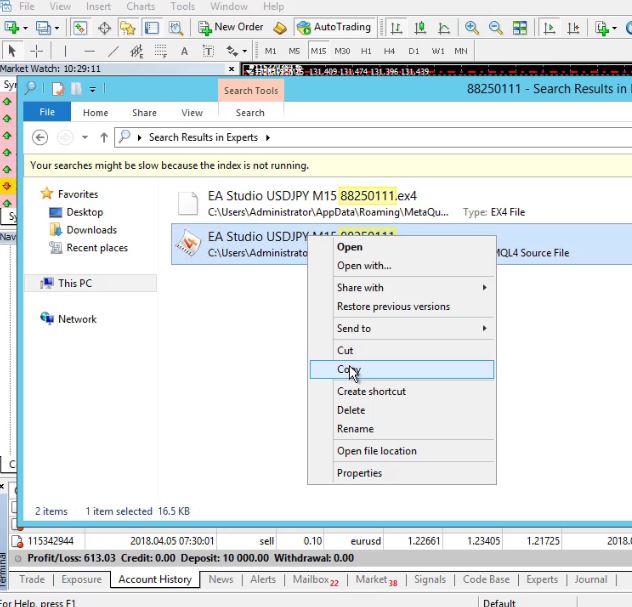

Use their unique identifiers (magic numbers) to isolate the top-performing EAs. In order to do that, open the Meta Trader, then go to File, Open Data Folder and then click on MQL4. Then go to the location of the Expert Advisors and inside “Search Experts” insert the magic number of each of the Top 3 EAs from FX Blue. A good practice is to make screenshot of the top expert advisors, so then it would be easier to search for them.

Then consolidate these EAs into a dedicated folder for focused deployment. To do that, you can create one folder within the “Experts” folder and name it for example “Top 3 Expert Advisors Forex” or “Top 3 EAs”. Then just copy the best expert advisor that you have identified or the several that you want to trade and paste them in the newly created folder.

4. Deploy on New Demo Accounts

Before trading live, test these top-performing EAs on a separate demo account. This stage minimizes risk and builds familiarity with their trading mechanics.

5. Maintain and Update Regularly

Keep the top-performing EAs active and replace them as necessary based on updated statistics. For instance, when one EA’s performance declines, replace it with a newly identified top performer from the original pool of 99 EAs.

By adhering to this method, as taught in our course, traders can systematically identify and utilize the most profitable EAs for MT4 and MT5, avoiding the pitfalls of relying on unverified market promises.

Deepen your understanding and jumpstart your journey in algorithmic trading, by enrolling in our 21-Day Free Algo Trading Course. This comprehensive program is designed to equip you with the skills to effectively use EAs and develop your strategies. Learn more and sign up today at eatradingacademy.com/algo-program or click the button below.

Strategies to Enhance EA Performance

1. Diversify with Multiple EAs

Combining several EAs can hedge risks and improve profitability. For instance, using different EAs for EURUSD, Bitcoin, and S&P 500 ensures that performance remains balanced across varying market conditions. Here’s a step-by-step approach:

- Choose Complementary EAs: Mix strategies—trend-following, scalping, and mean reversion.

- Equal Exposure: Balance trading volume across assets for consistent risk.

2. Test on Demo Accounts

Before deploying EAs on live accounts:

- Test their performance on demo accounts with simulated capital.

- Regularly analyze performance to identify top performers.

3. Regular Monitoring and Updates

- Replace underperforming EAs promptly.

- Update EAs monthly to leverage the latest market data.

4. Optimize Settings

Adjusting EA settings like lot size, stop loss, and take profit ensures alignment with market conditions and trading goals. Regular optimization helps maintain profitability.

The Best Expert Advisor Strategy: Trade with 5 EAs Simultaneously

Trading with multiple EAs offers an advanced approach to creating a robust and diversified trading strategy. Instead of relying on a single algorithm, multiple EAs enable you to hedge risks and capitalize on opportunities across various markets. For instance, implementing five EAs for EURUSD, Bitcoin, and S&P 500 markets helps mitigate risks inherent in any single market condition. By spreading exposure, you ensure your portfolio adapts to diverse trading environments, reducing dependency on one strategy or asset class.

Benefits of Multi-EA Trading:

- Diversify Risk: Utilizing multiple EAs lowers the overall portfolio risk by balancing losses in one market with gains in another. This approach ensures stable performance even during volatile periods.

- Capture Opportunities: Each EA is designed to respond to specific market conditions, allowing you to optimize gains across various scenarios, such as trend-following in EURUSD or volatility-driven trades in Bitcoin.

- Enhance Flexibility: With multiple EAs, you can employ diverse strategies—such as scalping, trend-following, and mean reversion—simultaneously.

Steps to Execute Multi-EA Strategies:

- Install EAs Across Markets: Set up each EA on its respective chart and assign appropriate timeframes.

- Activate AutoTrading: Enable AutoTrading to allow EAs to execute trades without manual intervention.

- Monitor and Balance Exposure: Regularly review performance metrics to ensure risk is evenly distributed across assets and markets.

Through this systematic approach, traders can leverage the combined strengths of multiple EAs, achieving consistent returns while mitigating market-specific risks.

The Importance of Backtesting and Forward Testing

Backtesting and forward testing are integral to validating an EA’s reliability and profitability. Each testing phase provides unique insights into the EA’s performance and suitability for live trading.

Backtesting:

Backtesting involves using historical market data to simulate an EA’s trades. This process assesses whether the strategy performs well under past conditions, providing insights into:

- Viability: Does the EA produce consistent results across different periods?

- Optimization: Parameter tuning helps identify the most effective settings for risk and reward management.

- Robustness: Evaluating performance under varying market scenarios ensures the EA’s adaptability.

Forward Testing:

Forward testing places the EA in real-time conditions on a demo account. Unlike backtesting, this method provides a realistic assessment of the EA’s behavior in live environments. Key aspects include:

- Execution Accuracy: Ensure trades align with expectations.

- Market Adaptation: Monitor the EA’s ability to respond to live market fluctuations.

- Consistency: Track profitability and risk metrics over time.

Metrics to Evaluate:

- Win Rate: The percentage of trades that close profitably.

- Profit Factor: The ratio of gross profits to gross losses, indicating overall efficiency.

- Maximum Drawdown: The largest observed loss from peak to trough in the account balance, a critical measure of risk.

Combining backtesting and forward testing ensures you deploy EAs with proven performance and reliability, reducing the likelihood of unexpected outcomes in live trading.

Advanced Tips for Success with EAs

Achieving consistent success with EAs requires leveraging advanced tools, avoiding common pitfalls, and maintaining a disciplined approach. Below are actionable tips for optimizing EA performance:

Utilize VPS Hosting

A Virtual Private Server (VPS) ensures uninterrupted trading by hosting your MetaTrader platform on a stable and secure server. This setup minimizes latency, prevents downtime, and allows EAs to operate seamlessly, even during power outages or network issues.

Avoid Over-Optimization

Over-optimization occurs when an EA is excessively fine-tuned to historical data, often leading to poor real-world performance. Instead:

- Focus on broader parameter ranges to enhance robustness.

- Test settings across diverse market conditions to avoid curve fitting.

Leverage MT5’s Advanced Features

MetaTrader 5 offers superior tools that can significantly improve EA deployment:

- Multi-Threaded Backtesting: Reduces the time required to analyze strategy performance.

- Depth of Market (DOM): Provides insights into market liquidity, improving trade entries and exits.

Participate in Trading Challenges

Many brokers and trading platforms host challenges where traders aim to achieve specific goals, such as a 10% profit with a maximum drawdown of 5%. EAs are particularly effective in these scenarios due to their precision and consistency. By meeting these criteria, you can refine your trading skills and gain recognition.

By integrating these advanced strategies, traders can maximize their EAs’ potential, ensuring both short-term profitability and long-term sustainability.

Conclusion

The journey to finding the best expert advisor requires diligence, testing, and consistent monitoring. By following this guide, you’ll be well-equipped to select and optimize EAs tailored to your trading goals. Remember, success with EAs is a continuous process of evaluation and adaptation.

Explore your options today and embrace the power of automated trading to achieve consistent results in the forex market. Whether you’re aiming for the best EA for MT5, the best expert advisor for MT4, or a diversified portfolio, the right tools and strategies will set you on the path to success.