Introduction

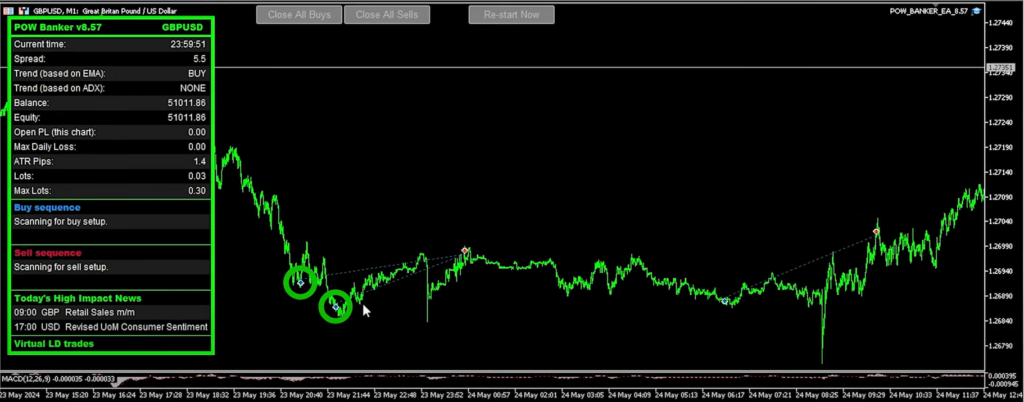

Discovering a reliable trend-following trading system can make a significant difference. I’ve been testing the Banker EA on a demo account for a few months now, and the results have been impressive. In this post, I’ll share how it performs, its features, and my personal experience with it.

Trading in the Forex market can feel overwhelming, especially for beginners, but the right tools can simplify things. This review will help you decide if the Banker EA is the right choice for your trading needs.

Banker EA Review: Introducing the Banker EA

The Banker EA is a trend-following trading system that one of our traders found, and based on its unique approach, decided we should test in the Academy.

Following trends is normally a manual system that usually requires a fair amount of technical skills and knowledge. The Banker EA simplifies this process by automating the trading based on market trends. I started testing the robot on a demo account on April 4th, and the first trade was executed on April 9th. Throughout this period, the system has shown many profitable trades.

Profits and Performance

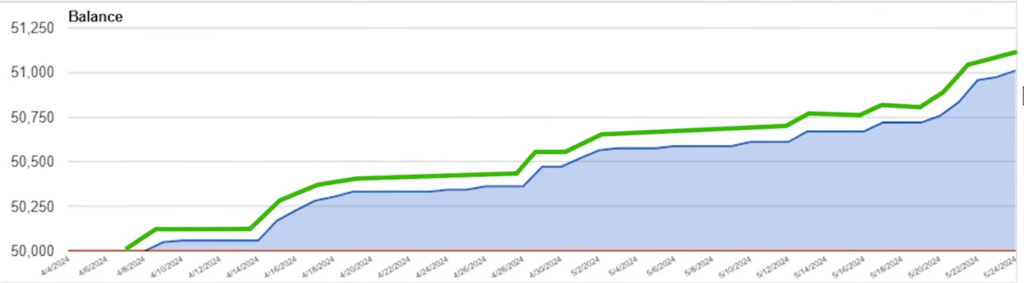

Since I began testing the Banker EA, the total profit from closed trades has been $1,011.86. By the time you read this, it could be more or less. While there have been a few losses, most trades have been profitable. Testing new expert advisors on demo accounts is vital to avoid risking real capital initially, giving you time to understand how it works. This approach helps you see if the robot is suitable for live trading or challenges. The consistent profitability the Banker EA has shown during the testing period highlights its potential as a valuable trading tool.

Banker EA Review: How Banker EA Trades

The Banker EA employs a unique trading strategy. As I analyzed the charts, it became evident that the system uses a recovery mechanism. For instance, if a long trade is opened and then the price moves against it, the system opens additional trades. This approach helps the EA recover from losing positions and maintain steady profits. The method of opening new trades in response to adverse price movements is a key feature of the Banker EA’s strategy.

Recovery System in Action

One distinctive aspect of the Banker EA is its use of decreasing lot sizes, contrary to the typical Grid Martingale systems. For example, the first trade might be opened with 0.09 lots, the second with 0.15 lots, and subsequent trades with smaller lot sizes like 0.03. This strategy allows the robot to follow trends effectively while minimizing risk. The recovery system kicks in when the price goes against the initial trade, opening new trades with adjusted lot sizes to balance the overall position.

Banker EA Review: Lot Size Strategy

The Banker EA’s lot size strategy is designed to manage risk while following market trends. By decreasing lot sizes after an initial increase, the system reduces the potential impact of losing trades on the overall account balance. This approach contrasts with the traditional Martingale strategy, which increases lot sizes and can lead to significant losses if the market continues to move against the trader. The lot size adjustments help improve the average price without risking the account.

Risks of Banker EA

While the Banker EA has shown promising results, it is essential to understand the associated risks. The system primarily opens long trades and uses a buy setup based on the exponential moving average trend. During testing, I noticed that the expert advisor is effective in an upward-trending market. However, it is crucial to be aware of potential drawdowns and market conditions that may affect its performance. Understanding these risks helps in making informed decisions about using the EA in different market conditions.

Banker EA Review: Analyzing Performance on FXBlue

To provide a clearer picture of the Banker EA’s performance, I analyzed the statistics on FXBlue. The results show a steady balance increase, with the EA trading only the Pound Dollar. The total return is 2%, equivalent to $1,000 in a 50k demo account. Analyzing performance on platforms like FXBlue offers valuable insights into the EA’s effectiveness and helps identify areas for improvement. These statistics are essential for evaluating the robot’s overall performance and reliability.

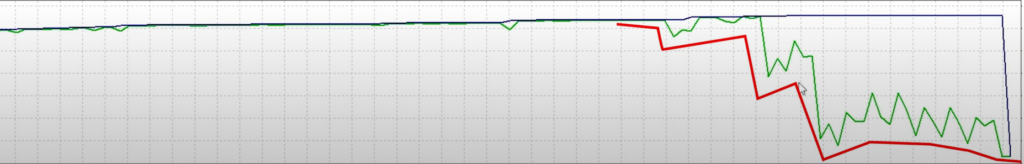

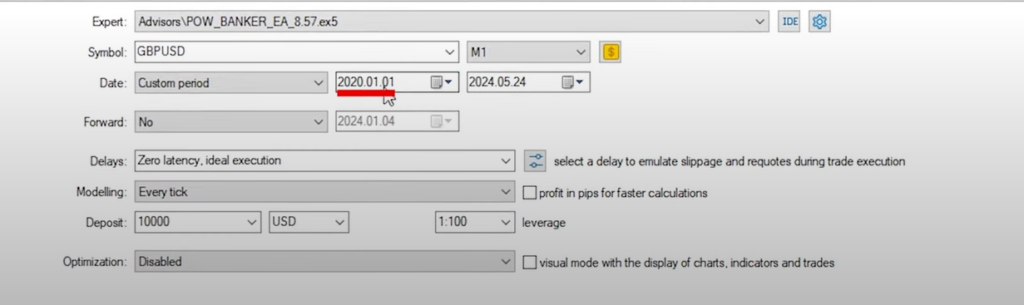

Backtesting Banker EA

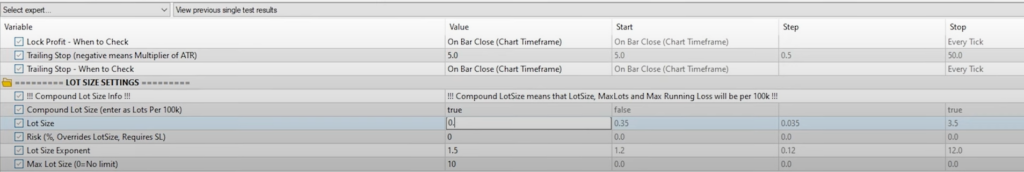

Running backtests is essential before using any expert advisor for trading. I tested the Banker EA on the Pound Dollar using the M1 time frame, starting from early 2020 until now. Backtesting shows how the EA might have performed in different market conditions, helping us see its reliability and strength. It also helps find any weaknesses in the trading system and allows traders to adjust settings for better results.

Banker EA Review: Importance of Backtesting

Backtesting is essential to understand how the Banker EA trades and the risks involved. The backtest results showed periods of drawdown and recovery, indicating the system’s ability to handle different market scenarios. This analysis builds confidence in the EA’s performance and identifies areas for potential adjustment. Backtesting ensures the EA is well-prepared for live trading by highlighting its strengths and weaknesses.

Playing with Inputs

Adjusting the inputs during backtesting is crucial, especially when dealing with a recovery system. The vendor allows control over the lot sizes and other inputs of the expert advisor. Experimenting with different settings helps find the optimal balance between risk and reward. Some configurations may result in account blowouts, necessitating adjustments to lower risk and improve performance. Playing with inputs helps tailor the EA to suit individual trading preferences and market conditions.

Banker EA Review: Final Backtest Results

The final backtest results showed a significant loss in 2020, followed by more stable performance. For example, in September 2022, the equity dropped from 20,333 to below 13,000. Increasing lot sizes too much can lead to account blowouts, so finding the right balance is essential. Analyzing the final results gives a clear picture of the EA’s performance over time. This information is crucial for making informed decisions about using the EA in live trading.

Decreasing Lot Size

When the backtest indicates an account blowout, decreasing the lot size is a practical risk management strategy. Starting with a smaller lot size and gradually adjusting it helps manage risk more effectively. For instance, starting with 0.05 lots and reducing it to 0.03 if necessary can help find a comfortable balance. These settings are not recommendations but an example of how to approach risk management. Decreasing lot size helps manage risk more effectively during periods of high market volatility.

Banker EA Review: Suitable Inputs for Brokers

Using the right settings for your broker ensures the EA works well. Different brokers have varying conditions, so it’s important to adjust the EA settings to match these conditions for the best results. Finding the right settings helps optimize the EA’s performance and ensures it runs efficiently in different market environments. Properly configuring the EA for your broker’s conditions is key to achieving the best trading outcomes.

Understanding the Recovery System

The recovery system in Banker EA is unique. Unlike typical Grid Martingale systems, Banker EA decreases lot sizes after the initial increase. This reduces risk while maintaining the potential for profit. The system kicks in when the price goes against the initial trade, opening new trades with adjusted lot sizes to balance the overall position. Understanding the recovery system is crucial for leveraging its benefits and minimizing risks. This knowledge helps traders make informed decisions about using the EA in different market conditions.

Banker EA Review: Why Decreasing Lot Sizes Matter

Reducing lot sizes helps manage risk better. Smaller lot sizes mean that the impact of a losing trade on the account balance is reduced. This is different from the usual Martingale strategy, which increases lot sizes and can lead to big losses if the market moves against the trader. Reducing lot sizes is very important. It offers a safer way to handle losing trades, ensuring the account balance is protected even during tough market conditions.

Performance on Different Currency Pairs

While my initial tests were on the Pound Dollar, I also explored Banker EA’s performance on other currency pairs. The results were consistent, demonstrating the robot’s ability to adapt to different market conditions. However, it’s essential to perform your own tests to see how it works with your preferred currency pairs. Testing the EA on different currency pairs provides insights into its versatility and adaptability. This information is valuable for traders looking to diversify their trading portfolio.

Banker EA Review: Adapting to Market Conditions

Banker EA’s flexibility lets it adapt to changing market conditions. The recovery system and lot size adjustments help it handle volatile markets. This adaptability is vital for long-term success in Forex trading. A robot that can adjust to different market scenarios is more likely to stay profitable over time. Adapting to market conditions is a key strength of Banker EA. This ability ensures that the EA remains effective even as market dynamics change, providing a consistent trading edge.

Importance of Monitoring

Even with a strong system like Banker EA, monitoring your trades is essential. Automated trading does not remove the need for oversight. Regularly checking performance and adjusting settings as needed ensures the robot works optimally. Monitoring trades allows you to respond to unexpected market events and adjust your trading strategy. This proactive approach improves the overall effectiveness of the EA.

Avoiding Over-Reliance

It’s tempting to depend entirely on an expert advisor, but it’s crucial to use it as part of a broader trading strategy. Combining automated trading with manual oversight and other tools can boost overall performance. This balanced approach helps manage risks and leverages different trading methods. Not relying too much on the EA ensures you keep control over your trading strategy. This way, you can enjoy the EA’s automation while still using your own market insights and judgments.

Banker EA Review: Broker Selection

Choosing the right broker is key when using an expert advisor. Look for brokers with low spreads and fast execution speeds. A good broker helps your expert advisor work well without problems like slippage or high costs. Picking the right broker is important for your trading success. A reliable broker gives you the support and tools you need to get the best performance from your EA.

Demo vs. Live Trading

Testing Banker EA on a demo account is a good start, but live trading presents different challenges. Market conditions can vary, and execution may differ from a demo environment. Moving from demo to live trading should be done carefully, with adjustments based on live performance. Knowing the differences between demo and live trading helps set realistic expectations and prepares you for potential challenges. This understanding is essential for a smooth transition to live trading.

Banker EA Review: Managing Expectations

While Banker EA has shown promising results, it’s important to manage expectations. No trading system is perfect, and losses will happen. The key is to keep a balanced approach and not expect continuous profits without any setbacks. Managing expectations helps you keep a realistic view on trading. This approach reduces disappointment and ensures you stay committed to your trading strategy, even during tough times.

Risk Management Strategies

Implementing effective risk management strategies is crucial when using Banker EA. Setting stop-loss levels and adjusting lot sizes based on account balance are essential practices. These strategies help protect your account from big losses and ensure sustainable trading. Risk management is the foundation of successful trading. By using sound risk management practices, you can preserve your capital and ensure long-term profitability.

Banker EA Review: Learning from Experience

Every trader’s experience with Banker EA will be different. Documenting your trades, analyzing performance, and learning from mistakes are vital steps. Continuous improvement and adaptation are key to long-term success in Forex trading. Learning from experience helps refine your trading strategy and improve the effectiveness of the EA. This ongoing process is essential for achieving consistent success in the Forex market.

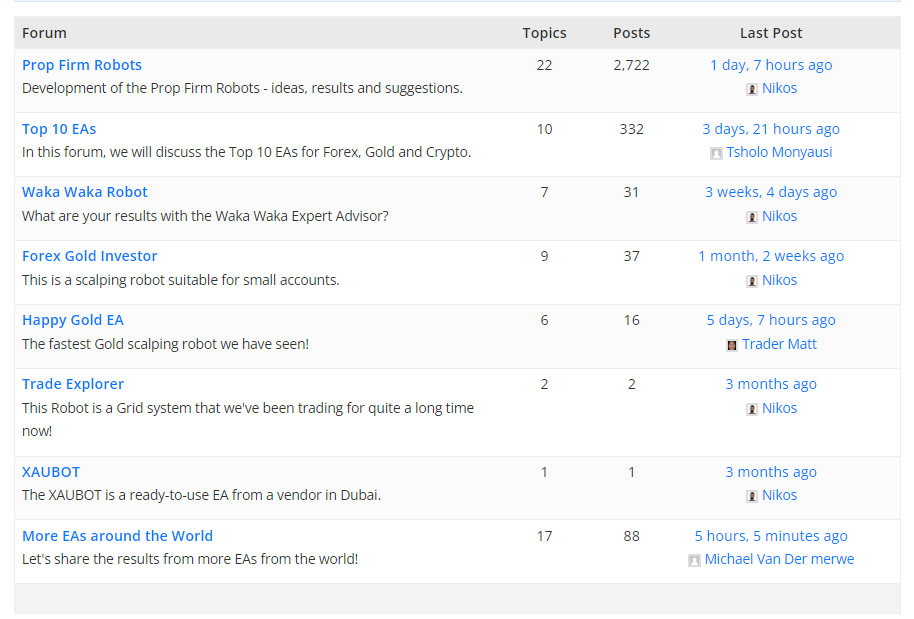

Community and Support

Engaging with the trading community can provide valuable insights. Sharing experiences, discussing strategies, and seeking advice from other traders can enhance your understanding of Banker EA. The support from the community can also help troubleshoot issues and optimize the robot’s performance. Community support provides a valuable resource for traders. Engaging with other traders helps build knowledge, share experiences, and find solutions to common challenges.

Final Thoughts

Thank you for taking the time to read our Banker EA review. Understanding the details of the Banker EA, from its recovery system to its lot size strategy, can greatly improve your trading experience. By combining this knowledge with good risk management and regular monitoring, you can get the most out of using the Banker EA. We hope this review gives you the insights you need to make informed decisions and succeed in your trading. Happy trading!

Banker EA Review: Conclusion

The Banker EA is an interesting trend-following trading system that has shown promising results in my demo account tests. With notable profits and a few losses, its unique recovery system and lot size strategy provide a fresh take on automated trading. However, you must understand the risks and perform multiple backtesting before using it for live trading. With the right settings and proper risk management, Banker EA could be a valuable addition to your trading tools. We encourage you to explore its potential and see how it can fit into your trading strategy. Happy trading!