Best Day Trader Indicator: Simple Strategy for Profitable Forex Trading

If you’re interested in trading on the Forex market, you’re probably looking for the best indicators to help you make profitable trades. In this blog post, we’ll explore the best day trader indicator that you can use, along with three other indicators that work well for me. You’ll learn how each of these indicators works and get example strategies to use in your own trading. Plus, we’ll even throw in a bonus at the end. So, let’s get started!

One of Best Day Trader Indicators is the Moving Average Indicator

The first and best day trader indicator is the Moving Average. It’s a simple tool that can be very profitable when used correctly. A simple Moving Average with a period of 9 represents the average price for the last 9 bars. If the current bar is above the 9 Moving Average, it means that the current price is higher than the average price for the last 9 bars.

Strategy Example

To use the Moving Average in your trading strategy, you can open a long trade whenever the price crosses the 9 Moving Average upwards. In other words, you need to see one bar that opens above Moving Average after opening below it. You can visualize this on a chart by looking for one bar below the red Moving Average and then another bar that opens above the Moving Average. This is a clear confirmation that the price has crossed the Moving Average.

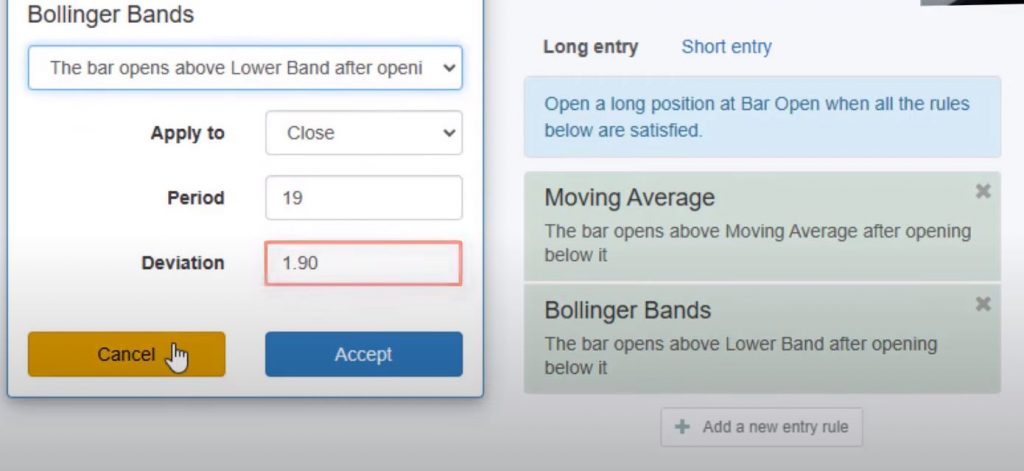

Another Great Day Tradeing Indicator: Bollinger Bands Indicator

The second best day trader indicator is the Bollinger Bands. They provide a confirmation to the Moving Average. The rule that the bar opens above the lower band after opening below it with a period of 19 and deviation of 1.9. Combining the Bollinger Bands with the Moving Average works great because you’ll be buying only when the price is at the lower band of the Bollinger Bands. The opposite applies for a short trade.

Strategy Example

To use the Bollinger Bands in your trading strategy, you can look for a bar that opens below the upper band, after opening above it. With a period of 41 and deviation of 40, you’ll exit your trade if you see a bar that opens below the upper band.

Any Day Trader Indicator will bring you Profit and Loss

It’s important to remember that every strategy has losses, but the key is to have more profits than losses. The strategies shown in this blog post have a Profit Factor higher than 1.1.In other words, more profits than losses. You’ll see an example of a profitable trade in the first strategy. It has a Take Profit of 90 Pips and a Stop Loss of 35 Pips. The result is a good risk reward ratio.

Bonus Tip

As a bonus tip, we recommend using Envelopes as an exit condition. If you see a bar that opens below the upper band, after opening above it, you’ll exit your trade. This can be helpful in avoiding losses and maximizing profits.

Best Day Trader Indicator is when we combine two: Moving Average and Bollinger Bands

The Moving Average and Bollinger Bands are two powerful indicators that work together to identify entry and exit points. The Moving Average helps traders identify trends, while the Bollinger Bands help traders identify volatility. When these two indicators are used together, traders can make more informed decisions about when to buy and sell.

To use this strategy, look for a short trade where the price has moved below the Bollinger Bands and the Moving Average. When the price starts to rise again, it’s time to exit the trade. For a long trade, look for a situation where the price has moved above the Bollinger Bands and the Moving Average. When the price starts to fall, it’s time to exit the trade.

This strategy has been proven to work. It has an average profit of $21 per day and a net profit of over $23,000. This is for the last 3 years.

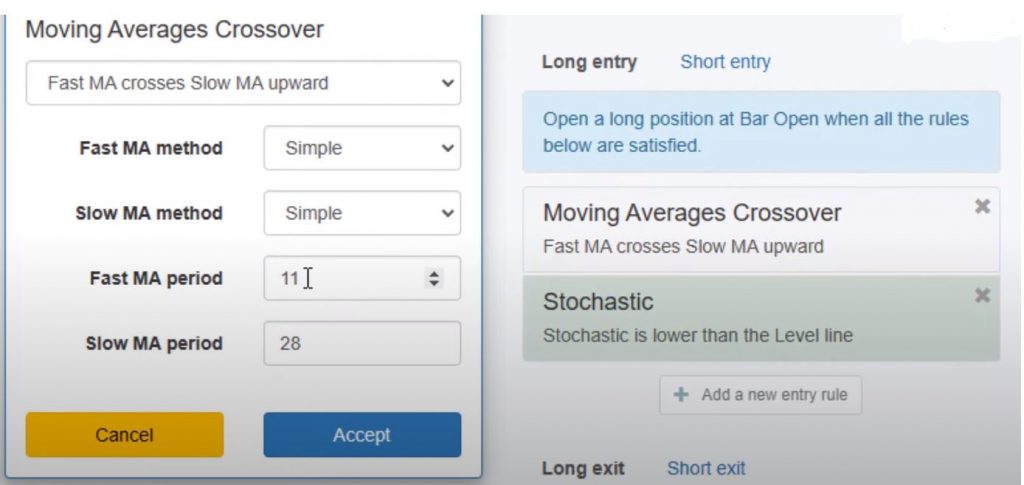

Moving Average Crossover

The Moving Average Crossover is another powerful indicator that can help traders make profitable trades. This indicator uses two moving averages with different periods that cross each other to identify trends. When the fast Moving Average crosses the slow Moving Average upwards, it’s time to enter a long trade.

Day Trader Indicator Number 4 is Stochastic

The Stochastic indicator is a popular momentum indicator that can be used to identify overbought or oversold conditions in the market. To use this indicator, look for a long entry when the Stochastic is below the level line. Set a stop loss of 61 pips and take profit of 53 pips. Don’t be afraid to trade with a risk-reward ratio below 1. The closer the take profit to the entry price, the bigger chance you have of hitting it before the stop loss.

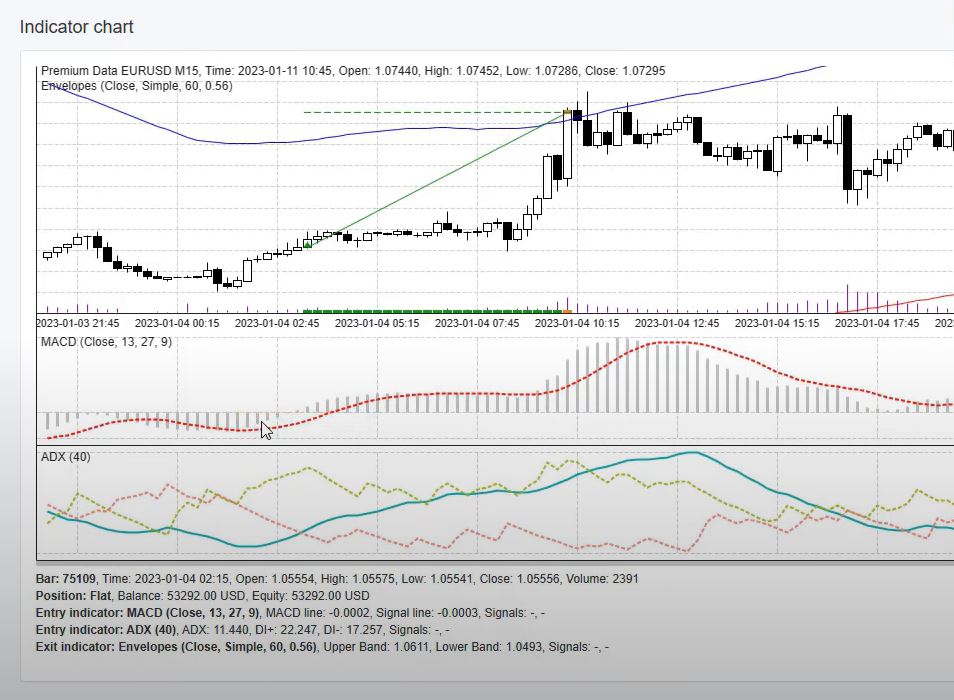

Envelopes

Envelopes are a set of lines placed above and below the price to form a channel. In this strategy, we use envelopes as exit indicators. If the bar opens above the upper band with a period of 20 and deviation of 0.5, or below the lower band after opening above it, we should close the trade.

Number 5 is MACD

MACD stands for Moving Average Convergence Divergence. It is displayed with a MACD line and a signal line, and the bars around the 0 line are the difference between the MACD and the signal line. Use the MACD strategy to see even bigger profits. Look for the MACD line to cross the 0 line upwards, but only if the ADX rises. Set a take profit of $64 and stop loss of $100 plus envelopes.

And here is the Best Day Trader Indicator: Forex Profit Supreme Meter

Forex Profit Supreme Meter is a strength indicator that shows the strength and weakness of different currencies in real-time. This way, it is easy to select the best pair to trade, long or short. For example, if the Euro has a strength above 7 and the Swiss has a strength below 2, it is logical to open a long Euro-Swiss trade.

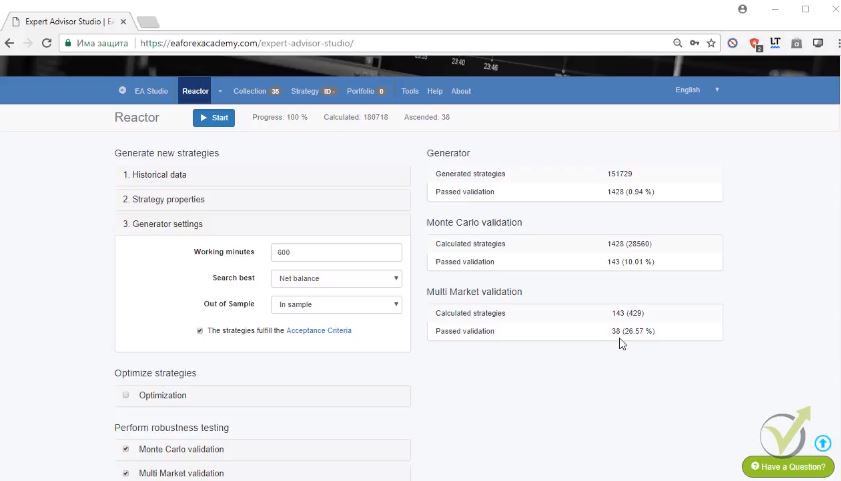

Bonus: Three Robots for Strategies

As a bonus, we will give you three robots for the strategies we demonstrated. Use the MA, MA Crossover, or MACD indicator with robots on MetaTrader to test them out.

Best Day Trader Indicator Final Thoughts

Finding the right day trader indicator can be a game-changer for your trading profits. The Stochastic, Envelopes, MACD, and Forex Profit Supreme Meter are some of the best indicators you can use to make informed trading decisions. Remember to always use stop loss and take profit orders to minimize your losses and maximize your gains. Happy trading!